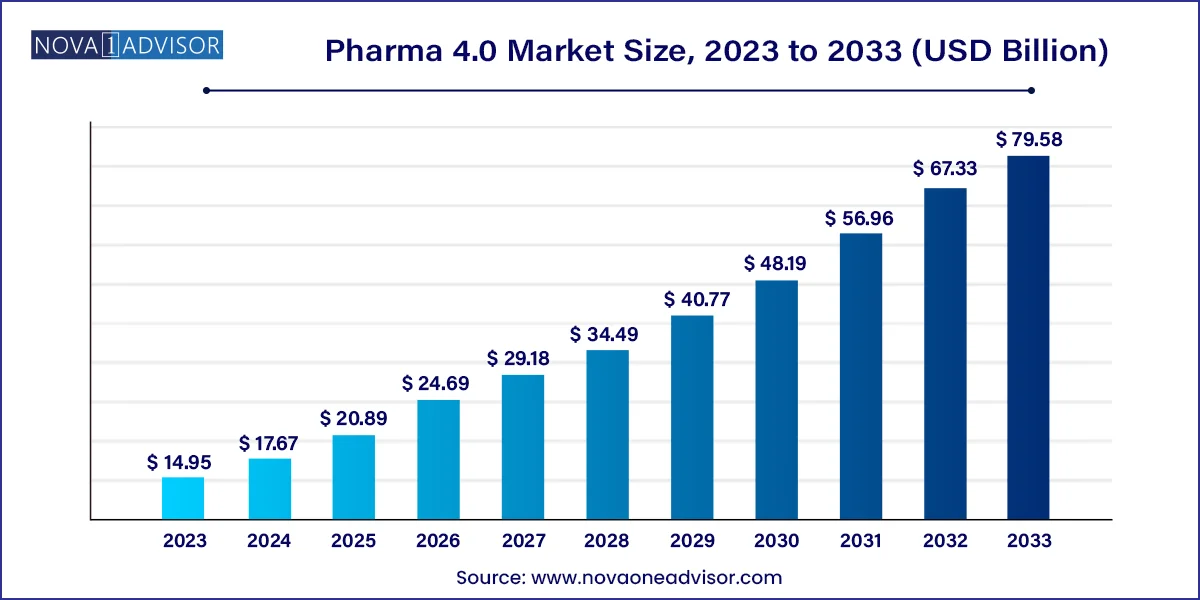

The global pharma 4.0 market size was valued at USD 14.95 billion in 2023 and is anticipated to reach around USD 79.58 billion by 2033, growing at a CAGR of 18.2% from 2024 to 2033.

Pharma 4.0 Market Key Takeaways

Pharma 4.0 Market Overview

The pharmaceutical sector is moving toward integration of recent technological developments in digitization and industry 4.0 practices into the drug manufacturing process. 'Pharma 4.0' is the name given to this integration. Creation of digital twins of production lines is an essential part of this integration.

Industry 4.0-related smart technologies, such as Big Data Analytics (BDA), Internet of Things (IoT), Cyber-Physical Systems (CPS), and Cloud Computing (CC), are essential in fostering the shift from conventional manufacturing to smart manufacturing.

Numerous manufacturing tasks, including remote sensing, process visualization, real-time data acquisition and monitoring, and control of all devices across a manufacturing network, are becoming more practical with the development of these industry 4.0 technologies.

Companies are focusing on smart manufacturing in the pharmaceutical sector by adopting pharma 4.0 technologies. Connected pharmaceutical manufacturing tools are also being used across the globe.

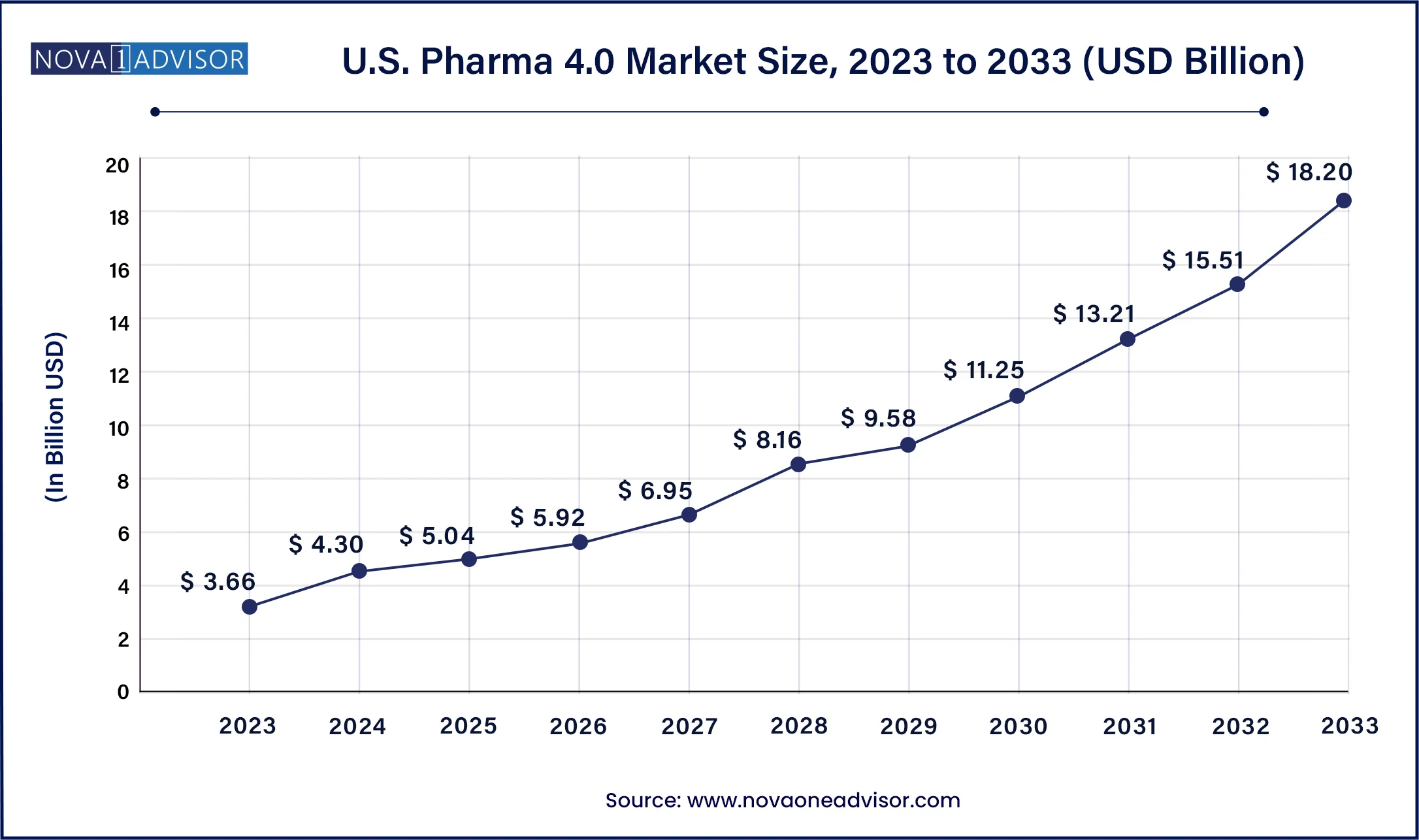

The U.S. pharma 4.0 market size was estimated at USD 3.66 billion in 2023 and it is predicted to reach around USD 18.20 billion by 2033, growing at a CAGR of 17.4% during the forecast period from 2024 to 2033.

North America dominated the market with the largest market size in 2023, the region is anticipated to maintain its position throughout the forecast period. The region has actively participated in the adoption of advanced technological solutions in almost every field. The focus and substantial potential for technological innovation in the pharmaceutical sector across the region along with the availability of investors for the same highlight the factors for the market’s expansion in North America. Enormous demand for drug discovery in the region promotes the accpetance of various technologies to improve the overall operative capabilities of the firms. This factor promises a bright future for the pharma 4.0 market in North America.

Moreover, the food and drug administration (FDA) of the United States has already stated the known importance of advanced technologies for the pharmaceutical as well as biotechnology industries, this element acts as a growth factor for the market by boosting the rate of adoption for such technologies.

Asia Pacific is expected to witness significant growth in the market during the forecast period. The region is currently experiencing a rapid acceptance of advanced technologies while addressing potential issues with the traditional operation systems. This element highlights the growth of the market in Asia Pacific. The improving infrastructure of pharmaceutical industry and rising requirements for novel drug development promote the growth of the market in the region. Multiple pharmaceutical companies in potential countries, such as India, South Korea, Japan and China are focusing on automation of tasks for lowering the overall time consumed at the firms. This is another factor to fuel the growth of the market in Asia Pacific in the upcoming years.

| Report Attribute | Details |

| Market Size in 2024 | USD 17.67 Billion |

| Market Size by 2033 | USD 79.58 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 18.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Application, and By End-User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Microsoft Corporation, Oracle Corporation, ABB, Honeywell International Inc., Cisco Systems, Inc., Siemens Healthcare GmbH, GE Healthcare, IBM Corporation, Amazon Web Services, Inc., and Others. |

The pharmaceutical sector is under pressure to improve operational efficiency and reduce production costs. This can be ascribed to the rise in need to bring drugs to market faster, growth in competition from generic drugs, and increase in cost of healthcare. Therefore, pharmaceutical companies are turning toward pharma 4.0 solutions to streamline operations, reduce costs, and improve productivity.

Pharma 4.0 solutions are driving operational efficiency by enabling pharmaceutical companies to optimize supply chain management. Pharmaceutical companies can track products throughout the supply chain, from raw materials to finished products, with the help of IoT sensors and other connected devices. This enables them to identify bottlenecks and inefficiencies in the production process, and take corrective actions to improve efficiency and reduce costs.

Pharma 4.0 solutions are also being adopted to improve the efficiency of drug development and clinical trials. Pharmaceutical companies can analyze large amounts of data to identify potential drug candidates and optimize clinical trial design by leveraging big data analytics and AI. This can enable them to bring drugs to market faster and at a lower cost, while also improving patient outcomes.

Pharmaceutical companies can also reduce the need for manual labor and improve accuracy and consistency of manufacturing processes by adopting advanced robotics and other automation technologies. This can lead to a significant decrease in production costs, while improving product quality and consistency.

Artificial intelligence (AI), Big Data Analytics, and Internet of Things (IoT) are gaining traction in the pharmaceutical sector. These technologies help enhance drug manufacturing processes.

Increase in usage of AI and big data analytics in drug discovery and development is one of the key drivers of the pharma 4.0 market. AI can be used to analyze large amounts of data, such as genomic data and clinical trial data, in order to identify potential drug candidates and optimize clinical trial design.

Growth in adoption of IoT devices in manufacturing and supply chain management is another key driver of the global market. IoT devices can be used to monitor the manufacturing process, track drug shipments, and monitor patient health. This data can be used to improve quality control, optimize supply chain management, and personalize treatments.

Cloud computing is a key technology that supports the implementation of digital tools and facilitates their integration and scalability in the pharmaceutical sector.

Cloud computing allows pharmaceutical companies to store and process large amounts of data securely and efficiently, without the need for expensive on-premise hardware. It also enables remote access to data and applications, which can improve collaboration and productivity across different departments, teams, and locations.

Cloud computing technology enables pharmaceutical companies to leverage the power of digital technologies in a flexible, scalable, and cost-effective manner. Pharmaceutical companies can accelerate innovation, improve patient outcomes, and enhance competitiveness in a rapidly evolving market by adopting cloud-based solutions.

As per the pharma 4.0 market research report, the drug discovery and development application segment is anticipated to lead the global landscape during the forecast period. Applications of industry 4.0 in the pharmaceutical industry are rising across the globe.

Pharma 4.0 refers to digital transformation in pharmaceuticals through the integration of advanced technologies. These advanced technologies improve the efficiency and effectiveness of the drug discovery and development process by reducing costs and improving patient outcomes.

Drug discovery and development process involves the adoption of data analytics to identify promising drug targets, predict potential drug interactions and side effects, and optimize drug efficacy and dosing. Thus, increase in usage of pharma 4.0 in drug development and discovery is fueling market progress.

The pharmaceutical companies end-user segment is estimated to account for major share of the global landscape during the forecast period. Pharma 4.0 refers to the fourth industrial revolution in the pharmaceutical sector, which is characterized by the integration of advanced digital technologies into drug development and manufacturing processes.

Pharmaceutical companies are increasingly adopting pharma 4.0 technologies to improve efficiency, quality, and safety of drug development and manufacturing. These technologies can help pharmaceutical companies optimize their manufacturing processes and accelerate drug development timelines.

The pharmaceutical sector is highly regulated, and pharma 4.0 technologies can help companies comply with regulatory requirements by providing real-time monitoring and control of manufacturing processes as well as end-to-end traceability of drug products.

Pharma 4.0 Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharma 4.0 market.

By Technology

By Application

By End-User

By Region