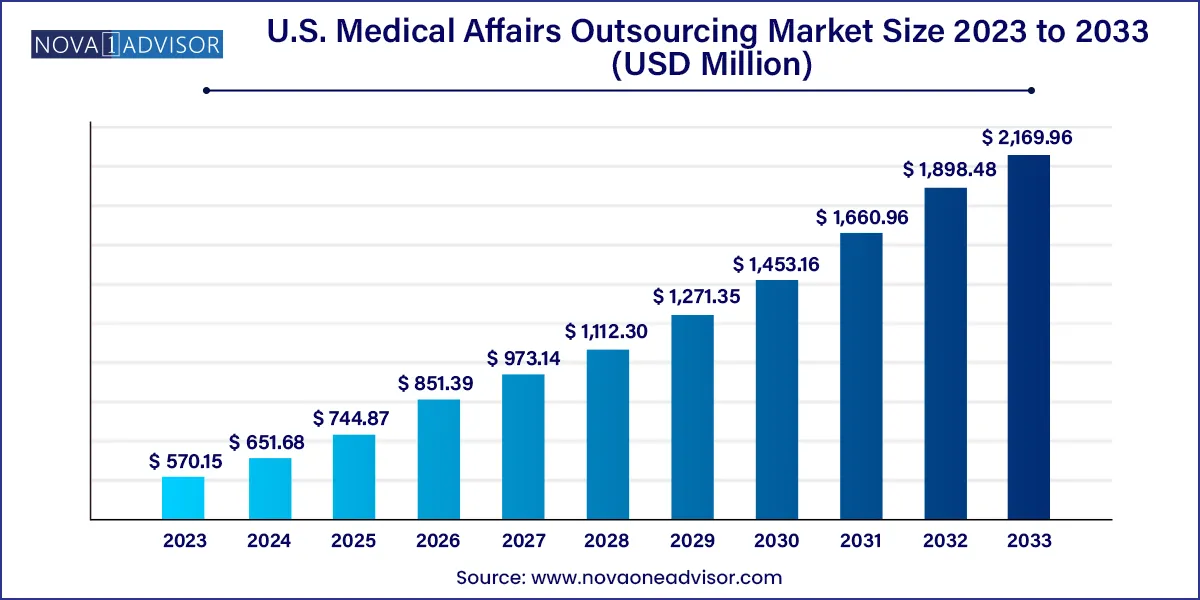

The U.S. medical affairs outsourcing market size was exhibited at USD 570.15 million in 2023 and is projected to hit around USD 2,169.96 million by 2033, growing at a CAGR of 14.3% during the forecast period 2024 to 2033.

The U.S. Medical Affairs Outsourcing Market has seen substantial evolution in recent years, catalyzed by a convergence of factors including escalating clinical trial complexity, the surge in biologics and precision therapies, and an increasing emphasis on real-world data and stakeholder engagement. Traditionally handled in-house by pharmaceutical, biopharmaceutical, and medical device companies, medical affairs functions are now increasingly being outsourced to specialized vendors for improved scalability, efficiency, and access to niche expertise.

Medical affairs functions encompass a range of activities scientific communication, stakeholder liaison, medical information dissemination, monitoring of clinical trials, and real-world evidence (RWE) generation. These are vital for regulatory compliance, market access, and post-market surveillance. As the U.S. healthcare ecosystem becomes more innovation-driven and value-oriented, life sciences companies are leveraging outsourcing models to remain agile, reduce operational burden, and enhance focus on their core competencies such as R&D and commercialization.

The U.S. market leads globally in the adoption of medical affairs outsourcing. Its highly regulated environment, substantial pharmaceutical pipeline, and robust life sciences infrastructure make it fertile ground for outsourcing partnerships. Moreover, the emphasis on medical affairs as a strategic rather than merely operational function has elevated the importance of this domain. Outsourcing firms offering expertise in therapeutic areas like oncology, rare diseases, and immunology have gained traction in supporting FDA submissions, KOL (Key Opinion Leader) engagement, and evidence-based scientific communication.

Companies in the U.S. are also actively partnering with Contract Research Organizations (CROs), Medical Affairs Organizations (MAOs), and hybrid service providers to access integrated offerings that span the product lifecycle from pre-launch strategy to post-market support. This shift has created a thriving market characterized by innovation, specialization, and robust competition.

Increased adoption of hybrid in-house and outsourced models to ensure strategic control alongside operational scalability.

Growing reliance on Medical Science Liaisons (MSLs) as front-line scientific communicators for complex therapies.

Expansion of Health Economics and Outcomes Research (HEOR) services to support value-based care and payer engagement.

Digital transformation in medical affairs, including AI-powered medical writing, data analytics platforms, and omnichannel scientific engagement.

Rise in demand for multilingual and multicultural medical information services to cater to diverse patient populations across the U.S.

Integration of real-world evidence (RWE) in medical affairs to bridge clinical trials and everyday clinical practice.

Increased outsourcing demand from emerging biopharma firms that lack internal capabilities but operate within highly specialized therapeutic areas.

Strategic partnerships between pharmaceutical companies and CROs focusing on long-term collaboration over transactional engagement.

| Report Coverage | Details |

| Market Size in 2024 | USD 570.15 Million |

| Market Size by 2033 | USD 2,169.96 Million |

| Growth Rate From 2024 to 2033 | CAGR of 14.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Services, Industry |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | IQVIA Holdings Inc.; Syneos Health Inc.; Pharmaceutical Product Development, LLC; ICON plc; SGS SA; Wuxi AppTec Clinical Development, Inc.; Indegene Inc.; The Medical Affairs Company (TMAC); Ashfield Healthcare Communications; ZEINCRO Group |

A key driver of the U.S. medical affairs outsourcing market is the expansion of the domestic biopharmaceutical pipeline, particularly in areas such as oncology, neurology, and autoimmune disorders. The complexity of these therapeutic categories, which often involve biomarker-driven treatment pathways and adaptive trial designs, requires high-level scientific support both during and after clinical development.

Medical affairs professionals play a central role in interpreting trial results, engaging with healthcare providers, and supporting market access strategies. As biopharma startups and mid-size firms proliferate in the U.S. many with limited internal infrastructure they turn to external partners for scalable, expertise-driven medical affairs support. Outsourcing enables these firms to accelerate go-to-market strategies while managing budget constraints, compliance demands, and stakeholder engagement effectively. For example, many emerging oncology firms based in Boston or San Diego have partnered with MAOs to manage their scientific communications, MSL deployment, and HEOR efforts as they move from Phase II to commercialization.

Despite the growth potential, regulatory and compliance complexities act as a restraint in the U.S. market. Medical affairs activities are tightly regulated by the FDA and are subject to scrutiny from the Office of Inspector General (OIG), particularly around promotional practices, data dissemination, and off-label communication. Any deviation from these standards can result in substantial fines, product recalls, or reputational damage.

When outsourcing medical affairs functions, companies must ensure that vendors have a deep understanding of these regulatory frameworks. Ensuring data security, audit readiness, and SOP compliance across outsourced teams can be challenging, especially when dealing with cross-functional and cross-geography operations. The cost and time required for due diligence, training, and periodic monitoring may discourage some companies from outsourcing or limit the scale of such engagements.

The growing emphasis on real-world evidence (RWE) represents a powerful opportunity for medical affairs outsourcing providers. The FDA’s 21st Century Cures Act and subsequent initiatives have encouraged the use of RWE in regulatory decisions, labeling changes, and drug development planning. As medical affairs functions shift from being support-based to becoming strategic hubs of scientific insight, the integration of RWE into medical strategy, stakeholder engagement, and value messaging is paramount.

Outsourcing partners with data science, epidemiology, and outcomes research capabilities are well-positioned to help life sciences companies leverage real-world data (RWD) from electronic health records (EHRs), claims databases, and patient registries. These insights can then be synthesized into HEOR publications, evidence dossiers, and payer communication tools. For instance, a U.S.-based rare disease company launching a novel gene therapy may collaborate with a CRO to gather long-term outcomes data from post-marketing registries to support label expansion and reimbursement.

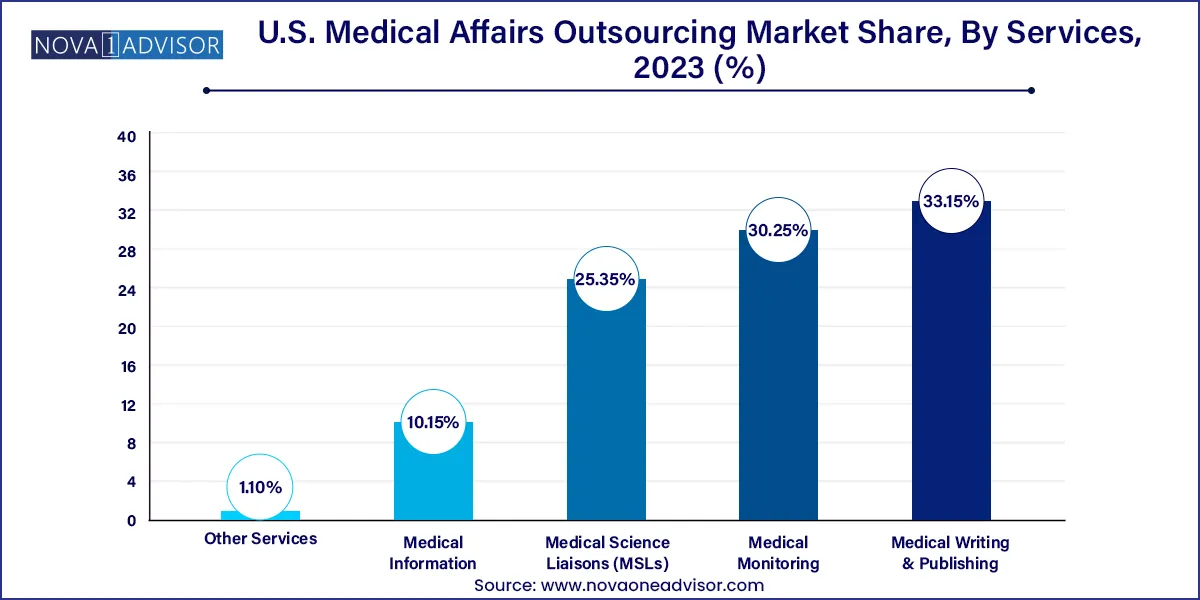

Medical Writing & Publishing dominated the U.S. medical affairs outsourcing market, owing to the continuous demand for high-quality documentation to support clinical development, regulatory submissions, and scientific publications. Companies rely on outsourced medical writers to produce Clinical Study Reports (CSRs), Investigator Brochures (IBs), manuscripts, and value dossiers. As the volume of clinical research grows and therapeutic categories become more complex, the need for subject matter expertise, scientific consistency, and compliance rises. Vendors offering therapeutic-area-specific writing teams, quick turnaround times, and AI-assisted editing tools are especially in demand.

Medical Science Liaisons (MSLs) are the fastest-growing service segment. The strategic role of MSLs has expanded, particularly with the rise of biologics and precision therapies that require deep scientific engagement with clinicians, researchers, and healthcare providers. Outsourced MSL programs allow companies to scale field-based scientific operations quickly across geographies and therapeutic areas. For example, a pharmaceutical company launching an immuno-oncology agent in the U.S. may deploy a team of MSLs through a third-party provider to educate oncologists, gather feedback, and support investigator-initiated trials (IITs) nationwide without building an in-house team from scratch.

The pharmaceutical sector dominated the market, attributed to its extensive pipelines, aggressive launch timelines, and growing portfolio of specialty drugs. Large pharmaceutical companies often outsource medical affairs functions to manage fluctuations in workload, access therapeutic expertise, and maintain consistency across global operations. For example, Pfizer and Merck have historically partnered with CROs to manage medical information services, particularly during global launches or regulatory updates that require rapid dissemination of scientific content.

The biopharmaceutical industry is the fastest-growing segment, driven by the increasing number of biotech startups focused on novel modalities such as cell therapy, gene editing, and RNA-based therapies. These companies often operate with lean teams and limited internal infrastructure, making them highly reliant on outsourcing for medical writing, HEOR strategy, and stakeholder education. The need to rapidly scale capabilities without compromising on regulatory compliance or scientific integrity drives the adoption of outsourced medical affairs solutions. Venture-backed firms in hubs like Boston’s Kendall Square or San Francisco’s Bay Area are typical examples of this outsourcing trend.

The U.S. market is characterized by a high degree of maturity, innovation, and fragmentation. The presence of leading pharmaceutical firms, dynamic biotech startups, and globally integrated CROs contributes to a highly competitive landscape. Life sciences clusters such as Boston-Cambridge, San Diego, San Francisco, and Raleigh-Durham anchor the demand side with their dense concentration of R&D activity, clinical trials, and regulatory engagement.

Government initiatives, such as the Cancer Moonshot and Rare Disease Programs, fuel demand for medical affairs expertise to support research translation and community education. Furthermore, payer scrutiny, value-based care initiatives, and patient advocacy efforts necessitate robust HEOR and medical communication strategies—services often outsourced for efficiency and scalability.

Post-COVID, virtual engagements and digital transformation have redefined how medical affairs operate. Remote MSL interactions, virtual advisory boards, and digital content dissemination are now part of standard operating models in the U.S. This evolution presents an opportunity for vendors offering end-to-end, technology-enabled services that align with evolving stakeholder expectations.

In March 2025, Syneos Health announced the launch of a new digital MSL engagement platform specifically tailored for oncology clients in the U.S., aimed at enhancing remote scientific exchange capabilities.

In January 2025, ICON plc expanded its medical writing and HEOR services in the U.S. through the acquisition of a Boston-based boutique medical communications firm specializing in rare disease strategy.

In November 2024, Parexel unveiled its U.S. Medical Affairs Innovation Hub in North Carolina, integrating AI tools for medical writing and automated literature surveillance.

In October 2024, IQVIA collaborated with a major U.S. biopharma firm to provide outsourced MSL services and evidence generation support for a new cell therapy approved under the FDA’s Regenerative Medicine Advanced Therapy (RMAT) designation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical affairs outsourcing market.

Services

Industry