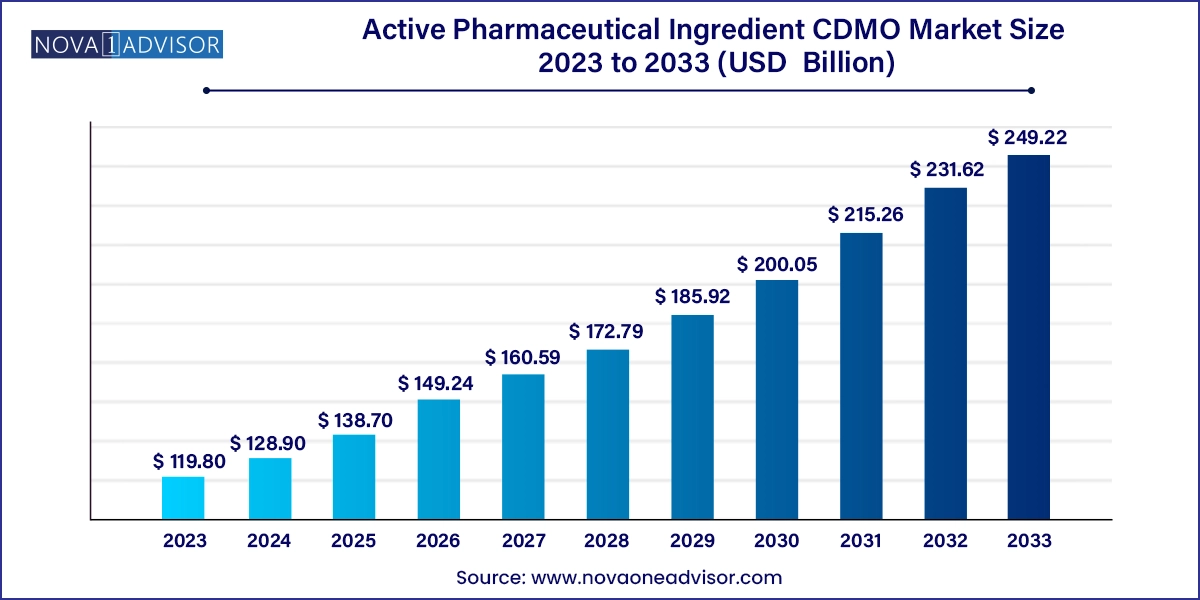

The global active pharmaceutical ingredient CDMO market size was valued at USD 119.80 billion in 2023 and is anticipated to reach around USD 249.22 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

The Active Pharmaceutical Ingredient (API) Contract Development and Manufacturing Organization (CDMO) market has become a critical segment within the global pharmaceutical value chain. With growing demands for new therapeutic agents, complex formulations, and stringent regulatory compliance, pharmaceutical companies are increasingly relying on CDMOs to provide scalable, cost-effective, and expertise-driven solutions for API production. API CDMOs offer comprehensive support from drug development to commercial-scale manufacturing, encompassing a wide range of services, including process development, custom synthesis, scale-up, analytical testing, and regulatory filing support.

The surge in outsourcing can be attributed to the pressures pharmaceutical companies face in reducing time-to-market and minimizing capital expenditure on infrastructure. With molecules becoming more complex and personalized, API production now demands specialized facilities, advanced technologies, and high-quality assurance processes that CDMOs are well-equipped to deliver. Moreover, the COVID-19 pandemic underscored the strategic importance of resilient and diversified supply chains, prompting pharmaceutical companies to partner more deeply with CDMOs for both innovative and generic drugs.

Increasing demand for highly potent APIs (HP-APIs) in oncology and targeted therapies

Expansion of biologics and antibody-drug conjugates (ADCs) in drug pipelines

Surge in demand for CDMOs offering end-to-end integrated services from clinical to commercial stages

Strategic reshoring of API manufacturing in North America and Europe for supply chain security

Growth in modular and continuous manufacturing technologies

Increasing regulatory scrutiny pushing quality, GMP compliance, and digital traceability

Collaborations between CDMOs and pharma/biotech companies for advanced synthetic routes and green chemistry

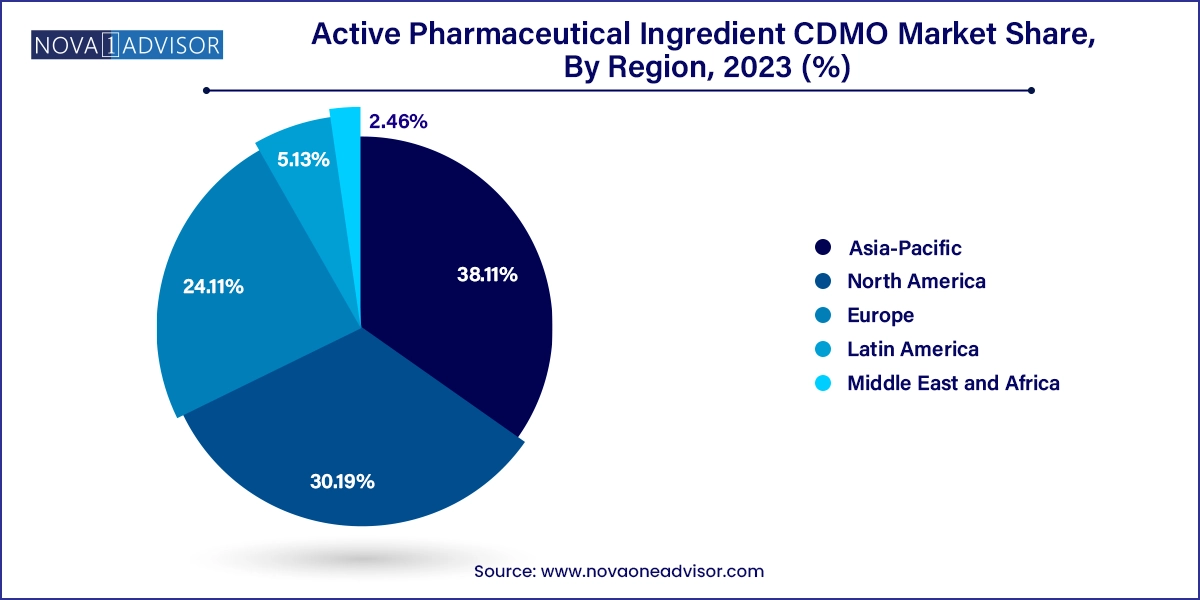

Rise of Asia-Pacific as a cost-competitive, innovation-driven CDMO hub

| Report Attribute | Details |

| Market Size in 2024 | USD 128.90 Billion |

| Market Size by 2033 | USD 249.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, synthesis, drug, application, workflow, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Cambrex Corporation; Recipharm AB; Thermo Fisher Scientific Inc. (Pantheon); CordenPharma International; Samsung Biologics; Lonza; Catalent, Inc.; Siegfried Holding AG; Piramal Pharma Solutions; Boehringer Ingelheim International GmbH |

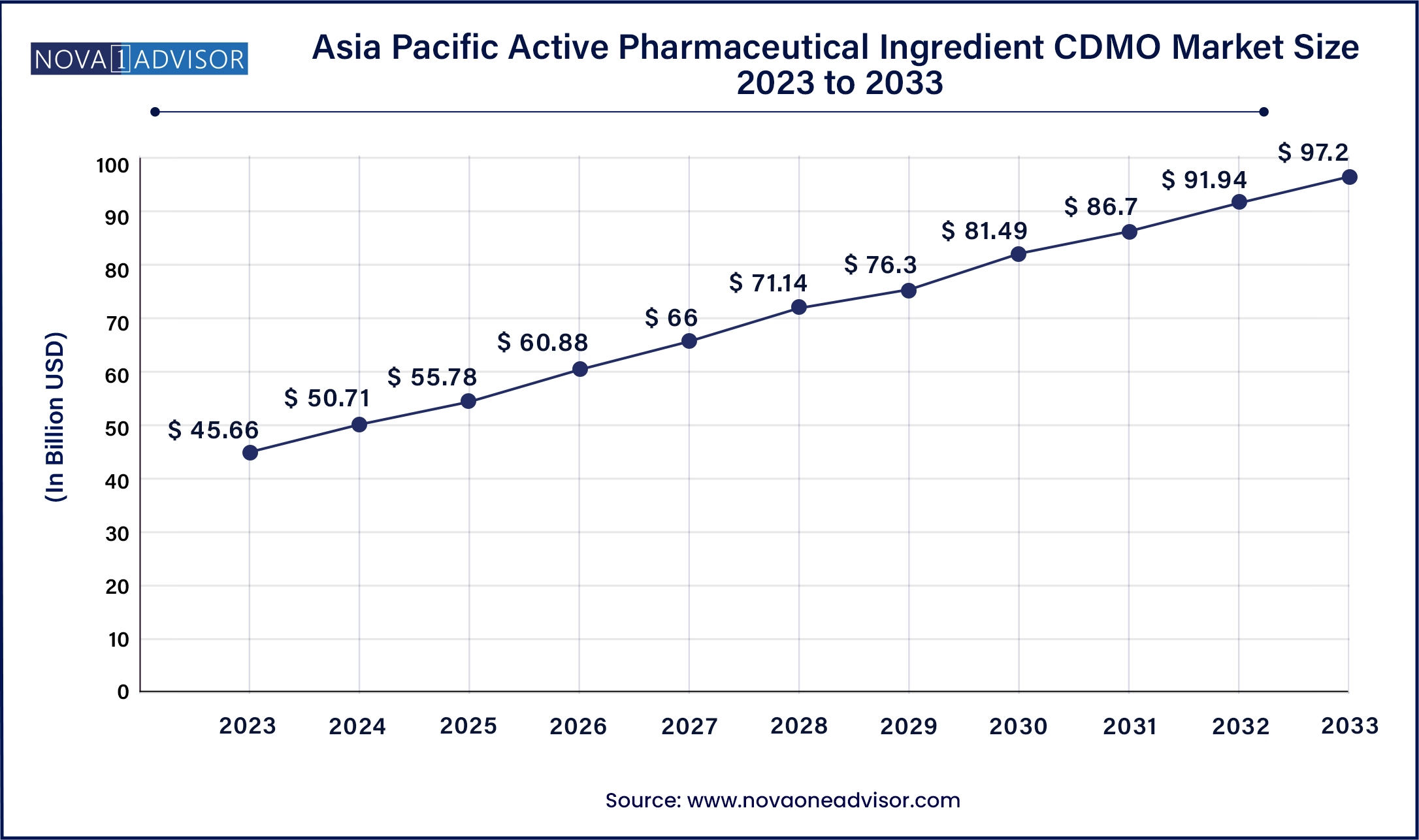

The Asia Pacific active pharmaceutical ingredient CDMO market size was valued at USD 45.66 billion in 2023 and is projected to surpass around USD 97.20 billion by 2033, registering a CAGR of 7.5% over the forecast period of 2024 to 2033.

Asia-Pacific is the fastest-growing region, led by India, China, and South Korea. India is known for its large-scale generic API manufacturing capabilities, while China is rapidly expanding its innovative API and biologics manufacturing sectors. Favorable labor costs, government incentives, and growing domestic pharmaceutical demand are positioning Asia-Pacific as a competitive and high-growth market for CDMO services. Global companies are increasingly partnering with APAC-based CDMOs for cost-effective clinical and commercial API supply.

North America dominates the global API CDMO market, driven by a strong pharmaceutical industry, advanced regulatory infrastructure, and high demand for novel drug development. The U.S. houses leading CDMOs like Cambrex, Catalent, and Thermo Fisher Scientific, which provide both synthetic and biologics manufacturing services. The region's emphasis on reshoring API production due to national security concerns has spurred investments in domestic capacity.

Synthetic APIs currently lead the market, as the majority of small molecule drugs rely on chemical synthesis methods. CDMOs in this segment provide advanced capabilities in multi-step organic synthesis, chiral chemistry, and continuous flow processing. With increasing pressure for cost optimization and compliance, synthetic API CDMOs are improving process efficiencies, green chemistry adoption, and solvent recovery techniques.

Meanwhile, Biotech APIs are experiencing rapid growth, particularly in the form of biologics, peptides, and oligonucleotides. These require fermentation or cell culture-based production methods. The success of mRNA vaccines, gene therapies, and monoclonal antibodies is accelerating the shift toward biotech APIs. CDMOs with upstream biologics capabilities, bioreactor capacity, and expertise in purification and protein characterization are capturing growing demand, especially from emerging biopharma firms.

Generic APIs form the dominant segment, as patent expirations of blockbuster drugs and global demand for affordable medicines continue to grow. CDMOs serving generic markets offer cost-effective solutions for high-volume API production with proven regulatory compliance. These operations focus on backward integration of intermediates, economies of scale, and margin-driven strategies.

Innovative drugs represent the fastest-growing segment, as pharmaceutical companies focus on novel compounds, specialty therapies, and orphan drugs. CDMOs supporting innovator clients must deliver high customization, stringent confidentiality, and adaptive project management. As drug development becomes more targeted and personalized, the role of CDMOs in accelerating early-phase clinical manufacturing and scaling to commercial production becomes more critical.

Oncology remains the dominant application area for API CDMO services, reflecting the large number of anti-cancer therapies in development and on the market. These APIs often involve HP-APIs, complex conjugates, or targeted delivery mechanisms, requiring specialized manufacturing expertise. Oncology drugs also have high value per dose, enabling CDMOs to invest in advanced containment and analytics capabilities.

Cardiovascular disease and diabetes APIs maintain steady demand, driven by high patient volumes and chronic disease prevalence. However, glaucoma and hormonal APIs are gaining ground, especially with the growth of personalized hormone therapies, women's health products, and ocular therapeutics. CDMOs offering niche capabilities in ophthalmic formulations and hormonal synthesis are expanding their service portfolios to address these therapeutic categories.

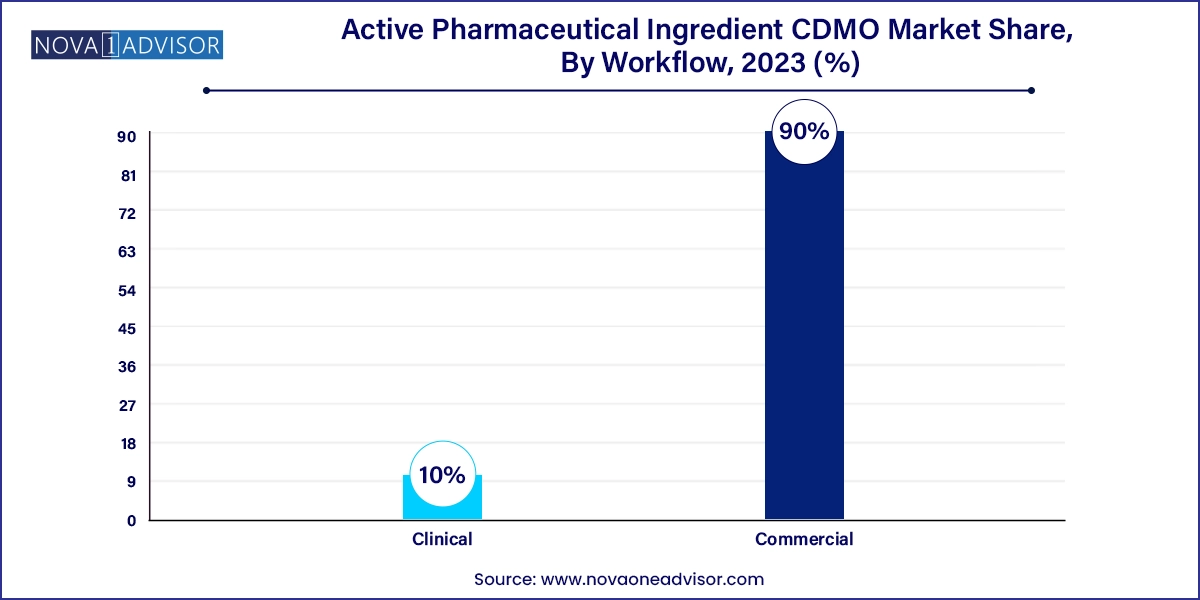

Commercial manufacturing dominates the workflow segment, as mature APIs in generic and branded markets require ongoing supply at large volumes. CDMOs in this category operate GMP-compliant facilities that serve as dedicated or multi-client manufacturing hubs. These services include tech transfer, process validation, and packaging support to meet global distribution needs.

Clinical development manufacturing is growing fastest, due to the rising number of small biopharma companies advancing early-phase trials. These firms typically lack in-house manufacturing capabilities and rely heavily on CDMOs for speed, agility, and regulatory guidance. Clinical manufacturing often demands small-batch, high-variability production with accelerated timelines. CDMOs that can offer integrated development, analytical services, and flexible batch sizes are well-positioned to serve this expanding client base.

March 2025: Cambrex announced the expansion of its High Potency API facility in Iowa, doubling its manufacturing capacity to meet increasing demand in oncology APIs.

January 2025: Lonza signed a $300 million strategic partnership with a major U.S. biotech firm to supply ADC payloads and linker technologies.

December 2024: WuXi STA opened a new continuous manufacturing API plant in China, emphasizing green chemistry and digital monitoring.

November 2024: Thermo Fisher Scientific acquired a specialized European CDMO to expand its HP-API and peptide production capabilities.

September 2024: Piramal Pharma Solutions inaugurated its expanded oligonucleotide API development center in Michigan, aimed at supporting next-gen RNA therapeutics.

The following are the leading companies in the active pharmaceutical ingredient CDMO market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these active pharmaceutical ingredient CDMO companies are analyzed to map the supply network.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Active Pharmaceutical Ingredient CDMO market.

By Product

By Synthesis

By Drug

By Workflow

By Application

By Region