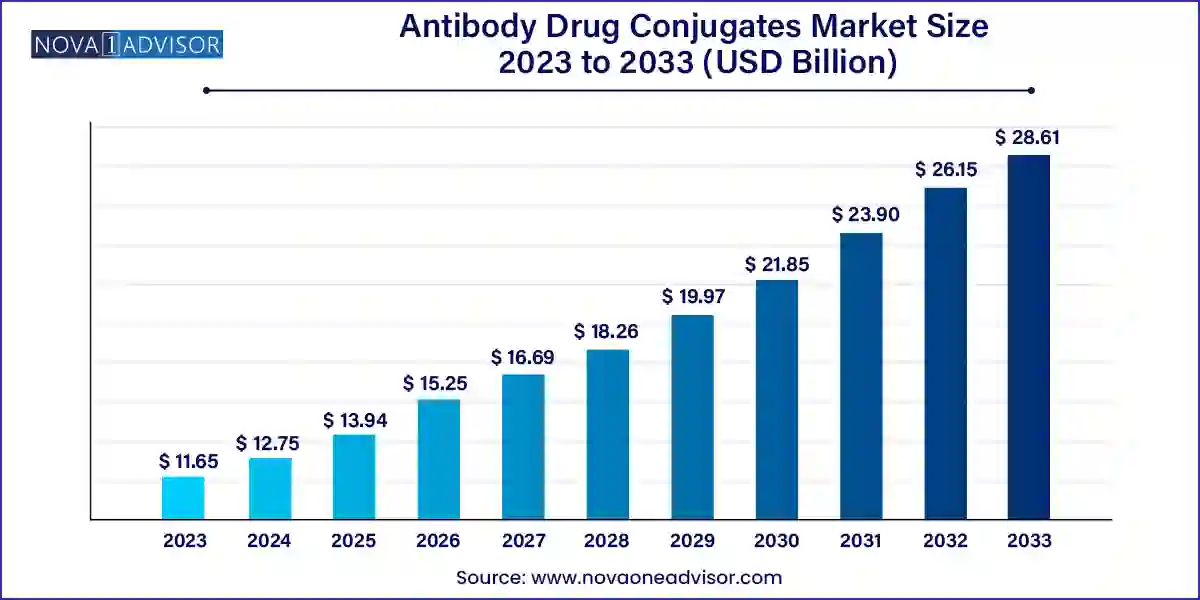

The global antibody drug conjugates market size was valued at USD 11.65 billion in 2023 and is anticipated to reach around USD 28.61 billion by 2033, growing at a CAGR of 9.4% from 2024 to 2033.

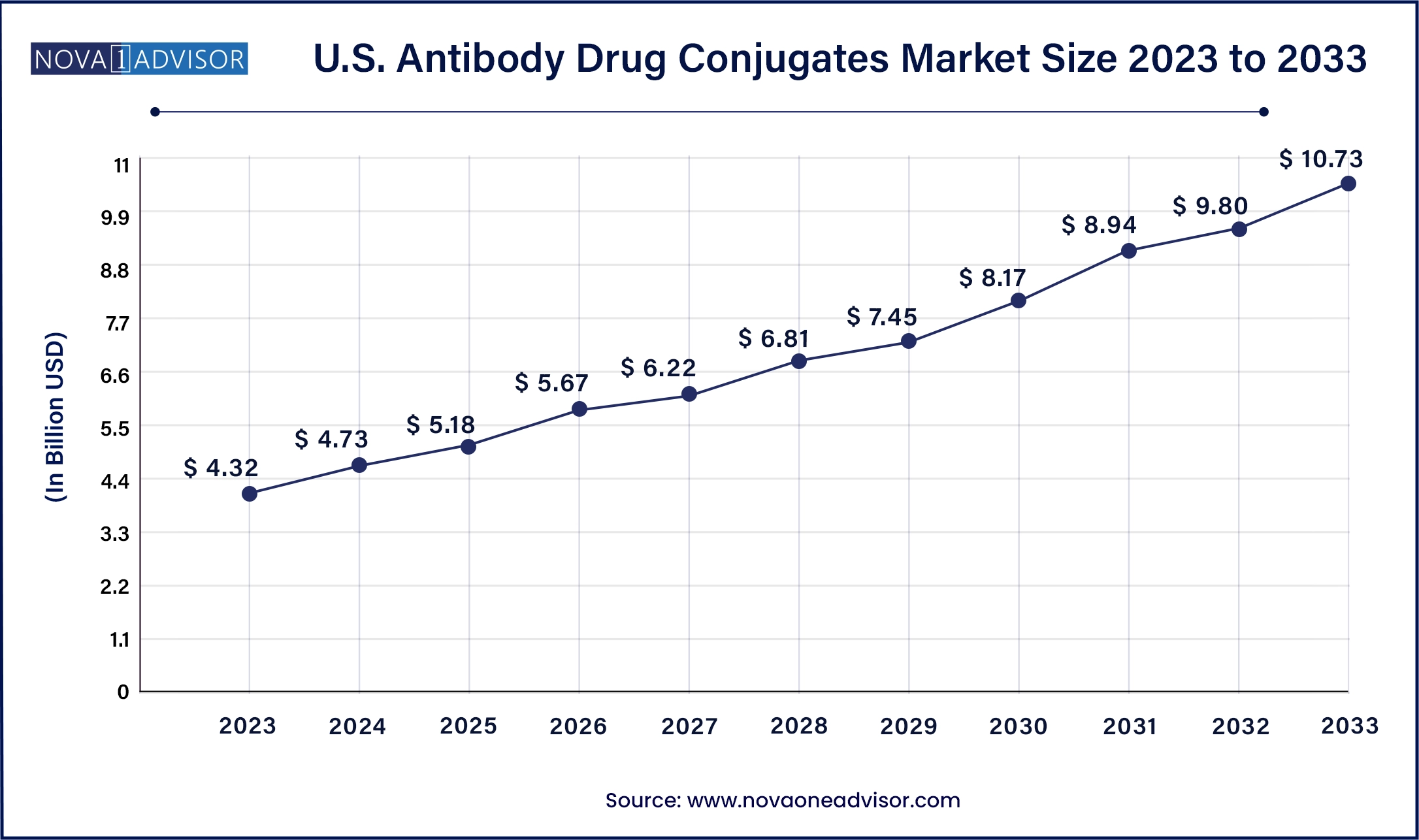

The U.S. antibody drug conjugates market is valued at USD 4.32 billion in 2023, and it is expected to reach USD 10.73 billion by 2033, with a CAGR of 9.53% during the forecast period of 2024-2033.

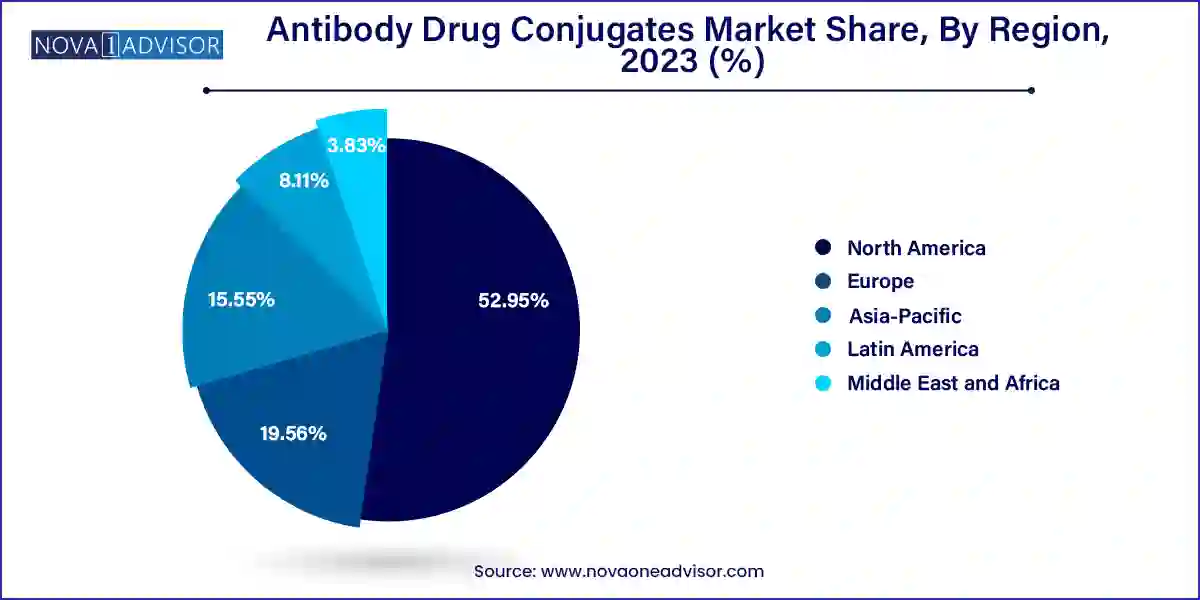

North America, particularly the United States, is the largest market for ADCs, accounting for over half of the global revenue. This dominance stems from early adoption of breakthrough oncology drugs, a robust regulatory framework that supports fast-track and orphan drug designations, and high per capita healthcare spending. Additionally, the U.S. houses several ADC trailblazers like Seagen (Pfizer), ImmunoGen, and Genentech, which continuously innovate and commercialize new candidates. Clinical trials are rapidly executed due to supportive patient recruitment infrastructure, and insurance reimbursement covers most high-cost oncology drugs, fueling demand.

Asia-Pacific is the Fastest Growing Region

The Asia-Pacific region is the fastest growing, driven by rapid urbanization, rising cancer incidence, and expanding access to advanced therapies. China and Japan are at the forefront, with Chinese biotech firms such as RemeGen and Lepu Biopharma actively developing and launching ADCs like Disitamab Vedotin. Moreover, favorable regulatory reforms in China, including accelerated drug approvals and inclusion of innovative drugs in the National Reimbursement Drug List (NRDL), have dramatically improved patient access. Collaborations between local and global players are also helping Western-developed ADCs penetrate Asian markets faster.

The Antibody Drug Conjugates (ADC) market has emerged as a dynamic and innovative landscape within oncology therapeutics, bridging the specificity of monoclonal antibodies with the potent cytotoxicity of chemotherapeutic agents. ADCs offer a targeted approach to cancer treatment by delivering cytotoxic drugs directly to tumor cells, thereby reducing collateral damage to healthy tissues. This promising modality has garnered significant attention from both pharmaceutical giants and emerging biotech firms. With over a dozen ADCs currently approved and many more in the pipeline, the market is undergoing rapid evolution.

In 2024, the ADC market was estimated at several billion USD globally, with a strong upward trajectory forecasted through 2034. This growth is being propelled by increasing incidences of cancers such as breast cancer, leukemia, and lymphoma, combined with the continued development of novel ADC technologies and linker-payload combinations. Regulatory support and accelerated approval pathways for breakthrough oncology therapies are further catalyzing market development.

Leading products like Kadcyla, Enhertu, and Adcetris have showcased clinical efficacy, setting benchmarks in various oncological indications. Simultaneously, ongoing R&D around newer targets like HER3, CD70, and TROP2 is expanding the potential therapeutic spectrum. The advent of next-generation ADCs with improved safety profiles, by optimizing linker stability and payload potency, also marks a defining evolution in the treatment landscape.

Rise in Combination Therapies: ADCs are increasingly being investigated in combination with immunotherapies, such as immune checkpoint inhibitors, to enhance therapeutic outcomes in refractory cancers.

Expansion Beyond Oncology: While ADCs are primarily focused on cancers, there is a growing pipeline exploring indications in autoimmune diseases and infectious diseases.

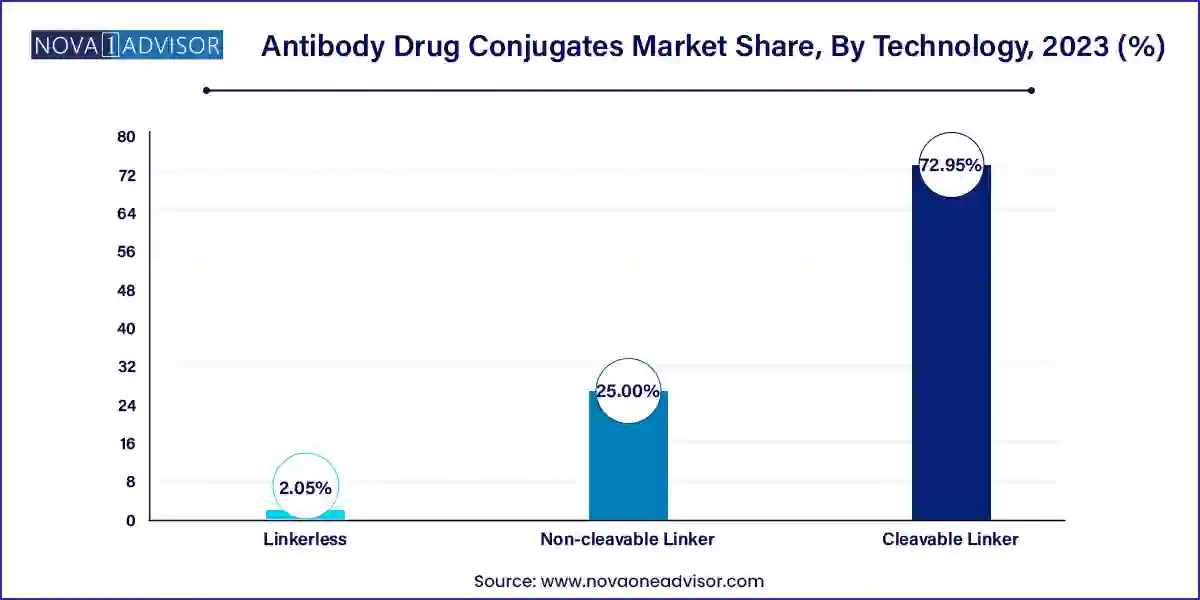

Technological Advancements in Linkers and Payloads: Improved stability of cleavable and non-cleavable linkers, alongside innovations in payloads like topoisomerase inhibitors and tubulin inhibitors, are improving the therapeutic index of ADCs.

Increased Investment in ADC Manufacturing Capabilities: Biopharma companies and CDMOs are investing heavily in ADC-specific manufacturing facilities due to the complex production processes involved.

Regional Expansion and Global Collaborations: Companies from Asia-Pacific, especially China, are becoming increasingly active in ADC R&D, with numerous cross-border licensing deals and joint ventures.

Growing Role of Companion Diagnostics: With the need for patient stratification and precision targeting, diagnostics companies are developing companion tests for HER2, TROP2, and other biomarkers.

| Report Attribute | Details |

| Market Size in 2024 | USD 12.75 Billion |

| Market Size by 2033 | USD 28.61 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application, product, target, technology, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Seagen, Inc., (previously Seattle Genetics, Inc.); Takeda Pharmaceutical Company Ltd.; AstraZeneca PLC, F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; ImmunoGen, Inc.; Gilead Sciences, Inc. (acquired Immunomedics); Daiichi Sankyo Company Ltd. |

One of the most compelling growth drivers for the ADC market is the escalating global prevalence of cancer, especially solid tumors and hematological malignancies. According to the World Health Organization, cancer is the second leading cause of death globally, with breast, lung, and colorectal cancers being the most prevalent. Antibody drug conjugates present an advanced therapeutic solution for patients who have relapsed or are refractory to conventional chemotherapy or targeted therapies. For instance, Enhertu, approved for HER2-low metastatic breast cancer, represents a shift in how previously untreatable patient subsets are now benefiting from ADCs. The ability of ADCs to deliver cytotoxic agents with high precision reduces systemic toxicity and enhances treatment efficacy, making them a cornerstone of next-generation oncology therapies.

Despite the potential, the ADC market faces significant challenges, the foremost being the complexity in development and large-scale manufacturing. ADCs are composed of three distinct components antibody, linker, and cytotoxic payload which need to be precisely conjugated under stringent conditions. This requires highly specialized manufacturing infrastructure and expertise. Any variability can affect the stability, efficacy, and safety of the final product. Additionally, scaling production while maintaining batch-to-batch consistency poses regulatory and quality control hurdles. The cost of production is also significantly higher than conventional biologics, often translating into higher treatment costs for patients and payers. This complexity limits entry for smaller players and can slow down commercialization timelines.

The ADC landscape is currently undergoing a technological renaissance, presenting a unique opportunity for innovation-led growth. Next-generation ADCs are integrating advanced payloads like topoisomerase I inhibitors, camptothecin derivatives, and immunostimulatory agents, which offer improved efficacy and minimized off-target toxicity. Additionally, new targets beyond HER2 and CD30 are gaining traction—examples include HER3 (patritumab deruxtecan) and TROP2 (datopotamab deruxtecan). These ADCs hold the promise of expanding the addressable patient pool, particularly in cancers with unmet clinical needs such as triple-negative breast cancer (TNBC) and urothelial carcinoma. Furthermore, the integration of artificial intelligence (AI) in target identification and drug design is accelerating discovery cycles. Biotech firms that can capitalize on these innovations may capture significant market share in the coming decade.

Breast cancer holds the largest share of the ADC market, driven by the robust adoption of products like Kadcyla (ado-trastuzumab emtansine) and Enhertu (trastuzumab deruxtecan) for HER2-positive and HER2-low metastatic breast cancer. These drugs have demonstrated superior progression-free survival rates compared to standard therapies. The growing incidence of HER2-expressing tumors and the widening eligibility criteria due to HER2-low classifications are further amplifying growth. Moreover, patient-friendly dosing regimens and inclusion in treatment guidelines by major oncology societies have enhanced their clinical acceptance.

On the other hand, blood cancers, particularly lymphoma and multiple myeloma, are experiencing the fastest market expansion. Drugs such as Adcetris (brentuximab vedotin) for Hodgkin lymphoma and Polivy (polatuzumab vedotin) for diffuse large B-cell lymphoma (DLBCL) are transforming hematological oncology care. These ADCs are being increasingly positioned in frontline therapy settings, not just relapsed or refractory cases, thanks to superior overall response rates and manageable toxicity profiles. Pipeline candidates targeting CD19, CD123, and CD70 are poised to further boost this segment.

Kadcyla remains a market leader due to its earlier approval and extensive use in HER2-positive breast cancer. Its established safety profile and integration into multiple lines of therapy provide a consistent revenue base. Clinical trials have reaffirmed its long-term benefit in early and metastatic stages, keeping it central to treatment protocols.

However, Enhertu is rapidly gaining traction and is projected to be the fastest-growing product in this space. Its recent FDA approvals for HER2-low breast cancer and non-small cell lung cancer (NSCLC) have opened new high-value indications. Enhertu’s superior efficacy profile and broader eligibility make it a game-changer. Ongoing trials evaluating its use in gastric and colorectal cancers indicate further expansion potential.

HER2 remains the most dominant target in the ADC market, owing to its established role in breast and gastric cancers. HER2-targeted ADCs such as Kadcyla and Enhertu have shown remarkable clinical success and form the backbone of HER2-positive cancer management. The market benefits from high diagnostic rates and strong biomarker correlation, making treatment decisions more precise.

CD30, a marker associated with Hodgkin lymphoma and certain T-cell lymphomas, is the fastest growing segment. Adcetris, targeting CD30, has become a standard in relapsed/refractory settings and is now being explored in frontline treatment. CD30’s expression in various lymphomas and promising results from combination studies with checkpoint inhibitors are accelerating its adoption.

Cleavable linker technologies dominate the ADC space due to their ability to release the cytotoxic payload specifically within tumor cells, enhancing efficacy and reducing systemic toxicity. These linkers are widely used in approved ADCs like Enhertu and Adcetris. Their versatility across payloads and disease types make them the preferred choice in both solid and hematologic malignancies.

Among payload technologies, MMAE (Monomethyl auristatin E) is witnessing rapid growth. It is a potent microtubule-disrupting agent used in ADCs like Adcetris and Polivy. With well-established synthesis routes and a favorable therapeutic index, MMAE continues to be a go-to payload. However, newer payloads like camptothecin and PBD dimers are also gaining clinical traction.

March 2025: Pfizer completed the acquisition of Seagen Inc., strengthening its position in the ADC market and gaining access to a rich pipeline including Tivdak and ladiratuzumab vedotin.

January 2025: Daiichi Sankyo and AstraZeneca announced updated positive data from the DESTINY-Breast06 trial, demonstrating strong efficacy of Enhertu in HER2-low metastatic breast cancer, likely expanding its label.

December 2024: ImmunoGen’s Elahere (mirvetuximab soravtansine) received full FDA approval for platinum-resistant ovarian cancer after showing improved survival rates.

November 2024: RemeGen received conditional approval in China for a novel HER2-targeted ADC, broadening the competitive landscape in Asia.

The following are the leading companies in the antibody drug Conjugates market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Antibody Drug Conjugates market.

By Application

By Product

By Target

By Technology

By Region