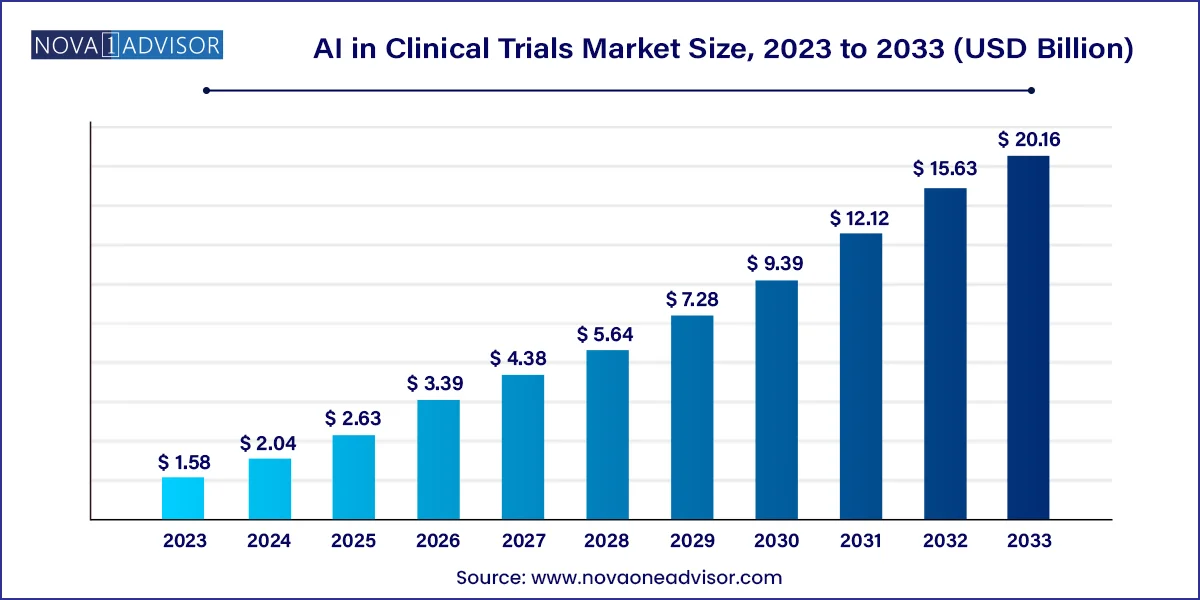

The global AI in clinical trials market size was valued at USD 1.58 billion in 2023 and is anticipated to reach around USD 20.16 billion by 2033, growing at a CAGR of 29% from 2024 to 2033.

The Artificial Intelligence (AI) in Clinical Trials market is undergoing a transformative shift, redefining how pharmaceutical companies, contract research organizations (CROs), and biotech firms approach drug discovery, development, and approval. The high cost, time consumption, and failure rates associated with traditional clinical trial models have created a demand for innovative, data-driven solutions—and AI stands at the forefront of this revolution.

Clinical trials, a cornerstone of drug development, often suffer from bottlenecks in patient recruitment, data management, protocol design, and regulatory compliance. AI applications—ranging from machine learning algorithms to natural language processing (NLP) and predictive analytics—are now being employed to streamline these workflows. AI enables real-time monitoring, automation of repetitive tasks, and predictive modeling that can forecast trial outcomes, identify patient drop-out risks, and optimize protocol amendments.

Global pharmaceutical giants like Pfizer and Novartis, as well as tech-savvy biotech firms and CROs, are actively investing in AI platforms. For instance, companies like Medidata (a Dassault Systèmes brand), PathAI, and Tempus have introduced AI tools that significantly improve trial efficiency, data integrity, and patient safety. With the increased digitization of healthcare records, expansion of wearable technology, and integration of real-world evidence (RWE), AI is playing a pivotal role in reducing trial durations and improving success rates.

Moreover, the global COVID-19 pandemic acted as an inflection point, accelerating AI adoption by demonstrating its efficacy in rapidly evaluating clinical outcomes, facilitating decentralized trials, and aiding in vaccine development timelines. The continued focus on personalized medicine, chronic disease management, and rare disease research further underscores the long-term value proposition of AI in clinical trials.

Surge in Decentralized Clinical Trials (DCTs): AI technologies are increasingly used to enable remote patient monitoring, virtual recruitment, and digital endpoint tracking.

Adoption of Predictive Analytics for Patient Stratification: AI helps identify high-probability responders, reducing heterogeneity and improving trial efficiency.

Growing Integration with Real-World Data (RWD) and Real-World Evidence (RWE): AI is essential in processing vast, unstructured datasets from EHRs, wearables, and claims databases.

Rise of NLP in Trial Design and Feasibility: Natural Language Processing is used to mine literature and past trial protocols to design optimized studies.

Use of AI in Adverse Event Detection and Risk-Based Monitoring: Algorithms are trained to detect anomalies in trial data, ensuring safety and compliance.

Cloud-Based AI Platforms Gaining Momentum: Scalable AI-as-a-Service models are enabling CROs and mid-sized pharma to access high-end analytics without major infrastructure investment.

Regulatory Interest in AI Transparency and Explainability: As AI becomes integral to clinical decision-making, regulators are increasing scrutiny over algorithmic transparency and validation.

Strategic Partnerships Between Tech and Pharma: Companies like IBM Watson Health, Google Health, and Microsoft Azure are forging alliances with life sciences firms to co-develop AI-powered platforms.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.04 Billion |

| Market Size by 2033 | USD 20.16 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 29% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Offering, By Technology, By Application, and By End-user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | AiCure, Antidote Technologies, Deep 6 AI, Mendel.ai, Phesi, Saama Technologies, Signant Health, Trials.ai, Innoplexus, IQVIA, Median Technologies, Medidata, and Others. |

Rising Cost and Complexity of Traditional Clinical Trials

One of the key drivers pushing the adoption of AI in clinical trials is the mounting cost and complexity associated with conventional trial methodologies. A typical Phase III trial can cost upwards of $200 million and take 6-7 years to complete. This investment is often at risk due to issues like patient non-compliance, low enrollment rates, data inconsistencies, and high dropout ratios. AI mitigates these risks through predictive modeling, intelligent data monitoring, and automated recruitment strategies.

By leveraging AI, pharmaceutical firms can simulate trial scenarios, identify ideal trial sites based on historical data, and match patients with protocols using real-time analytics. For instance, companies like Deep 6 AI use NLP to identify eligible patients from EHRs in seconds, a process that would traditionally take weeks. Ultimately, AI drives efficiency, reduces waste, and accelerates the timeline from drug discovery to approval—making it a vital tool in competitive drug development pipelines.

Data Privacy and Ethical Concerns in AI-Driven Trials

Despite its benefits, the implementation of AI in clinical trials is not without challenges—chief among them being data privacy and ethical governance. Clinical trials inherently deal with sensitive patient information, and AI platforms often require access to vast datasets that include personal health records, genomic data, and behavioral patterns. In Europe, stringent GDPR regulations limit the extent to which patient data can be used, while in the U.S., HIPAA compliance is mandatory for any AI deployment in healthcare.

Ethical concerns around bias in AI algorithms, lack of explainability, and the potential for discriminatory outcomes also hinder broad-scale adoption. There is an increasing demand for transparency in how algorithms are trained, validated, and used in decision-making. Moreover, without standardized frameworks to audit AI’s impact on trial outcomes, regulatory approvals can face delays. These complexities necessitate careful planning, legal consultation, and governance models, which can slow implementation, especially for smaller organizations.

Expansion of AI in Rare Disease and Precision Medicine Trials

An emerging opportunity within the market lies in the application of AI to rare disease and precision medicine trials. These trials often face unique challenges—small patient populations, complex genetic markers, and limited historical data. AI technologies are uniquely positioned to overcome these hurdles through advanced genomic analysis, machine learning predictions, and intelligent patient matching.

For example, AI can comb through massive genomic datasets to identify rare mutations or biomarkers that traditional analysis would miss. In combination with EHRs and registries, AI tools can locate eligible participants across geographic boundaries, enabling faster recruitment in ultra-targeted studies. As the pharmaceutical industry shifts towards niche therapies and individualized treatment plans, the ability of AI to enhance precision and feasibility makes it indispensable in next-generation trial models.

The services segment held the largest share of the AI in clinical trials market in 2023. especially as CROs and mid-sized biotech firms seek turnkey AI implementation without investing in infrastructure. These services include AI model development, data preprocessing, regulatory consulting, and post-trial analytics. Outsourcing these functions to AI-specialized vendors allows organizations to remain agile while accessing cutting-edge tools. As the demand for flexible trial designs and decentralized models rises, the service segment will continue its growth trajectory.

The deep learning segment held the largest share of the AI in clinical trials market in 2023. owing to its ability to analyze complex data structures such as radiographic images, histopathology slides, and multi-omics datasets. Deep learning models are especially useful in oncology and neurological trials, where high-resolution image analysis is required to track disease progression or treatment response. Tools like PathAI and Zebra Medical Vision are gaining traction for integrating deep learning into clinical endpoints and diagnostics.

Machine learning (ML) held the dominant share of the market in 2024, due to its robust applicability across trial planning, patient recruitment, data analysis, and risk-based monitoring. ML algorithms are particularly effective in handling large, heterogeneous datasets from wearables, EHRs, genomics, and imaging. For example, ML-driven platforms can predict trial success probabilities based on historical trial data and offer adaptive learning capabilities for real-time insights.

Oncology has remained the most dominant application of AI in clinical trials, driven by the large number of ongoing cancer trials and the complexity of patient stratification based on genetic mutations, tumor biomarkers, and disease stage. AI plays a pivotal role in identifying trial participants, predicting treatment efficacy, and optimizing dosing regimens. The vast amounts of radiological, histological, and molecular data generated in oncology trials make them ideal for AI integration.

Meanwhile, neurological disease trials represent the fastest-growing segment, largely due to rising incidences of conditions like Alzheimer’s, Parkinson’s, and multiple sclerosis. These trials are data-intensive and often prolonged due to variable symptom progression. AI tools are helping researchers track subtle cognitive changes, interpret MRI scans, and predict disease trajectory—thus improving trial endpoints and patient engagement.

Pharmaceutical and biotechnology companies dominated the end-user segment in 2023, reflecting their deep investments in AI to reduce trial timelines and improve R&D efficiency. These firms often lead innovation by integrating AI across multiple stages of drug development and engaging with AI vendors for co-development initiatives. For example, Pfizer has collaborated with IBM Watson to explore oncology-focused trial analytics, while Novartis has deployed AI platforms for smart protocol design.

Contract research organizations (CROs) are the fastest-growing end users, as they adopt AI to enhance service offerings and stay competitive in a rapidly evolving market. CROs like ICON plc, IQVIA, and Labcorp are investing in AI-enabled data management, remote monitoring, and patient engagement tools to meet client demands for efficiency and cost-effectiveness. This trend is expected to accelerate as CROs increasingly support decentralized and global trials.

North America held the largest share of the AI in clinical trials market in 2023, owing to its mature pharmaceutical ecosystem, significant AI innovation, and favorable regulatory environment. The U.S., in particular, is home to leading pharma companies, AI startups, and regulatory bodies that are actively supporting AI integration. The presence of the FDA’s Digital Health Center of Excellence, the growth of precision medicine, and the widespread availability of EHR data are all contributing factors. Furthermore, academic institutions such as MIT and Stanford are partnering with life sciences companies to develop next-gen AI tools for clinical research.

Asia-Pacific is emerging as the fastest-growing region due to its expanding pharmaceutical market, increasing trial volumes, and rapid adoption of digital health technologies. Countries like China, India, South Korea, and Japan are actively investing in AI-driven research ecosystems and are more receptive to decentralized trial models. The availability of large, genetically diverse patient populations and government-backed innovation hubs are attracting global sponsors to conduct trials in the region. Startups in China, such as Deep Intelligent Pharma, are already offering AI-powered trial design and data mining tools, accelerating regional adoption.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the AI in Clinical Trials market.

AI in clinical trials market, By Offering

AI in clinical trials market, By Technology

AI in clinical trials market, by Application

AI in clinical trials market, By End User

By Region