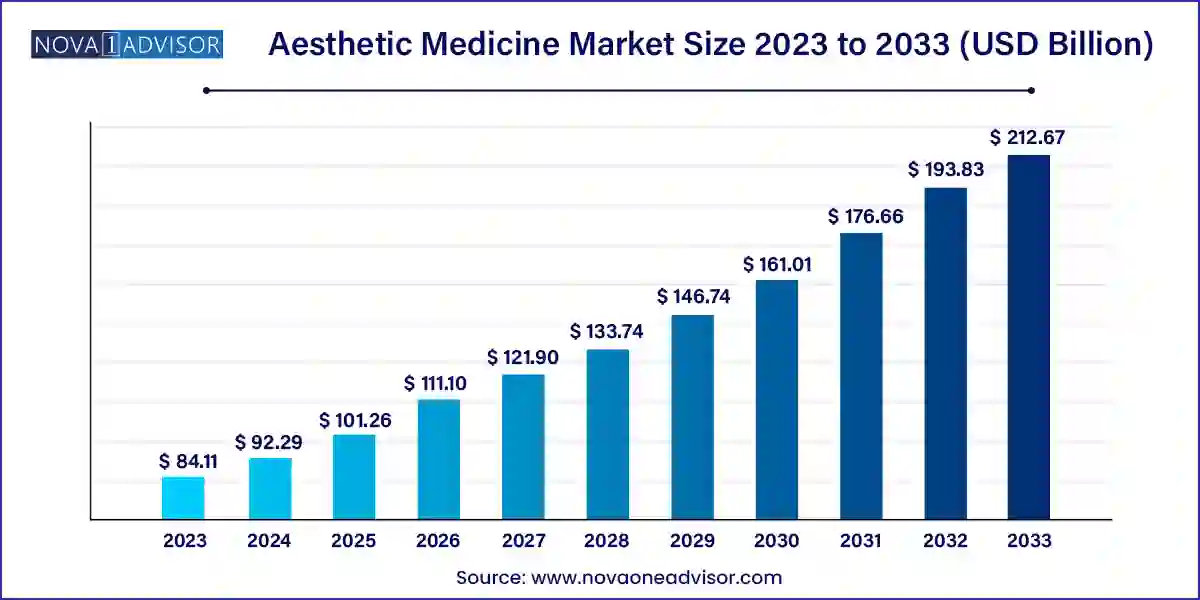

The global aesthetic medicine market size was valued at USD 84.11 billion in 2023 and is anticipated to reach around USD 212.67 billion by 2033, growing at a CAGR of 9.72% from 2024 to 2033.

A significant driver for the thriving aesthetic medicine market is the rising societal focus on individual appearance, propelling an increased desire for aesthetic procedures. This shift in cultural norms, combined with an expanding awareness of the diverse cosmetic solutions now accessible, has played a pivotal role in driving the market's upward trajectory. The growing acknowledgment and acceptance of various cosmetic interventions reflect an evolving mindset towards personal aesthetic enhancement, serving as a key driver in sustaining the aesthetic market's growth.

The 2022 data from the International Society of Aesthetic Plastic Surgery (ISAPS) highlights key trends in the top five global surgical procedures, providing insights into the factors shaping the aesthetic medicine market. Liposuction emerged as the most performed procedure, totaling 2,303,929, followed closely by Breast Augmentation at 2,174,616. Eyelid Surgery secured the third position with 1,409,103, and Abdominoplasty claimed the fourth spot with 1,180,623. The fifth spot was occupied by Breast Lift, recording 955,026 procedures.

Thus, the market has witnessed a spike during the past few months and is expected to be in high demand throughout the forecasted period. The growing awareness about fitness and overall appearance has increased the demand for aesthetic treatments in developing countries. Aesthetic procedures, such as liposuction, nose reshaping, and Botox injections, are gaining consumer interest in countries, such as India and South Korea. According to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, India was ranked among the top 5 countries performing non-surgical procedures at a global level. This highlights the lucrative growth prospects that lie ahead for industry players in the country.

| Report Attribute | Details |

| Market Size in 2024 | USD 92.29 Billion |

| Market Size by 2033 | USD 212.67 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Procedure, Product, Application, End-User, Gender, Route of Administration, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | AbbVie Inc., Galderma, Alma Lasers, Cynosure, Johnson & Johnson Private Limited, Lumenis Be Ltd., Solta Medical, Candela Medical, Hologic, Inc., Dentsply Sirona |

Based on procedure type, the industry has been segmented into invasive procedures and non-invasive procedures. The non-invasive procedures segment dominated the market with a share of 39.11% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Less pain, instant results, and low cost are some of the factors that have boosted the demand for non-invasive procedures at a global level. Popular non-invasive procedures include Botox injections, soft tissue fillers, and chemical peel. Moreover, invasive procedures, such as liposuction, breast augmentation, and nose reshaping, are some of the popular aesthetic procedures. The growing focus on physical appearance has increased the demand for these invasive procedures.

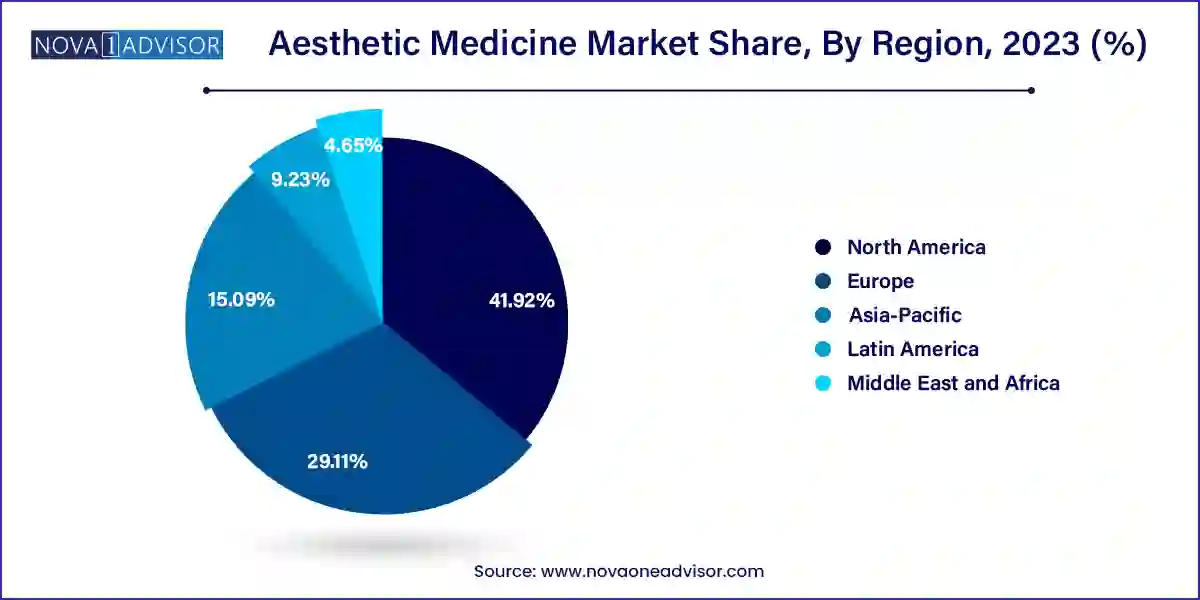

In 2023, North America accounted for the largest share of 41.92% of the global aesthetic medicine market revenue. Advanced healthcare infrastructure, high adoption of cosmetic procedures, increasing prevalence of skin disorders, and the presence of several certified & skilled cosmetic surgeons in the region are some of the major factors contributing to the growth of the regional market.

In 2022, the International Society of Aesthetic Plastic Surgery (ISAPS) revealed that a substantial number of aesthetic procedures were performed in the United States, totaling 7,448,196. This data underscores the country's continued popularity and demand for aesthetic enhancements, thus driving the U.S. aesthetic medicine market.

Asia Pacific is projected to grow at the highest CAGR during the forecast period. The region is backed by countries, such as China, India, Malaysia and South Korea. The availability of technologically advanced products and growing focus on physical appearance also support the growth. Moreover, South Korea is considered the hub of cosmetic surgeries, which is another key factor driving regional growth.

Some of the key players operating in the market include AbbVie; Cynosure; Evolus Inc.; Revance Therapeutics, Inc; Galderma; Lumenis; Solta Medical; Syneron Candela; Alma Laser.

The global market is highly fragmented with many local players competing with international players. However, the strict regulatory approval process is challenging the entry of new products into the market. Primary parameters affecting the competitive nature are the rapid adoption of advanced devices for improved treatment and technological advancement. Leading players are adopting various strategies, such as mergers & acquisitions, to retain their industry share and position. For instance,

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Aesthetic Medicine market.

By Procedure Type

By Product Type

By Application

By End-User

By Gender

By Route of Administration

By Region