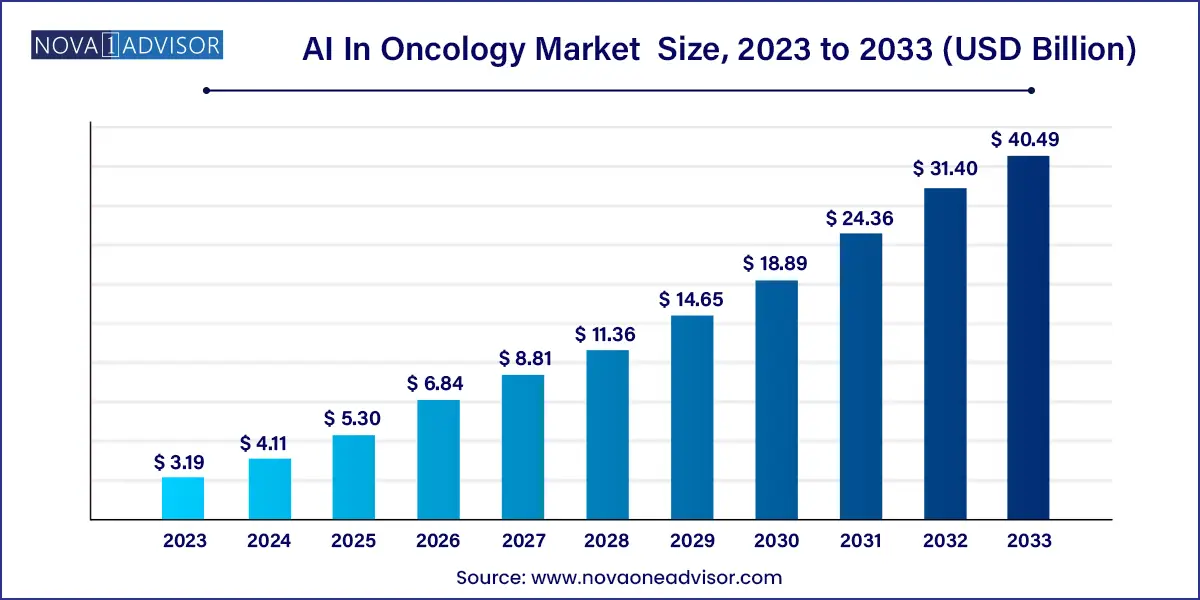

The global AI in oncology market size was estimated at USD 3.19 billion in 2023 and is projected to hit around USD 40.49 billion by 2033, growing at a CAGR of 28.93% during the forecast period from 2024 to 2033.

Key Takeaways:

AI In Oncology Market Growth

The growth of the market is attributed to increasing prevalence of cancer, technological advancement in cancer diagnostics & healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer.

The growing initiatives undertaken by public and private organizations to invest in research and development (R&D) for introduction of novel technologies are further anticipated to fuel the market growth. For instance, in October 2022, Tempus, a company specializing in precision medicine and AI, recently announced a program called Tempus+. This proprietary program utilizes real-world data to power collaborative precision oncology research. A community of researchers, including Baylor College of Medicine, Allegheny Health Network, Stanford Cancer Center, Rush University Medical Center, TriHealth, and others, is already using the Tempus+ program to advance their research. Furthermore, increasing product approval of AI-associated medical devices is anticipated to boost market growth. In January 2024, the U.S. FDA approved the first AI medical device, DermaSensor, to detect skin cancer.

The future of AI applications in cancer care is poised for groundbreaking advancements, encompassing early detection, precision medicine, and personalized treatment plans. AI's ability to analyze vast datasets, identify subtle patterns, and provide real-time insights holds the potential to revolutionize cancer diagnosis and therapy, ushering in a new era of improved patient outcomes and more efficient healthcare delivery.

AI In Oncology Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 4.11 Billion |

| Market Size by 2033 | USD 40.49 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 28.93% |

| 2023 | |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, cancer type, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Azra AI; IBM; Siemens Healthcare GmbH; Intel Corporation; GE HealthCare; NVIDIA Corporation; Digital Diagnostics Inc.; ConcertAI; Median Technologies; PathAI |

Segments Insights:

Component Type Insights

Based on component type, the hardware segment held the largest revenue share of 39.9% in 2023. Medical device manufacturers use AI technologies to innovate products to help healthcare providers enhance patient care. One of the major advantages of AI in medical devices is its capability to learn from real-world data and experience and improve its performance. Hence, several key players are investing in launching and advancing AI-based cancer therapy solutions. Moreover, governments are undertaking initiatives to promote the growth of AI-based medical devices. For instance, in January 2021, the U.S. FDA introduced an action plan for AI/ML-based Software as a Medical Device (SaMD). The plan was developed to support innovative work regulating medical devices and additional digital health technologies.

The software solutions segment is anticipated to witness the fastest CAGR from 2024 to 2033. The increasing adoption of AI software solutions by healthcare providers and payers operating in oncology is one of the major factors fueling software solutions segment growth. The software solutions are highly effective at predicting various types of cancer, including brain, breast, liver, lung, and prostate cancer. They offer better accuracy compared to clinicians. Hence, numerous key players are focusing on developing & launching new tools and platforms, increasing the competition in the market. For instance, in October 2023, Philips partnered with Quibim, a company specializing in imaging biomarkers, to launch AI-powered imaging and reporting solutions for Magnetic Resonance (MR) prostate screenings.

Cancer Type Insights

Based on cancer type, breast cancer is the single biggest cancer type holding the largest revenue share in 2023. The dominance of this segment is attributed to increasing prevalence of breast cancer among the population. According to the American Society of Clinical Oncology in 2020, around 2,261,419 new cancer cases were diagnosed globally, and most cases are seen in the U.S. with an estimated 297,790 new breast cancer cases in 2023. Growing cases amongst the population are propelling the need for introduction of technologically advanced products in the market, further propelling the market growth.

The prostate cancer segment is expected to register the fastest CAGR of 29.95% over the forecast period. Prostate cancer generally affects 13 out of every 100 men in the U.S., according to the data published by CDC. Moreover, according to the National Cancer Institute, in 2023, approximately 288,300 new prostate cancer cases were diagnosed, contributing to the segment’s growth. In addition companies are expanding their portfolios by launching new products and services, for instance, in January 2024, Quibim expanded its AI-based prostate cancer solutions portfolio by introducing QP-Prostate, an AI-based detection tool. The tool reduces the processing time and increases accuracy & quality.

Application Insights

Based on application, the diagnostics segment held the largest revenue share of 38.9% in 2023. Cancer diagnostics is an essential starting point for designing relevant therapeutic strategies and clinical management, and its AI-based advancement makes it more efficient and effective. Several companies are developing approaches for early diagnosis that include screening patients at risk with no symptoms & appropriately and rapidly investigating those who do. For instance, in December 2023, Dedalus S.p.A. partnered with Ibex Medical Analytics to launch an end-to-end AI-powered digital pathology solution to detect cancer.

The research & development segment is expected to grow at the fastest CAGR over the forecast period. Modern pharmaceutical companies are increasingly adopting AI to accelerate and improve various aspects of clinical development. While developing and testing a new drug, an extensive volume of data, ranging from terabytes to petabytes, is generated at each phase. Analyzing these huge datasets necessitates complex mathematical operations, a domain in which machine learning, a fundamental component of contemporary AI, demonstrates exceptional proficiency.

End-use Insights

Based on end-use, the hospitals segment led the market with a largest revenue share of 48.6% in 2023. The growth is attributed to the rising adoption of AI-powered solutions by hospitals, the increasing number of companies entering the market to cater to cancer care in hospitals, and positive responses from patients, the market is anticipated to grow significantly during the forecast period.

The segment is also expected to grow at the fastest CAGR over the forecast period, owing to technological advancements in the healthcare sector that have increased over recent years. Digitalizing processes and implementing AI, virtual reality, and immersive technologies are key examples that changed healthcare institutions’ diagnostic, treatment, and data collection processes, including hospitals. Furthermore, hospitals are integrating AI-powered algorithms in cancer therapy to enhance accuracy by avoiding misdiagnosis.

Regional Insights

North America AI in Oncology Market Trends

North America dominated the AI in oncology market with a revenue share of 43.9% in 2023, due to presence of well-developed digital infrastructure, favorable regulatory & reimbursement policies, and rising government initiatives to boost the adoption of AI technology in the healthcare industry. The rising prevalence of various cancers is propelling the need for development of advanced therapeutics and diagnostics which is further enabling growth of the regional market. In November 2021, Sanofi entered into collaboration with Owkin Inc. and invested USD 180 million in Owkin’s AI for advancement of the oncology pipeline.

U.S. AI in Oncology Market Trends

The AI in oncology market of U.S. held with the largest revenue share in the North America in 2023. The market is experiencing significant growth owing to the surging demand for AI applications to revolutionize medicine and advance research, diagnostics, & cancer treatment. Increasing FDA initiatives significantly contribute to the market growth of the U.S. For instance, FDA's efforts as highlighted in a December 2023 factsheet have led to the authorization, clearance, or approval of over 690 AI-enabled devices.

Canada AI in oncology market is experiencing significant growth with a CAGR of 26.8% due to rising cancer cases in the country. Furthermore, AI is rapidly reshaping Canadian healthcare, particularly in oncology, with government support and funding driving significant advancements. The Canadian Cancer Society (CCS) actively backs AI applications, funding research teams focused on early detection and cancer care innovations. For instance, the CCS funded four research teams in December 2023 to innovate early detection, cancer prevention, and care using AI.

Asia Pacific AI in Oncology Market Trends

Asia Pacific AI in oncology market is expected to grow at the fastest CAGR over the projected period. The growth is attributed to rising adoption of digitalization in diagnostic laboratories and hospitals aided by growing geriatric population and an increasing prevalence of cancer among the population. For instance, according to Globocan in 2020, there were an estimated 19 million new cancer cases worldwide, with Asia-Pacific accounting for 9.7 million. Furthermore, key players are taking initiatives to improve cancer care in the region. In June 2022, GE Healthcare collaborated with National Cancer Centre Singapore with an aim to focus on artificial intelligence to improve cancer care.

AI in oncology market in China held the largest revenue share of 22.6% in the APAC region in 2023. Ongoing research initiatives leverage advancements in ML, image analysis, and data processing to enhance the accuracy & efficiency of AI applications in oncology. These collaborations facilitate the translation of research findings into practical solutions, fostering the integration of AI into clinical practices and healthcare systems.

India AI in oncology market’s growth is primarily driven by various factors such as the increasing prevalence of cancer, the growing need for advanced diagnostic & treatment solutions, and the rising adoption of AI technologies in healthcare for improved patient outcomes. Over 1.7 million people in India have cancer. Moreover, advancements in healthcare infrastructure and digitalization efforts support the integration of AI technologies to assist in early detection, diagnosis, and personalized cancer treatment.

Various factors driving Japan's AI in oncology market include the country's commitment to maximizing the positive impact of AI on society rather than imposing strict regulations due to perceived risks. Moreover, collaborations and product launches between technology companies and hospitals are key drivers in Japan's AI in oncology market. For instance, in August 2023, BostonGene, NEC Corporation, and Japan Industrial Partners collaborated to establish BostonGene Japan, Inc., a joint venture based in Tokyo.

Recent Developments

Key AI In Oncology Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Market players such as Azra AI; IBM; Siemens Healthcare GmbH; Intel Corporation; and others dominated the market. These key players have been developing novel technologies to cater to different end-use applications. For instance, in January 2023, Massive Bio announced the plans to adopt AI use in oncology with development and launch of drug matching product in 2023. Furthermore, key participants in the industry are embracing the strategy of introducing new products to sustain a competitive advantage within the market. For instance, in January 2020, ConcertAI launched eurekaHealth 3.0, combining use-case-aligned RWD and AI technologies to develop real-world evidence services and insights for oncology clinical development.

Some of the prominent players in the AI In Oncology Market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the AI In Oncology market.

By Component Type

By Cancer Type

By Application

By End-use Type

By Region