The global cell and gene therapy clinical trials market size reached USD 11.62 billion in 2023 and is projected to hit around USD 47.40 billion by 2033, expanding at a CAGR of 15.09% during the forecast period from 2024 to 2033.

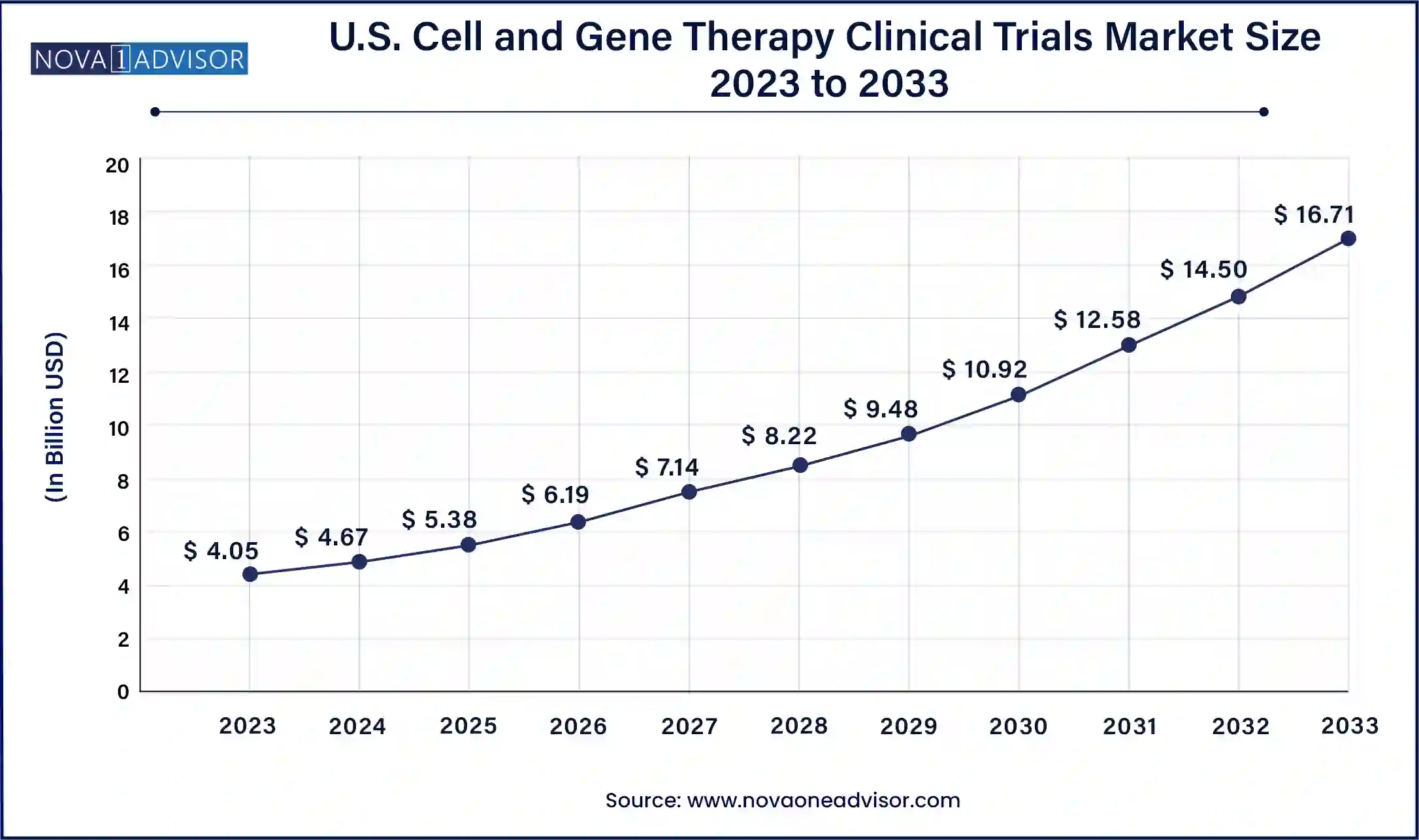

The U.S. cell and gene therapy clinical trials market size was exhibited at USD 4.05 billion in 2023 and is projected to be worth around USD 16.71 billion by 2033, poised to grow at a CAGR of 15.23% from 2024 to 2033.

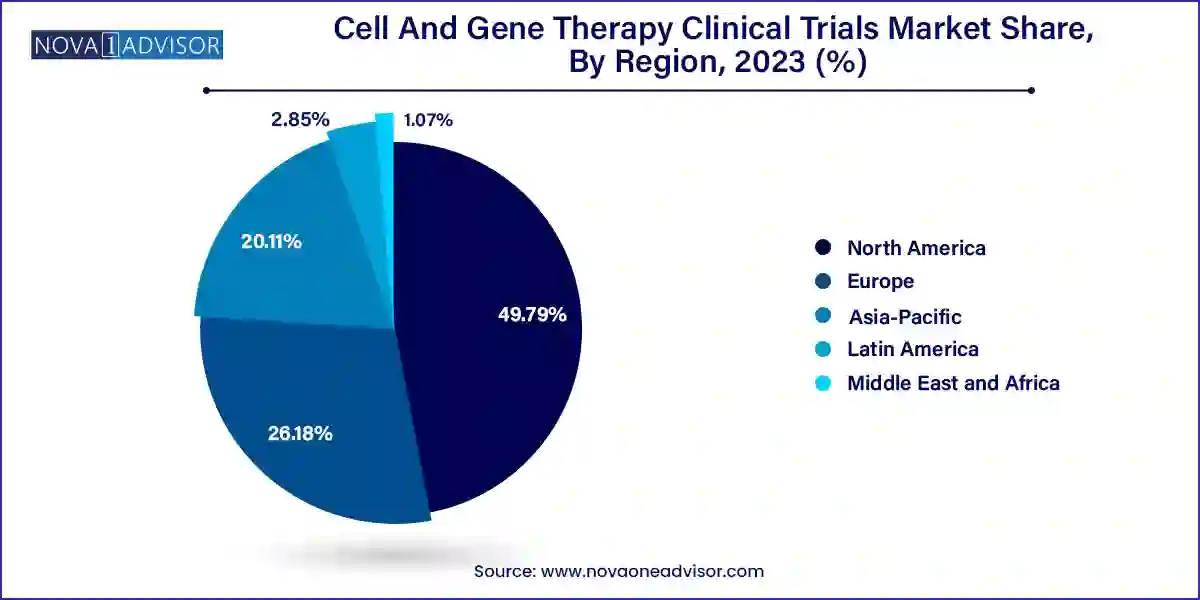

North America, led by the United States, dominates the CGT clinical trials market, with the majority of ongoing trials, IND filings, and regulatory designations originating here. The region benefits from a robust biotech ecosystem, leading academic institutions, and an innovation-friendly regulatory framework under the FDA. The presence of major CGT players such as Novartis, Gilead, and Bluebird Bio further consolidates its leadership. Additionally, financial support from public and private investors, along with philanthropic foundations, accelerates trial execution.

Asia-Pacific is the fastest-growing region, driven by a rapid increase in research activity, infrastructure investment, and regulatory modernization. Countries like China, Japan, and South Korea are launching national gene therapy programs, facilitating international partnerships, and building GMP-compliant manufacturing hubs. China's volume of early-phase CGT trials has grown significantly in the last five years, positioning the region as a key player in the global clinical development landscape.

The global cell and gene therapy (CGT) clinical trials market represents one of the most dynamic and transformative segments of the life sciences industry. These trials aim to explore and validate highly personalized therapies that leverage genetic modification or cellular manipulation to treat a variety of complex, often previously untreatable, diseases. CGT has evolved from theoretical scientific ambition into a viable therapeutic approach, as evidenced by numerous investigational new drugs (INDs), breakthrough designations, and regulatory approvals in recent years.

The increase in clinical activity in this sector is attributed to advances in genomic technologies, greater understanding of disease at the molecular level, and improved delivery systems for genetic material. Clinical trials in this domain are highly resource-intensive, scientifically rigorous, and frequently target rare or orphan indications with unmet medical needs. Oncology leads the charge, but applications are rapidly expanding to include CNS disorders, genetic and metabolic conditions, hematological malignancies, and autoimmune diseases.

The development and execution of CGT clinical trials require collaboration across biotech firms, pharmaceutical companies, academic research centers, contract research organizations (CROs), and regulatory agencies. Strategic partnerships, funding initiatives, and streamlined regulatory pathways such as RMAT (Regenerative Medicine Advanced Therapy) designation in the U.S. have significantly boosted trial initiation rates. However, the market still faces operational and scientific hurdles that must be addressed to ensure broader accessibility and success.

Rising trial volume in rare diseases and orphan indications

Increasing use of CRISPR and gene editing platforms in early-phase trials

Adoption of decentralized trial models with remote monitoring

Expansion of cell therapy trials using CAR-T and TCR therapies

Growth in autologous versus allogeneic therapy comparisons

Improved vector technologies enhancing gene delivery efficiency

Increased regulatory collaboration and use of accelerated approval pathways

Integration of real-world evidence (RWE) in long-term follow-up studies

| Report Attribute | Details |

| Market Size in 2024 | USD 13.38 Billion |

| Market Size by 2033 | USD 47.40 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.09% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Phase, indication, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corp.; Syneos Health; Medpace, Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC |

The explosive growth in CGT pipelines across the globe is a fundamental driver for the clinical trials market. According to industry data, there are over 2,000 active CGT clinical trials underway globally, with the U.S., Europe, and China being the most prominent regions. Many of these trials are targeting rare, life-threatening conditions that have limited or no effective treatments, which provides both strong medical rationale and regulatory incentives for investment.

Technologies such as CAR-T cell therapies, AAV-mediated gene transfer, CRISPR-Cas9 editing, and lipid nanoparticle (LNP) delivery platforms are contributing to a wave of innovation. Companies like Novartis, Pfizer, CRISPR Therapeutics, and Bluebird Bio are pioneering therapies that not only hold curative potential but also redefine how clinical endpoints are measured. This momentum is fueling demand for trial infrastructure, patient recruitment services, and genomic data management tools across all phases of development.

Despite the promise, CGT trials face significant restraints related to manufacturing scalability and supply chain logistics. Unlike traditional small molecules, cell and gene therapies often require customized, patient-specific production processes. For example, autologous CAR-T therapies involve harvesting a patient’s own T-cells, genetically modifying them, and reinfusing them—a multi-step, tightly regulated process that must be completed within a defined time window.

These logistics create bottlenecks in trial execution, especially in geographically dispersed studies. Moreover, challenges in vector production (e.g., AAV, lentiviral), cold chain transportation, and quality control often delay enrollment and increase costs. The industry is actively working on standardization, automation, and centralized manufacturing platforms, but these barriers continue to impact the scalability of global CGT trials.

One of the most significant opportunities for the CGT clinical trials market is the availability of fast-track regulatory pathways and orphan drug incentives. Programs like the FDA’s RMAT, EMA’s PRIME, and Japan’s Sakigake designation enable expedited development and review processes, particularly for therapies targeting serious or rare diseases. These pathways reduce time-to-market, provide early dialogue with regulators, and often allow for rolling submissions.

Orphan designations further incentivize sponsors through market exclusivity, fee waivers, and grant funding. As a result, there has been a notable increase in early-phase trials for conditions like Duchenne muscular dystrophy, spinal muscular atrophy, and Leber congenital amaurosis. These mechanisms are encouraging investment in high-risk areas and supporting smaller biotech firms to bring forward novel therapies that would otherwise struggle to reach clinical development.

Phase II trials dominate the CGT clinical trials landscape, reflecting the high level of interest in validating therapeutic efficacy following early safety assessments. These mid-stage studies often focus on determining optimal dosing, expanding target populations, and establishing biomarker responses. Given the complexity of CGT therapies and the requirement for long-term follow-up, Phase II trials are generally longer and more resource-intensive than their conventional counterparts. Sponsors frequently collaborate with academic medical centers and centers of excellence to access patient cohorts with rare conditions.

Phase I trials are the fastest-growing segment, particularly with the rise of early-stage biotech companies and academic spinouts entering the clinical domain. These trials are critical for assessing safety, tolerability, and pharmacokinetics of novel CGT approaches, such as CRISPR-based editing or mRNA-mediated gene replacement. Regulatory agencies have shown greater flexibility in supporting these trials through fast-track and adaptive designs, allowing faster transition to proof-of-concept studies in small patient populations.

Oncology dominates the cell and gene therapy clinical trials market, driven by the high success rate of CAR-T cell therapies and the broad applicability of TCR-engineered T cells. Hematological malignancies, including non-Hodgkin lymphoma, acute lymphoblastic leukemia, and multiple myeloma, are the primary focus, although solid tumors such as glioblastoma and melanoma are gaining attention. Immuno-oncology remains a fertile ground for innovation, and CGT approaches are increasingly being integrated with checkpoint inhibitors and targeted therapies.

Endocrine, metabolic, and genetic disorders are the fastest-growing indications, particularly with the increasing focus on inherited conditions such as hemophilia, spinal muscular atrophy (SMA), and lysosomal storage diseases. Gene therapies targeting these disorders have received accelerated designations and shown strong clinical outcomes in early trials. Innovations in viral vector design and gene silencing techniques are broadening the therapeutic reach in this segment, making it a hotspot for both academic and industry-led trials.

In April 2025, CRISPR Therapeutics and Vertex Pharmaceuticals announced the initiation of a Phase III trial for exa-cel, a CRISPR-based gene therapy for beta-thalassemia and sickle cell disease.

In February 2025, bluebird bio received RMAT designation from the FDA for its LentiGlobin gene therapy targeting cerebral adrenoleukodystrophy (CALD).

In January 2025, Novartis launched a global Phase II/III trial of a next-gen CAR-T therapy for relapsed diffuse large B-cell lymphoma (DLBCL).

In November 2024, Sarepta Therapeutics expanded enrollment for its Phase II gene therapy trial in Duchenne muscular dystrophy to include ambulatory patients under 12.

In September 2024, Beam Therapeutics announced positive preliminary data from its base-editing gene therapy trial in chronic hepatitis B.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cell And Gene Therapy Clinical Trials market.

By Phase

By Indication

By Region