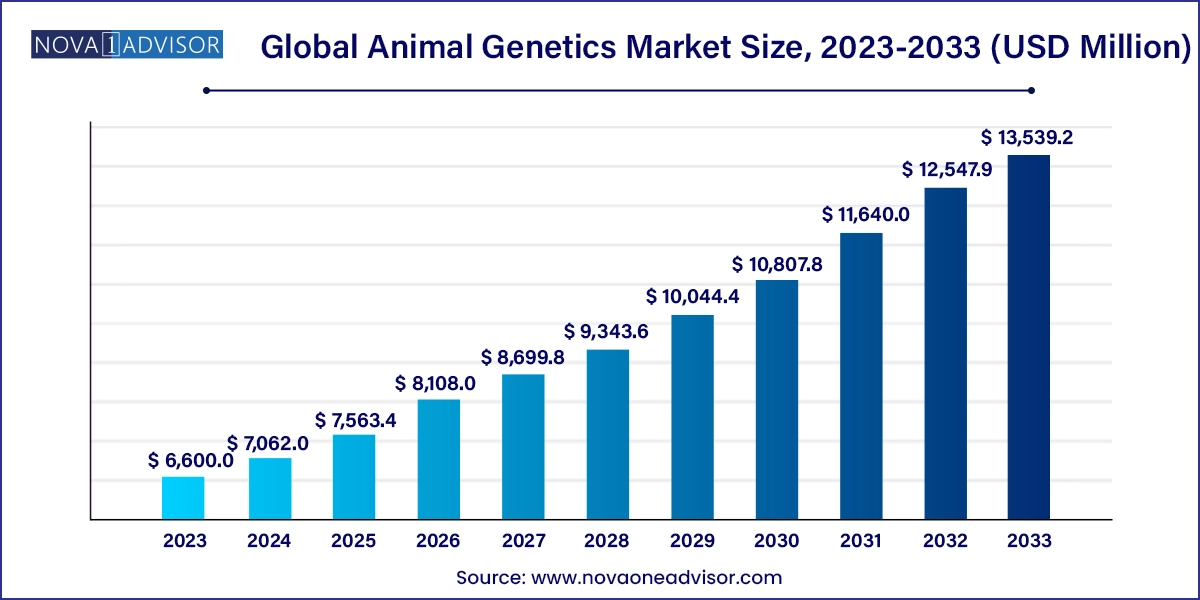

The global animal genetics market size was valued at USD 6,600.0 million in 2023 and is anticipated to reach around USD 13,539.2 million by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

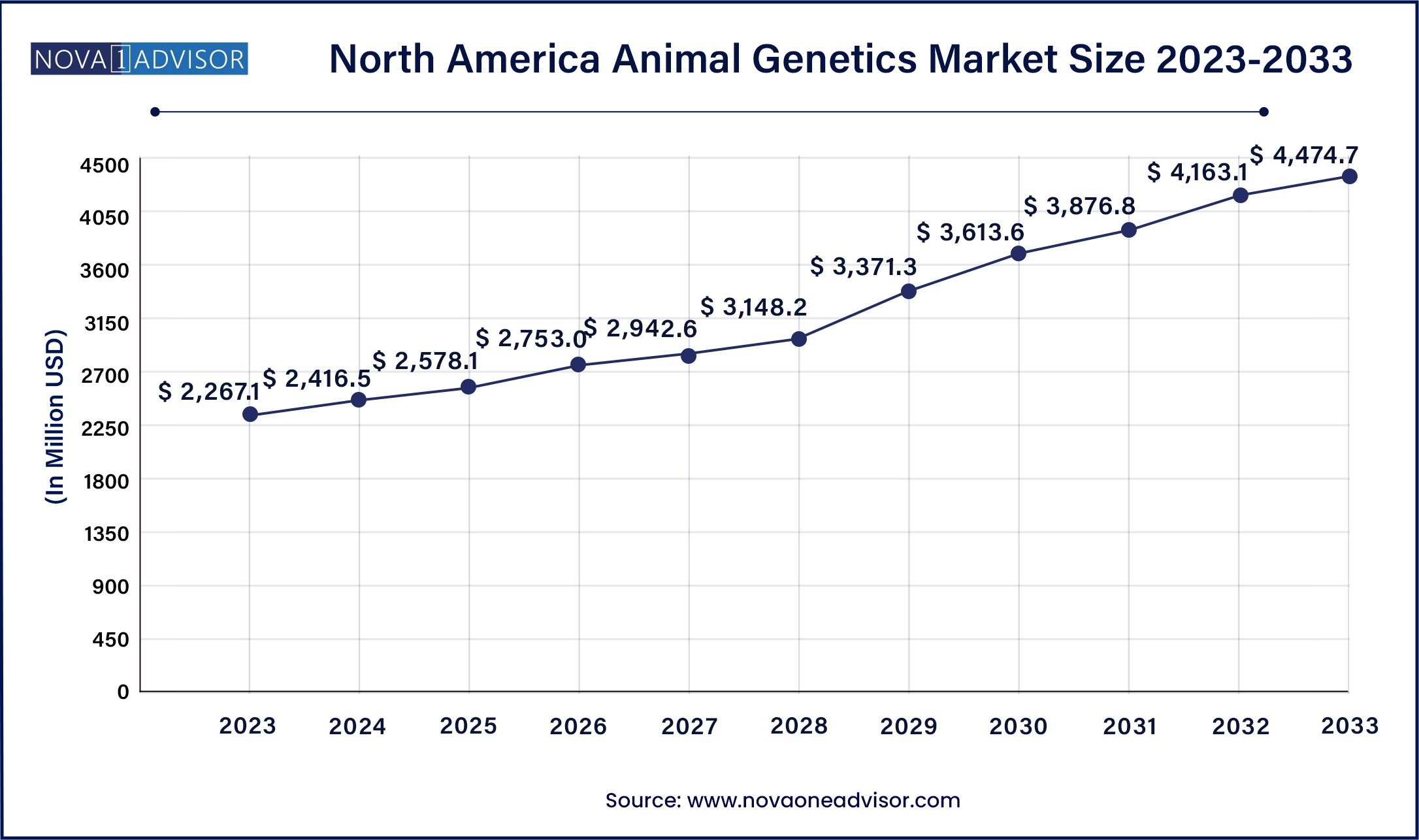

The North america Animal genetics market size was exhibited at USD 2,267.1 million in 2023 and is projected to be worth around USD 4,474.7 million by 2033, poised to grow at a CAGR of 7.1% from 2024 to 2033.

North America leads the global animal genetics market, with the United States at the forefront of innovation, product development, and commercialization. The region boasts a mature livestock industry, advanced R&D capabilities, and a favorable regulatory environment for biotechnology. U.S.-based companies like Zoetis, Neogen, and Genus plc (via its PIC unit) are global leaders in animal genetics products and services. Furthermore, widespread use of genomic selection in cattle breeding, strong veterinary infrastructure, and government support through institutions like USDA reinforce North America’s leadership.

.webp)

In contrast, Asia-Pacific is the fastest-growing region, driven by population growth, rising protein consumption, and evolving animal farming practices. Countries like China and India are aggressively modernizing their livestock sectors to reduce import dependency and improve food security. China, in particular, is investing in large-scale pig and poultry genetics programs following the impact of African Swine Fever. In India, genetic improvement programs for indigenous cattle are gaining traction through partnerships between research institutions and private AI service providers. Additionally, the rapid growth of pet ownership in Southeast Asia is creating demand for companion animal genetic diagnostics and breeding solutions.

The Animal Genetics Market is at the forefront of transforming animal breeding, livestock productivity, and disease resistance strategies across the globe. As the demand for sustainable animal-derived products such as meat, milk, and eggs increases, animal genetics offers a high-precision toolkit to enhance desirable traits, manage disease risks, and optimize reproductive success. This multidisciplinary field incorporates advanced technologies such as genomics, biotechnology, artificial insemination, embryo transfer, and genetic engineering to improve the genetic quality of both domesticated livestock and companion animals.

In modern animal agriculture, where productivity must rise to meet the protein needs of a growing global population, traditional breeding practices are no longer sufficient. Animal genetics allows breeders to make data-driven decisions based on DNA profiling, trait selection, and genomics mapping, thereby accelerating genetic progress and ensuring better outcomes in both productivity and animal welfare. Key commercial species including bovine, porcine, and poultry are the major focus of genetic programs due to their economic significance.

The market encompasses a wide array of product and service segments from live animals and genetic materials (semen and embryos) to genetic testing services that aid in disease control, parentage verification, and trait prediction. Governments, agribusiness companies, and research institutions are investing heavily in animal genetics, not just to increase yields but also to enhance climate resilience, feed efficiency, and disease resistance in animals.

Moreover, animal genetics has implications beyond livestock agriculture. Companion animals, such as dogs and horses, are also benefiting from genetic diagnostics and selective breeding for health, performance, and aesthetics. As a result, the market straddles both commercial farming and pet care ecosystems, making it one of the most dynamic intersections of science, agriculture, and commerce.

Rise of Genomic Selection Tools: High-throughput DNA sequencing and SNP chips are revolutionizing how traits like milk yield, meat quality, and fertility are selected in breeding programs.

Expansion of AI and Machine Learning: Predictive analytics models are being integrated into animal genetics platforms to improve trait forecasting and breeding decision support.

Growing Popularity of Gene Editing (CRISPR): Targeted genome modification in animals, especially cattle and pigs, is gaining traction for traits like disease resistance and hornless dairy cows.

Customized Companion Animal Breeding: Genetic testing for canine diseases, coat color, and behavioral traits is fueling demand among breeders and pet owners.

Focus on Sustainable Breeding: Genetic improvement is increasingly geared toward reducing the environmental footprint of livestock by enhancing feed conversion and methane efficiency.

Integration with Reproductive Technologies: Artificial insemination, in-vitro fertilization (IVF), and embryo transfer are increasingly paired with genetic profiling to increase reproductive success rates.

Government-Backed Genomic Initiatives: Countries such as Australia, Canada, and Brazil are promoting national livestock genomics projects to improve food security and export competitiveness.

| Report Attribute | Details |

| Market Size in 2024 | USD 7,062.0 million |

| Market Size by 2033 | USD 13,539.2 million |

| Growth Rate From 2024 to 2033 | CAGR of 7.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product & Service, By End User, By Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Neogen Neogen Corporation; Genetics Australia; Hendrix Genetics BV; URUS Group LP; CRV; Semex; Swine Genetics International; STgenetics; Animal Genetics Inc.; Generatio GmbH; Zoetis; Genus plc |

A key driver for the animal genetics market is the escalating global demand for high-quality animal protein, including beef, pork, chicken, milk, and eggs. As income levels rise, particularly in emerging economies across Asia and Latin America, dietary patterns are shifting from carbohydrate-based staples to protein-rich animal foods. According to the FAO, global meat consumption is projected to increase by 14% by 2030 compared to 2020 levels.

To meet this demand sustainably, farmers and agribusinesses must produce more output with fewer inputs a goal that animal genetics directly supports. Genetically superior animals exhibit faster growth rates, higher yields, better feed conversion ratios, and greater disease resistance. For instance, the introduction of genomic breeding values (GBVs) in dairy cattle has significantly improved milk production traits while also managing issues like mastitis and infertility. Such precision breeding is a critical pillar in feeding a growing population without overtaxing environmental resources.

Despite its benefits, the animal genetics industry faces ethical and regulatory challenges that can hinder innovation and market adoption. Concerns around genetic modification, especially with newer techniques like CRISPR, have sparked debates on animal welfare, biodiversity, and food safety. In many countries, consumer skepticism and strict regulations delay the approval and commercialization of genetically modified animals.

For example, while the U.S. FDA approved genetically modified salmon for human consumption in 2015, public backlash and retail resistance delayed market entry for years. Similarly, the breeding of gene-edited hornless cattle in the U.S. was met with bioethical scrutiny despite its benefits for animal welfare. Moreover, the global landscape for animal biotechnology regulation is fragmented, with widely varying rules between the U.S., EU, China, and India, making international trade and collaboration complex. This patchwork of governance often slows down R&D and commercialization, especially for startups and emerging market players.

An emerging opportunity lies in the integration of animal genetics with digital livestock farming technologies. As the agriculture industry digitizes, there is a growing need for real-time data on animal health, productivity, and breeding cycles. Genetic data, when combined with sensors, wearables, and AI platforms, can create a comprehensive profile of each animal, enabling predictive management and personalized breeding strategies.

For instance, precision livestock systems can alert farmers when a genetically superior sow is entering her fertile period or when a genetically valuable calf shows signs of health decline. These real-time insights enhance breeding efficiency, minimize losses, and optimize resource use. Companies offering “genetics-as-a-service” bundled with farm management software are tapping into this demand. In markets like Australia and the Netherlands, such systems are already being piloted on large commercial dairy and pig farms, offering a scalable model for future global expansion.

Animal genetic products dominate the market, particularly live animals and genetic materials (semen and embryos). These products are at the core of breeding programs in both commercial farms and specialty breeders. Among live animals, bovine and porcine species hold significant market share due to their widespread consumption and economic value. High-genetic-merit bulls and sows are traded internationally to improve herd productivity and quality across geographies. In India, for example, imported Holstein-Friesian bulls have helped local dairy farmers achieve record milk yields, while in the U.S., superior Duroc and Yorkshire pigs are used in industrial pork operations.

Meanwhile, genetic testing services are the fastest-growing segment, driven by the surge in demand for genomic diagnostics, trait analysis, and disease risk profiling. The segment includes DNA typing, genetic disease tests, and trait-specific evaluations (e.g., marbling in beef cattle or litter size in pigs). Genetic trait testing particularly for bovine and canine species is seeing rapid growth due to its role in selection programs, show dog breeding, and the booming pet genetics industry. With the falling cost of genomic sequencing and the proliferation of easy-to-use test kits, genetic testing is becoming accessible to both large commercial farms and individual animal owners.

Veterinary hospitals and clinics dominate the end-user segment, as they are the primary point of care for animal health, diagnostics, and breeding consultations. These facilities are increasingly offering in-house genetic tests, especially for companion animals, to assess hereditary diseases or determine optimal breeding matches. In addition, reproductive specialists at veterinary clinics often coordinate artificial insemination or embryo transfer services, using genetic profiles to select donor and recipient animals.

However, academic and research institutes are the fastest-growing end users, reflecting the surge in public and private investment in livestock genomics. These institutions conduct foundational research, such as genome mapping of indigenous breeds, discovery of novel traits, and gene-environment interactions. Projects like the 1000 Bull Genomes Project and China’s Pig Genome Initiative are pivotal in building the genetic knowledge base that commercial firms use for product development. Furthermore, universities often partner with agri-tech startups and multinational corporations for joint R&D and pilot programs.

March 2025 – Neogen Corporation launched a new high-throughput genotyping platform for bovine and porcine applications, enabling faster and more cost-effective breeding decisions for commercial farms in North America and Latin America.

January 2025 – Zoetis Inc. announced the global expansion of its Clarifide® Plus genomic testing solution for dairy cattle into India and Southeast Asia, aimed at small and medium-scale dairy cooperatives.

November 2024 – Genus plc’s PIC division began commercial trials of gene-edited pigs in partnership with a Brazilian meat processing company, focusing on resilience to Porcine Reproductive and Respiratory Syndrome (PRRS).

September 2024 – Mars Petcare (Wisdom Panel) launched an AI-enhanced DNA screening service for dogs, capable of predicting breed-specific health risks and behavior traits with over 95% accuracy.

July 2024 – CRV Netherlands introduced a cloud-based herd management system integrated with real-time genetic evaluation tools for dairy farmers in Europe, in collaboration with Wageningen University.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Animal Genetics market.

By Product & Service

By End User

By Region