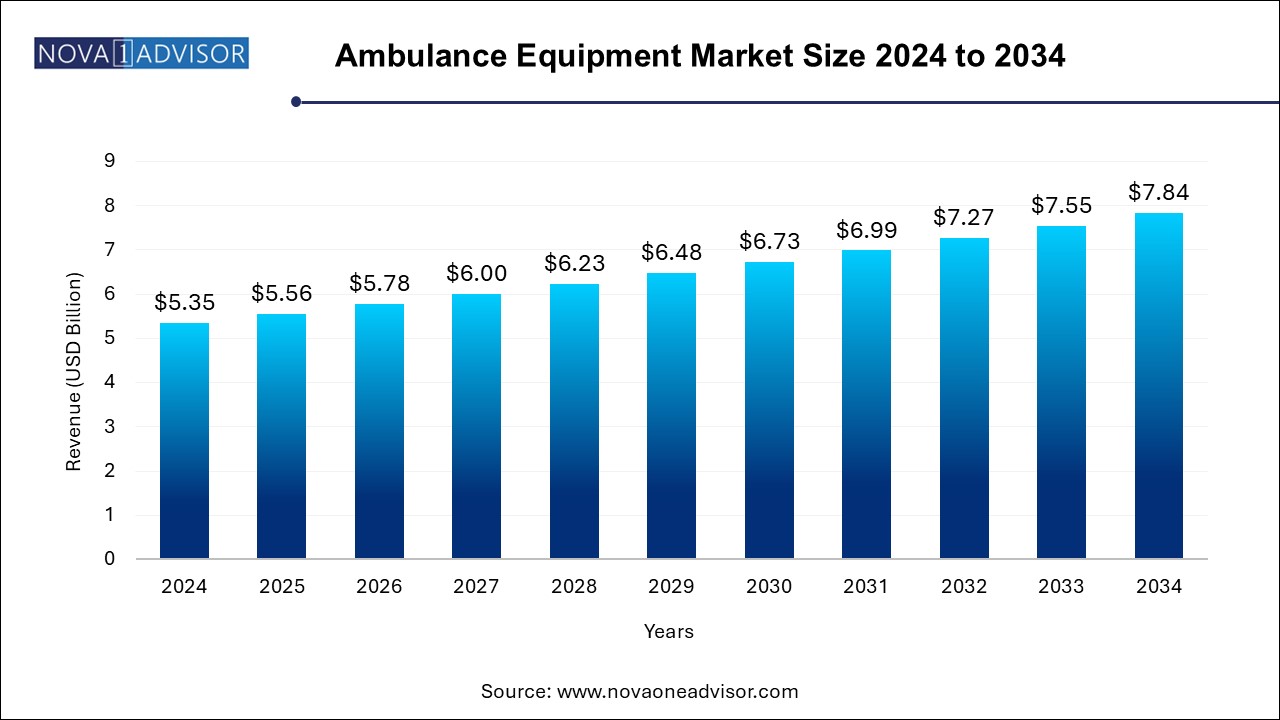

The ambulance equipment market size was exhibited at USD 5.35 billion in 2024 and is projected to hit around USD 7.84 billion by 2034, growing at a CAGR of 3.9% during the forecast period 2024 to 2034.

The Ambulance Equipment Market plays a crucial role in enhancing emergency medical services (EMS), acting as the backbone of pre-hospital care infrastructure. As demand for prompt, safe, and effective transportation of patients continues to grow globally, so too does the market for ambulance-specific medical equipment. This market includes a wide array of tools and devices designed to stabilize patients en route to healthcare facilities, ranging from transportation stretchers and burn kits to advanced life support (ALS) and diagnostic equipment.

The ambulance equipment market is intrinsically tied to the broader public health infrastructure, responding to societal demands stemming from increased urbanization, rising road accidents, growing geriatric populations, and expanding healthcare access in emerging economies. Moreover, the evolution of healthcare delivery—especially with an emphasis on mobile healthcare, trauma care systems, and disaster response—has made ambulances more than just transport vehicles. They have become mobile ICUs equipped with state-of-the-art tools for life-saving interventions.

In 2024, the global ambulance equipment market was valued at USD XX billion, and projections indicate a strong growth trajectory through 2034, supported by government investments in emergency response systems, the proliferation of private ambulance services, and technological advancements in medical equipment miniaturization and integration.

Integration of Telemedicine in Ambulances: Real-time communication between ambulance staff and hospital physicians is becoming commonplace, allowing better care during transit.

Rising Demand for Air and Water Ambulances: Regions with remote geographies and urban congestion are increasingly deploying alternative transportation modes.

Modular and Compact Equipment Design: Emphasis on lightweight, portable, and energy-efficient devices that can operate within space-constrained ambulance interiors.

Adoption of AI and IoT in Emergency Equipment: Predictive analytics, real-time monitoring, and smart devices are being used to enhance EMS precision.

Increased Public and Private Investment: Governments and private entities are focusing on strengthening EMS infrastructure post-COVID-19.

Specialized Pediatric and Geriatric Ambulance Tools: Customized equipment for vulnerable demographics is gaining attention.

Sustainable and Eco-Friendly Equipment: Growing focus on low-emission vehicles and reusable emergency tools to reduce ecological impact.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.56 Billion |

| Market Size by 2034 | USD 7.84 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 3.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Equipment, Transportation Mode, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | 3M; Emergency Medical International; Emergency Medical Products, Inc; First Care Products Ltd; Medtronic PLC; Ambu A/S; Drägerwerk AG & CO. KGaA; Stryker; Allied Healthcare Products, Inc.; BLS Systems Limited. |

One of the most significant drivers for the ambulance equipment market is the alarming rise in road traffic accidents and trauma-related emergencies. According to the World Health Organization (WHO), nearly 1.3 million people die each year from road traffic crashes, and millions more sustain non-fatal injuries, often requiring urgent medical attention. In such scenarios, the 'Golden Hour' becomes critical—the window in which emergency care can significantly reduce mortality and long-term disability.

Ambulances are increasingly being equipped with hemorrhage control kits, immobilization devices, ventilators, and cardiac monitors to address such emergencies effectively. The demand for rapid, high-functioning equipment is particularly intense in countries undergoing rapid motorization without parallel improvements in road safety infrastructure. Moreover, military applications and natural disaster responses also underscore the need for advanced and reliable ambulance equipment.

Despite the promising growth outlook, the market faces constraints in the form of high costs associated with ambulance equipment procurement, maintenance, and staff training. Advanced medical tools such as automated external defibrillators (AEDs), ventilators, and blood analyzers are capital-intensive, making it difficult for smaller service providers and government agencies in developing regions to keep pace.

Further adding to the burden are the costs of regular calibration, servicing, and the need for compatibility with specific ambulance models or national EMS protocols. The economic disparity across regions often translates to inconsistent quality of emergency care, with rural and under-resourced areas relying on outdated or insufficient equipment. Unless there are subsidies or public-private partnerships, the adoption of advanced ambulance equipment may remain limited in price-sensitive markets.

A major opportunity lies in the expansion of EMS systems in emerging markets, especially across Asia Pacific, Latin America, and parts of Africa. As these regions face growing urban populations and lifestyle-related health conditions, the demand for reliable pre-hospital care is surging. Governments are increasingly investing in emergency response fleets, trauma centers, and medical infrastructure, recognizing that improving EMS reduces the overall burden on hospitals and improves patient outcomes.

Initiatives like India’s Ayushman Bharat Health Infrastructure Mission, China’s “Healthy China 2030”, and Brazil’s mobile health units (SAMU) are examples of how developing countries are ramping up their ambulance services. There is ample room for innovation and market entry, especially for local manufacturers that can provide cost-effective, durable, and customized solutions suited for harsh or remote environments.

Transportation equipment dominates the ambulance equipment segment, primarily due to its indispensable role in every type of ambulance, whether it be ground, air, or water-based. Stretcher systems, wheelchairs, evacuation chairs, stair chairs, and immobilization devices are essential for moving patients safely and efficiently, especially in trauma or unconscious states. These components often form the foundation of an ambulance's operational setup and are subject to regular upgrades for ergonomic, safety, and hygiene improvements. Leading manufacturers are also integrating automated and hydraulic functions to ease the task for EMS personnel.

In contrast, diagnostic and infection control equipment is emerging as the fastest-growing category, especially post the COVID-19 pandemic. Portable diagnostic tools such as ECG monitors, blood pressure analyzers, glucometers, and point-of-care devices are now standard in modern ambulances to assess patient vitals immediately. Simultaneously, the inclusion of disinfection systems like UV sterilizers, HEPA filtration units, and antimicrobial surfaces are in high demand. This trend is further supported by the rising cases of communicable diseases and global preparedness for pandemics, making infection control a non-negotiable in ambulance design.

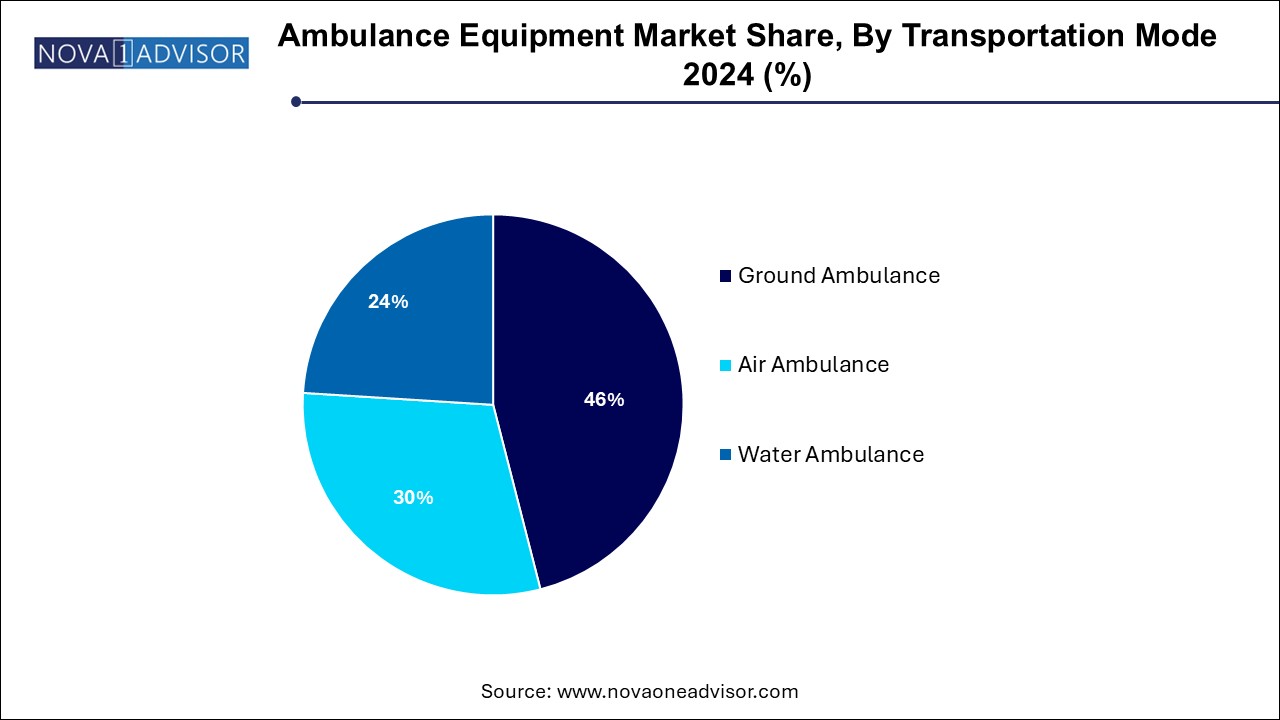

The ground ambulance segment dominated the market with the largest revenue share of 46.0% in 2024, accounting for the largest share due to their ubiquitous presence, cost-effectiveness, and wide application in urban and rural settings. Ground units serve as the primary link between the site of an incident and a medical facility, carrying a full spectrum of equipment from basic first aid to full ICU-grade tools. Fleet expansions, GPS integration, and intelligent dispatch systems have increased their reliability and reach, especially in countries like the U.S., Germany, India, and Japan, where government and private operators coexist.

The air ambulance segment is projected to grow at a CAGR of 4.1% over the forecast period. as critical care during long-distance or inter-hospital transfers becomes essential. These units are equipped with ventilators, infusion pumps, and monitoring systems, essentially functioning as flying ICUs. High-profile cases, such as transporting cardiac or stroke patients from remote areas to tertiary care hospitals, underscore the importance of air ambulances. Rising per capita healthcare expenditure, support from insurance companies, and growth in medical tourism are further driving demand for air-based emergency medical services.

North America stands as the dominant region in the ambulance equipment market, largely due to its mature healthcare infrastructure, comprehensive emergency response systems, and continuous technological innovation. The United States and Canada boast well-established EMS protocols supported by trained paramedics and advanced equipment. Additionally, high healthcare spending, favorable reimbursement scenarios, and stringent regulatory frameworks contribute to the adoption of the latest tools and devices.

The presence of leading industry players such as Stryker, Medtronic, and Zoll Medical Corporation, along with proactive collaborations between private ambulance operators and hospitals, reinforces North America's leadership. Moreover, public initiatives like Federal Emergency Management Agency (FEMA) preparedness grants continue to enhance equipment standards.

Asia Pacific is poised to register the highest CAGR in the ambulance equipment market through 2034. A combination of demographic shifts, healthcare reforms, and economic development is pushing countries like China, India, Indonesia, and Vietnam to invest heavily in EMS infrastructure. Urban congestion, rising motor vehicle accidents, and increased awareness about emergency response are key drivers. Furthermore, collaborations between governments and private ambulance providers are improving equipment availability and response time.

In India, for instance, states like Tamil Nadu and Telangana have implemented 108 emergency services, offering GPS-enabled ambulances equipped with oxygen cylinders, defibrillators, and advanced communication systems. Japan and South Korea are leveraging robotics and AI to develop smart ambulance systems, further advancing regional growth.

February 2025 – Stryker Corporation launched its next-gen Power-PRO XT stretcher with enhanced battery life and ergonomic controls, designed for demanding EMS operations.

January 2025 – Zoll Medical Corporation unveiled its X Series Advanced monitor/defibrillator, optimized for field use with real-time CPR feedback and remote data streaming.

December 2024 – Medline Industries introduced a new line of modular ambulance disinfection systems, including UV-C light integration and compact fogging units, aimed at curbing infection risks in high-volume emergency vehicles.

November 2024 – Air Methods Corporation, a leading U.S.-based air ambulance provider, partnered with Philips Healthcare to incorporate advanced portable ultrasound systems across its fleet.

October 2024 – Ambu A/S, a Denmark-based company, expanded its Asia Pacific footprint by opening a medical device assembly unit in Malaysia focused on disposable diagnostic tools for ambulances.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the ambulance equipment market

Equipment

Transportation Mode

Regional