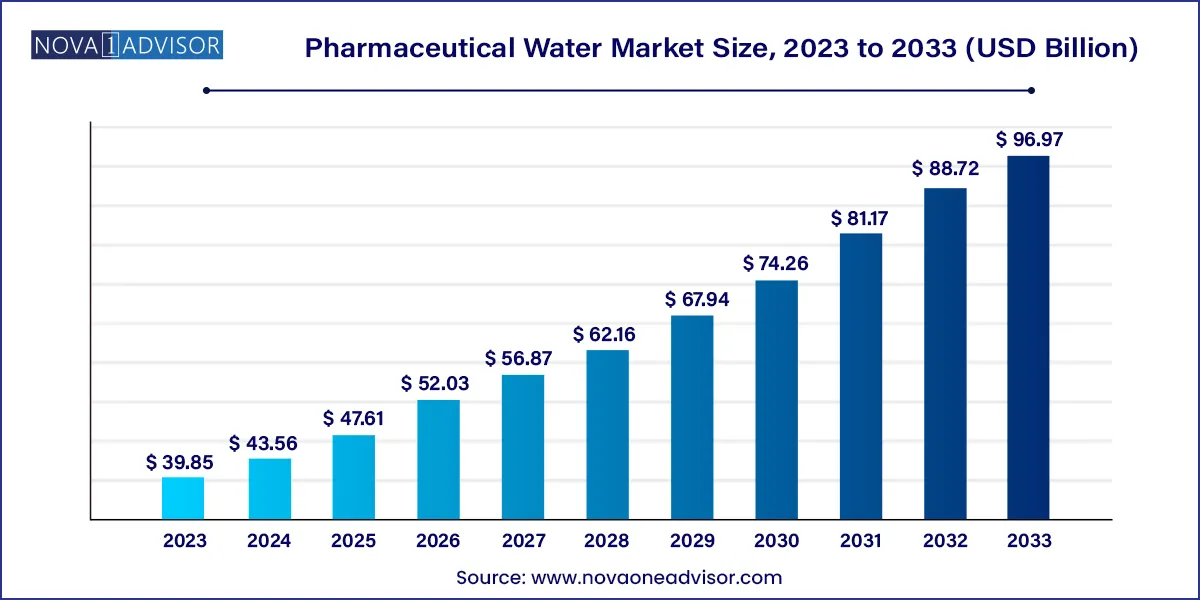

The global pharmaceutical water market size was valued at USD 39.85 billion in 2023 and is anticipated to reach around USD 96.97 billion by 2033, growing at a CAGR of 9.3% from 2024 to 2033.

The pharmaceutical water market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing demand for high-quality water in the pharmaceutical industry, where stringent regulations and standards necessitate the use of ultra-pure water in various processes, including drug formulation and manufacturing. Additionally, the rising prevalence of chronic diseases and the subsequent growth in pharmaceutical production are fueling the demand for purified water systems. Technological advancements in water purification methods, such as reverse osmosis and ultraviolet disinfection, are also contributing to the market's expansion. Furthermore, the growing focus on quality control and assurance in pharmaceutical processes, driven by regulatory bodies, is pushing companies to invest in advanced water treatment solutions, thereby boosting the market growth.

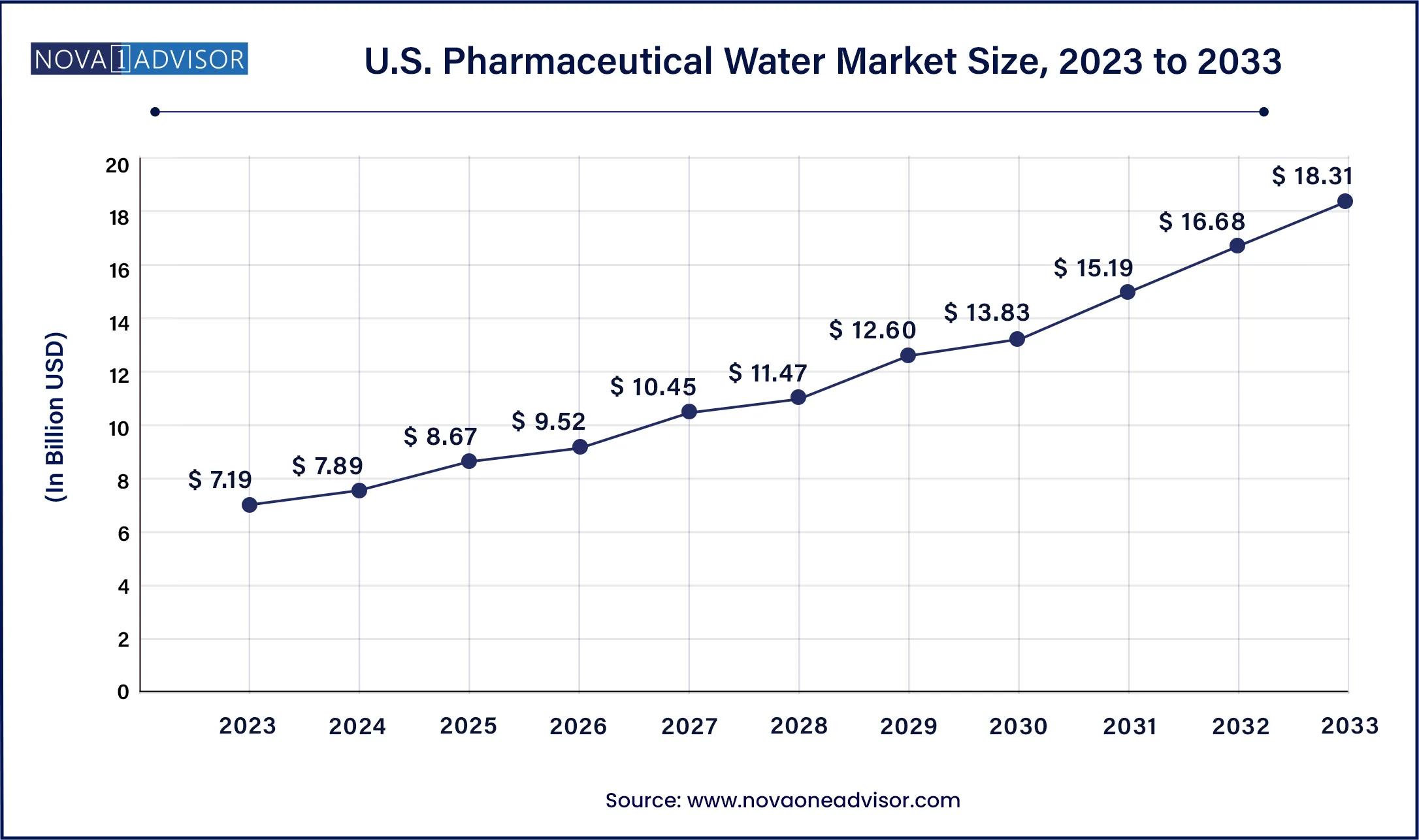

The U.S. pharmaceutical water market size was valued at USD 7.19 billion in 2023 and is predicted to hit USD 18.31 billion by 2033 with a CAGR of 9.8% from 2024 to 2033.

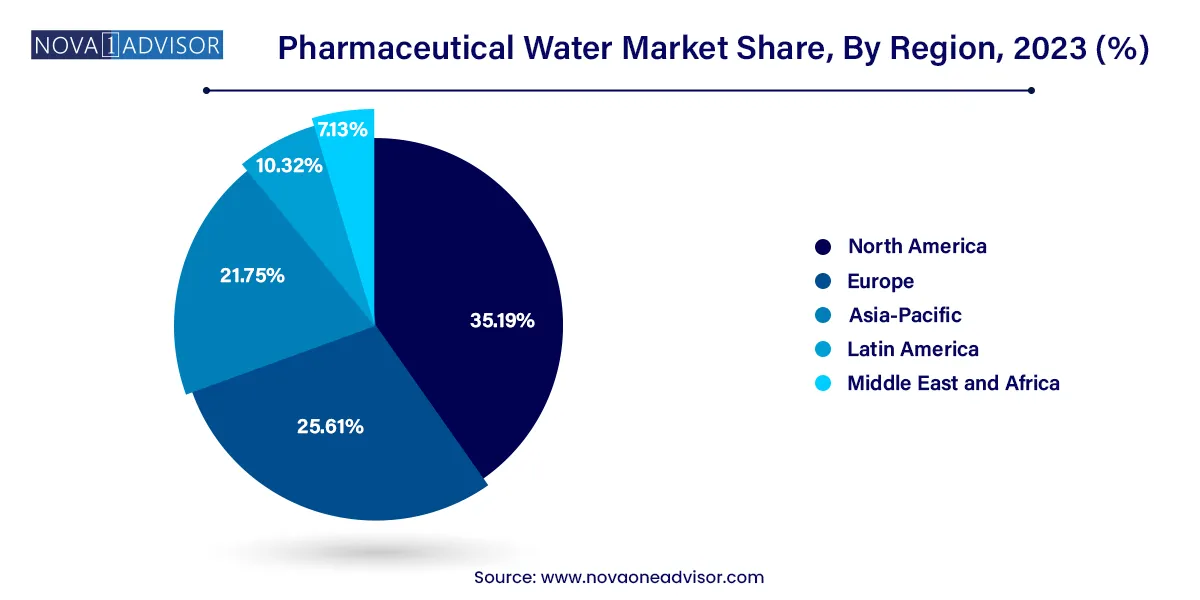

North America is Estimated to be Garner Major Chunk of Pharmaceutical Water Market

The research report covers key trends and prospects of Pharmaceutical Water products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. North America seized major stake of the pharmaceutical water market in 2022. Occurrence of important companies and development strategies accepted by these players are the major influences propelling the growth of pharmaceutical water market in the region.

Emerging countries embrace the majority of prospects for pharmaceuticals water market, with China leading the control. China is expected to be the fastest developing region for outlay in the pharmaceuticals water market. Investments of USD 68.3 million in 2014 are set to increase to USD 130.7 million in 2018. The level of development is being motivated by the rising expectation of progressively large and prosperous population in China, which will consequence in augmented spending on upgraded pharmaceutical and healthcare products. For water-associated corporations, the prospects present in projects presented by international pharmaceutical firms manufacturing in the region. Further, in India, investment in pharmaceutical water will also perceive striking progress during years to come.

| Report Attribute | Details |

| Market Size in 2024 | USD 43.56 Billion |

| Market Size by 2033 | USD 96.97 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | B. Braun Melsungen AG, Merck KGaA, Thermo Fisher Scientific, Inc., Baxter International, Inc., Intermountain Life Sciences, Cytiva (Danaher), Standard Reagents, Pvt. Ltd., FUJIFILM Irvine Scientific, CovaChem, LLC, Pfizer, Inc and Fresenius Kabi AG. |

The water for injection segment dominated the pharmaceutical water market in 2023. Water for injection (WFI) is a critical component in pharmaceutical manufacturing processes, particularly for the formulation of parenteral drugs such as injectables, infusions, and sterile solutions. Regulatory agencies such as the United States Pharmacopeia (USP), European Pharmacopoeia (EP), and other international regulatory bodies mandate strict quality standards for WFI to ensure product safety, efficacy, and compliance with Good Manufacturing Practices (GMP).

Pharmaceutical Water Market Revenue, By Type, 2022-2030 (USD Bn)

| By Type | 2022 | 2023 | 2027 | 2030 |

| HPLC Grade Water | 7.29 | 8.10 | 11.84 | 15.24 |

| Water for Injection | 27.41 | 30.60 | 45.56 | 59.49 |

The pharmaceutical & biotechnology companies segment led the market with the largest share in 2023. Pharmaceutical water is a critical component in the manufacturing of pharmaceutical products, as it is used in various stages of production, including formulation, cleaning, and quality control. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent requirements for the quality and purity of water used in pharmaceutical manufacturing. Pharmaceutical and biotechnology companies have the expertise, resources, and infrastructure to meet these regulatory standards and ensure the production of high-quality pharmaceutical water.

Pharmaceutical Water Market Revenue, By Application, 2022-2030 (USD Bn)

| By Application | 2022 | 2023 | 2027 | 2030 |

| Pharmaceutical & Biotechnology Companies | 19.97 | 22.30 | 33.25 | 43.44 |

| Academics & Research Laboratories | 14.72 | 16.39 | 24.15 | 31.29 |

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical Water market.

By Type

By Application

By Region