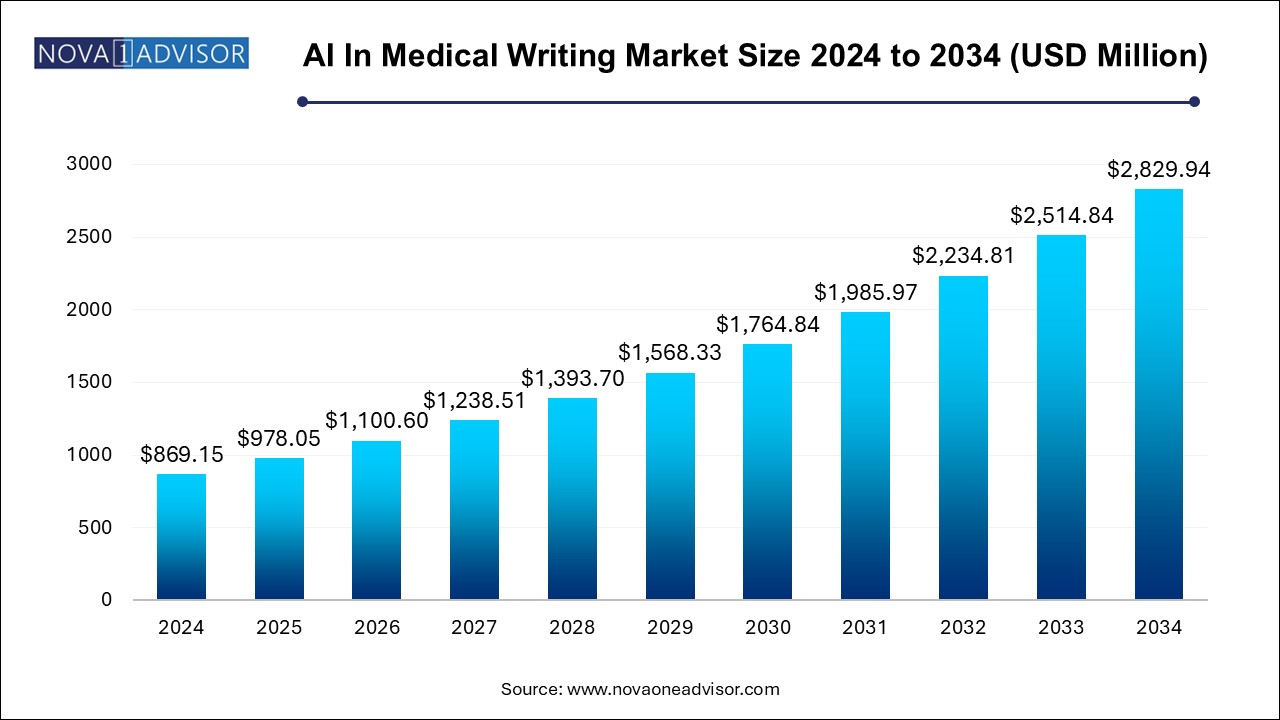

The AI in medical writing market size was exhibited at USD 869.15 million in 2024 and is projected to hit around USD 2829.94 million by 2034, growing at a CAGR of 12.53% during the forecast period 2025 to 2034.

Artificial intelligence (AI) ensures compliance with stringent regulatory requirements by offering accurate, consistent, and error-free documentation. Natural language processing (NLP) algorithms are equipped to detect inconsistencies and align content with guidelines set by agencies like the FDA and EMA. This capability is critical in the medical writing industry, where non-compliance can lead to delays or rejections. The assurance of producing high-quality, regulation-compliant content has driven organizations to adopt AI technologies to meet evolving standards.

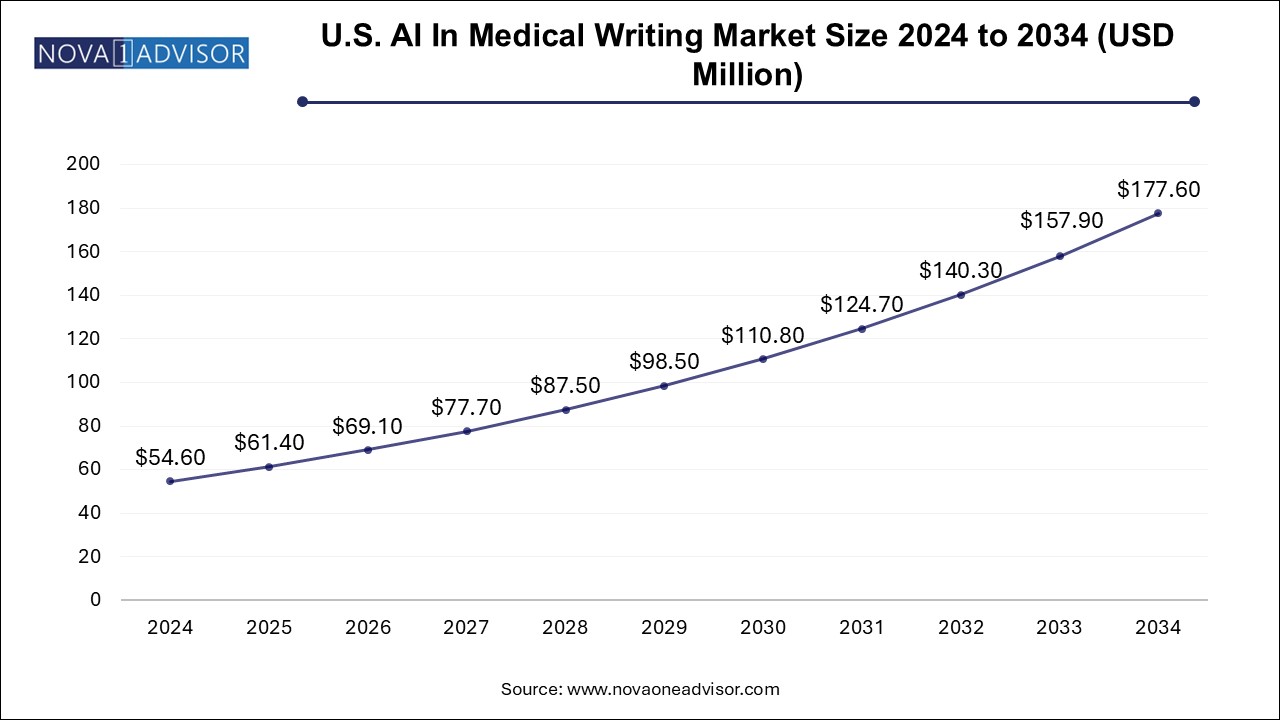

The U.S. AI in medical writing market size is evaluated at USD 54.6 million in 2024 and is projected to be worth around USD 177.6 million by 2034, growing at a CAGR of 11.31% from 2025 to 2034.

North America AI in medical writing market is experiencing robust growth, driven by advancements in AI technology and its application in medical writing processes. According to a Science Direct report published in September 2024, AI can streamline manuscript preparation by aligning content with journal guidelines and expediting the peer-review process. This time-saving capability enhances efficiency, enabling researchers and writers to focus on critical tasks, fueling market expansion across the region.

U.S. AI In Medical Writing Market Trends

The U.S. AI in medical writing market is growing rapidly, driven by technological advancements and innovative solutions. Cutting-edge AI tools streamline regulatory writing, data analysis, and content generation, improving accuracy and efficiency. For instance, in August 2023, Celegence introduced CAPTIS Copilot, an AI-driven compliance solution for medical device and diagnostic manufacturers. The platform is designed to streamline regulatory processes, including medical writing tasks such as crafting clinical evaluation reports, regulatory submissions, and post-market surveillance documentation. Leveraging advanced AI capabilities, CAPTIS Copilot enhances document accuracy, compliance, and efficiency, ensuring manufacturers meet stringent global regulatory standards.

Europe AI In Medical Writing Market Trends

AI in medical writing market in Europe is expanding due to several key factors, including robust investment in AI research, strong pharmaceutical and biotech industries, and increasing adoption of digital transformation in healthcare. Advanced AI solutions enhance compliance with stringent European regulatory frameworks, streamline document creation, and improve efficiency. Collaborative efforts among industry players further drive innovation, solidifying Europe as a leader in integrating AI into medical writing processes.

The UK AI in medical writing market is growing due to the technology's ability to save time and simplify complex tasks. AI-powered tools streamline the creation of regulatory and scientific documents, reducing manual effort. Their user-friendly interfaces make them accessible to professionals across sectors, enhancing productivity and supporting the UK's thriving pharmaceutical and biotechnology industries.

AI in medical writing market in Germany is witnessing growth driven by innovation and the rising demand for scientific writing solutions. The introduction of AI tools like Springer Nature's Curie in October 2023 highlights this trend. Curie assists researchers in crafting scientific documents efficiently, addressing the increasing need for precision and speed in Germany's dynamic pharmaceutical and research sectors.

Asia Pacific AI In Medical Writing Market Trends

The AI in medical writing market in the Asia Pacific dominated with a revenue share of 30.41% and is growing rapidly, fueled by increasing demand for efficient and accurate scientific writing solutions. Rising pharmaceutical research activities and a growing need to streamline regulatory documentation processes are driving adoption. AI tools offer time-saving benefits and enhanced accuracy, making them indispensable in meeting the region's expanding medical and scientific communication requirements.

AI in medical writing market in Japan is experiencing significant growth, driven by advancements in AI technology and the nation's focus on precision and innovation. AI-powered tools streamline scientific documentation, improve accuracy, and reduce time spent on regulatory submissions, making them vital for Japan's expanding pharmaceutical and biotechnology industries.

AI in medical writing market in China is growing rapidly, driven by the increased adoption of AI tools to enhance productivity and streamline scientific writing processes. For instance, a 2023 Springer Nature report highlighted that 90% of Chinese researchers who used AI-assisted tools during trials advanced their manuscripts to peer review, resulting in a 14% rise in published articles.

| Report Coverage | Details |

| Market Size in 2025 | USD 978.05 Million |

| Market Size by 2034 | USD 2829.94 Million |

| Growth Rate From 2025 to 2034 | CAGR of 12.53% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Parexel International (MA) Corporation; Trilogy Writing & Consulting GmbH; Freyr; Cactus Communications; GENINVO; IQVIA Inc.; ICON plc; Syneos Health; IBM; Teladoc Health, Inc.; SmarterDx; Abridge AI, Inc.; Suki AI, Inc.; Movano; Heidi; Corti; Tortus AI; Nabla Technologies, Certara, Inc. |

Based on type, the market is segmented into clinical writing, typewriting, scientific writing, and others. The typewriting segment led the market in 2024, accounting for the largest revenue share of 32.89%. This segment plays a crucial role throughout the entire product development process, particularly in scientific documentation. Typewriting is essential for the proper organization and presentation of data from clinical trials, which is required for regulatory submissions and product authorization. Upon receiving approval for a drug or product, post-approval regulatory certification becomes mandatory, necessitating additional paperwork and documentation. Due to the stringent regulations and extensive documentation requirements, there has been a surge in demand for efficient and accurate medical writing, further driving the growth of this segment.

The clinical writing segment, on the other hand, is expected to experience the fastest CAGR of 13.30% during the forecast period. Clinical writing is regularly used by medical professionals for various purposes, including patient documentation, clinical trial reporting, and regulatory submissions. Clinical writers need to have a comprehensive understanding of the clinical field, medical terminology, and the language used in medical documentation. In addition, they must be able to effectively communicate with both clinical professionals and regulatory bodies, which requires expertise in understanding the target audience and purpose of the writing.

The end use segment comprises medical devices, pharmaceuticals, biotechnology, and others. In 2024, the pharmaceutical segment led the market, capturing a revenue share of 34.0%. Pharmaceutical companies make substantial investments in research and development (R&D) to create innovative drugs and treatments. These efforts generate extensive data from clinical trials, preclinical studies, and scientific literature, providing a rich source for training AI models used in medical writing tasks.

The adoption of AI-enabled solutions has significantly streamlined the medical writing process, with many companies reporting notable reductions in the time required for these tasks. Specifically, AI-powered tools can automate substantial portions of the Clinical Study Report (CSR) writing process, enhancing efficiency and accuracy. The time savings achieved through CSR automation solutions vary by provider. For instance, ZYLiQ.ai, a player in the industry, claims its solutions can reduce the time medical writers spend on tasks by 60-70%. This growing reliance on AI-driven technologies underscores the pharmaceutical sector’s pivotal role in advancing the adoption of AI in medical writing.

The medical devices segment is projected to experience the fastest CAGR of 13.59% during the forecast period. Medical writing is a critical component of the medical device development process, involving preparing documents such as clinical trial protocols, investigator brochures, patient information leaflets, and regulatory submissions. These documents provide essential insights into device safety, efficacy, and usage. Furthermore, medical writing documents the scientific rationale, regulatory compliance, and clinical data supporting device development. This ensures a clear narrative, aiding regulatory approvals and establishing credibility in the device's design, development, and effectiveness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the AI in medical writing market

By Type

By End Use

By Regional

Chapter 1. Research Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Type

1.1.2. End Use

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline.

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database.

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. End use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. AI in Medical Writing Market Variables, Trends & Scope

3.1. Market Dynamics

3.1.1. Market driver analysis

3.1.2. Market restraint analysis

3.1.3. Market Opportunities

3.2. AI in Medical Writing Market Analysis Tools

3.2.1. Industry Analysis - Porter’s

3.2.1.1. Supplier power

3.2.1.2. Buyer power

3.2.1.3. Substitution threat

3.2.1.4. Threat of new entrant

3.2.1.5. Competitive rivalry

3.2.2. PESTEL Analysis

3.2.2.1. Political landscape

3.2.2.2. Economic landscape

3.2.2.3. Social landscape

3.2.2.4. Technological landscape

3.2.2.5. Environmental landscape

3.2.2.6. Legal landscape

3.2.3. COVID-19 Impact Analysis

3.2.4. Case Studies

Chapter 4. AI in Medical Writing Market: Type Estimates & Trend Analysis

4.1. Type Market Share, 2024 & 2034

4.2. Segment Dashboard

4.3. Global AI in Medical Writing Market by Product Type Outlook

4.4. Clinical Writing

4.4.1. Market estimates and forecast 2021 to 2034 (USD Million)

4.5. Scientific Writing

4.5.1. Market estimates and forecast 2021 to 2034 (USD Million)

4.6. Type Writing

4.6.1. Market estimates and forecast 2021 to 2034 (USD Million)

4.7. Others

4.7.1. Market estimates and forecast 2021 to 2034 (USD Million)

Chapter 5. AI in Medical Writing Market: End Use Estimates & Trend Analysis

5.1. End Use Market Share, 2024 & 2034

5.2. Segment Dashboard

5.3. Global AI in Medical Writing Market by End Use Outlook

5.4. Medical Devices

5.4.1. Market estimates and forecast 2021 to 2034 (USD Million)

5.5. Pharmaceutical

5.5.1. Market estimates and forecast 2021 to 2034 (USD Million)

5.6. Biotechnology

5.6.1. Market estimates and forecast 2021 to 2034 (USD Million)

5.7. Others

5.7.1. Market estimates and forecast 2021 to 2034 (USD Million)

Chapter 6. AI in Medical Writing Market: Regional Estimates & Trend Analysis, By Product, By Type, By End Use

6.1. Regional Market Share Analysis, 2024 & 2034

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size & Forecasts Trend Analysis, 2021 to 2034:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2021 to 2034 (USD Million)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2021 to 2034 (USD Million)

6.5.3. Mexico

6.5.3.1. Key country dynamics

6.5.3.2. Regulatory framework/ reimbursement structure

6.5.3.3. Competitive scenario

6.5.3.4. Canada market estimates and forecasts 2021 to 2034 (USD Million)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2021 to 2034 (USD Million)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2021 to 2034 (USD Million)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2021 to 2034 (USD Million)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2021 to 2034 (USD Million)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2021 to 2034 (USD Million)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2021 to 2034 (USD Million)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2021 to 2034 (USD Million)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2021 to 2034 (USD Million)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2021 to 2034 (USD Million)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2021 to 2034 (USD Million)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2021 to 2034 (USD Million)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2021 to 2034 (USD Million)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2021 to 2034 (USD Million)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Singapore market estimates and forecasts 2021 to 2034 (USD Million)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2021 to 2034 (USD Million)

6.8.2. Argentina

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Argentina market estimates and forecasts 2021 to 2034 (USD Million)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2021 to 2034 (USD Million)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2021 to 2034 (USD Million)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2021 to 2034 (USD Million)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Key company market share/position analysis, 2024

7.4. Company Profiles

7.4.1. Parexel International (MA) Corporation.

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Technology Type benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Trilogy Writing & Consulting GmbH

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Technology Type benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Freyr

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Technology Type benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Cactus Communications

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Technology Type benchmarking

7.4.4.4. Strategic initiatives

7.4.5. GENINVO

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Technology Type benchmarking

7.4.5.4. Strategic initiatives

7.4.6. IQVIA Inc.

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Technology Type benchmarking

7.4.6.4. Strategic initiatives

7.4.7. ICON plc

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Technology Type benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Syneos Health

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Technology Type benchmarking

7.4.8.4. Strategic initiatives

7.4.9. IBM

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Technology Type benchmarking

7.4.9.4. Strategic initiatives

7.4.10. Teladoc Health, Inc.

7.4.10.1. Company overview

7.4.10.2. Financial performance

7.4.10.3. Technology Type benchmarking

7.4.10.4. Strategic initiatives

7.4.11. SmarterDx

7.4.11.1. Company overview

7.4.11.2. Financial performance

7.4.11.3. Technology Type benchmarking

7.4.11.4. Strategic initiatives

7.4.12. Abridge Al, Inc.

7.4.12.1. Company overview

7.4.12.2. Financial performance

7.4.12.3. Technology Type benchmarking

7.4.12.4. Strategic initiatives

7.4.13. Suki AI, Inc.

7.4.13.1. Company overview

7.4.13.2. Financial performance

7.4.13.3. Technology Type benchmarking

7.4.13.4. Strategic initiatives

7.4.14. Movano

7.4.14.1. Company overview

7.4.14.2. Financial performance

7.4.14.3. Technology Type benchmarking

7.4.14.4. Strategic initiatives

7.4.15. Heidi

7.4.15.1. Company overview

7.4.15.2. Financial performance

7.4.15.3. Technology Type benchmarking

7.4.15.4. Strategic initiatives

7.4.16. Corti

7.4.16.1. Company overview

7.4.16.2. Financial performance

7.4.16.3. Technology Type benchmarking

7.4.16.4. Strategic initiatives

7.4.17. Tortus AI.

7.4.17.1. Company overview

7.4.17.2. Financial performance

7.4.17.3. Technology Type benchmarking

7.4.17.4. Strategic initiatives

7.4.18. Nabla Technologies

7.4.18.1. Company overview

7.4.18.2. Financial performance

7.4.18.3. Technology Type benchmarking

7.4.18.4. Strategic initiatives