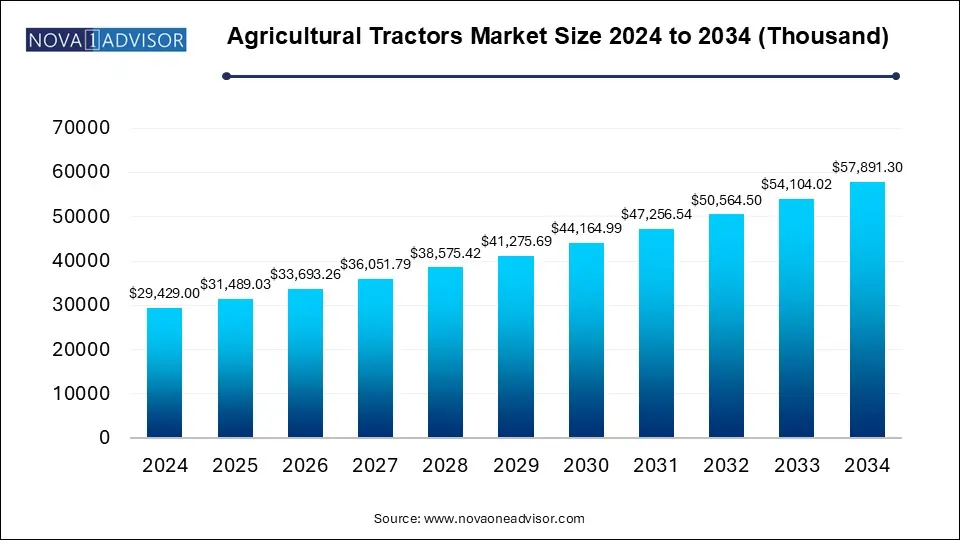

The global agricultural tractors market size was exhibited at USD 29,429.00 thousand in 2024 and is projected to hit around USD 57,891.30 thousand by 2034, growing at a CAGR of 7.00% during the forecast period of 2025 to 2034.

The agricultural tractors market plays a crucial role in enhancing agricultural productivity across the globe. Tractors are vital machinery in the farming sector, providing significant assistance in performing essential tasks such as plowing, tilling, planting, and harvesting. The global market for agricultural tractors has witnessed notable growth driven by advancements in technology, mechanization trends, and the rising demand for efficient and productive farming solutions. Tractors, varying in size and power, are adapted to different farming needs, ranging from small-scale farms to large industrial agricultural operations.

In recent years, the increasing demand for automation, alongside improved fuel efficiency and environmental sustainability, has led to the development of new tractor models. These innovations are designed to meet the diverse needs of farmers globally, including the need to reduce labor costs and improve operational efficiency. The agricultural tractors market is also influenced by factors such as government subsidies for mechanization, technological advancements, and changing consumer preferences for eco-friendly and energy-efficient farming equipment.

As the world continues to face challenges like food security, climate change, and labor shortages, the demand for agricultural tractors is expected to grow in order to meet the increasing agricultural output needs. Moreover, emerging economies in regions like Asia-Pacific, which have large agricultural sectors, are anticipated to be key drivers of market growth.

Agricultural Tractor Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 29,429.00 Thousand |

| Market Size by 2033 | USD 57,891.30 Thousand |

| Growth Rate From 2024 to 2033 | CAGR of 7.00% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Engine Power, Driveline Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | AGCO Corp.; CLAAS KGa AmbH; CNH Industrial N.V.; Deere & Company; Escorts Ltd.; International Tractors Ltd/; Kubota Corp.; Mahindra & Mahindra Ltd.; Tractors and Farm Equipment Ltd.; YanmarCo., Ltd. |

Market Dynamics:

Driver

Technological Innovations

The introduction of next-generation tractor technologies, such as GPS-guided navigation, automated driving systems, and machine learning, is enhancing tractor efficiency and driving their adoption among farmers. These innovations provide farmers with enhanced accuracy and productivity, reducing the reliance on manual labor.

As agricultural operations scale up globally, farmers are increasingly turning to tractors to boost productivity and manage larger acreages effectively. The need to perform tasks like plowing, tilling, planting, and harvesting more efficiently is accelerating the demand for tractors.

Restraint

The high upfront cost of advanced tractors, particularly those with new technologies or higher engine power, can be a significant barrier for small and medium-scale farmers in emerging economies. This high capital expenditure can limit tractor adoption, especially among low-income farmers.

As fuel prices increase globally, the operational costs of tractors, especially diesel-powered models, are rising. This increase in fuel costs is a significant concern for farmers, particularly in regions where diesel is a major source of power for agricultural equipment.

Some of the newer tractor models, especially those with advanced technology and electric engines, require specialized maintenance. This can lead to increased costs and a lack of trained technicians in rural areas, creating a restraint for widespread adoption.

Opportunity

The growing trend toward environmentally sustainable farming practices presents a significant opportunity for electric tractors. With stricter emission standards in many countries, electric tractors are poised to replace traditional diesel-powered models, offering farmers a greener alternative.

The increasing use of precision farming techniques, which involves the use of sensors, GPS, and data analytics, presents opportunities for tractor manufacturers to develop more sophisticated models. Tractors integrated with precision farming tools can help optimize land use, reduce resource waste, and increase crop yield.

The two-wheel drive (2WD) segment held the largest market share in 2024, and it is expected to maintain its dominance over the forecast period. This segment benefits from lower upfront costs and greater maneuverability, making it an attractive option for middle-income farmers, particularly in regions like Asia-Pacific. In countries like India, 2WD tractors are widely preferred due to their affordability. However, rising fuel costs, especially in diesel, could be a concern, as it increases the operating costs for farmers.

In terms of engine power, tractors with less than 40 horsepower (HP) led the market in 2024. These tractors are compact, affordable, and suitable for basic agricultural tasks, making them popular among small-scale farmers. Their ability to handle various farming operations with low fuel consumption and maintenance costs has positioned them as the preferred choice for farmers in developing countries.

Asia-Pacific is the largest and fastest-growing region for the agricultural tractor market. Countries like China and India are major contributors to the demand for tractors, driven by their vast agricultural sectors and the growing trend of mechanization. India, in particular, has seen a surge in demand for small- and medium-sized tractors, driven by the need for cost-effective solutions for small-scale farmers. In China, large farms are increasingly adopting modern tractors to improve agricultural efficiency. The region's strong focus on boosting agricultural output and reducing manual labor is expected to continue driving growth.

North America is anticipated to experience the fastest growth in the tractor market due to the rise of technologically advanced tractors and precision agriculture practices. The U.S. and Canada are leading markets for high-horsepower tractors, where demand is driven by the need for large-scale, efficient farming equipment. The growing emphasis on sustainability and environmental regulations is also accelerating the shift towards electric and hybrid-powered tractors in this region.

Europe is seeing moderate growth in the tractor market, with countries like Germany, France, and the UK being key contributors. The European market is characterized by a high adoption rate of advanced tractor technologies, including automation and electric-powered tractors. Stringent environmental regulations and the drive towards sustainable farming are pushing the demand for eco-friendly tractors in the region.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global agricultural tractors market.

Engine Power

Driveline Type

By Region