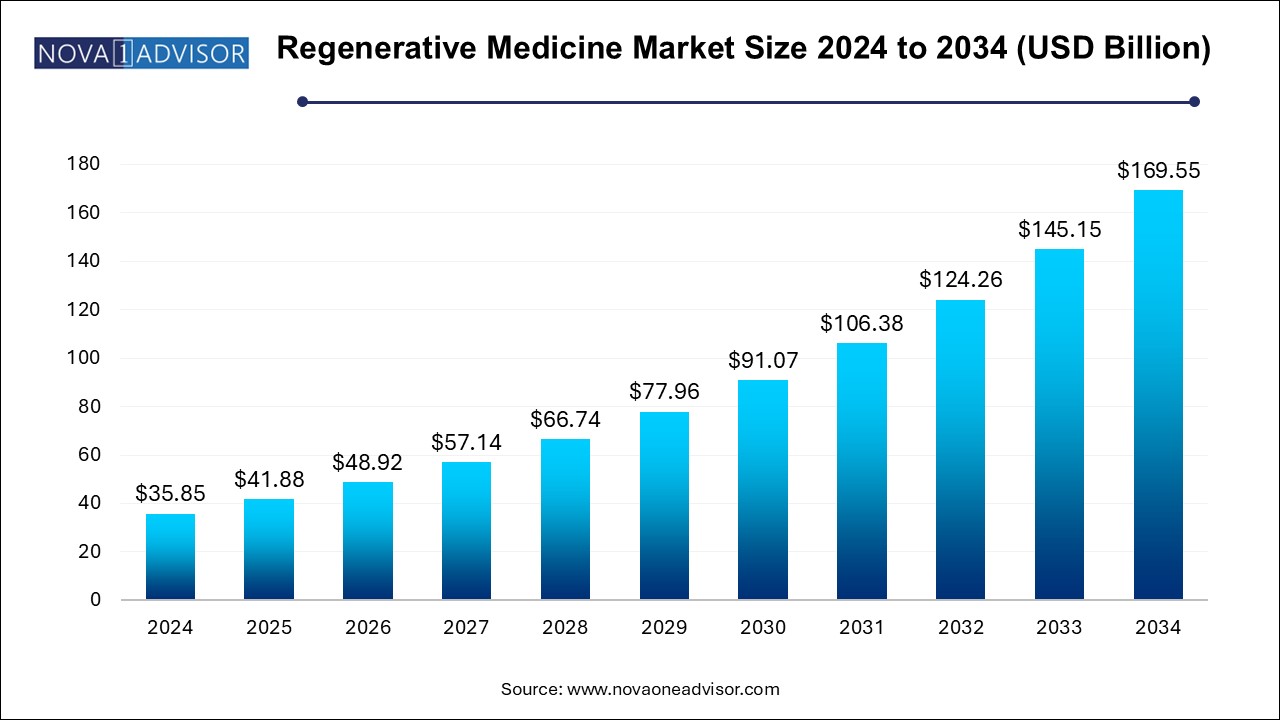

The regenerative medicine market size was exhibited at USD 35.85 billion in 2024 and is projected to hit around USD 169.55 billion by 2034, growing at a CAGR of 16.81% during the forecast period 2025 to 2034.

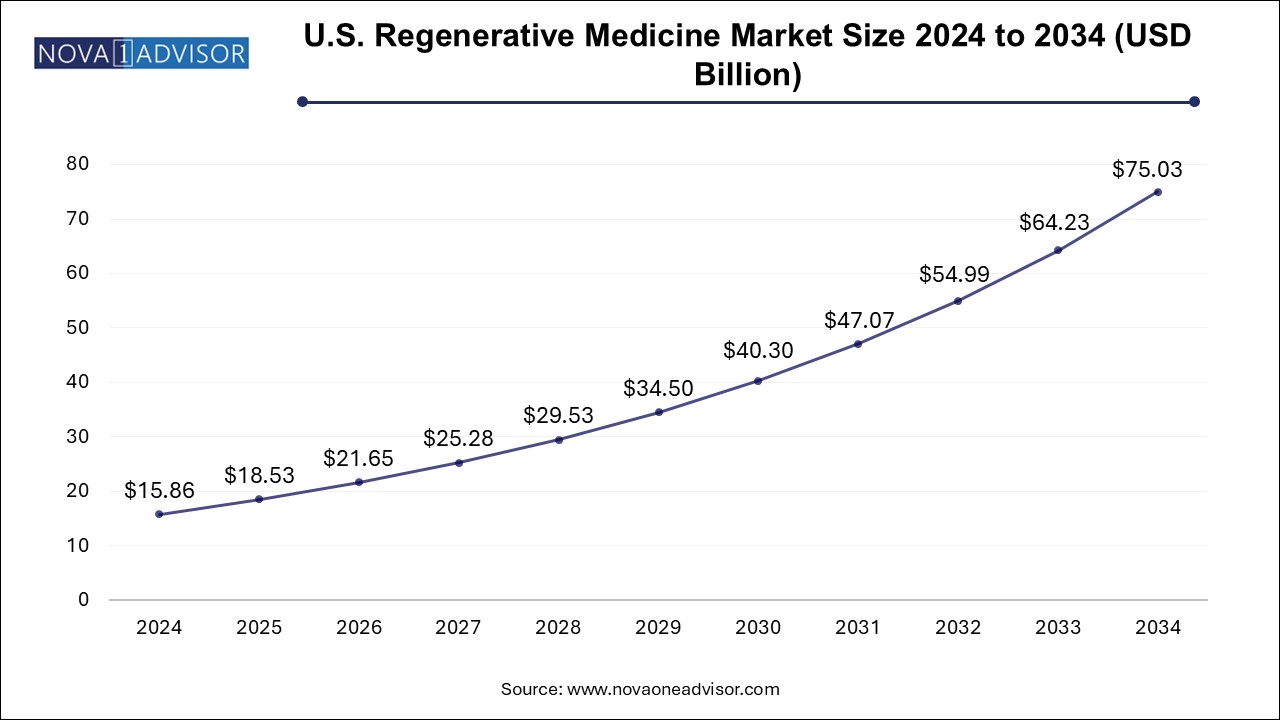

The U.S. regenerative medicine market size is evaluated at USD 15.86 billion in 2024 and is projected to be worth around USD 75.03 billion by 2034, growing at a CAGR of 15.17% from 2025 to 2034.

North America dominates the regenerative medicine market, led by the United States. The region benefits from advanced healthcare infrastructure, a strong pipeline of regenerative therapies, and proactive regulatory frameworks. The FDA’s RMAT designation and accelerated approval programs have enabled faster market entry for innovative products. The presence of top-tier biotech companies, academic institutions, and research funding bodies like NIH further strengthens the region’s leadership.

Asia-Pacific is the fastest-growing region, driven by supportive government policies, rapidly improving healthcare infrastructure, and high patient demand. Countries such as Japan, South Korea, and China are investing heavily in regenerative medicine research and commercialization. Japan’s accelerated pathway for regenerative medical products and China’s stem cell therapy trials have created conducive environments for clinical innovation. Additionally, the growing middle class and medical tourism in Asia are boosting regional adoption.

The regenerative medicine market represents a groundbreaking domain within modern healthcare, focused on repairing, replacing, or regenerating human cells, tissues, or organs to restore or establish normal function. This multidisciplinary field leverages technologies such as cell therapy, gene therapy, tissue engineering, and biomaterials to address complex medical conditions ranging from musculoskeletal and cardiovascular diseases to oncology and ophthalmology.

As global healthcare systems shift toward personalized medicine and curative rather than palliative care, regenerative therapies have emerged as a revolutionary solution. Stem cells, induced pluripotent stem cells (iPSCs), and gene-edited products are at the forefront of research and clinical application. These therapies offer immense potential to treat degenerative disorders, inherited diseases, and trauma-related injuries that were previously deemed untreatable.

The market is being driven by a confluence of scientific advances, increased funding from public and private sectors, and supportive regulatory pathways such as the FDA’s Regenerative Medicine Advanced Therapy (RMAT) designation. Moreover, the expansion of biobanks, growing success in CAR-T cell therapies, and wider integration of tissue-engineered products into clinical protocols have accelerated the commercialization of regenerative medicine.

Growing number of FDA approvals for cell and gene therapy products

Increased investment in stem cell research and biobanking infrastructure

Emergence of 3D bioprinting for tissue and organ regeneration

Integration of AI and machine learning in regenerative therapy R&D

Expansion of off-the-shelf allogenic cell-based products

Growth in autologous therapies tailored for rare and chronic diseases

Strategic partnerships between biotech firms and academic research institutions

Rising adoption of regenerative medicine in orthopedic and dermatological applications

| Report Coverage | Details |

| Market Size in 2025 | USD 41.88 Billion |

| Market Size by 2034 | USD 169.55 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 16.81% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Therapeutic Category, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK). |

Therapeutics dominate the regenerative medicine market, particularly in the form of cell-based immunotherapies, gene therapies, and stem cell-based interventions. Autologous and allogenic cell therapies are being used in dermatology, musculoskeletal disorders, and oncology. Autologous therapies, which use a patient’s own cells, are favored for reduced rejection risk, while allogenic therapies are gaining ground for their scalability and off-the-shelf potential. Gene therapies, such as Luxturna and Zolgensma, have proven the viability of treating genetic disorders at the source, and more such approvals are on the horizon.

Services are the fastest-growing product segment, especially due to the rise of contract development and manufacturing organizations (CDMOs), stem cell banking, and clinical trial support services. As startups and smaller biotech firms focus on R&D, they rely heavily on third-party services for logistics, cell harvesting, expansion, cryopreservation, and regulatory compliance. The increasing complexity of regenerative therapies makes specialized services indispensable to the market’s value chain.

Musculoskeletal applications dominate the therapeutic category, owing to the extensive use of stem cells and tissue-engineered products in treating bone and cartilage injuries, osteoarthritis, and spinal cord injuries. These applications are supported by strong clinical evidence and increasing use in sports medicine and orthopedic surgery. Platelet-rich plasma (PRP), bone grafts, and stem cell injections are seeing rapid integration into standard care protocols.

Oncology is the fastest-growing therapeutic category, especially driven by the rise of cell-based immunotherapies like CAR-T and tumor-infiltrating lymphocytes (TILs). Regenerative techniques are also being explored in reconstructive surgery following cancer excision. Furthermore, gene editing tools such as CRISPR-Cas9 are enabling targeted modification of cancer cells, increasing the success rates of personalized oncology treatments.

In April 2025, Novartis announced the expansion of its gene therapy manufacturing facility in North Carolina to support its regenerative medicine pipeline.

In March 2025, Astellas Pharma received FDA clearance for a new stem cell-based therapy for treating dry age-related macular degeneration.

In January 2025, CRISPR Therapeutics and Vertex Pharmaceuticals began Phase III trials for their gene-editing therapy targeting sickle cell disease and beta-thalassemia.

In November 2024, Organogenesis Holdings Inc. launched a next-generation bioengineered skin substitute for chronic wound care.

In September 2024, Mesoblast Limited partnered with a major U.S. hospital network to advance its allogenic stem cell therapy for heart failure.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Regenerative Medicine Market

By Product

By Therapeutic Category

By Regional