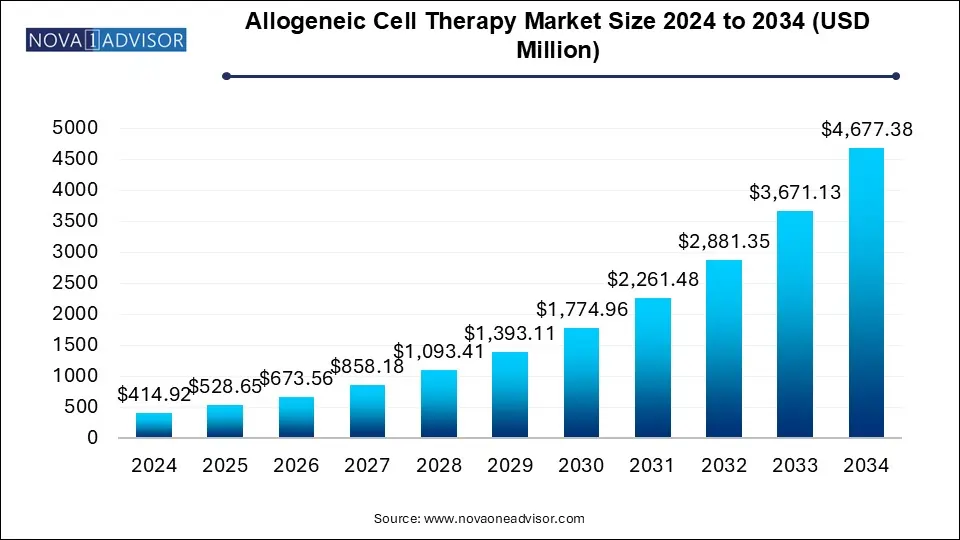

The allogeneic cell therapy market size was exhibited at USD 414.92 million in 2024 and is projected to hit around USD 4,677.38 million by 2034, growing at a CAGR of 27.41% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 528.65 Million |

| Market Size by 2034 | USD 4,677.38 Million |

| Growth Rate From 2025 to 2034 | CAGR of 27.41% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Therapy Type, Therapeutic Area, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | SSM Cardinal Glennon Children's Medical Center; Cleveland Cord Blood Center; Duke University School of Medicine; New York Blood Center; Clinimmune Labs; University of Colorado Cord Blood Bank; MD Anderson Cord Blood Bank; LifeSouth Community Blood Centers, Inc.; Bloodworks Northwest; JCR Pharmaceuticals Co., Ltd.; Sumitomo Pharma Co., Ltd.; Atara Biotherapeutics; Mallinckrodt Pharmaceuticals; Tego Science Inc; Takeda Pharmaceutical Company Limited; STEMPEUTICS RESEARCH PVT LTD; Biosolution Co., Ltd.; MEDIPOST Co., Ltd. |

The growing incidence of chronic diseases such as cancer, cardiovascular diseases, autoimmune disorders, and genetic diseases is expected to drive the growth of the allogeneic cell therapy industry. According to estimates published by the American Cancer Society, 1.9 million new cancer cases were diagnosed in the U.S. alone in 2024, resulting in over 609,000 deaths. Moreover, the aging population worldwide is expected to contribute to a further increase in the global burden of chronic diseases. These factors indicate the critical need for advanced medical treatments, such as allogeneic cell therapy, to treat chronic diseases and improve patient outcomes.

The COVID-19 pandemic had an unfavorable impact on the allogeneic cell therapy industry, causing a decline in research and development activities. This disrupted various processes, including research, clinical trials, manufacturing, and logistics, ultimately affecting the quality of clinical evidence for cell and gene therapies. As a result, evaluating the treatment benefits and economic impacts of these therapies has become more challenging.

However, the pandemic has also raised awareness about the use of cell therapy as a potential treatment option for COVID-19. This increasing awareness is expected to have a positive impact on the market in the coming years. For instance, in May 2020, Lineage Cell Therapeutics received USD 5 million in emergency funding from the California Institute for Regenerative Medicine (CIRM) to develop a potential vaccine against SARS-CoV-2 using VAC, their allogeneic dendritic cell therapy.

Furthermore, the increasing need for advanced medical treatments for chronic diseases has led to a surge in clinical trials for cell therapies. According to data published by ClinicalTrials.gov, as of April 2021, there were 1,358 active cell therapy trials, representing a 43% increase from 2020 to 2021, compared to a 24% increase from 2019 to 2020. The majority of this growth has been due to CAR-T cell clinical trials, which have increased by 83%.

Moreover, there has been a shift in the focus of clinical trials from autologous to allogeneic cell therapy, with many companies conducting clinical trials on allogeneic cell therapy candidates for various diseases, such as cancer, genetic disorders, and autoimmune diseases. This trend is expected to continue, as there is increasing interest from governments, private organizations, and biotechnology companies in the development of allogeneic cell therapies.

Furthermore, the allogeneic cell therapy industry is expected to grow due to the increasing investments in research and development by governments and private & public organizations. For instance, in November 2024, the California Institute for Regenerative Medicine (CIRM) Board awarded over USD 6 million to Jianhua Yu at the Beckman Research Institute of City of Hope for developing a new approach to target hypoxia metastatic breast tumors with allogeneic off-the-shelf anti-EGFR CAR NK cells. This approach aims to improve the efficacy and safety of cancer therapy.

The market is also supported due to the increasing acceptance of cell therapy products by regulatory bodies. For instance, In January 2023, Sana Biotechnology, Inc. received clearance from the FDA to initiate a first-in-human study of SC291, a CD19-targeted allogeneic CAR T cell therapy, in patients with B-Cell malignancies. Additionally, in August 2024, the EMA approved Charles River to commercially produce and distribute allogeneic cell therapy drug products in Europe. These regulatory approvals indicate the growing acceptance of allogeneic cell therapy products as viable treatment options for patients with chronic diseases.

Based on the therapy type, the stem cell therapies segment dominated the market with the largest share of 77% in 2024. The highest market share of the segment is attributed to the increasing incidence of target diseases that can be treated with such therapies. Allogeneic stem cell therapies are most frequently used to treat chronic diseases like blood cancers, leukemia, and lymphoma as well as specialized blood or autoimmune disorders.

For instance, the Globocan 2020 study states that 19.3 million cancer cases were detected worldwide in 2020, and the majority of those patients received chemotherapy as treatment. Furthermore, it was observed that chemotherapy radiation can harm the patient's stem cells, requiring an allogeneic stem cell transfer. Such factors can boost segment growth in the near future.

The non-stem cell therapies segment is expected to grow at the fastest CAGR of 31.32% by 2034 owing to the exponential growth in the number of CAR-T therapy clinical studies and its higher success rate. Non-stem cell-based allogeneic cell therapies typically involve the isolation of somatic cells from the human body, their propagation, expansion, selection, and administration to patients for therapeutic, preventive, or diagnostic applications. In addition to immune cells like T cells, natural killer (NK) cells, dendritic cells (DCs), and macrophages, non-stem cell-based treatments also use chondrocytes, keratinocytes, fibroblasts, hepatocytes, and pancreatic islet cells. Hence, a wide range of cell types in this segment is likely to boost its growth in the coming years.

The hematological disorders segment accounted for the largest market share of 59.0% in 2024. The use of allogeneic cell therapy in the treatment of hematological disorders is necessary due to the increasing prevalence of leukemia, lymphoma, and myeloma, among others. Additionally, the key market players are implementing several strategic plans to create cutting-edge allogeneic cell therapies for hematological disease treatment.

For instance, in January 2024, Bristol Myers Squibb and Century Therapeutics collaborated in developing iPSC-derived allogeneic treatments for solid tumors and hematologic malignancies. Similarly, the increasing number of FDA approvals and strategic moves by key market participants are contributing to the segment's largest market share.

The dermatological disorders segment is expected to witness a rapid CAGR by 2034 since there is a wide range of cell-based therapies under development for the treatment of dermatological diseases.

The market is also anticipated to experience profitable growth during the forecast period due to rising awareness of allogeneic stem cell-based therapy products that can be used to treat a wide range of dermatological diseases, including atopic dermatitis, autoimmune skin disorders, skin aging, wound healing, scar therapy, and many others.

North America accounted for the largest market share of 81.0% in 2024 owing to the presence of a well-established healthcare system and the increasing prevalence of chronic diseases. The region has a high demand for advanced medical treatments, including cell-based therapies, to manage chronic diseases, leading to significant market growth. Additionally, the region has several biotechnology companies, research institutes, and academic institutions working on developing and testing new allogeneic cell-based therapies.

The Europe region is expected to see a significant growth rate in the market from 2025 to 2034, due to various factors such as the increasing investments and favorable policies implemented by governments toward the adoption of regenerative medicines. Key regulatory approvals in this domain are expected to fuel the market growth for the region. For instance, in December 2020, Ebvallo became the first authorized allogeneic T-cell immunotherapy approved by the European Union and is used for the treatment of relapsed or refractory Epstein‑Barr virus-positive post‑transplant lymphoproliferative disease.

These organizations receive significant funding from both the public and private sectors, enabling them to conduct extensive research and development activities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the allogeneic cell therapy market

By Therapy Type

By Therapeutic Area

By Regional