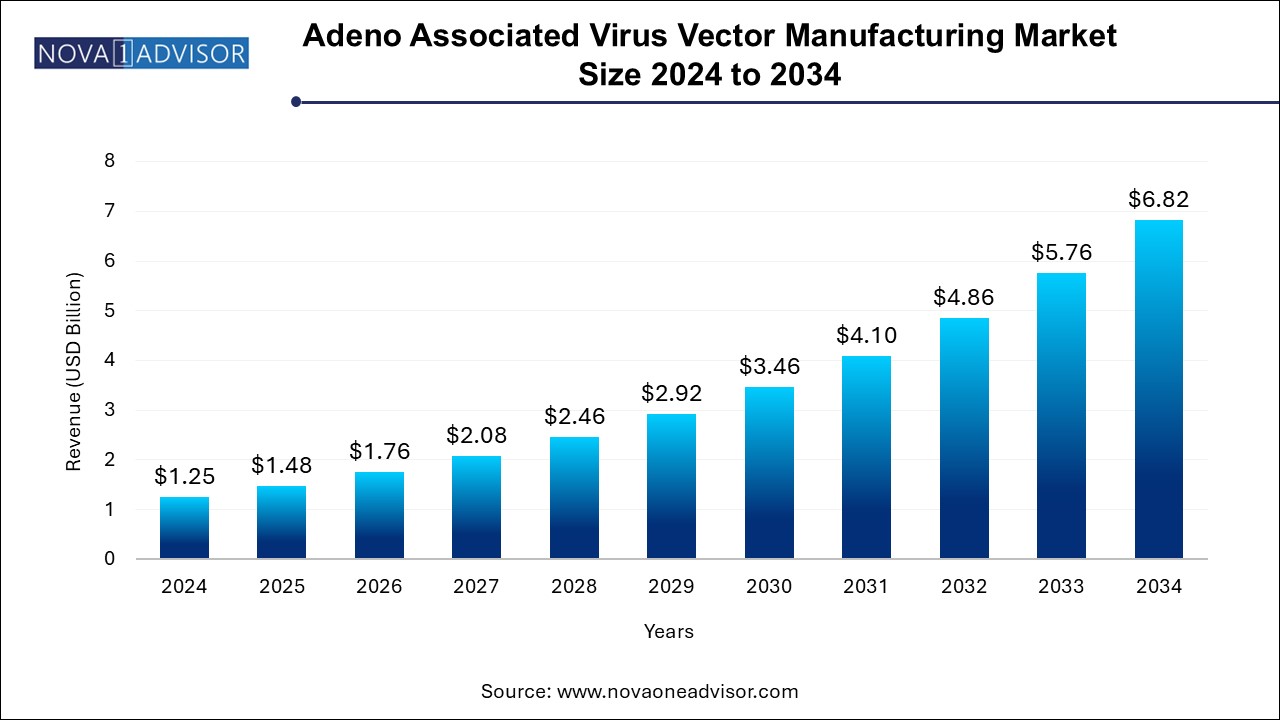

The adeno associated virus vector manufacturing market size was exhibited at USD 1.25 billion in 2024 and is projected to hit around USD 6.82 billion by 2034, growing at a CAGR of 18.5% during the forecast period 2024 to 2034.

The Adeno-Associated Virus (AAV) vector manufacturing market is witnessing substantial growth, driven by the rising adoption of gene therapies for the treatment of genetic disorders, hematological diseases, and ophthalmic conditions. AAV vectors are gaining prominence due to their high transfection efficiency and minimal immunogenicity, making them ideal for gene delivery. They are particularly critical in gene therapy applications, where precision and safety are paramount. As the global healthcare sector continues to explore the potential of genetic engineering to treat chronic and rare diseases, the demand for AAV vectors is expected to rise significantly. The market includes a wide array of applications, from preclinical and clinical studies to commercial manufacturing, providing a comprehensive landscape for AAV vector production and commercialization.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size by 2034 | USD 6.82 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 18.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Scale of Operations, Method, Therapeutic Area, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd; Charles River Laboratories; Oxford Biomedica PLC; WuXi AppTec; Yposkesi, Inc.; Sarepta Therapeutics, Inc.; Pfizer Inc.; Genezen; Creative Biogene; GenScript (ProBio) |

Driver: Rising Adoption of Gene Therapies

The adoption of gene therapies, especially for rare and chronic diseases, is one of the primary drivers of the AAV vector manufacturing market. With the success of treatments like Luxturna for retinal disease and Zolgensma for spinal muscular atrophy, gene therapy has become a viable treatment option for conditions that were previously untreatable. AAV vectors, being one of the most efficient delivery methods for genetic material, are integral to these therapies. As more gene therapies receive approval, the need for high-quality, scalable AAV vector manufacturing is set to increase, driving demand within the market.

Restraint: High Manufacturing Costs and Complex Production Processes

One of the key restraints in the AAV vector manufacturing market is the high cost of production and the complexity involved in the manufacturing process. Producing high-quality AAV vectors in large quantities involves sophisticated technology, stringent quality control measures, and specialized expertise. This leads to higher production costs compared to traditional pharmaceutical manufacturing methods. For many biotech companies, especially smaller startups, the cost of AAV vector production can be a barrier to entry. Moreover, the complexity of scaling production from preclinical studies to commercial manufacturing further exacerbates these challenges.

Opportunity: Expansion in Emerging Markets

The growth of the AAV vector manufacturing market presents a significant opportunity for expansion in emerging markets. Regions such as Asia-Pacific and Latin America are experiencing growth in the biotechnology and healthcare sectors, and the increasing focus on rare and genetic diseases presents an opportunity for AAV vector manufacturers to tap into these markets. Governments in emerging economies are also investing in the biotechnology industry, which can foster the development of gene therapies and AAV vector production. With a growing number of patients in these regions requiring gene therapy, manufacturers can expand their operations to meet the increasing demand for AAV vectors.

The clinical segment holds a dominant share in the AAV vector manufacturing market, primarily driven by the growing demand for advanced therapies, especially in gene therapy applications. As pharmaceutical and biotech companies increasingly conduct clinical trials, the need for scalable and high-quality AAV production has risen significantly. This segment benefits from substantial investments in research and development, along with support from non-commercial entities sponsoring trials. Additionally, regulatory incentives for innovative treatments have led to a surge in clinical studies, further boosting the demand for reliable AAV vector manufacturing at a clinical scale to ensure safe and effective therapeutic outcomes.

The commercial segment is the fastest-growing in the market, driven by the growing number of gene therapies moving from clinical trials to commercialization. As more gene therapies gain regulatory approval and reach the market, the need for large-scale AAV vector manufacturing is growing. Commercial manufacturing involves the production of AAV vectors in bulk to meet the demand for widespread distribution. The growth of the commercial segment is largely attributed to successful gene therapy products, such as Zolgensma and Kymriah, which are leading the way in the use of AAV vectors. This trend is expected to continue as gene therapy products expand globally.

The In Vivo method dominates the AAV vector manufacturing market, particularly in gene therapy applications where vectors are directly administered into the body to deliver therapeutic genes. In Vivo approaches are considered highly effective for treating genetic disorders, as they allow for the direct targeting of affected tissues or organs. This method is essential in many clinical applications, such as for neurological and hematological disorders. As the market for in vivo gene therapies grows, so does the demand for in vivo AAV vector manufacturing.

The In Vitro method, where cells are modified outside of the body, is the fastest-growing method for AAV vector manufacturing. This method is gaining traction due to its application in cell therapy and certain genetic therapies. In vitro AAV vector production is typically used for research purposes, especially in the early stages of gene therapy development. With advancements in biotechnology and the rising number of companies focusing on cell-based therapies, the demand for in vitro AAV vector manufacturing is expected to see substantial growth.

The neurological disorders segment held the largest market share of 29.35% in 2024. Advances in gene therapy for neurological diseases, such as Parkinson’s disease and spinal muscular atrophy, are rapidly driving demand for AAV vectors. These therapies, which involve targeting the brain and spinal cord, are becoming increasingly effective, and the need for high-quality AAV vector manufacturing to support these treatments is growing. As neurological disorders represent a large unmet medical need, the demand for AAV vectors in this area is expected to grow rapidly.

The genetic disorders segment is anticipated to grow at the highest CAGR of 21.17% from 2024 to 2034. This growth is driven by the rising prevalence of genetic disorders linked to factors such as unhealthy lifestyles, environmental influences, poor dietary habits, hereditary issues, and weakened immune systems. AAV vector-based therapies are being developed as potential solutions for these conditions, with a strong focus from research institutes on exploring new treatment options. AAV-based gene therapies are gaining prominence due to their ability to target various tissues and cells, offering a safer and more effective alternative to other viral vectors like lentivirus and adenovirus. AAV's favorable safety profile and long-term gene expression potential make it a leading choice in the development of gene therapies.

The gene therapy segment held the largest market share of 48.0% in 2024 as AAV vectors are predominantly used in gene therapies to treat a variety of genetic disorders. This application accounts for the largest share of the market due to the high demand for gene therapy products targeting conditions such as hemophilia, muscular dystrophy, and retinal diseases. As more gene therapies are developed and approved, the demand for AAV vectors in gene therapy will continue to lead the market.

The cell therapy segment is expected to grow at a significant CAGR in the AAV vector manufacturing market driven by the increasing use of AAV vectors to deliver therapeutic genes into cells for treating various conditions. This segment is particularly prominent in immunotherapy and cancer treatment, where AAV vectors are used to modify immune cells for targeted therapies. As innovations in cell therapy continue, particularly in the fields of immuno-oncology, the demand for AAV vectors is expected to grow quickly.

North America adeno associated virus vector manufacturing market is accounted for the largest market share of 49.82% in 2024.The region is home to leading biotechnology companies, academic institutions, and regulatory bodies that are driving the development and commercialization of gene therapies. With regulatory approvals for numerous AAV-based therapies and a large number of clinical trials being conducted in the region, North America remains the market leader in AAV vector manufacturing. Additionally, the presence of major companies providing AAV vector manufacturing services further strengthens the region’s dominance.

The Asia-Pacific region is the fastest-growing in the AAV vector manufacturing market. Countries like China, India, and Japan are investing heavily in biotechnology, with an increasing number of research institutions and biotechnology companies focusing on gene therapy. Additionally, the growing healthcare infrastructure and improving regulatory frameworks in these countries are fostering the development of gene therapies, creating substantial demand for AAV vector manufacturing. As a result, the Asia-Pacific region is expected to experience rapid growth in the coming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the adeno associated virus vector manufacturing market

Scale of Operations Scope

Method Scope

Therapeutic Area Scope

Application Scope

Regional