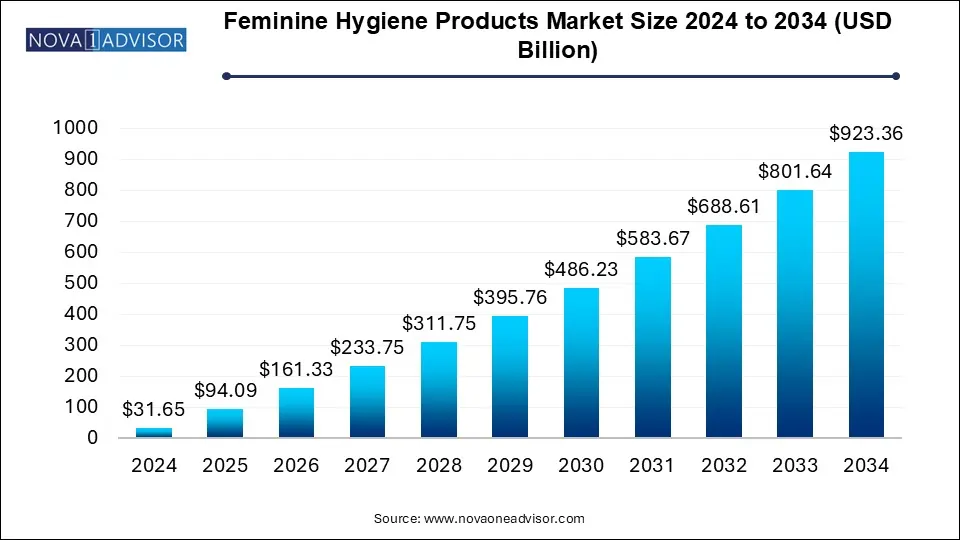

The feminine hygiene products market size was estimated at USD 31.65 billion in 2024 and is projected to hit around USD 923.36 billion by 2034, expanding at a CAGR of 7.7% during the forecast period from 2025 to 2034. The rise in menstrual literacy, particularly in developing countries is expected to boost the growth of the feminine hygiene products market.

Feminine hygiene products refer to the products that are most widely used to maintain personal hygiene during the time of menstruation. Feminine hygiene products include sanitary napkins/pads, tampons, disposable razors & blades, internal cleaners & sprays, vaginal creams, feminine wipes, hygiene breathable films, panty liners, period panties, intimate washers and cleaners, hair removal products, menstrual cups, and others. The adoption of these products assists in cleaning vaginal discharge, removing unwanted hair, and overall keeping the internal body parts clean. Factors such as the increase in the number of menstrual awareness campaigns, rising focus on personal hygiene, increasing adoption of feminine hygiene products among educated women, and increasing product innovations are expected to fuel the expansion of the feminine hygiene products market throughout the projected period.

| Report Coverage | Details |

| Market Size in 2025 | USD 94.09 Billion |

| Market Size by 2034 | USD 923.36 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Procter & Gamble, GLENMARK PHARMACEUTICALS LTD, Unicharm Corporation, Unilever, Maxim Hygiene, KCWW, Edgewell Personal Care, Premier FMCG (Pty) Ltd., Essity Aktiebolag, Ontex BV, Bodywise (UK) Limited, Kao Corporation, Prestige Consumer Healthcare Inc. |

Opportunity:

Rising demand for Eco-Friendly and Organic Feminine Hygiene Products

Conventional napkins contain several synthetic products such as rayon dioxin, allergy-provoking metal dyes, and highly processed wood pulp which are responsible for allergies, infection, and inflammation. Some of these chemicals have proven to be carcinogenic after long-term use. Health issues caused by sanitary napkins and increasing environmental concerns have shifted the manufacturer's focus on developing eco-friendly and organic feminine hygiene products. Demand among women for cloth sanitary pads, and pads made from organic materials & biodegradable products is increasing to reduce health hazards caused by irritants, dyes, and harmful chemicals found in sanitary napkins or tampons. This presents a lucrative opportunity for vendors to strengthen their market position through the development of eco-friendly and organic feminine hygiene products.

Restraint:

High costs

Lack of awareness

The lack of awareness is anticipated to projected to hamper the market's growth. The market has observed a lack of awareness regarding feminine hygiene products in underdeveloped countries. In addition, orthodox and conventional approaches towards menstruation may restrict the expansion of the global feminine hygiene products market.

The menstrual products segment holds the highest share of the global feminine hygiene products market. Under this segment, sanitary pads & napkins have the highest demand followed by tampons. These are the most commonly used feminine hygiene products across the globe. Consumers in Asia Pacific still prefer sanitary pads, whereas Americans are gradually shifting to tampons and menstrual cups. Nevertheless, it is witnessed that women in developing countries have started buying menstrual cups, period panties, etc., mostly online. Such factors are significantly fueling the segment’s growth.

On the other hand, the cleaning and deodorizing products segment is anticipated to witness rapid growth in the coming years owing to rising consumer awareness to maintain hygiene and avoid odor-causing bacteria, surging disposable income of women, and supportive government initiatives to spread mensuration literacy.

The supermarket's segment accounted for the highest feminine hygiene products market growth rate. The segment’s growth is attributed to the rise in bulk purchases, attractive discounts, and the easy availability of various feminine hygiene products from multiple brands. In addition, supermarkets are increasingly collaborating with companies to offer convenient solutions for women customers, thus fuelling the segment’s growth. For instance, In April 2024. Pinkie Pads launched a tween line in Walmart stores. Pinkie, a feminine care company devoted to creating solutions for the youngest menstruators, will expand its retail presence to 1300 Walmart stores across the U.S.

On the other hand, the offline segment is expected to witness remarkable growth during the forecast period owing to the rapid expansion of the e-commerce sector. The online retail stores provide convenience and attractive discounts on the shopping of menstrual care products such as menstrual cups, tampons, and others.

Asia Pacific accounted for the largest share of the global revenue. Asia Pacific is expected to be a key revenue generator for feminine hygiene products manufacturers during the forecast period. Rising awareness about sanitation, increasing government initiatives, the surge in the number of campaigns carried out on social media, and rapid urbanization are some of the key drivers of the Asia Pacific feminine hygiene products market. Moreover, increasing demand for sanitary products, such as ultra-size sanitary pads with high capacity to absorb, and special side leakage protection is also supporting the growth of the Asia Pacific feminine hygiene products market. Growth in the feminine hygiene products market is mainly attributed to the growing demand for sanitary protection products in developed markets such as China, Japan, India, Australia, and Hong Kong. Sanitary pads are preferred over other feminine hygiene products across Asian countries. Furthermore, the easy availability of these feminine hygiene products through various sales channels including supermarkets, online stores, hypermarkets, pharmacies, and others, accelerates the feminine hygiene products market revenue in the region.

On the other hand, North America accounted for the largest share of the global revenue. The growth of the region is attributed to supportive government initiatives and campaigns for better understanding of female hygiene products, increasing disposable income, a surge in the number of women working population, and increasing awareness towards maintaining personal hygiene in women. Such factors are propelling the growth of the feminine hygiene products market in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Feminine Hygiene Products Market

By Product

By Distribution Channel

By Geography