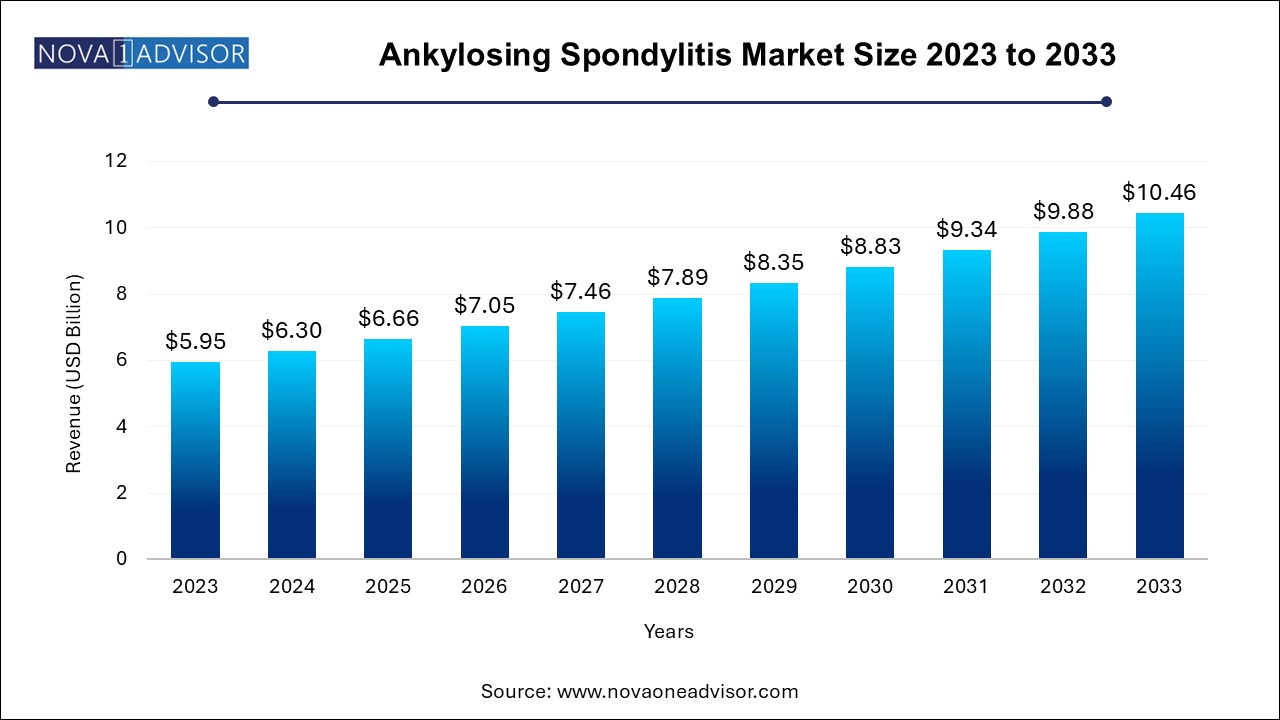

The global ankylosing spondylitis market size was exhibited at USD 5.95 billion in 2023 and is projected to hit around USD 10.46 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.95 Billion |

| Market Size by 2033 | USD 10.46 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Drug class, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | AbbiVie, Inc; Amgen, Inc; Pfizer, Inc; UCB, Inc.; Novartis AG; Eli Lilly and Company; Johnson and Johnson Services, Inc; Merck and Co., Inc; Izana Biosciences; Zydus Lifescience ltd.; |

Ankylosing spondylitis market is projected for continued growth, driven by continuing research development, the introduction of new therapies, and increasing global awareness. Strategic collaborations between pharmaceutical companies and healthcare providers are expected to boost treatment accessibility and improve patient outcomes.

TCAhe market is expanding, with significant opportunities for growth driven by advancements in medical research and increased global healthcare investment. In addition, rising prevalence, improved diagnostics, and advanced treatment options are contributing to the market’s growth. Key drivers of the market include improved diagnostic techniques that have led to earlier and more accurate detection, facilitating timely intervention and better patient outcomes. Addressing challenges such as treatment costs and access to healthcare is expected to be crucial for sustained market development.

The TNF (Tumor Necrosis Factor) segment dominated the market and accounted for a revenue share of 59.4% in 2023. TNF inhibitors, which target tumor necrosis factors to manage autoimmune conditions such as rheumatoid arthritis, are anticipated to experience significant growth. This growth is driven by an increase in autoimmune disease diagnoses and advancements in biological therapies. Overall, TNF-dominated factors, including introducing new TNF inhibitors, are expected to play a crucial role in shaping the market dynamics.

The Non-steroidal Anti-Inflammatory Drug (NSAID) market is expected to grow at a CAGR of 8.8% over the forecast years. This growth is driven by several key factors, including the increasing prevalence of chronic pain and inflammatory diseases such as arthritis and osteoarthritis, which require effective pain management solutions.

TNF Inhibitors are further categorized into various subsegments based on types, including Humira, Simponi, Remicade, Enbrel, and Cimzia. Humira is a leading TNF inhibitor, accounting for the largest market revenue share of 26.9% in 2023. This growth is attributed to its ability to relieve patients with severe symptoms, significantly improving their quality of life. In addition, Humira works by blocking the activity of TNF, a substance in the body that causes inflammation and leads to immune system diseases. Its extensive use and effectiveness have made it the top-selling drug globally, with sales reaching billions of dollars annually.

The hospital pharmacy led the market and accounted for the largest revenue share of 48.3% in 2023. This growth is attributed to a more extensive stock of medications, including more specialized and investigational medicines for treating ankylosing spondylitis. In addition, the rising incidence rate of the condition and the rise in the number of in-patients and out-patients led to hospitalization, which resulted in the growth of the hospital pharmacy segment. One of the essential aspects that drive the dominance of hospital pharmacies is that specialized healthcare providers need to administer and monitor the effects of TNF inhibitors, such as infusion therapies, making hospitals the preferred setting for these treatments.

Retail pharmacies are expected to grow at a CAGR of 8.0% over the forecast period, owing to their increasing accessibility and convenience. Patients can obtain their medications more efficiently, with extended hours of operation and widespread locations reducing the need for frequent hospital visits. The expanding availability of biosimilars in retail pharmacies also contributes to the growth of this distribution channel.

The North America ankylosing spondylitis market accounted for the largest revenue share of 57.9% in 2023. This growth is attributed to the availability of advanced diagnostic tools and high healthcare expenditures in North America. Furthermore, major pharmaceutical companies in the region have played a significant role in driving market expansion.

U.S. Ankylosing Spondylitis Market Trends

The U.S. ankylosing spondylitis market dominated the North American market with a share of 91.2% in 2023, owing to its higher prevalence and increasing incidence. The U.S. has a large population of patients diagnosed with ankylosing spondylitis, necessitating a rapid market for effective treatments. The country's advanced healthcare system ensures that patients have access to the latest therapies and specialized care, contributing to its dominance in the market.

Canada ankylosing spondylitis market is experiencing exponential growth and is expected to grow at a CAGR of 8.7% over the forecast period. This growth is driven by increased disease awareness, improved diagnostic capabilities, and enhanced access to advanced treatments. In addition, Canada’s healthcare system supports the widespread availability and accessibility of advanced therapies, including biologics and TNF inhibitors. These treatments have shown significant efficacy in managing ankylosing spondylitis symptoms and slowing disease progression, thereby boosting the market’s growth.

EuropeAnkylosing Spondylitis Market Trends

The ankylosing spondylitis market in Europe registered a significant revenue share in 2023, owing to the advancements in medical research and the development of novel therapeutic options, such as biologics and biosimilars, which have expanded treatment options and improved patient outcomes. In addition, the increasing prevalence of ankylosing spondylitis, driven by factors such as genetic predisposition and aging populations, is further fueling market growth.

Germany ankylosing spondylitis market holds a dominant position in Europe, driven by its advanced healthcare system and substantial research and development investments. The country has a high prevalence of ankylosing spondylitis and a well-established healthcare infrastructure, ensuring that patients have access to the latest treatments. In addition, Germany's solid pharmaceutical industry and focus on innovative therapies contribute to its leading market position.

The ankylosing spondylitis market in Spain is witnessing rapid growth over the projected years. Key growth drivers include increased awareness and diagnosis of ankylosing spondylitis, improved access to advanced treatments, and government initiatives to develop healthcare services. Spain’s effort to integrate advanced biologics and TNF inhibitors into its healthcare system improves patient outcomes and drives market growth.

Asia Pacific Ankylosing Spondylitis Market Trends

The Asia Pacific ankylosing spondylitis market is anticipated to grow at a CAGR of 8.7% over the forecast period. The region is experiencing growth due to rising awareness of the disease and increased healthcare expenditures.

The ankylosing spondylitis market in Chinaled the Asia Pacific region and accounted for the largest revenue share in 2023. This growth is attributed to its large patient population and increasing healthcare investments. In addition, the growing prevalence of ankylosing spondylitis and the expansion of healthcare infrastructure have facilitated greater access to advanced treatments, thereby driving the market’s growth in China.

India ankylosing spondylitis market is experiencing rapid growth due to rising awareness of the disease, improved diagnostic capabilities, and enhanced healthcare access. In addition, the Indian government’s initiatives to improve healthcare services and increased investment in the pharmaceutical sector are also contributing to this growth. Furthermore, cost-effective biologics and other advanced treatments make these therapies more accessible to the broader population.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ankylosing spondylitis market

Drug Class

Distribution Channel

Regional