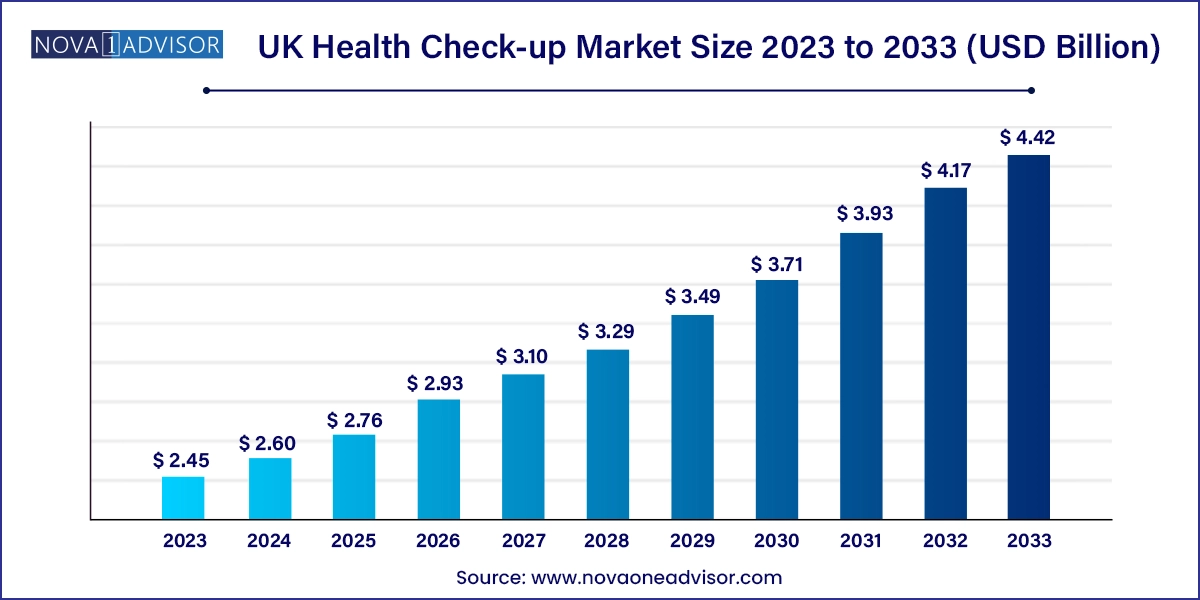

The UK health check-up market size was exhibited at USD 2.45 billion in 2023 and is projected to hit around USD 4.42 billion by 2033, growing at a CAGR of 6.09% during the forecast period 2024 to 2033.

The UK health check-up market has evolved significantly over the past decade, transitioning from reactive treatment models to a proactive, preventive healthcare approach. With an aging population, increased lifestyle-related diseases, and mounting pressure on the National Health Service (NHS), routine health check-ups are becoming a critical part of individual and population health management in the United Kingdom. This market encompasses a broad range of diagnostic assessments, including blood and body fluid analysis, imaging diagnostics, cardiovascular evaluations, and neurological assessments.

Rising health awareness among the public, advances in diagnostic technologies, and support from public and private sector stakeholders have driven the growth of regular health screening in the UK. While the NHS continues to offer a baseline of check-up services, demand for more comprehensive, rapid, and personalized screenings has prompted a surge in private health check-up providers. These include hospitals, diagnostic chains, wellness clinics, mobile screening units, and telehealth platforms offering at-home testing services.

Further accelerating this growth is the emergence of employer-sponsored wellness initiatives, preventive screening coverage by insurance providers, and increasing reliance on digital health tools that enable remote testing, consultation, and data monitoring. The COVID-19 pandemic has also played a role in reshaping health consciousness, with individuals increasingly opting for preventive care and full-body assessments to detect underlying conditions early. As lifestyle diseases such as obesity, hypertension, cardiovascular ailments, and diabetes continue to rise in prevalence, the UK health check-up market is poised for strong, sustained growth across diverse end-user segments.

Increased Focus on Preventive Health: More individuals are undergoing annual health check-ups to detect early signs of chronic conditions.

Rise of Corporate Health Screening Programs: UK-based employers are offering subsidized or free health check-up packages to employees as part of wellness programs.

Integration of Digital Health Tools: Remote health monitoring, teleconsultations, and at-home sample collection kits are reshaping how check-ups are delivered.

Personalized Screening Packages: Health check-ups are becoming more targeted with age, gender, lifestyle, and genetic predisposition-based packages.

Insurance-driven Preventive Check-ups: Private health insurers are increasingly covering routine diagnostics to reduce long-term policy claims.

Demand for Advanced Imaging & Cardio-Metabolic Assessments: MRI, CT, and cardiac screenings are gaining popularity among high-risk populations.

Post-pandemic Health Awareness: COVID-19 led to a boom in demand for comprehensive check-ups, especially for respiratory, cardiac, and metabolic parameters.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.60 Billion |

| Market Size by 2033 | USD 4.42 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.09% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Test Type, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK |

| Key Companies Profiled | Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; SYNLAB International GmbH; OPKO Health, Inc.; Eurofins Scientific; UNILABS; Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions |

Growing Burden of Lifestyle Diseases and the Shift Toward Preventive Healthcare

A leading driver of the UK health check-up market is the rising incidence of lifestyle-related illnesses and the accompanying national push toward preventive healthcare models. Sedentary lifestyles, poor dietary habits, rising obesity rates, and increasing mental health stress have contributed to a surge in chronic conditions such as hypertension, diabetes, cardiovascular disease, and cancer. According to Public Health England, nearly 40% of the UK’s disease burden is preventable through early screening and behavioral changes.

Routine check-ups are essential to identify risk factors early and implement timely interventions. For instance, full blood panels, ECGs, and lipid profiles can help diagnose asymptomatic high cholesterol or diabetes. Early detection allows for disease management through lifestyle modifications or medication, reducing the burden on the NHS and improving patient outcomes. As both private and public health stakeholders acknowledge the long-term benefits of early diagnostics, demand for structured health assessments continues to rise.

Health Inequality and Disparities in Access

Despite strong growth potential, the UK health check-up market faces a persistent challenge in the form of health inequalities and inconsistent access. While urban centers and affluent regions have a wide array of private diagnostic centers and digital health tools, rural and underserved areas often rely solely on NHS services, which may not offer comprehensive routine check-ups. This creates gaps in early detection among disadvantaged populations.

Moreover, private health check-ups are often expensive, with many advanced diagnostic packages costing hundreds of pounds. Although insurance schemes are improving, a significant portion of the population still pays out of pocket. Language barriers, lack of awareness, and cultural stigmas around routine testing in some ethnic communities also contribute to underutilization. Overcoming these challenges requires targeted outreach, subsidized programs, and the integration of public-private screening models to ensure equitable access to preventive diagnostics.

Digital Health Platforms and At-home Diagnostic Testing

One of the most promising opportunities in the UK health check-up market lies in the growth of digital health platforms and at-home diagnostic testing. The pandemic accelerated the adoption of home-based health services, leading to increased consumer comfort with at-home test kits and virtual consultations. Companies are now offering easy-to-use sample collection kits for blood, saliva, or urine, enabling patients to get tested from home and receive digital reports within 24-48 hours.

Startups and digital health providers are offering targeted packages like hormone analysis, cardiac panels, liver function, allergy testing, and even genetic predisposition tests, all without requiring a clinic visit. This model increases convenience, encourages regular testing, and expands access to preventive diagnostics for those with mobility or time constraints. As remote patient monitoring tools and wearable devices become more mainstream, the ecosystem around virtual preventive health will continue to create new revenue streams and improve national screening rates.

Blood, urine, and body fluid tests remain the most commonly conducted tests across all health check-up programs in the UK, accounting for the majority of diagnostic volume. These tests form the baseline for detecting organ function, hormonal imbalances, nutrient deficiencies, infections, and chronic conditions such as diabetes, thyroid disorders, and anemia. Their affordability, availability, and scalability make them a cornerstone of both public and private health check-up packages. Almost every provider, from the NHS to private diagnostics companies, includes a core set of blood tests in their standard health screening packages.

However, imaging-based tests, particularly MRI and CT scans, are growing rapidly in demand. As patients seek comprehensive assessments and early detection of silent conditions like tumors, cardiovascular blockages, or neurological changes, imaging diagnostics are gaining ground. For individuals aged 40+, full-body scans or specific organ screening (brain, lungs, heart) are increasingly popular. These high-value services are commonly chosen by private individuals or offered in high-tier corporate health check plans. The fastest growth is seen in bundled diagnostic packages that combine blood tests with imaging and non-imaging assessments.

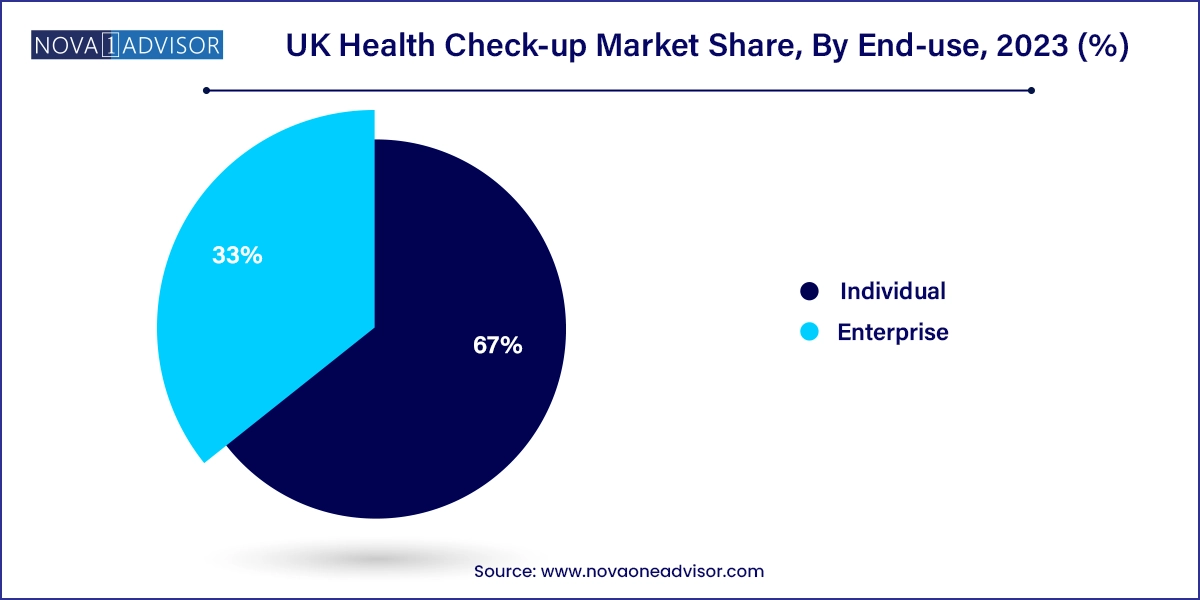

Individual-driven health check-ups are currently the largest contributor to the UK health check-up market. This includes both direct out-of-pocket spending and services availed under individual health insurance plans. Many individuals opt for yearly or biennial health screening, especially after age 35 or in the presence of family history of chronic illnesses. The availability of customizable check-up packages at private hospitals, wellness centers, and online platforms has made individual health screening more accessible. Middle-aged adults and the elderly represent the highest adoption group.

Enterprise-driven health check-ups, particularly within the corporate private sector, are growing rapidly as employers recognize the benefits of healthy employees on productivity and morale. Companies are partnering with diagnostic providers to offer on-site or voucher-based health checks to their workforce. Similarly, the insurance sector is beginning to integrate health check-ups into preventive plans, offering discounts on premiums for policyholders who undergo regular screenings. The public government sector is also expanding wellness checks among civil service departments to reduce absenteeism and ensure early disease management among employees.

The UK’s health check-up landscape is shaped by a mix of public health services and a growing private diagnostics sector. The NHS offers basic health assessments through programs such as the NHS Health Check, targeted at individuals aged 40 to 74 without pre-existing conditions. However, these services are often limited in scope and frequency, leading many individuals to seek comprehensive private assessments.

Urban centers like London, Manchester, Birmingham, and Edinburgh are home to a wide array of private health check-up providers, ranging from hospital-affiliated diagnostic departments to boutique wellness clinics. Innovations like at-home sample collection, mobile testing vans, and teleconsultations are bridging access gaps in semi-urban and rural communities. Leading supermarket chains and pharmacies are also offering basic diagnostic packages, increasing outreach.

The UK government continues to prioritize early intervention as part of its 10-year health strategy, supporting preventive testing through GP practices and digital tools. Insurance companies like Bupa and AXA are playing an increasing role in funding and structuring health check-up programs that incentivize healthy living through wearable integration and wellness tracking.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK health check-up market

Test Type

End-use