The global next-generation sequencing library preparation market size was exhibited at USD 1.43 billion in 2023 and is projected to hit around USD 4.93 billion by 2033, growing at a CAGR of 13.18% during the forecast period 2024 to 2033.

.jpg)

Next-Generation Sequencing (NGS) has revolutionized the genomics landscape, enabling unprecedented insights into genetic variations, transcriptomes, and epigenetic changes. Central to the success of NGS is the library preparation process, a critical step that significantly impacts the quality and reliability of sequencing data. This overview delves into the burgeoning market of NGS library preparation, highlighting its significance, growth drivers, challenges, and future prospects.

The growth trajectory of the Next-generation Sequencing (NGS) Library Preparation market is primarily driven by a confluence of factors that underscore its increasing relevance in genomics research and clinical diagnostics. Firstly, technological advancements have significantly enhanced the efficiency and scalability of NGS library preparation processes, facilitating faster sequencing with reduced costs. This has spurred adoption across academic research institutions, biopharmaceutical companies, and clinical laboratories aiming for high-throughput genomic analysis. Secondly, the expanding applications of NGS in personalized medicine, oncology, infectious diseases, and agricultural genomics have amplified demand for robust library preparation kits tailored to specific research objectives. Moreover, the rising prevalence of chronic diseases and genetic disorders necessitates comprehensive genomic profiling, further fueling market growth. Additionally, collaborations between academic institutions, industry players, and regulatory bodies are fostering innovation, standardization, and the development of novel library preparation methodologies. Lastly, increasing investments in genomics research and the integration of NGS technologies into routine clinical workflows are projected to propel the market forward, paving the way for transformative advancements in precision medicine and diagnostics.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.43 Billion |

| Market Size by 2033 | USD 4.93 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.18% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Sequencing Type, Product, Application, End-Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Agilent Technologies, Inc., Integrated DNA Technologies, F. Hoffmann-La Roche AG, Inc., Illumina, Inc., Beckman Coulter Inc. (now part of Danaher Corporation), Becton, Merck KGaA, Dickinson and Company, New England Biolabs, Inc., PerkinElmer Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Thermo Fisher Scientific Inc., Tecan Group Ltd. |

The Next-generation Sequencing (NGS) Library Preparation Market Dynamics are significantly influenced by continuous technological advancements and innovation. As the demand for faster, more accurate, and cost-effective sequencing solutions intensifies, companies are investing heavily in research and development to enhance library preparation methodologies. Innovations such as streamlined workflows, automation, and multiplexing capabilities are driving efficiency gains, reducing turnaround times, and lowering per-sample costs. Furthermore, the introduction of novel enzymes, adapters, and library preparation kits optimized for various sequencing platforms and applications is expanding the market's scope. This relentless pursuit of innovation not only fosters competition among industry players but also catalyzes the adoption of NGS technologies across diverse sectors, including research, diagnostics, and personalized medicine.

Another pivotal dynamic shaping the NGS Library Preparation market is the expanding applications in genomics research and clinical diagnostics. With the increasing recognition of genomics as a cornerstone for understanding complex diseases, therapeutic development, and personalized medicine, the demand for comprehensive and reliable sequencing solutions has surged. NGS library preparation plays a critical role in facilitating high-throughput genomic analysis, enabling researchers and clinicians to extract meaningful insights from vast amounts of genomic data. Moreover, the integration of NGS technologies into clinical diagnostics workflows is transforming patient care by enabling precise molecular profiling, early disease detection, and treatment stratification. As a result, the growing adoption of NGS in oncology, infectious diseases, rare genetic disorders, and agricultural genomics is driving market growth and diversifying its application landscape.

One of the significant restraints affecting the Next-generation Sequencing (NGS) Library Preparation market is the high initial capital investment and operational costs associated with implementing and maintaining NGS platforms. While technological advancements have led to cost reductions over time, the upfront expenses for acquiring state-of-the-art sequencing instruments, specialized equipment, and consumables remain substantial. Additionally, the need for skilled personnel, extensive computational resources for data analysis, and ongoing maintenance and upgrades further escalates operational expenditures. These cost constraints pose challenges for academic institutions, smaller research laboratories, and healthcare facilities with limited budgets, potentially limiting their access to advanced NGS technologies and hindering market penetration in emerging regions.

Another significant restraint in the NGS Library Preparation market is the complexity and standardization challenges associated with library preparation protocols and workflows. The intricate nature of sample preparation, library construction, and sequencing procedures necessitates meticulous attention to detail, rigorous quality control measures, and specialized expertise. Variability in methodologies, reagent formulations, and sequencing platforms across different manufacturers can lead to inconsistencies in results, affecting reproducibility and comparability of genomic data. Moreover, the lack of universally accepted standards and guidelines for library preparation and data interpretation complicates inter-laboratory collaborations, data sharing, and regulatory compliance. As a result, efforts to standardize protocols, enhance reproducibility, and establish consensus in the scientific community are essential to address these challenges and unlock the full potential of NGS technologies in genomics research and clinical applications.

A significant opportunity in the Next-generation Sequencing (NGS) Library Preparation market lies within emerging markets and untapped sectors that are increasingly recognizing the value of genomics research and personalized medicine. As awareness grows regarding the role of NGS technologies in advancing healthcare outcomes, academic research, and agricultural innovation, developing regions present lucrative growth prospects. These markets offer opportunities for market players to expand their footprint, establish strategic partnerships, and collaborate with local stakeholders to address region-specific challenges and unmet needs.

Another compelling opportunity in the NGS Library Preparation market is the advancements in precision medicine, therapeutic development, and targeted genomic interventions. As the understanding of genetic variability, disease mechanisms, and therapeutic responses deepens, the demand for personalized and targeted sequencing solutions continues to escalate. NGS library preparation plays a pivotal role in facilitating comprehensive genomic profiling, biomarker discovery, and patient stratification, enabling clinicians and researchers to develop tailored therapeutic strategies, optimize treatment protocols, and improve patient outcomes. Furthermore, the convergence of NGS technologies with artificial intelligence, machine learning, and data analytics is unlocking new opportunities for predictive modeling, drug discovery, and precision healthcare delivery.

A significant challenge facing the next-generation sequencing (NGS) library preparation market is the complexity associated with data analysis and interpretation. As sequencing technologies evolve, generating vast volumes of genomic data has become more accessible and cost-effective. However, the computational infrastructure, bioinformatics tools, and expertise required to process, analyze, and derive meaningful insights from this data remain formidable hurdles. The complexity of integrating multi-dimensional genomic datasets, identifying clinically relevant variants, and translating genomic information into actionable insights for healthcare providers and researchers poses significant challenges. Additionally, ensuring data accuracy, reproducibility, and standardization across different sequencing platforms and analytical pipelines is essential but challenging. As a result, addressing these bioinformatics and data management challenges is crucial to harnessing the full potential of NGS technologies and facilitating their widespread adoption in diverse applications.

Another critical challenge in the NGS Library Preparation Market revolves around regulatory and ethical considerations governing genomic data generation, storage, sharing, and interpretation. The evolving regulatory landscape, stringent quality control requirements, and privacy concerns surrounding genomic data pose challenges for market players, researchers, and healthcare providers alike. Ensuring compliance with international standards, data protection regulations, and ethical guidelines while promoting data sharing, collaboration, and innovation is a delicate balancing act. Moreover, navigating the complexities of informed consent, data ownership, intellectual property rights, and patient privacy rights adds another layer of complexity to the regulatory landscape. As genomic research and clinical applications continue to advance, addressing these regulatory, legal, and ethical challenges is paramount to fostering public trust, ensuring data integrity, and unlocking the full potential of NGS technologies in improving healthcare outcomes.

By Segments

Sequencing Type Insights

Targeted Genome Sequencing dominated the market due to its cost-effectiveness, speed, and clinical utility. This approach allows focused analysis of specific genes or regions of interest, making it ideal for oncology panels, hereditary disease screening, and pharmacogenomics. Library prep kits tailored for targeted sequencing are designed for amplicon or hybrid-capture protocols and allow multiplexing—maximizing output while minimizing sequencing costs. For example, Illumina's TruSight panels and Agilent's SureSelect kits have enabled labs to run hundreds of targeted assays efficiently, particularly in high-throughput clinical diagnostic environments.

Whole-genome sequencing (WGS) is the fastest-growing segment, driven by its increasing adoption in rare disease diagnosis, prenatal screening, and population genomics. Advances in sequencing chemistry and data storage have made WGS more accessible, but the challenge remains in preparing libraries that maintain uniform coverage across the entire genome. Companies like NEB and Roche are investing in WGS-compatible kits that reduce bias, handle low-input DNA, and integrate barcoding for sample tracking. As clinical and research interest shifts toward comprehensive genomic landscapes, library prep innovations supporting WGS will be in high demand.

Products Insights

Reagents & Consumables led the market, especially DNA Library Preparation Kits, which account for the largest share. These kits form the backbone of nearly every sequencing workflow, whether in oncology, microbiology, or inherited disease diagnostics. Kits such as Illumina’s Nextera DNA Flex and Thermo Fisher’s Ion AmpliSeq are valued for their robustness, speed, and compatibility with multiple input types. RNA Library Preparation Kits are also gaining ground with increasing interest in transcriptome profiling and gene expression studies.

Instruments are the fastest-growing product segment, thanks to the growing automation trend in sample preparation. Devices like Agilent’s Bravo NGS workstation and Hamilton’s NGS Star automate repetitive pipetting steps, enabling error-free and high-throughput library construction. The integration of cloud-based monitoring and remote diagnostics has also made these systems more efficient for large sequencing centers and diagnostic labs. As sequencing scales up, the need for instrument-assisted library prep will grow exponentially.

Application Insights

Disease Diagnostics remained the dominant application, with Cancer Diagnostics leading within this sub-segment. NGS is now standard practice in oncology for identifying driver mutations, monitoring resistance mechanisms, and guiding immunotherapy decisions. High-quality library prep is critical to ensure that even low-frequency variants are captured accurately. For example, in liquid biopsy-based diagnostics, the DNA is often fragmented and present in very low concentrations, requiring ultra-sensitive library preparation protocols.

Drug and Biomarker Discovery is the fastest-growing application. Pharmaceutical companies are leveraging NGS to identify genetic markers linked to drug efficacy, safety, and disease prognosis. From transcriptome-wide profiling to methylation analysis, these applications require sophisticated library prep tools that offer high sensitivity and consistency. The growth of companion diagnostics and biomarker-led clinical trials is expected to fuel demand for specialized prep kits with modular workflows and high automation compatibility.

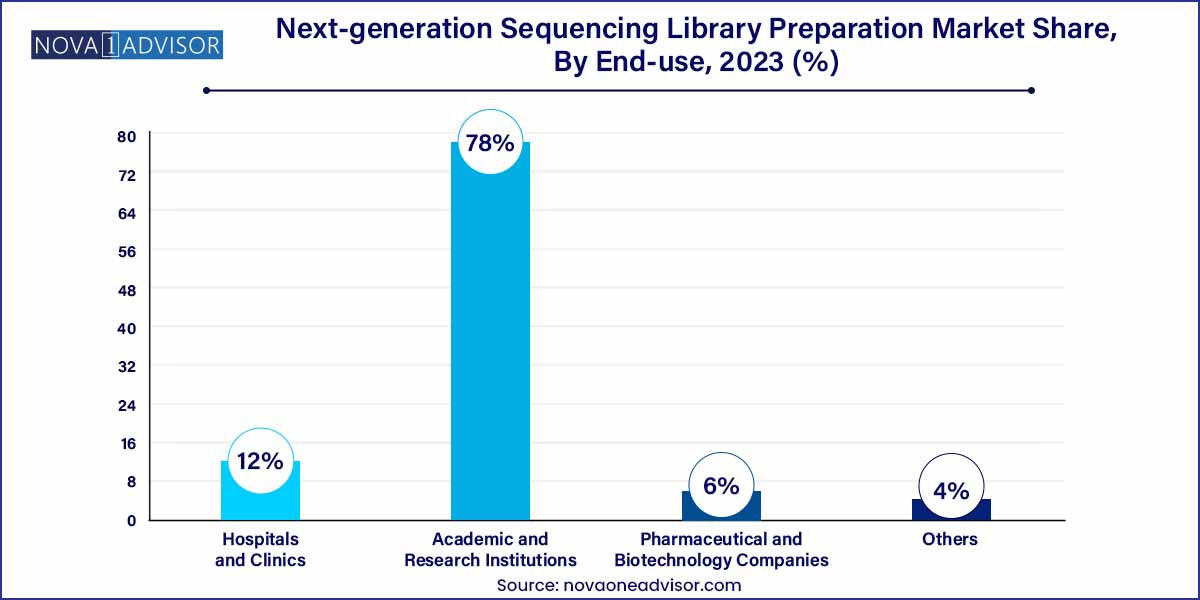

End-use Insights

Pharmaceutical and Biotechnology Companies dominated the end-user segment, driven by the need for consistent, high-throughput NGS workflows to support R&D, biomarker validation, and regulatory submissions. These companies often invest in premium library prep systems and services to streamline multi-omics studies and clinical development. Collaborations with CDMOs and service providers further enhance their sequencing capabilities.

Academic and Research Institutions are the fastest-growing users. With expanding funding in genomics research from public agencies like the NIH and the European Commission, universities and research labs are scaling up their sequencing capacities. Open-source bioinformatics tools, availability of grants, and academic-industry collaborations are also boosting their role in generating large-scale genomic datasets, thus increasing demand for flexible and customizable library prep kits.

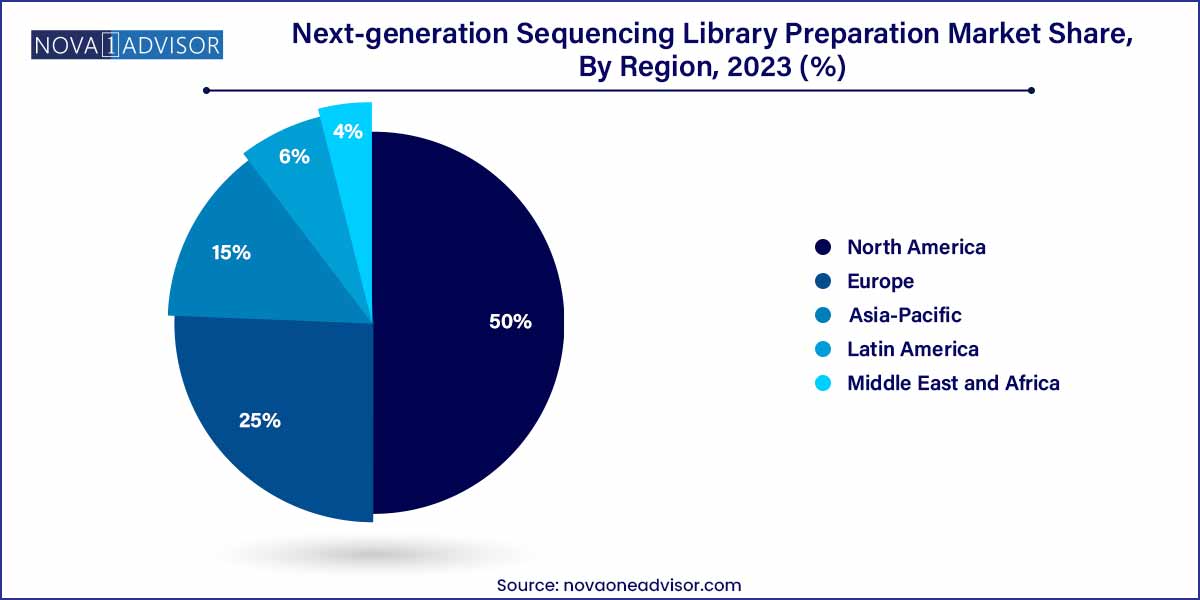

Regional Insights

North America holds the largest market share in the NGS library preparation market. The presence of top sequencing companies (Illumina, Thermo Fisher, Agilent), world-class research institutions, and a strong regulatory environment has driven adoption. Programs like the NIH’s All of Us, the CDC’s Advanced Molecular Detection initiative, and significant cancer genomics funding contribute to the market's dominance. Moreover, the U.S. leads in the adoption of NGS-based diagnostics, with CLIA-certified labs integrating automated library prep systems for rapid turnaround times.

Asia-Pacific is the fastest-growing region, with China, India, South Korea, and Japan emerging as genomic innovation hubs. The growth is fueled by large population cohorts, government-backed genome projects (like China's Precision Medicine Initiative and India’s GenomeIndia), and increasing investment by global players in local manufacturing. Companies such as BGI Group and Genetron Health are not only innovating in sequencing technologies but also developing home-grown library prep solutions tailored for regional needs

In March 2025, New England Biolabs (NEB) launched its NEBNext UltraExpress RNA Library Prep Kit, promising a 30% reduction in prep time for mRNA sequencing applications.

In January 2025, Twist Bioscience partnered with Element Biosciences to integrate Twist’s target enrichment panels with Element’s sequencing platforms, ensuring compatibility from library prep to readout.

In November 2024, Illumina unveiled a new automation-friendly version of its Nextera DNA Flex Kit, optimized for high-throughput operations and featuring dual-index barcoding for multiplexed studies.

In October 2024, PerkinElmer expanded its NGS consumables line by acquiring a niche kit manufacturer specializing in microbial and virome library prep kits.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2033. For this study, Nova one advisor, Inc. has segmented the global Next-generation sequencing library preparation market.

Sequencing Type

Products

Application

End-use

By Region