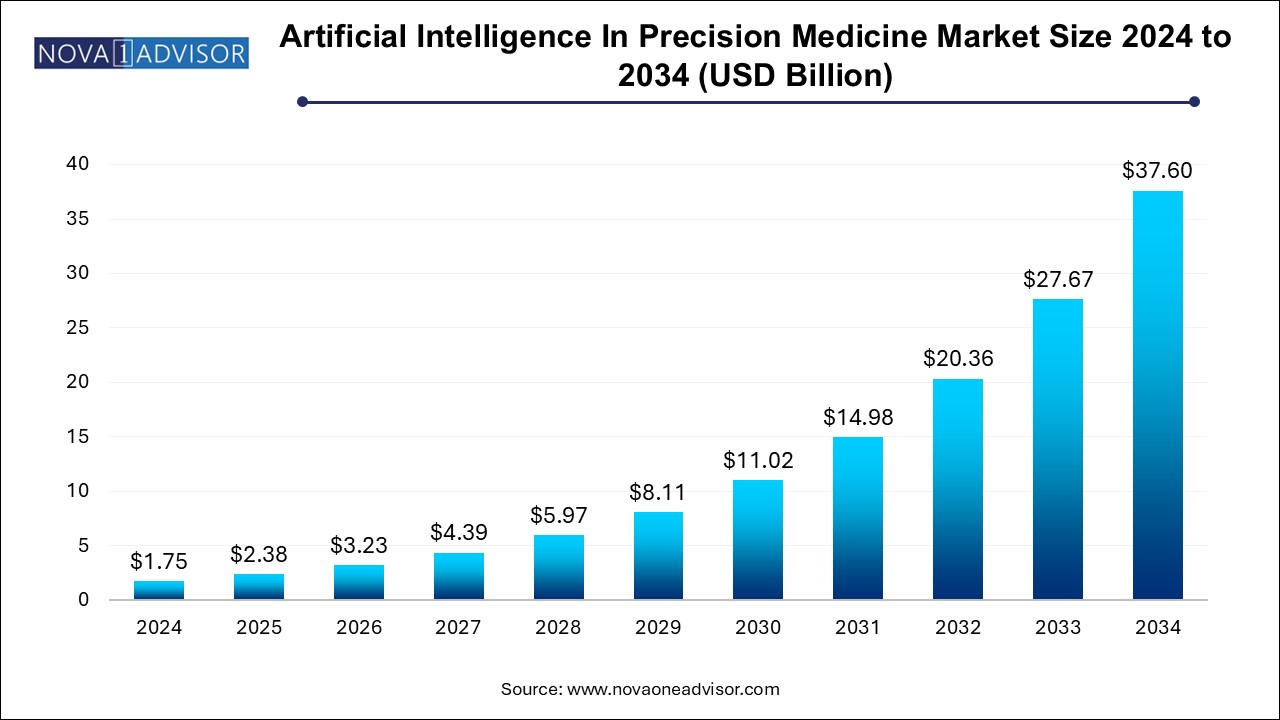

The artificial intelligence in precision medicine market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 37.60 billion by 2034, growing at a CAGR of 35.9% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.38 Billion |

| Market Size by 2034 | USD 37.60 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 35.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technology, Component, Therapeutic Application, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | BioXcel Therapeutics, Inc.; Sanofi S.A.; NVIDIA Corp.; Alphabet Inc. (Google Inc.); IBM; Microsoft; Intel Corporation; AstraZeneca plc; GE HealthCare; Enlitic, Inc. |

The market growth is primarily driven by increasing investments in R&D and rising demand for personalized medications. Collaborations among key companies also play a significant role in driving industry growth. For instance, in August 2024, Enlitic collaborated with GE Healthcare to assist PACS users in enhancing workflow efficiencies through data standardization using Enlitic Curie. The rise in cancer cases across the globe had a positive impact on the AI in precision medicine market. According to the WHO statistics, globally, around 10 million deaths were caused due to cancer in 2024.

Rising adoption of a sedentary lifestyle and increased alcohol & tobacco consumption are some of the major factors responsible for the rising prevalence of cancer. Moreover, the growing R&D investment drives market growth. The African Access Initiative, a collaboration of corporate and public organizations, focuses on addressing the cancer problem in South Africa by expanding access to cancer therapies & diagnosis and developing a technologically cutting-edge healthcare infrastructure. Furthermore, in precision medicine, wearables play a crucial role in capturing and analyzing data that can be utilized for personalized diagnostics, disease management, and preventive care.

Wearable devices can track changes in physiological parameters and detect early warning signs of diseases, allowing for timely intervention and proactive healthcare. Integrating wearables with advanced analytics and ML algorithms further enhances their potential in precision medicine. By leveraging AI and data analytics, wearables can identify patterns, detect anomalies, and provide valuable insights for disease monitoring, medication adherence, and lifestyle modifications. The growing demand for digital healthcare and clinical health records is another key factor driving the market growth. The increasing adoption of Electronic Health Records (EHRs) and digital health platforms has led to the generation of vast amounts of patient data.

AI technologies, such as ML and deep learning algorithms, have the potential to analyze and derive insights from this data, enabling personalized and precise medical interventions. The COVID-19 pandemic positively impacted the market, presenting opportunities for AI-powered computer systems to combat the virus. Various technology companies and startups have been actively working toward mitigating, preventing, and containing the spread of the virus. The outbreak of COVID-19 has also accelerated the growth of the AI market in other domains, driven by the widespread adoption of remote work policies necessitated by the pandemic.

Based on technology, the market is segmented into Natural Language Processing (NLP), deep learning, computer vision, and context-aware processing. The deep learning segment dominated the market with a share of 33.7% in 2024. The growth can be driven by advancements in data center capabilities, increased processing power, and the ability to perform tasks autonomously. Deep learning algorithms enable the integration and modeling of diverse patient data across different modalities and time, leading to improved predictions & personalized treatment recommendations. This segment is growing in popularity due to the development in high processing power, data center capabilities, and the ability to perform tasks without human intervention.

Furthermore, the use of cloud-based technology is increasing in several sectors, supporting the expansion of the market. Recent deep learning algorithms can integrate and model diverse data from a single patient across modalities and time, allowing for better predictions and therapy recommendations specific to each patient. The NLP segment is expected to grow at the fastest CAGR of 36.5% during the anticipated period. NLP is anticipated to play a crucial role in expediting the healthcare decision-making process. The true benefit of establishing effective algorithms depends on the quality of the data obtained. A quicker decision-making process will allow physicians to focus on value-added treatment.

In terms of components, the market is segmented into hardware, software, and services. The software segment held the largest share of 41.6% in 2024. The significant adoption of AI-powered software solutions for precision medicine by institutions, providers, and patients is expected to drive the growth of the software segment. In September 2019, GE Healthcare collaborated with several local software companies in China, such as Shukun Technology, 12 Sigma Technologies, YITU Technology, Biomind, and Yizhun Medical AI, to develop the Edison AI platform and facilitate a seamless digital transition for GE Healthcare.

Furthermore, the software segment is projected to grow at the fastest CAGR of 36.2% during the estimated period. The increasing adoption of AI-based software solutions for precision medicine by healthcare payers, institutions, providers, and patients is projected to drive the growth of the software segment. The rapid expansion of the segment is due to the increasing use of AI-based technologies in various healthcare applications, including cybersecurity, dose error reduction, virtual assistants, robot-assisted surgeries, clinical trials, fraud detection, and telemedicine. Moreover, government and private players' initiatives are expected to fuel the segment’s growth.

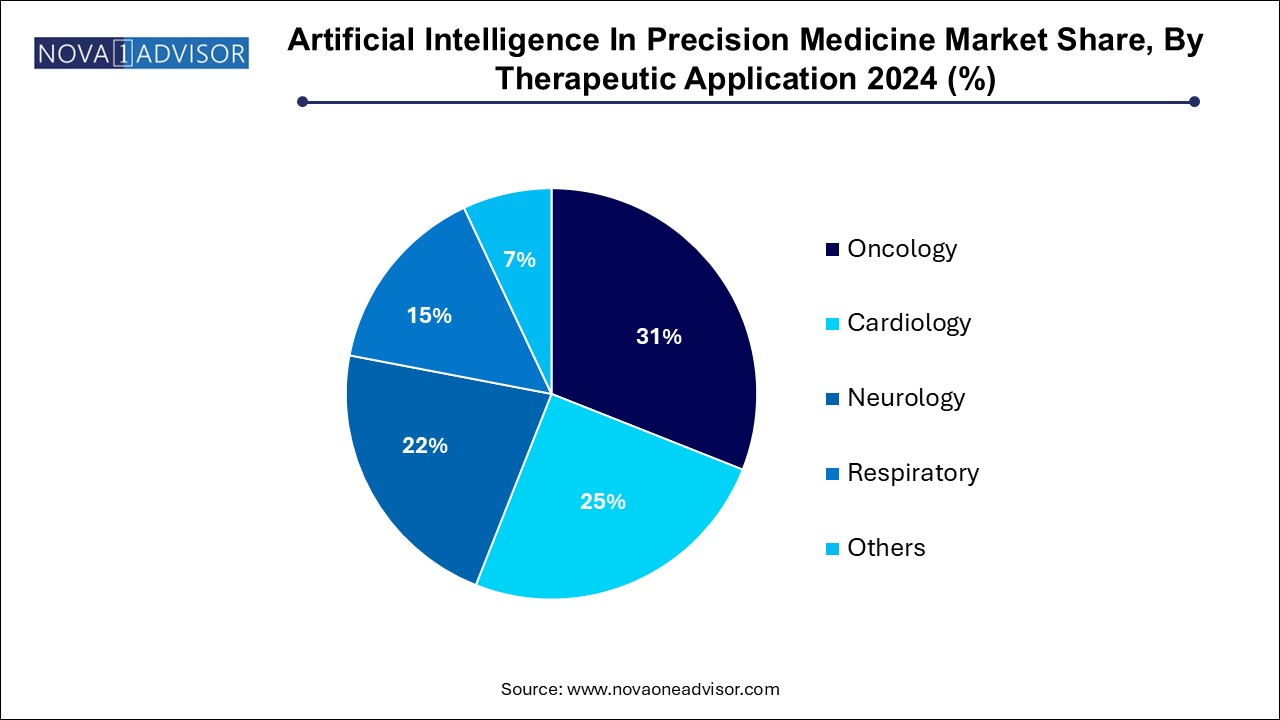

On the basis of therapeutic applications, the global market has been further segmented into oncology, cardiology, neurology, respiratory, and others. Oncology emerged as the dominant segment and accounted for a revenue share of 31.0% in 2024. This segment will remain dominant throughout the forecast period. The integration of AI in oncology has facilitated faster and more accurate cancer diagnosis, leading to improved patient outcomes, and is projected to drive the growth of this segment over the forecast period. AI in oncology aids in faster and more accurate cancer diagnosis, resulting in improved patient outcomes, and is expected to fuel the segment expansion over the projected period.

Rising cancer prevalence and growing developments in healthcare infrastructure are among the significant factors expected to drive segment growth. The growing number of cancer patients worldwide and the increasing number of cases are expected to put pressure on the healthcare system, which is expected to drive growth. On the other hand, the neurology segment is anticipated to register the fastest CAGR of 36.8% over the forecast period. A rise in the incidence of neurological illnesses, such as migraines, epilepsy, brain tumors, dementia, and Alzheimer’s disease, is expected to fuel the neurology segment growth. Technological improvements and the requirement for early detection of neurological problems are boosting market expansion.

North America dominated the market with a revenue share of 29.6% in 2024. Growth of the market is attributed to the strategic presence of major players, such as Abbott; Danone; Targeted Medical Pharma, Inc.; Nestlé; and Mead Johnson & Company, LLC. For instance, in July 2024, Certara, Inc., which pioneered biostimulation, announced a two-year collaboration with Memorial Sloan Kettering Cancer Center to build new biosimulation software. This collaboration helps companies develop a biosimulation platform for CAR T-cell treatment. Furthermore, CAR T-cell treatment, known as immunotherapy, employs immune system T-cells, which have experienced a unique modification to combat certain types of blood cancer. The increasing demand for personalized treatment is the primary factor driving market expansion in the U.S.

Furthermore, rising demand for reducing healthcare expenditure and growing patient health-related digital information datasets are fueling market growth. The rising global geriatric population, changing lifestyle, and growing prevalence of chronic illnesses have increased the need for early disease diagnosis and treatment. This is expected to drive the market growth in the country. Europe is anticipated to witness substantial growth at a CAGR of 36.3% over the forecast period owing to the growing technological advancements and rising healthcare spending capacity of the people. The increasing government initiatives are fueling regional market growth. The European Cancer Imaging Initiative aims to help innovators and researchers translate real-world oncology data on the quality and scale required to develop new cancer detection, diagnosis, and treatment solutions, especially those based on AI.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the artificial intelligence in precision medicine market

Technology

Component

Therapeutic Application

Regional