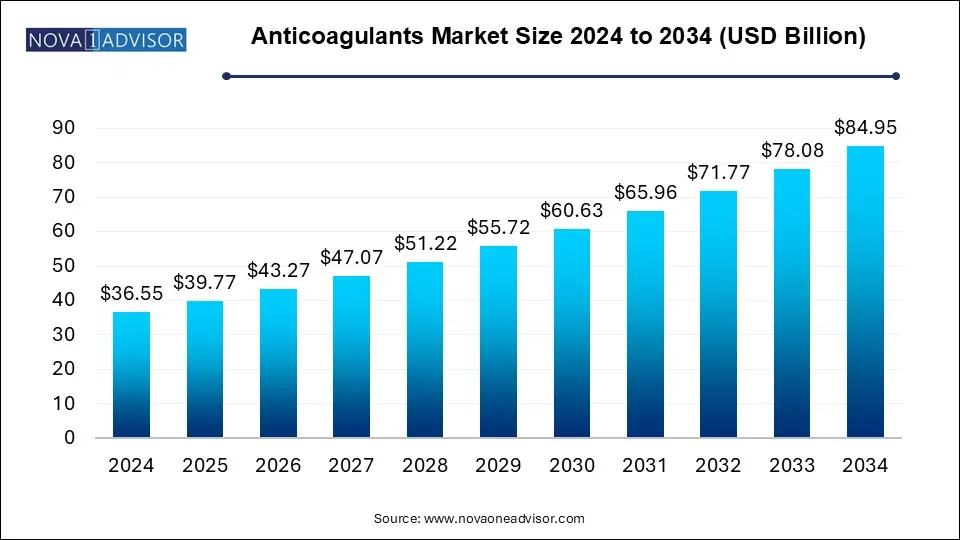

The anticoagulants market size accounted for USD 39.77 billion in 2025 and is forecasted to hit around USD 84.95 billion by 2034, representing a CAGR of 8.8% from 2025 to 2034. The demand for anticoagulants has increased due to increased cardiovascular health awareness, driving the anticoagulants market. The increased need for better blood thinners is driving demands for innovative anticoagulant therapies.

| Report Coverage | Details |

| Market Size in 2025 | USD 39.77 Billion |

| Market Size by 2034 | USD 84.95 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Drug Category, Route of Administration, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Aspen Holdings; Pfizer Inc.; Bristol-Myers Squibb Company; GSK plc; Sanofi, Bayer AG; Boehringer Ingelheim International GmbH; DAIICHI SANKYO COMPANY, LIMITED; Johnson & Johnson Services Inc.; Eisai Co., Ltd. |

The anticoagulants market refers to the global incidence of cardiovascular diseases such as vein thrombosis, pulmonary embolism, and atrial fibrillation, and medicines and therapies utilized to prevent these disorders. The market has witnessed transforming growth, driven by increased cardiovascular disease prevalence, an aging population, and improved healthcare infrastructure. Drawing focus on the development of innovative and advanced enterprises positively influencing the market. For instance, the adoption of novel oral anticoagulants (NOACs) has increased due to their improved educational safety profiles. Developments of new anticoagulants with improved safety and reduced risk of bleeding events and side effects, addressing emerging markets.

The aging population is the key factor contributing to the global anticoagulants market growth. The risk of cardiovascular disease is high among the aging population. Specific conditions like atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE) are more common in older adults. Also, the elderly population faces a high risk of chronic diseases like hypertension, diabetes, and kidney disease, further contributing to an increase in the risk of cardiovascular disease. The ongoing focus of pharmaceutical companies is to develop anticoagulants with more effectiveness and safety profiles for older adults, coupled with reduced risk of bleeding and balancing the advantages of anticoagulation.

The Increasing Adoption of Novel Oral Anticoagulants (NOACs), Presents Significant Growth Opportunities to the Anticoagulants Market

The Novel Oral Anticoagulants (NOACs) are an emerging class of anticoagulants, coupled with their improved efficacy and safety profile compared to conventional anticoagulants. Novel oral anticoagulants are convenient and easy to use, making them more popular. These anticoagulants reduce the risk of bleeding and make them ideal in indications of stroke prevention, deep vein thrombosis, and pulmonary embolism. The rising awareness of novel oral anticoagulants among healthcare professionals and patients contributes to increasing adoption. The increased burden of cardiovascular disease and rising focus on developing novel anticoagulants, including NOACs, are expected to open significant growth opportunities for the anticoagulants market to grow.

Bleeding complications Hinder the Adoption of Anticoagulants

Anticoagulants increase the risk of major bleeding and intracranial hemorrhage, which can cause life-threatening events. Elderly patients or patients with multiple health conditions are at high risk of bleeding complications. The limited availability of reversal agents for the anticoagulants makes it difficult to manage the bleeding events. These bleeding complications reduce the adoption of antibiotics, particularly for elderly patients. However, monitoring of patients on anticoagulants and the development of novel anticoagulants with improved safety profiles can help to reduce the risk of bleeding.

The novel oral anticoagulants (NOACs) segment dominated the market in 2024 due to increased demand for safer and more convenient anticoagulants. The increase in the incidence of cardiovascular diseases like atrial fibrillation, deep vein thrombosis, and pulmonary cardiovascular diseases like atrial fibrillation, deep vein thrombosis, and pulmonary embolism have driven demand for novel oral anticoagulants (NOACs).

The Heparin and Low Molecular Weight Heparin (LMWH) segment is anticipated to witness growth in the forecast period. These anticoagulants have a high efficacy and safety profile. Heparin and low molecular weight heparin are approved for a wide range of indications.

The oral anticoagulants segment generated the largest market share in 2024. Oral anticoagulants are convenient, efficacy, and safe compared to traditional anticoagulants. The convenient and easy-to-use nature of oral anticoagulants increases their popularity in the market.

The injectable anticoagulants segment is projected to contribute a significant market share in the forecast period due to its wide range of indications, including in the prevention and treatment of deep vein thrombosis, pulmonary embolism, and acute coronary syndrome. Quick and safe result of injectable anticoagulants drives the demand.

The atrial fibrillation/myocardial infarction (heart attack) segment leads the market with the highest market revenue share. The segment growth is attributed to the increased prevalence of stroke and other thromboembolic events in patients with AF. Ongoing R&D efforts to improve the efficacy and safety of anticoagulants are expected to develop advanced strategies for preventing and managing AF and MI in the upcoming period.

The Deep Vein Thrombosis (DVT) segment is anticipated to lead the market in the forecast period with a high prevalence of deep vein thrombosis and demand for drugs that prevent and treat blood clots, like novel oral anticoagulants (NOACs), driven by their high efficacy and safety profile.

North America dominates the global anticoagulants market due to the high prevalence of cardiovascular diseases, aging population, well-established healthcare expenditure, and strong regulatory framework in the region. The presence of key players and high investments in the research and development sector has a significant impact on market expansion. The increased research and development activities, particularly in novel oral anticoagulants (NOACs), provide innovative approaches to anticoagulant drugs.

The United States is leading the regional market. The country has a high prevalence of cardiovascular diseases such as atrial fibrillation, different atrial fibrillation, different thrombosis, and pulmonary embolism. High rate of obesity driving the prevalence of such disease. Additionally, increased spending on healthcare has a positive impact on market expansion.

Asia Pacific is anticipated to witness significant forecast growth. Factors like a rapidly aging population, increased healthcare expenditure, and a large patient population with cardiovascular diseases are driving demands for anticoagulants in the region. Growing awareness about CVDs and the importance of anticoagulation therapy, combined with the presence of strong regulatory frameworks play a crucial role in increasing market expansion. Additionally, the collaborative approaches between research institutes, universities, and pharmaceutical companies contribute to the innovation and development of novel anticoagulant medicines.

China leading the regional market, driven by a large patient pool and increased healthcare expenditure. China has witnessed high demand for Novel oral anticoagulants (NOACs). The increased focus on cost-effectiveness influences trends and strategies, driving innovation and development. Additionally, government and regulatory initiatives and investments for the R&D sector, to boost the anticoagulant market in the upcoming period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Anticoagulants Market

By Drug Category

By Route of Administration

By Application

By Geography