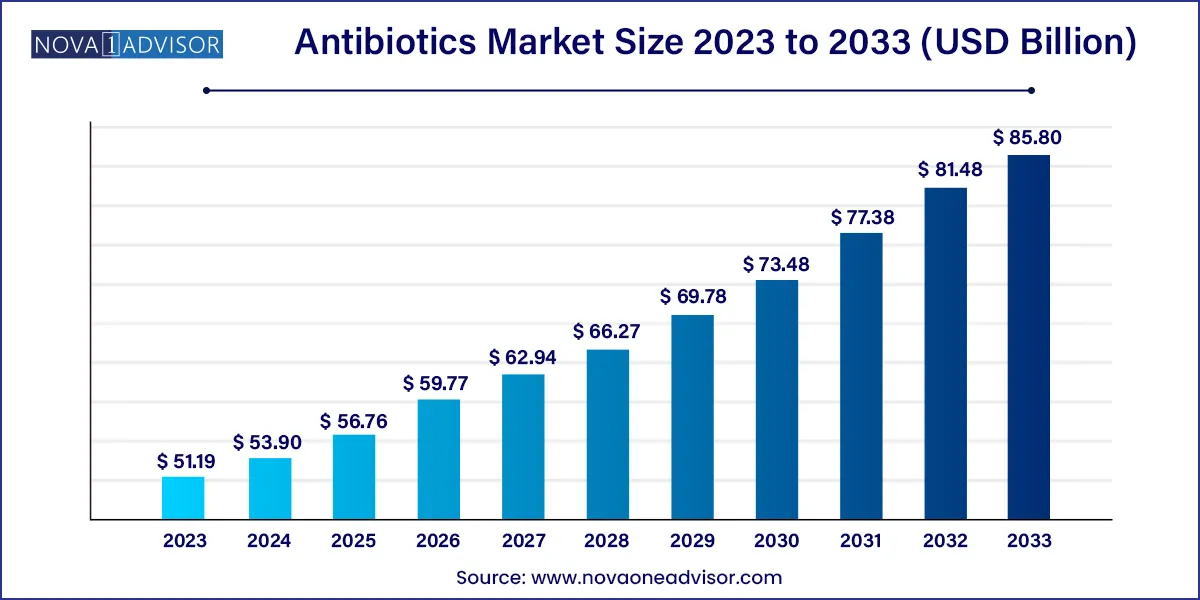

Antibiotics Market Size and Growth

The global antibiotics market size was valued at USD 51.19 billion in 2023 and is projected to surpass around USD 85.80 billion by 2033, registering a CAGR of 5.3% over the forecast period of 2024 to 2033.

Antibiotics Market Key Takeaways

Increasing prevalence of infectious diseases is a major factor contributing to market growth. According to the CDC, there were over 31 million cases of influenza in the U.S.during the 2022-2023 flu season. The development of advanced products and growing collaboration activities for the development of antibiotics are also expected to drive industry growth over the forecast period. The COVID-19 pandemic positively impacted the industry's growth.

According to the Elsevier Ltd. article published in February 2023, a study was conducted to estimate the association between COVID-19 cases and vaccination with global antibiotic sales. As per the study, about 75% of patients with COVID-19 were given antibiotics, contributing to antimicrobial resistance. Sales of all four (cephalosporin, penicillin, macrolides, and tetracycline) gradually increased to pre-pandemic levels until May 2022. Increasing efforts are being undertaken for the development of advanced products boosting the market demand.

According to Pew Charitable Trust, in December 2020, around 43 promising molecules were being investigated in the U.S. Out of these molecules, around 15 candidates were in phase 1 clinical trials, 13 in phase 2 and phase 3, and 2 candidates are under review by the U.S. FDA. Around 19 of these candidates were active against gram-negative ESKAPE bacteria.In addition, 1 in 4 drugs in the pipeline belong to novel drug classes. Key players are collaborating for antibiotic development to divide expenses.

According to the Global Antibiotic Research & Development Partnership (GARDP) Foundation article published in November 2022, Mitsubishi Tanabe Pharma Corporation (MTPC) and GARDP signed an agreement that allows access to over 50,000 compounds in MTPC's library by GARDP. To identify new compounds with antibacterial activity for drug-resistant bacteria, a set of substances is evaluated at the Institute Pasteur Korea's Optimized High Throughput Screen. This Agreement promotes the efforts of GARDP in developing antibiotics to address serious bacterial infections while at the same time ensuring that their availability is sustainable. These aspects are boosting the market demand.

Antibiotics Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 53.90 Billion |

| Market Size by 2033 | USD 85.80 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Drug Class, Application, Action Mechanism, Drug Origin, Spectrum Of Activity, Route of Administration, Distribution Channel, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott Laboratories (US), Pfizer Inc. (US), Johnson & Johnson Services, GlaxoSmithKline PLC (UK), Sanofi (France), Bristol-Myers Squibb Company (US), Eli Lilly and Company (US), Novartis AG (Switzerland), Bayer AG (Germany), Astellas Pharma Inc. (Japan) |

Drug Class Insights

The penicillin segment accounted for the largest revenue share of 23.8% in 2023. Penicillin is the first drug class to be discovered and is still widely used to treat various infections, especially those caused by staphylococci and streptococci, clostridium, and listeria. They act by either inhibiting cell wall synthesis or by preventing the formation of the peptidoglycan layer. In treating infections like pharyngitis, skin infection, bronchial cough, gonorrhea, and ear fungus, these medicines represent the first line of treatment. Antibiotic resistance development, allergic activities, and several other adverse effects are the main reasons these drugs are expected to lose market share over the forecast period. According to a WHO article published in March 2023, the primary public health issue is skin-related neglected tropical diseases (NTDs). About 1.8 billion people in the world are estimated to be affected by skin diseases at any point in time.

Cephalosporin is anticipated to witness a significant growth rate over the forecast period. Cephalosporin are subtypes of the beta-lactam group of antibiotics. These drugs act against gram-positive and gram-negative bacteria, such as Pseudomonas aeruginosa, Klebsiella pneumonia, and Bactericides fragilis. Similar to the penicillin class, generics dominate the cephalosporin segment and have demonstrated comparably seasonal usage patterns.Cephalosporin include five generations of drugs with a varied spectrum of activity. However, these drugs' third, fourth, and fifth generations are conventional antibiotics used to treat resistant pathogens. Cefixime is the most common third-generation broad-spectrum cephalosporin used to treat infection caused by P. aeruginosa & N. gonorrhea. It has activity against S. aureus, S. pneumonia, and Enterobacteriaceae spp.These aspects are augmenting the market demand.

Application Insights

On the basis of application, the market has been subdivided into skin infections, urinary tract infection, ear infection, septicemia, gastrointestinal infection and respiratory infections. Among these the respiratory infection has shown the maximum growth as a result of the huge number of patients who fall under this category. With the rapidly increasing global pollution and climate change the number of people suffering with respiratory disorders has increased tremendously. The outbreak of the pandemic had a severe impact on the respiratory system of the people which has proved to be a driving factor for the market.

The military system of the people has been hampered tremendously which has a direct impact on the respiratory organs. Rapidly increasing demand for medicines in order to treat respiratory disorders Is there a sponsible for the growth of the antibiotics market during the forecast period. The urinary tract infection segment is considered to be the next largest segment which has dominated the market with the highest demand and supply.

The skin infections market has also shown a considerable growth as a result of the huge population suffering with it. The rapid research and development which is carried out by the key market players has made the drugs related to these disorders The key market players which are held in pipeline for the forecast period.

Route of Administration Insights

On the basis of route of administration, the parenteral route it's the fastest growing market and has held the largest share whether it's high demand among the people. The rapidly increasing technological development and minimum amount of dose that is being administered with the help of syringes has boosted the demand tremendously. The rapidly rising number of patients who are getting admitted in hospitals in order to get treated for infections and ailments have helped this market to record a considerable growth during the forecast period.

The greater number of days which are patient has to spend in the premises of the hospital also proves to be a driving factor for the growth of the market. With the increasing time that the patient has to spend in the hospital premises the number of infections which the patient suffers with increases. This proves to be a major opportunity for the growth of the market. In order to control the hospital acquired infections various health care organizations have taken multiple steps and imposed rules and regulations in order to manage them. The application of parenteral drugs has been encouraged in order to prevent the spread of hospital acquired infection. The oral segment has shown a significant growth in the market as a result of the number of people who prefer to self-drug themselves by considering medicines over-the-counter. These multiple factors have proved to be the opportunities for the market during the forecast period.

Distribution Channel Insights

On the basis of distribution channel, the hospital sector has been considered as the largest as a result of the huge number of patients that choose a hospital set-up for getting treated in case of infections over the other types of health care sectors. The rapidly increasing specialized hospitals in the society has also attributed to the growth of this segment rapidly. The presence of specialists in the hospital domain has also proved to be a driving factor for the growth of the market.

With the increasing trend of online shopping people prefer to purchase medicines and drugs through the online pharmacies which has also proved to be a driving factor for the market. on the other hand, the retail pharmacies have shown a tremendous growth as a result of the increasing number of over-the-counter purchases performed by the patients in order to avoid the additional hospital expense.

The online research which is carried out by the patient themselves is responsible for this increase in over-the-counter drugs. Belonging to the average class usually prefer to choose this distribution channel in order to get themselves treated. The outbreak of the pandemic had a serious impact on the hospital sector which boosted in the segment of online pharmacies.

Action Mechanism Insights

The cell wall synthesis inhibitors segment dominated the market in 2023. Cell wall synthesis inhibitors are widely used antibiotics, as they are described with wide-spectrum action against gram-positive and gram-negative bacteria. These drugs inhibit the synthesis of the peptidoglycan layer, which is crucial for the structural activity of the cell wall. This category of drugs includes cephalosporin, penicillin, carbapenems, and others. This segment is expected to grow significantly over the forecast period due to increased research initiatives and government funding.

According to the U.S. FDA article, in 2022, 37 novel drugs were approved by the Center for Drug Evaluation and Research (CDER) as new beneficial biological products under Biologics License Applications (BLAs) or as novel molecular entities (NMEs) under New Drug Applications (NDAs). The RNA synthesis inhibitors segment is estimated to register a significant CAGR over the forecast period owing to a surge in R&D initiatives and product launches undertaken by market players. According tothe Royal Society of Chemistry article published in 2022, segment growth is further driven by rifamycins and fidaxomycin, which are well-known and clinically approved classes of natural products that inhibit RNAP.

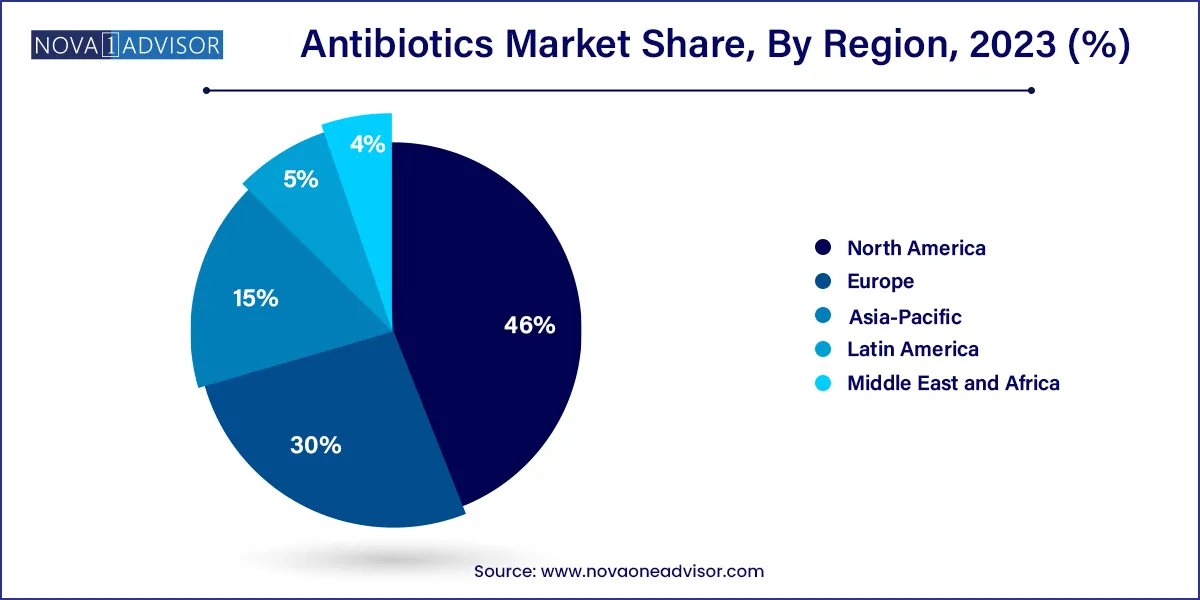

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 46.00% in 2023 owing to increased cases of infectious diseases, high instances of administering non-prescribed medications, the presence of well-established clinics & hospitals, and a growing number of skilled professionals in the region. According to the University of OSLO article published in May 2023, the chief suppliers of antibiotics are India and China. Imports of antibiotics and antibiotic ingredients from both countries are very important to the world. China is the world's major producer and manufacturer of antibacterial ingredients. Similarly, According to the BBC news article published in September 2023, National data show that 29.1% of the 125 million population is aged 65 years or older. Japan's birth rate is the lowest in the world. The geriatric population is more susceptible to infectious diseases. In addition, the incidence of drug-resistant infectious diseases is increasing, leading to a rise in demand for novel treatment options.

North America is anticipated to witness significant growth. These markets are highly standardized with advancements in healthcare infrastructure. Regional market growth is driven by rising incidences of infectious diseases, which, in turn, are boosting the demand for new antimicrobial formulations. The growth is also driven by increased research and development activity, as well as by a variety of existing antibiotic stewardship initiatives. According to a Definitive Healthcare article published in August 2023, in 2021, the number of antibiotic prescriptions issued by healthcare providers increased to 211.1 million. In years prior, this number fluctuated between 201.9 million (2020) and about 250 million (2018 and 2019).

Antibiotics Market Top Key Companies:

Antibiotics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Antibiotics market.

By Drug Class

By Application

By Action Mechanism

By Drug Origin

By Spectrum Of Activity

By Route of Administration

By Distribution Channel

By Region