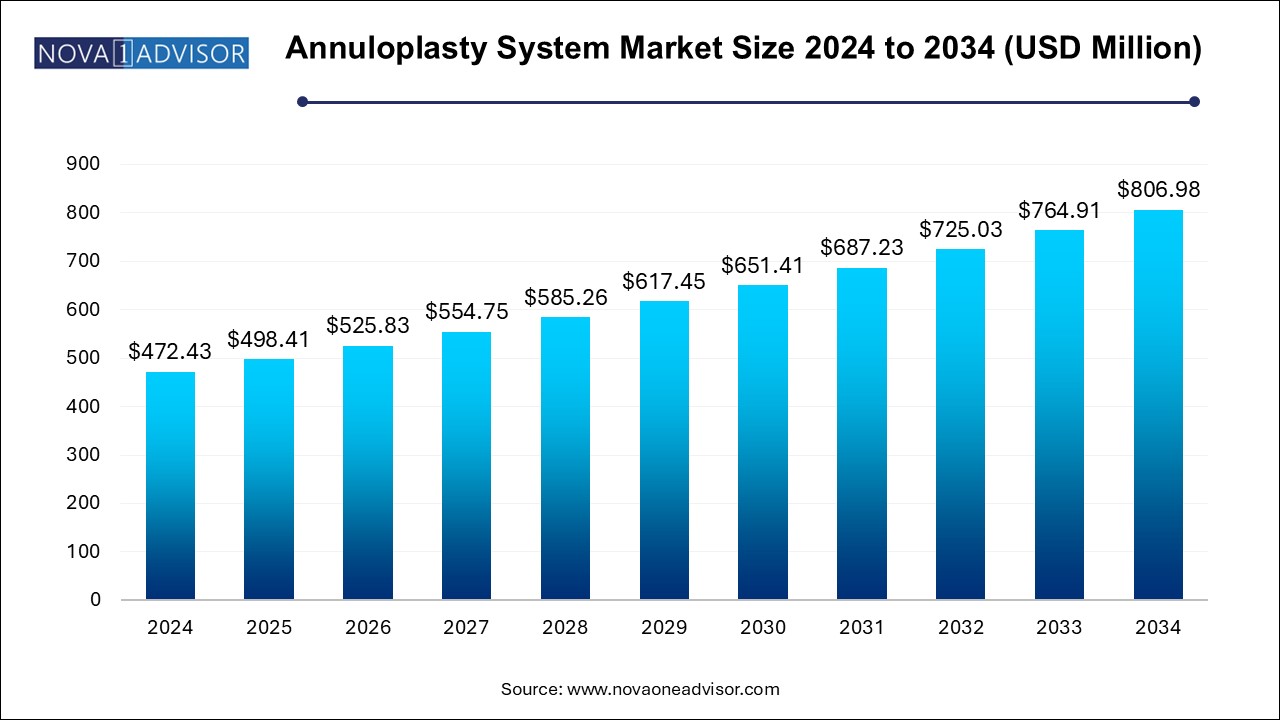

The annuloplasty system market size was exhibited at USD 472.43 million in 2024 and is projected to hit around USD 806.98 million by 2034, growing at a CAGR of 5.5% during the forecast period 2025 to 2034.

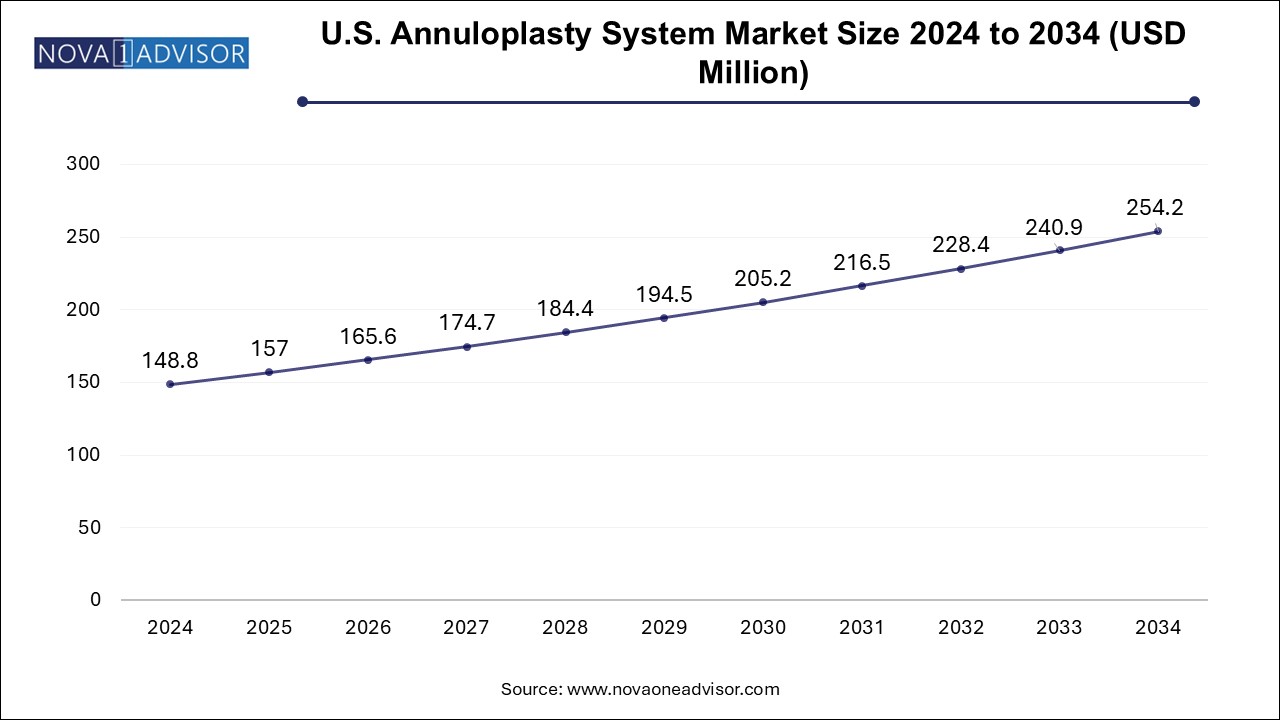

The U.S. annuloplasty system market size is evaluated at USD 148.8 million in 2024 and is projected to be worth around USD 254.2 million by 2034, growing at a CAGR of 4.98% from 2025 to 2034.

North America annuloplasty system market dominated globally, accounting for a 41.1% revenue share in 2024. This growth can be attributed to the region’s developed healthcare infrastructure, growing CVD incidence, accessibility to advanced annuloplasty products, and a higher prevalence of heart valve diseases. According to an American Heart Association article published in January 2024, CVD is a leading cause of mortality in the U.S., with approximately 2,552 deaths occurring daily due to related complications, based on 2021 data. This staggering number highlights the critical need for effective treatments, particularly in addressing heart valve conditions that often arise from CVD. Heart valve disorders continue to contribute to the growing burden of cardiovascular diseases, and the demand for innovative solutions such as annuloplasty systems is increasing. These systems play a vital role in repairing damaged heart valves, offering patients a chance at improved health outcomes and contributing to the overall effort to reduce cardiovascular-related mortality.

U.S. Annuloplasty System Market Trends

The annuloplasty market in the U.S. is expected to grow significantly over the forecast period. The increasing incidence of heart disease and rising awareness and technological advancements drive the market's growth. According to the CDC article published in October 2024, in the U.S., heart defects affect nearly 1% of all newborns, equating to about 40,000 births annually. While some types of heart defects, particularly mild forms, are becoming more prevalent, others have remained stable in terms of occurrence. Among these, the most common is the ventricular septal defect (VSD), which often requires surgical intervention. Heart defects, including those impacting the heart valves, continue to present a significant health challenge, and the demand for effective treatment options, such as annuloplasty systems, is rising. These systems offer a promising solution for repairing damaged heart valves, addressing a key component of cardiovascular care, and supporting the growing need for specialized procedures in managing congenital heart conditions.

Europe Annuloplasty System Market Trends

Europe's annuloplasty system market held the second-largest revenue market share in 2024. The high mortality rate of CVDs is boosting the demand for annuloplasty systems in Europe. According to a WHO article published in May 2024, CVDs remain the leading cause of premature death and disability in Europe, responsible for over 42.5% of all annual fatalities, equating to approximately 10,000 deaths each day. The high prevalence of CVDs in the region underscores the urgent need for advanced treatment solutions, particularly for complex heart conditions such as valve dysfunction and structural heart issues. As CVDs continue to strain healthcare systems, there is an increasing demand for effective treatments, including those targeting heart valve repair, such as annuloplasty systems. These advanced solutions are essential for improving patient outcomes, especially in cases involving more intricate procedures and higher complication risks. The rising burden of CVDs drives the development of innovative annuloplasty techniques and tools, positioning these systems as a critical component of cardiovascular care across Europe.

Germany's annuloplasty system market dominated the European region, with the highest revenue share of 25.2% in 2024. The increasing number of coronary heart disease (CHD) and technological advancements fuel the market's growth. According to the Springer article published in March 2024, Germany, with 11,314 deaths attributed to coronary heart disease (CHD), faces a significant challenge from cardiovascular diseases (CVDs). This high mortality rate highlights the pressing need for innovative treatment solutions, particularly for complex conditions like valve dysfunction and structural heart issues. The rising incidence of CHD further underscores the importance of improving patient outcomes through innovative and effective cardiovascular interventions. The growing prevalence of heart valve-related conditions in Germany drives an increased demand for advanced annuloplasty systems and associated technologies. This rising need is anticipated to fuel the growth of the country's annuloplasty system industry, focusing on improving the management of cardiovascular diseases (CVDs) and enhancing patient outcomes.

The UK's annuloplasty system market held the second-largest market share in 2024. Rising CVD deaths and technological advancements drive the market's growth. According to a Guardian News & Media Limited article published in January 2024, in the UK, the premature death rate due to cardiovascular diseases (CVDs) increased to 80 per 100,000 individuals in 2022, showing a rise from 83 per 100,000 in 2011. This growing mortality rate underscores the pressing need for advanced treatment options, particularly in managing complex heart valve conditions. CVD continues to impact a significant portion of the population, and the demand for innovative solutions, including annuloplasty systems, is expected to rise. This trend drives the expansion of the annuloplasty system industry in the UK as healthcare providers seek to improve patient outcomes and reduce the burden of cardiovascular diseases.

The France annuloplasty system market is anticipated to witness a significant CAGR during the forecast period. The increasing number of CVD cases and technological advancements drive the market's growth. According to the Elsevier B.V. article published in November 2024, cardiovascular disease (CVD) affects nearly 3 million adults, highlighting the substantial prevalence of heart-related conditions. The growing incidence of CVD emphasizes the increasing demand for advanced medical solutions, particularly for complex heart valve issues. With a significant portion of the population affected by heart diseases, including valve dysfunctions, there is a rising need for innovative treatments such as annuloplasty systems. These systems play a crucial role in addressing conditions like mitral and tricuspid valve dysfunction, supporting the growth of the annuloplasty market as healthcare providers focus on improving patient outcomes and providing effective therapies for CVD-related complications.

Asia Pacific Annuloplasty System Market Trends

The Asia Pacific annuloplasty system market is expected to grow at the fastest CAGR over the forecast period due to the rising number of cardiovascular diseases, rising geriatric population and increasing R&D activities. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, the APAC region, with about 697 million individuals aged 60 and above, accounts for around 60% of the global elderly population. The growing prevalence of cardiovascular issues among older people is pushing the need for advanced medical solutions, such as annuloplasty systems, leading to an expansion of the market in the region. Healthcare providers are focusing on addressing the unique needs of this demographic, contributing to the rising demand for effective annuloplasty treatments.

China annuloplasty system market accounted for the second-largest share in the Asia Pacific region in 2024. The increasing number of surgeries and rising CHD cases drive the market's growth. According to the Chinese Medical Association article published in April 2024, In China, coronary heart disease (CHD) affects around 2 million individuals, with 150,000 new cases diagnosed each year. CHD is a leading cause of mortality among individuals with congenital disabilities, accounting for nearly 40% of deaths in those under 20. The high prevalence of CHD underscores the urgent need for advanced treatment solutions for complex cardiovascular conditions. The increasing incidence of cardiovascular diseases, the annuloplasty systems market in China is expected to grow, fueled by innovations to improve clinical outcomes and address the country's healthcare needs.

The Japan annuloplasty system market held the largest market share in 2024 in the Asia Pacific region. The increased number of CVD procedures and rising CHD cases drive the market's growth. According to the NCBI article published in February 2024, In Japan, the 63,054 cardiovascular surgeries performed annually highlight the rising prevalence of cardiovascular diseases and the increasing need for specialized treatment options. The rise in surgical procedures is anticipated to drive the growth of the annuloplasty system market in Japan, as the focus shifts toward innovative interventions designed to improve patient outcomes and enhance the success and efficiency of cardiovascular surgeries.

The India annuloplasty system market is experiencing significant growth. Increasing healthcare expenditures, government initiatives, and rising CHD cases drive the market's growth. According to the Apollo Hospital article published in September 2024, in India, an estimated 150,000 to 200,000 children are born annually with congenital heart disease, underscoring the increasing demand for advanced cardiac care solutions. The growing prevalence of heart conditions, including structural abnormalities such as valve dysfunction, has amplified the need for effective surgical and interventional treatments. With the rising incidence of congenital and acquired heart diseases, the demand for annuloplasty systems is expected to surge as healthcare providers adopt innovative approaches to enhance patient outcomes. The complexity of heart valve repair and the focus on improving procedural success rates are anticipated to drive the growth of the annuloplasty system industry in India.

Latin America Annuloplasty System Market Trends

The Latin America annuloplasty system market is growing owing to the rising incidence of CHD and a strategic initiative by key players and organizations to drive market growth. According to the American College of Cardiology Foundation article published in September 2024, congenital heart disease is notably more prevalent in Latin America and the Caribbean, with incidence rates approximately 60% higher than cancer. Affecting an estimated eight to 13 out of every 1,000 births, this condition underscores the critical need for advanced cardiovascular care across the region. The high prevalence of congenital and acquired heart diseases has fueled the demand for effective surgical interventions, particularly for addressing valve-related disorders. As healthcare providers increasingly seek innovative solutions to manage complex valve repairs, the annuloplasty system market in Latin America is poised for growth. This expansion is driven by the rising focus on improving procedural outcomes and the adoption of cutting-edge technologies to enhance the quality of care for patients with heart valve conditions.

Brazil's annuloplasty system market is expanding due to growing CVD incidences, and government initiatives favorable to the growth of the market. For instance, in September 2023, the Brazilian government and healthcare institutions are making concerted efforts to enhance cardiovascular care and improve patient outcomes. Collaborative initiatives, such as the partnership between Mount Sinai and the Brazilian Clinical Research Institute, are advancing research and medical education in cardiovascular diseases. These measures underscore the growing need for state-of-the-art treatment options in the country. Brazil faces an increasing prevalence of cardiovascular conditions, including heart valve disorders, and the demand for innovative surgical solutions is rising. This trend is expected to drive the growth of the annuloplasty system market in Brazil, fueled by a focus on advanced technologies to address valve repair complexities and deliver improved outcomes for patients with heart valve diseases.

MEA Annuloplasty System Market Trends

The MEA annuloplasty system market is expected to grow lucratively due to the increasing incidence of CVD diseases, rising CHD incidence, and the growing use of advanced medical technologies in the region. According to the Frontiers Media S.A. article published in 2024, in the (MEA) region, congenital heart disease (CHD) affects approximately 1% of live births, leading to an estimated 1.5 million new cases annually. Unique challenges, such as high consanguinity rates and disparities in healthcare access, add complexity to diagnozing and treating cardiovascular conditions. With the rising prevalence of heart diseases, including structural abnormalities like valve disorders, the demand for advanced treatment options is increasing. This growing need is driving the expansion of the annuloplasty system industry across the MEA region as healthcare providers adopt innovative solutions to address complex valve repair cases and improve patient outcomes in cardiovascular care.

Saudi Arabia's annuloplasty system market is anticipated to grow at a CAGR of 5.3% over the forecast period. The rising number of surgeries and increasing incidence of CVD cases drive the market's growth. According to the article published by BMC Cardiovascular Diseases in March 2024, 1.6% of individuals aged 15 and older in Saudi Arabia were affected by cardiovascular diseases (CVD) in 2024, including heart conditions and related disorders. This prevalence underscores the increasing demand for advanced healthcare solutions, particularly for managing structural heart conditions such as valve disorders. The rising burden of cardiovascular diseases highlights the critical need for advanced annuloplasty systems, driving growth in the market as healthcare providers in Saudi Arabia prioritize advanced technologies to enhance treatment outcomes and address the complexities of heart valve repair.

| Report Coverage | Details |

| Market Size in 2025 | USD 498.41 Million |

| Market Size by 2034 | USD 806.98 Million |

| Growth Rate From 2025 to 2034 | CAGR of 5.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic; Abbott; Edwards Lifesciences Corporation; Corcym; Labcor Laboratories Ltda; AFFLUENT MEDICAL; Valcare Medical; Braile Biomédica; Micro Interventional Devices, Incorporated |

The mitral valve repair segment held the largest market share of 61.5% in 2024. This can be attributed to advanced annuloplasty systems, which improve patient outcomes in mitral valve repair surgeries. According to the NCBI article published in May 2024, there has been successful adoption of robot-assisted mitral valve repair in Japan, where universal health coverage has facilitated broad access to these advanced treatments. Analysis of 2,443 patients from 250 institutions in the Japan Cardiovascular Surgery Database showed that robot-assisted mitral valve repair resulted in shorter operation times and reduced cardiopulmonary bypass and aortic cross-clamp times. The robot-assisted repair significantly shortened operation times compared to traditional small right thoracotomy. While ICU stay was slightly extended, discharge time was notably faster for robot-assisted procedures. Robot-assisted mitral valve repair, with its reduced complications and faster recovery, is increasing the demand for minimally invasive annuloplasty solutions. Hospitals performing higher volumes of these procedures report improved outcomes, driving the growth of advanced annuloplasty systems, particularly in regions embracing these innovative approaches.

The tricuspid valve repair segment is anticipated to grow at the fastest CAGR over the forecast period. Increasing CVD incidence and technological advancements drive the growth of the segment. For instance, in April 2024, Abbott revealed that the U.S. Food and Drug Administration (FDA) has approved its innovative TriClip transcatheter edge-to-edge repair (TEER) system, designed specifically to treat tricuspid regurgitation (TR), commonly known as a leaky tricuspid valve. This approval comes after the Circulatory System Devices Panel of the FDA’s Medical Devices Advisory Committee voted 13 to 1, with no abstentions, confirming that the benefits of the TriClip system outweigh the associated risks.

The hospital segment held the largest market share of 60.0% in 2024. This can be attributed to the hospitals' comprehensive surgical facilities and post-surgical care. The patients undergoing annuloplasty procedures can require close post-operative monitoring and care. Moreover, several hospitals are increasing their service offerings by establishing cardiovascular facilities that treat heart-associated conditions. This is further anticipated to increase the number of annuloplasty procedures performed in the hospitals, thereby driving the segment growth. For instance, in April 2024, McCarthy announced the establishment of a new cardiovascular care facility at Emory University Hospital (EUH) in Atlanta, U.S. The expansion aims to enhance and expand operations for the growing heart and vascular patient population.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing presence of patients towards cost-effective treatments, growing demand for outpatient procedures, and better convenience. Ambulatory surgical centers eliminate unnecessary services such as patient stays and overheads, which decrease treatment costs and offer a cost-effective treatment alternative. Moreover, the shorter waiting period and comparatively easier scheduling are expected to increase patients' preference towards these facilities, thereby driving the segment growth. According to the Definitive Healthcare, LLC. article published in April 2024, at the end of 2023, the U.S. had 9,374 active Ambulatory Surgery Centers (ASCs), reflecting a rise in outpatient surgical services. This expansion of ASCs is fueling the demand for innovative surgical technologies, including annuloplasty systems, to enhance the efficiency and outcomes of minimally invasive heart procedures.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the annuloplasty system market

By Application

By End Use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. Internal Database

1.5. Details of primary research

1.6. Market Formulation & Validation

1.7. Research Scope and Assumptions

1.7.1. List of Secondary Sources

1.7.2. List of Primary Sources

1.7.3. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application Outlook

2.2.2. End Use Outlook

2.3. Competitive Insights

Chapter 3. Annuloplasty System Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Drivers Analysis

3.2.1.1. The increasing prevalence of cardiovascular diseases (CVD)

3.2.1.2. Growing geriatric population base

3.2.1.3. Increasing preference for minimally invasive procedures

3.2.1.4. Development of advanced annuloplasty systems and products

3.2.2. Market Restraints Analysis

3.2.3. Complications and risks associated with annuloplasty procedures

3.3. Annuloplasty System Market Analysis Tools

3.3.1. Porter’s Analysis

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and Social landscape

3.3.2.3. Technological landscape

3.3.2.4. Environmental landscape

Chapter 4. Annuloplasty System Market: Application Estimates & Trend Analysis

4.1. Application Market Share Analysis, 2024 & 2034

4.2. Segment Dashboard

4.3. Annuloplasty System Market: By Application, 2018 to 2030

4.4. Mitral Valve Repair

4.4.1. Mitral Valve Repair Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Tricuspid Valve Repair

4.5.1. Tricuspid Valve Repair Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Aortic Valve Repair

4.6.1. Aortic Valve Repair Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Annuloplasty System Market: End Use Estimates& Trend Analysis

5.1. End Use Market Share Analysis, 2024 & 2034

5.2. Segment Dashboard

5.3. Annuloplasty System Market: By End Use, 2018 to 2030

5.4. Hospitals

5.4.1. Hospitals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Ambulatory Surgical Centers

5.5.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Other End

5.6.1. Other End Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Annuloplasty System Market: Regional Estimates & Trend Analysis by Country, Application and End Use

6.1. Regional Market Share Analysis, 2024 & 2034

6.2. Regional Market Snapshot

6.3. Annuloplasty System Market Share, By Region, 2024 & 2034, USD Million

6.4. North America

6.4.1. North America Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.2. U.S.

6.4.2.1. Key Country Dynamics

6.4.2.2. Regulatory Landscape/Reimbursement Scenario

6.4.2.3. Competitive Insights

6.4.2.4. U.S. Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.3. Canada

6.4.3.1. Key Country Dynamics

6.4.3.2. Regulatory Landscape/Reimbursement Scenario

6.4.3.3. Competitive Insights

6.4.3.4. Canada Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.4. Mexico

6.4.4.1. Key Country Dynamics

6.4.4.2. Regulatory Landscape/Reimbursement Scenario

6.4.4.3. Competitive Insights

6.4.4.4. Mexico Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Europe

6.5.1. Europe Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.2. UK

6.5.2.1. Key Country Dynamics

6.5.2.2. Regulatory Landscape/Reimbursement Scenario

6.5.2.3. Competitive Insights

6.5.2.4. UK Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.3. Germany

6.5.3.1. Key Country Dynamics

6.5.3.2. Regulatory Landscape/Reimbursement Scenario

6.5.3.3. Competitive Insights

6.5.3.4. Germany Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.4. France

6.5.4.1. Key Country Dynamics

6.5.4.2. Regulatory Landscape/Reimbursement Scenario

6.5.4.3. Competitive Insights

6.5.4.4. France Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.5. Italy

6.5.5.1. Key Country Dynamics

6.5.5.2. Regulatory Landscape/Reimbursement Scenario

6.5.5.3. Competitive Insights

6.5.5.4. Italy Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.6. Spain

6.5.6.1. Key Country Dynamics

6.5.6.2. Regulatory Landscape/Reimbursement Scenario

6.5.6.3. Competitive Insights

6.5.6.4. Spain Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.7. Denmark

6.5.7.1. Key Country Dynamics

6.5.7.2. Regulatory Landscape/Reimbursement Scenario

6.5.7.3. Competitive Insights

6.5.7.4. Denmark Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.8. Sweden

6.5.8.1. Key Country Dynamics

6.5.8.2. Regulatory Landscape/Reimbursement Scenario

6.5.8.3. Competitive Insights

6.5.8.4. Sweden Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5.9. Norway

6.5.9.1. Key Country Dynamics

6.5.9.2. Regulatory Landscape/Reimbursement Scenario

6.5.9.3. Competitive Insights

6.5.9.4. Norway Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6. Asia Pacific

6.6.1. Asia Pacific Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.2. China

6.6.2.1. Key Country Dynamics

6.6.2.2. Regulatory Landscape/Reimbursement Scenario

6.6.2.3. Competitive Insights

6.6.2.4. China Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.3. Japan

6.6.3.1. Key Country Dynamics

6.6.3.2. Regulatory Landscape/Reimbursement Scenario

6.6.3.3. Competitive Insights

6.6.3.4. Japan Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.4. India

6.6.4.1. Key Country Dynamics

6.6.4.2. Regulatory Landscape/Reimbursement Scenario

6.6.4.3. Competitive Insights

6.6.4.4. India Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.5. South Korea

6.6.5.1. Key Country Dynamics

6.6.5.2. Regulatory Landscape/Reimbursement Scenario

6.6.5.3. Competitive Insights

6.6.5.4. South Korea Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.6. Australia

6.6.6.1. Key Country Dynamics

6.6.6.2. Regulatory Landscape/Reimbursement Scenario

6.6.6.3. Competitive Insights

6.6.6.4. Australia Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6.7. Thailand

6.6.7.1. Key Country Dynamics

6.6.7.2. Regulatory Landscape/Reimbursement Scenario

6.6.7.3. Competitive Insights

6.6.7.4. Thailand Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.7. Latin America

6.7.1. Latin America Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.7.2. Brazil

6.7.2.1. Key Country Dynamics

6.7.2.2. Regulatory Landscape/Reimbursement Scenario

6.7.2.3. Competitive Insights

6.7.2.4. Brazil Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.7.3. Argentina

6.7.3.1. Key Country Dynamics

6.7.3.2. Regulatory Landscape/Reimbursement Scenario

6.7.3.3. Competitive Insights

6.7.3.4. Argentina Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8. Middle East and Africa

6.8.1. Middle East and Africa Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8.2. Saudi Arabia

6.8.2.1. Key Country Dynamics

6.8.2.2. Regulatory Landscape/Reimbursement Scenario

6.8.2.3. Competitive Insights

6.8.2.4. Saudi Arabia Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8.3. UAE

6.8.3.1. Key Country Dynamics

6.8.3.2. Regulatory Landscape/Reimbursement Scenario

6.8.3.3. Competitive Insights

6.8.3.4. UAE Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8.4. South Africa

6.8.4.1. Key Country Dynamics

6.8.4.2. Regulatory Landscape/Reimbursement Scenario

6.8.4.3. Competitive Insights

6.8.4.4. South Africa Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8.5. Kuwait

6.8.5.1. Key Country Dynamics

6.8.5.2. Regulatory Landscape/Reimbursement Scenario

6.8.5.3. Competitive Insights

6.8.5.4. Kuwait Annuloplasty System Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Market Share Analysis

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Product Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. Medtronic

7.6.1.1. Participant’s Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.1.4. Recent Developments

7.6.2. Abbott

7.6.2.1. Participant’s Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.2.4. Recent Developments

7.6.3. Edwards Lifesciences Corporation

7.6.3.1. Participant’s Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.3.4. Recent Developments

7.6.4. Corcym

7.6.4.1. Participant’s Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.4.4. Recent Developments

7.6.5. Labcor Laboratories Ltda

7.6.5.1. Participant’s Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.5.4. Recent Developments

7.6.6. AFFLUENT MEDICAL

7.6.6.1. Participant’s Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.6.4. Recent Developments

7.6.7. Valcare Medical

7.6.7.1. Participant’s Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.7.4. Recent Developments

7.6.8. Braile Biomédica

7.6.8.1. Participant’s Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

7.6.8.4. Recent Developments

7.6.9. Micro Interventional Devices, Incorporated

7.6.9.1. Participant’s Overview

7.6.9.2. Financial Performance

7.6.9.3. Product Benchmarking

7.6.9.4. Recent Developments