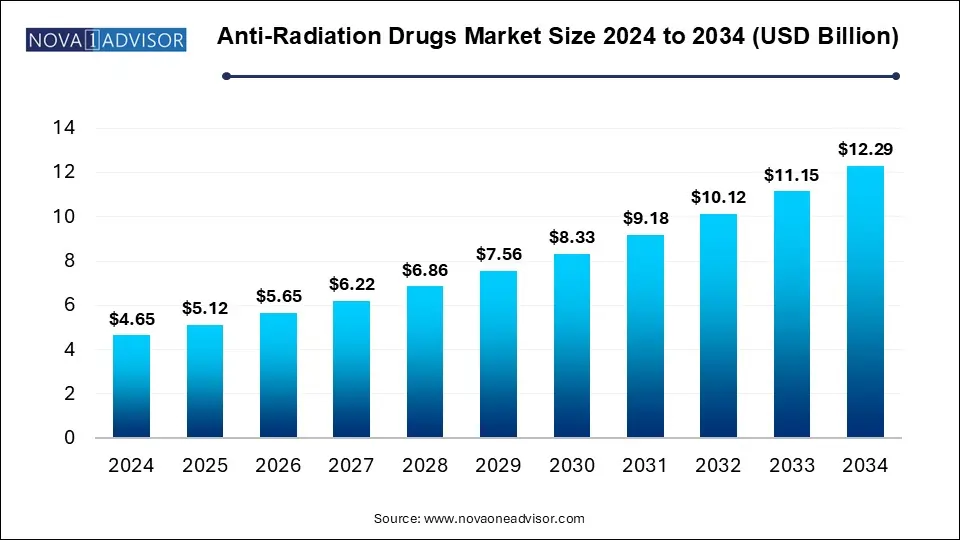

The global anti-radiation drugs market size was calculated at USD 4.65 billion in 2024 and is predicted to increase from USD 5.12 billion in 2025 to approximately USD 12.29 billion by 2034, expanding at a CAGR of 10.21% from 2025 to 2034. The adoption of radiation therapy in cancer treatments has increased, driving the anti-radiation drugs market. The expansion of nuclear power and the incidence of industrial radiation exposures driving demands for anti-radiation drugs. Increased demand for anti-radiation drugs in radiation accidents and emergencies is boosting the market.

The anti-radiation drugs market has witnessed transformative growth driven by factors like increased cancer incidence, nuclear power expansion, and demand for radiation protection. The awareness of radiation safety has increased around the globe. Advancements in radiation therapies and regulatory support for novel drug developments are contributing to market expansion. Increased risk of nuclear accidents and industrial radiation exposures is driving demand for anti-radiation drugs. Government initiatives and funding for radiation protection and adoption in healthcare play a favorable role in market growth.

The increased cancer prevalence is driving innovations and developments of anti-radiation drugs. Increased incidence of cancers has increased demand for radiation therapies. Cancer needs treatments and drugs to protect tissues and cells, and anti-radiation drugs protect the tissues and cells. Advancements in cancer treatments and therapies such as immunotherapy and targeted therapy are further contributing to an increasing demand for anti-radiation drugs. Awareness about radiation safety among patients and healthcare professionals is surging, shifting toward anti-radiation drugs

| Report Coverage | Details |

| Market Size in 2025 | USD 5.12 Billion |

| Market Size by 2034 | USD 12.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.21% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Compound, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Amgen Inc., Anbex Inc., Arco Pharmaceuticals LLC, BTG International Inc., Cellphire, Inc., Chrysalis BioTherapeutics, Inc., Darnitsa, Enzychem Lifesciences Corporation, Humanetics Corporation, Mission Pharmacal Company, Myelo Therapeutics GmbH, Partner Therapeutics, Pluri Inc. |

Development of Personalized Medicine Holding Market Potential

Personalized medicines are enabling novel treatment approaches for patient radiation exposure to improve efficacy and reduce side effects. Anti-radiation drug dosing and administration are witnessing precision medicine approaches to reduce toxicity and improve results. Genetic profiles can identify individual treatments and drugs for radiation damage, enabling targeted therapies. Regulatory support for tailored, personalized medicine approaches is highly contributing to this growth. Researchers are focusing on developing combination therapies, combining anti-radiation drugs with other treatment solutions to improve efficacy and reduce side effects of the drugs, holding great potential for novel advancements in anti-radiation drugs.

Adverse Effects Hampers Adoption of Anti-Radiation Drugs

Antiradiation drugs have adverse effects, such as nausea, diarrhea, abdominal pain, neurotoxicity, and hypotension. These drugs can also increase the risk of cardiovascular events like strokes and heart attacks. The neurological toxicity, like tremors and confusion, caused by antiradiation drugs further contributes to adverse effects. The toxicity and adverse effects of anti-radiation drugs are hampering their adoption among healthcare professionals. Regulatory frameworks are delaying approval times, which contribute to high costs. However, ongoing research and developments in anti-radiation drugs are expected to overcome these challenges.

The Potassium iodide (Kl) segment dominated the market in 2024 due to the high use of potassium iodide for preventing thyroid cancer. potassium iodide has been proven safe and effective in protecting against radiation exposure. Potassium iodide has become crucial for nuclear accidents or other radiation emergencies.

However, the DTPA (Diethylenetriamine Pentaacetate) segment is expected to lead the market in the forecast period. The DTPA (Diethylenetriamine Pentaacetate) is highly effective in removing radioactive materials. The rising incidence of nuclear power accidents, radiation therapy demands, and industrial radiation exposures are driving demand for DTPA (Diethylenetriamine Pentaacetate) anti-radiation drugs.

The Acute Radiation Syndrome (ARS) segment leads the market due to increased demand for increased cancer incidence. Acute radiation syndromes are highly adapted for nuclear or radiological incidents. The regulatory encouragements for innovations and developments in novel anti-radiation drugs are expanding the segment.

Radiation Exposure accounted for the fastest-growing segment of the market. the increased risk of radiation exposure in medical and industrial applications and driving demand for anti-radiation drugs. Increased nuclear power expansions are further contributing to radiation exposure incidence. The awareness of radiation safety has taken place, driving a shift toward demands for anti-radiation drugs.

The hospital pharmacies accounted for the largest market share in 2024. Expanding healthcare infrastructure, increased cancer burden, and growing developments of cancer specialty hospitals are contributing to the segment growth. Hospital pharmacies are the prior distributors of anti-radiation drugs because of their ability to improve patient care and safety.

Retail pharmacies are the second largest segment of the market. The growing regulatory approval for over-the-counter drugs for nuclear medicine and oncology sectors, driving the segment growth. Easy accessibility and a large distribution network of retail pharmacies make them popular among the patient population.

High Cancer Prevalence: to Boost North American Market

North America dominated the global anti-radiation drugs market due to factors like the increased prevalence of cancer and the high adoption of anti-radiation therapies. The high prevalence of cancer leads to increased lane adoption of radiation therapies in North America, with the presence of key pharmaceutical companies enabling innovative anti-radiation drugs in the region.

Regulatory Support Contributes to U.S. Market Growth

The United States leading the regional market due to increasing cancer prevalence, adoption of radiation therapies, and strong research and development sectors. Government and regulatory support play a crucial role in market expansion. Government initiatives such as the U.S. Government's Medical Countermeasures (MCM) program encourage innovations and developments of novel anti-radiation drugs in the country. The National Cancer Institute's (NCI) involvement in research and developments and FDA approvals for novel therapies and drugs is leveraging this growth.

Large Patient Pool fuling Asian Market

Asia Pacific is expected to witness significant growth and forecast. Asia is the home of medical tourism. The Asia Pacific region has a large patient pool driven by increased incidence of cancer. Expanding healthcare expenditures and the presence of key vendors are contributing to market expansion. Government initiatives and investments in improving healthcare infrastructure and access to cancer treatments are driving innovation and the development of novel anti-radiation drugs. Increased demand for personalized medicines and technological advancements are projected to advance the anti-radiation drugs area in the Asia Pacific.

China and India held significant market share due to expanding healthcare expenditure, a large patient pool for cancer, and favorable government initiatives. Countries have witnessed extreme growth in radiation facilities and investments in anti-radiation devices. The rising awareness of radiation safety and the growing economy are fueling market growth in these countries.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Anti-Radiation Drugs Market

By Compound

By Application

By Distribution Channel

By Regional