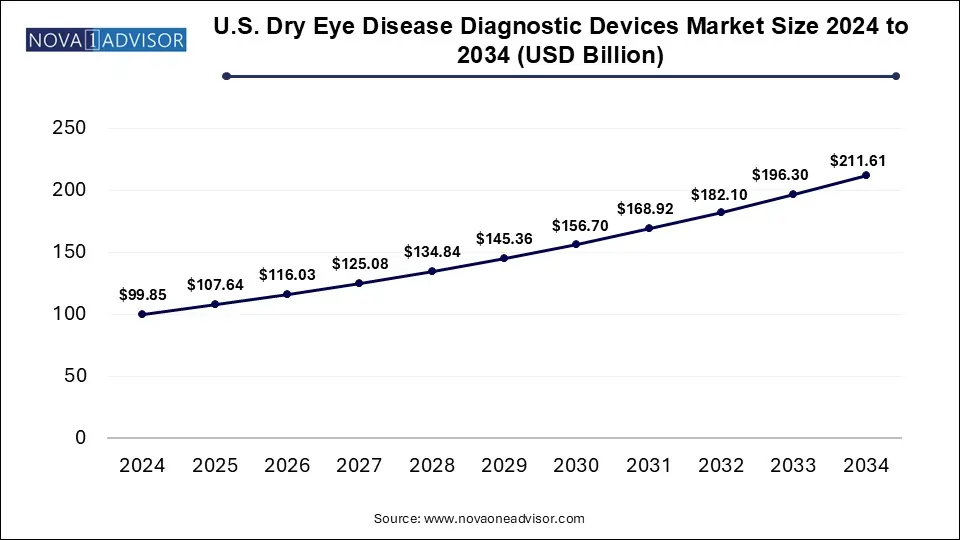

The U.S. dry eye disease diagnostic devices market size was valued at USD 99.85 billion in 2024 and is expected to Hit USD 211.61 billion by 2034, growing at a CAGR of 7.8 during the forecast period from 2025 to 2034. Technological advancement, the rising chronic prevalence, and rising consumer awareness drive the U.S. dry eye disease diagnostic devices market.

An increase in the prevalence of dry eye diseases (DED) provides a platform for a steady-growth market for dry eye treatment devices in the U.S. Such risk factors as prolonged screen exposure, overuse of contact lenses, diabetes, glaucoma, and autoimmune disorders are contributing to the rising need for effective treatments. With yearly reports of an increase in average screen time, more people are developing symptoms of dry eye. The therapeutic landscape is changing, and physicians are targeting a wider array of causes rather than simply offering temporary relief. This change in direction will further drive growth in this market in the next few years. Moreover, the presence of some established bidders in the market will enhance the availability of advanced technologies and further accelerate the demand.

| Report Coverage | Details |

| Market Size in 2025 | USD 107.64 Billion |

| Market Size by 2034 | USD 211.61 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Technology |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Lumenis; ESW Vision; Johnson & Johnson Vision Care; MiBo Medical Group; Alcon Inc.; Sight Sciences |

Drivers

Emerging Technologies for Dry Eye Diagnosis

Emerging technologies are key driving factors for the U.S. dry eye diagnostic devices market. Innovations in dry eye diagnosis are now enhancing accuracy and efficiency. Reflective meniscometry measures parameters quantitatively on tear meniscus shape and volume, while optical coherence tomography (OCT) provides precise and reproducible measurements of tear film thickness and tear volume. Tear film stability analysis measures some aspects of dynamic change that are important for severity classification; interferometry checks lipid layer thickness, with drying correlating with meibomian gland dysfunction; and osmolarity detects those changes, providing some quantitative measure for diagnostic purposes but creating challenges in the differentiation between dry and healthy eyes. The evaluation of biomarkers, and especially inflammatory markers like matrix metalloproteinase 9, heralds new avenues for diagnosis through individualized assessments

Opportunity

Future of AI in Dry Eye Disorder Management

AI and modern technology have shown emerging talents to dramatically humanitarianize dry eye disease (DED) management, ranging from early identification to more personalized care and finally assimilation with newer technologies. AI algorithms would be required to analyze large data sources to detect the presence of an asymptomatic early stage of the disease prompt intervention could be conducted before the patient is even aware of its presence. Predictive analytics increase efforts to prevent disease with the development of personal risk profiles used to provide evidence-based lifestyle-changing recommendations and improve compliance with medication treatment. AI-based tools encourage conversion into engagement with patients in personalized education along with real-time feedback. Its combination with telemedicine can further enhance remote monitoring and improve access and quality of care. In conjunction with wearable technologies, VR, and robots, AI is poised to pave the way for revolutionized diagnostics and therapy. AI promises to revolutionize not only how we conduct DED diagnosis and management but also the results achieved with patients, yet challenges regarding data privacy and clinical workflow integration remain.

Restraint

High Cost of Diagnostic Devices

The potential application of advanced dry eye diagnostic devices, including optical coherence tomographies (OCT), interferometers, and AI-powered devices, finds a serious obstacle in their very high costs throughout modern practice. Most of these technologies are expensive to purchase maintain, and operate efficiently; therefore, such devices will not be easily available in smaller clinics and practices. Besides, the meagerness of reimbursements from insurers makes healthcare facilities think twice before investing in these devices, and so availability is limited to institutions with good funding and specialty clinics. This cost barrier can greatly deter the early diagnosis and optimum management of dry eye disease in underserved populations.

The MGX segment dominated the market. MGX is responsible for the massive domination of the dry eye treatment devices market in the U.S. It proves effective in diagnosing and treating Meibomian Gland Dysfunction (MGD), a chief cause of dry eye. MGX compresses the eyelids with specific instruments and extracts oil from clogged glands. Most eye specialists prescribe warm compressors and thermal pulsation along with MGX to enhance the secretion of oil. There are several industries developing heat pumps mostly intended to improve treatment outcomes. Meanwhile, the combination (IPL+MGX) segment is expected to grow fastest during the forecast period. The combination of IPL and MGX is receiving great attention because it seems to have a better result for treatment efficacy. The IPL helps warm the meibomian glands or calm the surrounding blood vessels while using MGX when dealing with gland blockage. This therapy has proven effective through multiple research studies in progress; it looks promising in driving the growth of this market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Dry Eye Disease Diagnostic Devices Market

By Technology