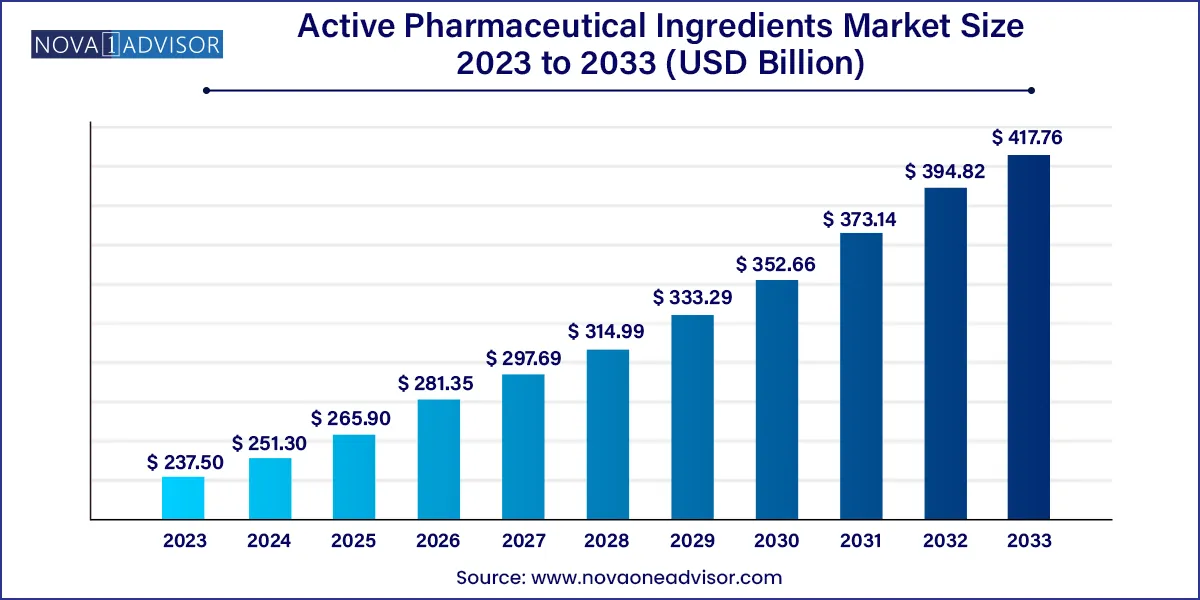

The global active pharmaceutical ingredients market size was exhibited at USD 237.50 billion in 2023 and is projected to hit around USD 417.76 billion by 2033, growing at a CAGR of 5.81% during the forecast period 2024 to 2033.

Key Takeaways:

Active Pharmaceutical Ingredients Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 251.30 Billion |

| Market Size by 2033 | USD 417.76 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.81% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type of Synthesis, Type of Manufacturer, Type, Application, Type of Drug, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Cipla Inc., AbbVie Inc., Aurobindo Pharma, Sandoz International GmbH (Novartis AG), Viatris Inc., Fresenius Kabi AG, STADA Arzneimittel AG |

Advancements in Active Pharmaceutical Ingredient (API) manufacturing, growth of the biopharmaceutical sector, and an increase in geriatric population are among the key drivers of API market. An increase in prevalence of chronic diseases, such as cardiovascular diseases and cancer, is anticipated to boost market growth.

Global geriatric population is increasing. According to UN, in 2023, people aged 65 and above accounted for 771 million of the population, and the number is anticipated to reach 994 million by 2033 to 1.6 billion by 2050. The number of elderly people is showing fastest growth in Africa, with a threefold increase estimated in people aged 60 and above, followed by Latin America, reaching 18.8 billion by 2050. Aging is considered the greatest risk factor for development of diseases, including cardiovascular and neurological diseases. Thus, rapidly growing global geriatric population is resulting to be a high-impact-rendering driver for API market.

Increasing prevalence of infectious diseases and hospital-acquired infections is driving market growth. In addition, growing incidence of cardiovascular, genetic, and neurologic disorders is anticipated to act as a high-impact-rendering driver for market growth. Cardiovascular Diseases (CVDs) are the most prevalent causes of death globally. According to WHO, cardiovascular diseases cause death of 17.9 million people per day and are expected to cause approximately 25 million deaths by 2033. Increasing epidemiology of lifestyle, aided with rising number of smokers globally, growing incidence of obesity, and increasing dietary irregularities, are factors likely responsible to propel market growth. A recent report by the United Nations (UN) in May 2023 suggests that there has been a 75% increase in the number of girls and 61% in the number of boys with obesity in Europe.

Outsourcing of APIs has become profitable over in-house production. However, this trend took a different turn during the COVID-19 pandemic. Companies are looking to diversify their API suppliers and manufacturers to different locations instead of outsourcing it to just one manufacturer. In addition, risk mitigation is done using dual sourcing to ensure a continuous supply. Hence, key companies aim to capitalize on this ongoing outsourcing trend with new acquisitions. For instance, in August 2023, EUROAPI announced its deal to acquire BianoGMP to enhance its CDMO expertise in oligonucleotide manufacturing, which is a high-growth industry. This further demonstrates the company’s plans for vertical integration.

Market Concentration & Characteristics

Market growth stage is high, and pace of the active pharmaceutical ingredients market growth is accelerating. The API market is characterized by a high degree of strategic outsourcing by companies that allows them to focus on core competencies, which results in increased productivity.Moreover, patent expirations are responsible for remarkable losses for pharmaceutical firms. Loss of patent of blockbuster drugs leads to development of generics. Thus, outsourcing of APIs become profitable over in-house production.

Rise in demand for targeted therapies with high potency API compounds, such as HPAPI, is anticipated to create significant demand for personalized medicines further. For instance, ADCs leverage on specificity of antibodies for cancer cells. These cells use linker technology to attach themselves to the antibody. These advanced features of ADCs are anticipated to drive the market, with most pharmaceutical companies pursuing such development programs.

Increasing government initiatives globally to support API production for securing a robust supply of raw materials for pharmaceutical production is expected to drive market growth. For instance, in November 2023, India announced a scheme to push API manufacturing to reduce the dependency on China. The Department of Pharmaceuticals India rolled out a Production Linked Incentive (PLI) scheme of nearly USD 18,064.54 million (₹15,000 crores) for pharmaceuticals.

Furthermore, with COVID-19 pandemic and broader reshoring of API production, there is now a stronger emphasis on bringing clinical product supply security back to the U.S., where clinical studies are conducted. Furthermore, many small biotech companies require domestic fabrication of clinical trial APIs, since their research is dependent on a domestic U.S. funding source. In such instances, businesses must seek manufacturing partners capable of domestic production.

Segments Insights:

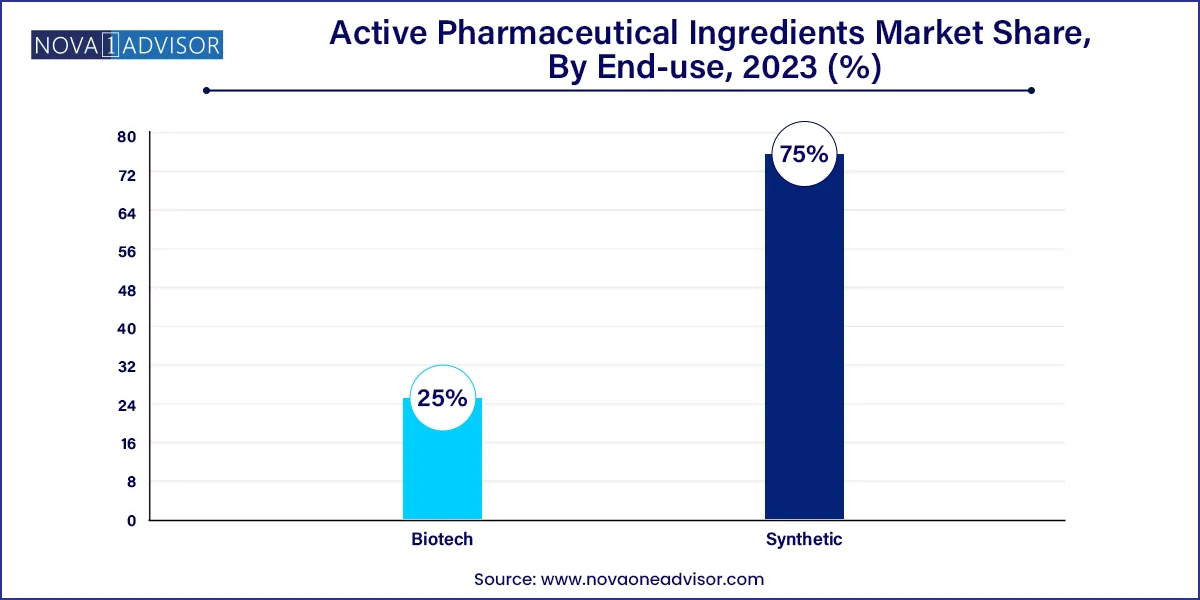

Type of Synthesis Insights

Synthetic segment held the largest revenue share of 75.0% in 2023. Major driver for synthetic API market is high demand for generic drugs. APIs used to develop generic drugs contribute to high revenue for synthetic and chemical API manufacturing companies. This is creating a wide opportunity for CDMOs working in this segment. Opportunity in the synthetic API market becomes even more lucrative for CDMOs owing to an increase in outsourcing trend, as companies want to improve profitability by reducing the cost of production. In October 2023, Cambrex announced completion of its USD 38 million small molecule API manufacturing facility. This investment doubled the size of the company’s manufacturing facility and enhanced its ability to acquire more customers to meet their evolving needs.

Biotech API segment is expected to show fastest growth during the forecast period. Growth of biotech API segment can be attributed to rising investments in biopharmaceutical and biotechnology sectors. This allows innovation of new molecules that aid in treating diseases such as cancer. Key players are highly focused on biotech APIs owing to high revenue generation and profitability associated with them.For instance, in May 2023, OLON Group announced its entry into the ADC API business with its facility located in Italy. The company invested €22 million (USD 23.13 million) for the production with a containment level of OEB6.

Type of Manufacturer Insights

Captive APIs segment held the largest market share in 2023. More companies are investing in solving challenges and developing new chemical ways for in-house production of APIs. This aids in reducing costs and risk of contamination. Protein synthesis and artificial intelligence are expected to accelerate development with greater control over the process.Furthermore, recent initiatives and developments by key players indicate a strong preference for in-house manufacturing over outsourcing.For instance, in September 2021, AstraZeneca announced an investment of USD 360 million in its API manufacturing facility in Ireland to commercialize novel products. Such initiatives undertaken by key players are anticipated to boost segment growth.

Merchant APIs segment is anticipated to grow at fastest growth over the forecast period.Contract manufacturing and outsourcing of API molecule development are growing trends in pharmaceutical sector. As captive production of APIs is expensive, companies have started opting for outsourcing to minimize expenses. Merchant APIs eliminate the need for investing in expensive equipment and sophisticated infrastructure. Post pandemic, key companies are expanding their capacities to enhance their market presence. For instance, in May 2023, MilliporeSigma announced the expansion of its U.S.-based facility, with an investment of USD 69 million, doubling its manufacturing capacity for Highly Potent Active Pharmaceutical Ingredient (HPAPI). The facility is dedicated to the development and commercial manufacturing of Antibody Drug Conjugates (ADCs).

Type Insights

Innovative APIs segment dominated the overall API market with a revenue share in 2023. The market's growth is attributed to increase in funding and favorable regulations for R&D facilities. Many novel innovative products are now in pipeline due to extensive research in this field and are expected to be launched in near future. Furthermore, increasing support from regulatory agencies for approval of new drugs is projected to facilitate market growth, which can be attributed to an increase in focus of government on healthcare and pharmaceuticals due to COVID-19.

Generic APIs segment is anticipated to show fastest growth over the forecast period. Expiry of patent of various branded molecules is a key factor that offer high opportunity for growth of generic API drugs.Post pandemic, pharmaceutical industry is nearing a patent cliff by 2033, with nearly 200 molecules losing exclusivity and over 100 biosimilars developing as of 2023. This creates an opportunity for generic API manufacturers as the demand for the API of these products is set to rise by the end of this decade. This includes over 60 molecules that belong to the oncology segment with complex high revenue generating API’s.

Application Insights

Cardiology segment dominated the API market with a revenue share in 2023 attributable to rising prevalence of cardiovascular diseases globally. According to the World Heart Report 2023, over half a billion people worldwide are affected by CVDs, causing approximately 20.5 million deaths in 2021 - almost a third of global deaths and an increase from the previously estimated 121 million CVD-related deaths. Cardiovascular disease is one of the world's most serious public health problems, prompting extensive research into APIs in the field. Simvastatin is a cholesterol-lowering drug belonging to statin class and used in treatment of dyslipidemia. Rosuvastatin calcium is an additional API used for cardiovascular diseases by AstraZeneca.

Oncology segment is anticipated to grow at fastest growth rate over the forecast period. Increasing global prevalence of cancer is a key factor driving this market. Collaboration among pharmaceutical companies, research institutions, and regulatory entities remains pivotal in expediting drug development, ensuring patient safety, & fostering innovation. For instance, in March 2023, Pfizer Inc. and Seagen Inc. confirmed a definitive merger agreement. Through this strategic deal, Pfizer will acquire Seagen, a renowned biotech firm specializing in revolutionary cancer treatments. The agreement includes a cash transaction of USD 229 per Seagen share, resulting in an enterprise value of USD 43 billion.

Type of Drug Insights

Prescription segment dominated the overall API market with a revenue share in 2023. The uptake of prescription drugs is largely dependent on physicians’ prescriptions. Use of prescription drugs, such as Proton Pump Inhibitors (PPI), in the management of general conditions, heartburn, has plateaued owing to several adverse effects. However, Histamine-2 Receptor Antagonist (H2RA) prescription rate has been impacted. Prescription drugs dominated in oncology segment as cancer is primarily treated using chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. The use of biology is also increasing.Due to the increased efficacy of novel targeted therapies, the number of prescriptions for targeted therapies is rapidly increasing. Furthermore, major players are launching novel targeted therapies.

OTC segment is expected to show the fastest growth over the forecast period. OTC products are easily accessible to the population and is frequently impacted by changes in consumer behavior. Consumer preference is shifting from use of antacids for heartburn to ensuring gut health by taking probiotics. This paradigm shift is creating greater opportunities for preventive products, such as health supplements, nutraceuticals, and probiotics, while slashing the growth of existing products.

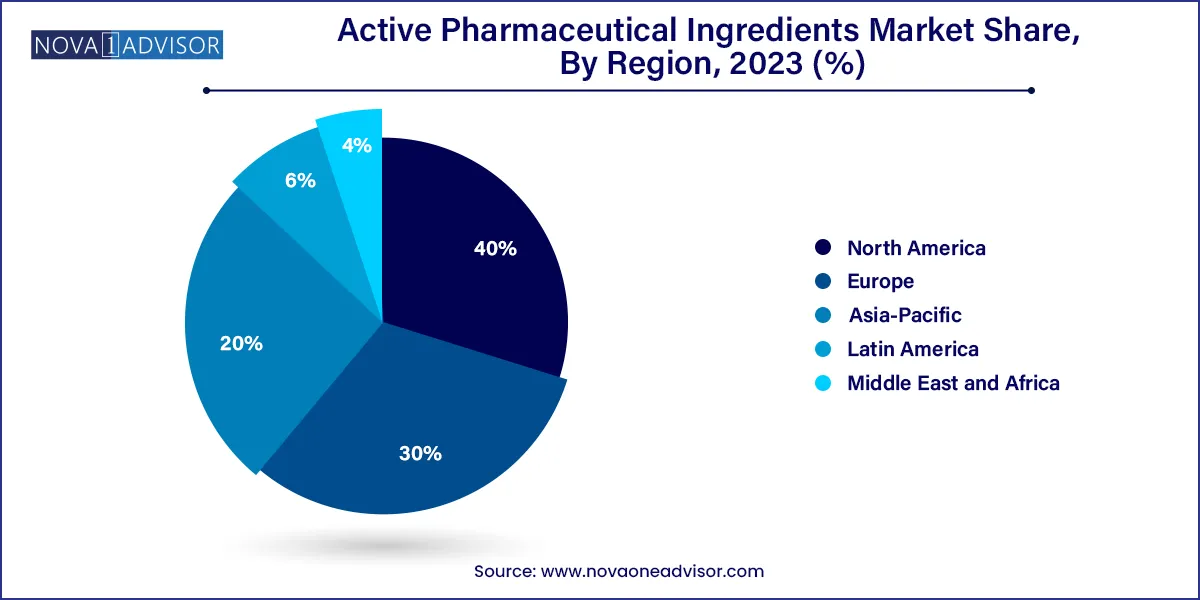

Regional Insights

North America API market for led with a share of 40.0% in 2023 owing to rising prevalence of cardiovascular, genetic, and other chronic diseases aided with growing research in field of drug development. Presence of key players such as AbbVie Inc.; Curia; Pfizer Inc. (Pfizer Center One); Viatris Inc.; and Fresenius Kabi AG is positively influencing growth. For instance, in February 2023, Viatris received FDA approval for Generic Restasis—a cyclosporine ophthalmic emulsion for treating dry eye disease. Region shows high value manufacturing areas, including complex & high potent APIs, gene therapies & biologicals, which is expected to provide relative growth. Moreover, there is significant expansion of innovators and CDMOs seen in the region, which is creating an expanded advantage for manufacturing and commercializing APIs.

API market in Asia Pacific is registering fastest growth over the forecasted years. Market is experiencing sharp growth as majority of API production occurs in countries present in the region with high API export rate.China is the largest producer of APIs, manufacturing over 1,600 varieties of chemical APIs. Moreover, several key global players are establishing their operations in the region. Rising investment and initiatives to support and expand manufacturing facilities is further driving growth of overall API market. For instance, in November 2023, Aurobindo Pharma is expected to complete Penicillin G plant approved under the PLI scheme by 2024, with investment of USD 2,000 million to ensure and promote domestic manufacturing of API by increasing the production capacity to 15,000 tons annually in India. Moreover, in June 2023, Piramal Pharma Solutions invested USD 30 million for expanding its capabilities in Telangana, India.

Recent Developments

Some of the prominent players in the Active pharmaceutical ingredients market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global active pharmaceutical ingredients market.

Type of Synthesis

Synthetic APIs Market, By Type

Type of Manufacturer

Type

Application

Type of Drug

By Region