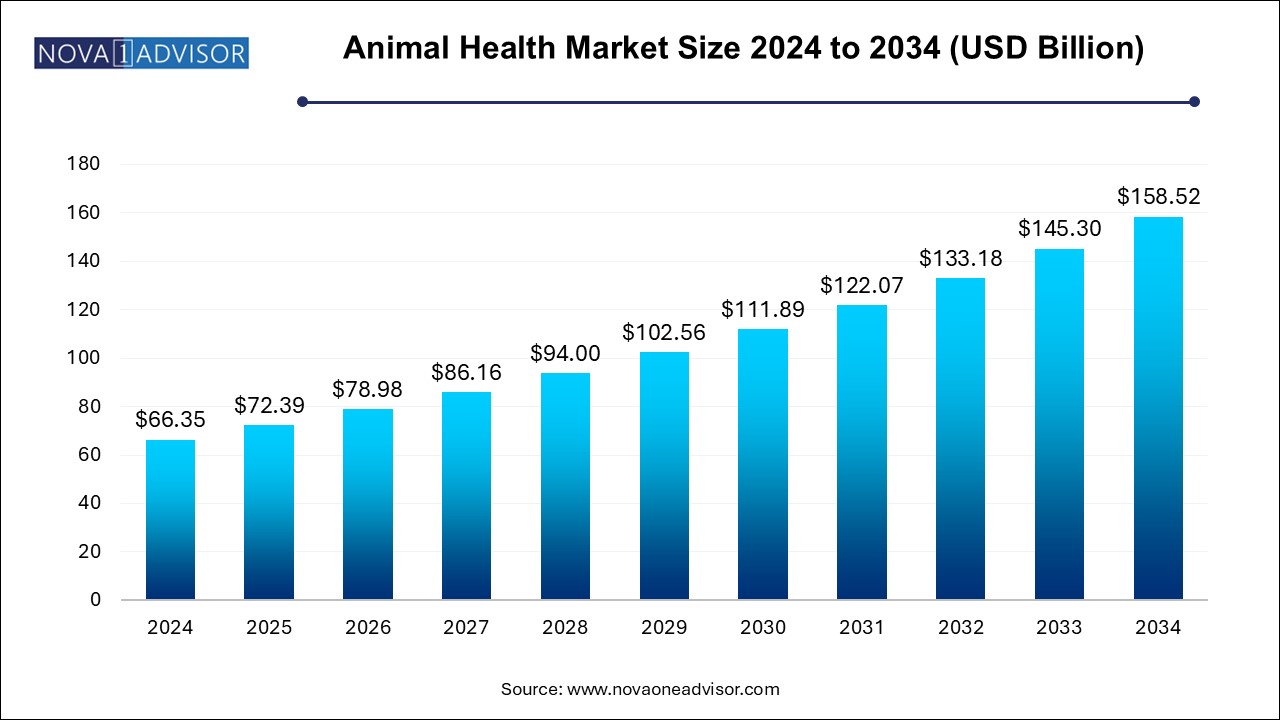

The animal health market size was exhibited at USD 66.35 billion in 2024 and is projected to hit around USD 158.52 billion by 2034, growing at a CAGR of 9.1% during the forecast period 2024 to 2034.

The global animal health market plays a critical role in safeguarding the well-being of animals both livestock (production animals) and pets (companion animals) while directly influencing human health, food safety, and economic stability. This market encompasses a diverse array of products and services including vaccines, pharmaceuticals, diagnostics, feed additives, veterinary devices, and software solutions that support disease prevention, diagnosis, treatment, and management.

With rising concerns around zoonotic diseases, food security, pet humanization, and sustainable livestock management, the animal health industry has expanded rapidly. The market is shaped by veterinarians, animal owners, livestock producers, government regulators, and technology innovators. Advances in biotechnology, diagnostics, telemedicine, and digital livestock monitoring have significantly improved the precision and efficiency of animal healthcare.

Veterinary pharmaceuticals and biologics remain foundational to the industry, but there is a growing focus on preventive health, real-time disease monitoring, and individualized care, especially for pets. Demand for veterinary reference laboratories and in-house diagnostic capabilities has surged, enabling faster, more accurate treatment decisions.

Regulatory agencies such as the USDA, EMA, and FDA’s Center for Veterinary Medicine ensure stringent approval protocols, yet also support innovation through fast-track mechanisms for critical animal health interventions. As global pet adoption rises and meat consumption drives livestock production, the animal health market is forecast to continue its robust growth, supported by innovation, partnerships, and increasing awareness of One Health principles a collaborative approach recognizing the interconnection between people, animals, and their shared environment.

Rise of Pet Humanization: Increased emotional bonding with pets has spurred demand for premium healthcare products and personalized veterinary services.

Technological Integration in Livestock Management: Precision farming tools, livestock wearables, and remote monitoring systems are being adopted for disease tracking and productivity optimization.

Veterinary Telemedicine Expansion: Digital consultations, remote diagnostics, and AI-driven triage tools are transforming veterinary care delivery, especially in underserved rural areas.

Increased Investment in Companion Animal Diagnostics: Rapid tests, imaging, and in-house lab systems are seeing high uptake in vet clinics and hospitals.

Zoonotic Disease Preparedness: COVID-19, avian flu, and African swine fever outbreaks have heightened focus on veterinary surveillance and emergency response protocols.

Customized Vaccines and Biologics: New advances are enabling personalized vaccines and immunotherapies for animals, tailored to regional pathogen profiles.

E-commerce and Direct-to-Consumer Channels: Online platforms are disrupting traditional distribution by offering pet medications, supplements, and diagnostic kits with doorstep delivery.

Global Regulatory Harmonization: Cross-border collaboration is simplifying veterinary drug approvals, particularly in vaccine distribution for transboundary animal diseases.

| Report Coverage | Details |

| Market Size in 2025 | USD 72.39 Billion |

| Market Size by 2034 | USD 158.52 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 9.1% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Distribution Channel, Animal Type, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc. |

Pharmaceuticals are the leading product category, comprising antiparasitics, anti-infectives, anti-inflammatories, and analgesics. These are widely used in both livestock and pets to treat common conditions such as gastrointestinal worms, respiratory infections, mastitis, and skin disorders. The ease of administration via injections, oral suspensions, and topical solutions makes pharmaceuticals a staple in veterinary practices worldwide.

Diagnostics are the fastest-growing product category, reflecting the increased focus on early disease detection, surveillance, and personalized treatment planning. Veterinary hospitals and clinics are adopting rapid test kits, point-of-care analyzers, and imaging tools for accurate diagnosis. Innovations such as PCR-based pathogen detection, AI-assisted imaging, and multiplex test panels are transforming animal disease management. Rising pet health awareness and livestock biosecurity regulations are further boosting diagnostic demand.

Production animals dominate the global animal health market, driven by the need to ensure herd health, meat quality, and compliance with food safety regulations. Cattle, swine, poultry, and aquaculture are key contributors, especially in emerging economies where animal protein consumption is rising. Diseases like foot-and-mouth disease (FMD), bovine respiratory disease (BRD), avian influenza, and parasitic infestations necessitate regular vaccination, deworming, and diagnostics. The intensification of livestock farming has further elevated the importance of biosecurity and preventive care.

Companion animals are the fastest-growing segment, owing to increasing pet ownership, urbanization, and higher disposable incomes. Dogs and cats are the primary contributors, with owners willing to invest in premium healthcare, grooming, nutritional supplements, and insurance. Conditions such as arthritis, obesity, cancer, and dental diseases are commonly treated in pets, requiring both prescription drugs and diagnostics. The rise in equine sports and therapy animals has also expanded veterinary services for horses in specific regions.

Hospital/clinic pharmacies dominate the distribution landscape, particularly due to regulatory norms that restrict access to certain drugs without veterinary prescriptions. These pharmacies are integrated with private vet practices, pet hospitals, and livestock health centers, offering both medications and advice under professional supervision.

E-commerce is the fastest-growing channel, fueled by the convenience of home delivery, subscription models, and increasing digital literacy among pet owners. Online platforms such as Chewy, Amazon, and PetMed Express offer over-the-counter products like supplements, grooming items, and even prescription drugs with proper verification. The COVID-19 pandemic further accelerated e-commerce adoption in animal health.

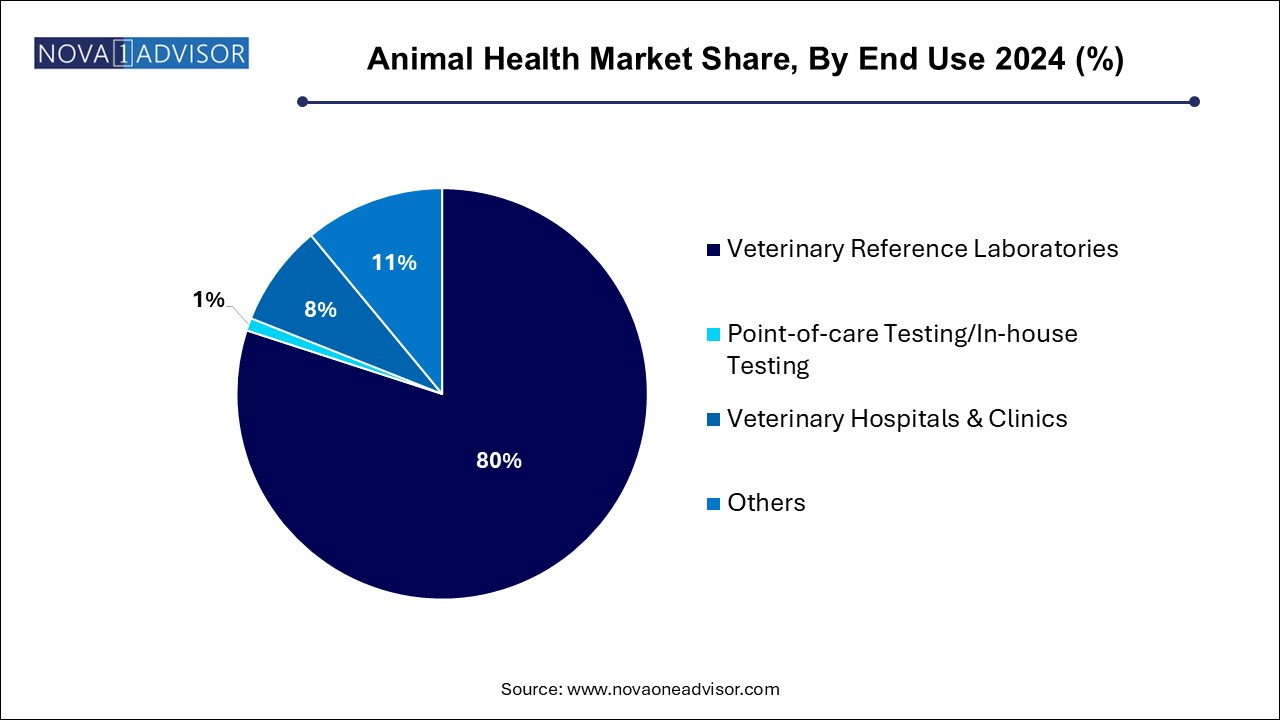

Veterinary hospitals and clinics are the primary end-users, providing comprehensive services including diagnostics, surgery, vaccination, and chronic care management. These facilities are expanding globally, supported by government and private investment in veterinary infrastructure. Advanced clinics now offer oncology, cardiology, orthopedics, and dental specialties for pets.

Point-of-care testing and in-house diagnostics are growing rapidly, allowing veterinarians to make faster decisions and improve patient outcomes. These setups reduce the need for external lab submissions and are increasingly adopted in mobile vet practices and small clinics.

North America holds the largest share of the global animal health market, driven by high veterinary healthcare standards, widespread pet ownership, and a mature livestock industry. The United States leads the region with advanced veterinary pharmaceutical companies, top-tier animal diagnostics players, and extensive regulatory oversight by the FDA Center for Veterinary Medicine (CVM).

Pet insurance penetration is rising in Canada and the U.S., enabling higher spending on chronic and specialty care. Livestock productivity is supported by well-established disease control programs, diagnostic networks, and feed safety regulations. Key players like Zoetis, Elanco, and IDEXX have a strong regional presence, supported by veterinary schools, research institutions, and a large base of professional veterinarians.

Asia-Pacific is the fastest-growing animal health market, owing to rising pet adoption, expanding middle-class incomes, and government focus on food safety and livestock productivity. Countries like India, China, Japan, South Korea, and Australia are investing in livestock vaccination programs, disease surveillance, and veterinary infrastructure.

China has made animal health a national priority under its agricultural modernization drive, while India’s NDDB and Ministry of Fisheries, Animal Husbandry & Dairying support mass deworming and vaccination initiatives. Companion animal care is booming in urban centers, where pet owners seek specialized grooming, diagnostics, and nutrition products. International companies are also forming joint ventures with local firms to tap into this high-potential market.

April 2025: Zoetis launched Librela™, a monoclonal antibody therapy for canine osteoarthritis in the U.S., marking a major expansion in chronic pain management for dogs.

January 2025: IDEXX Laboratories announced a new line of AI-powered diagnostic tools to enhance real-time pathogen detection and lab imaging accuracy.

December 2024: Merck Animal Health acquired a controlling stake in Vence, a virtual fencing and livestock tracking company, expanding its digital animal management portfolio.

October 2024: Boehringer Ingelheim inaugurated a new vaccine production facility in France to increase output of poultry and swine vaccines for European and Asian markets.

August 2024: Elanco Animal Health entered into a partnership with an Indian pharmaceutical firm to co-develop affordable veterinary antibiotics for rural livestock owners.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the animal health market

Animal Type

Product

Distribution Channel

End-use

Regional