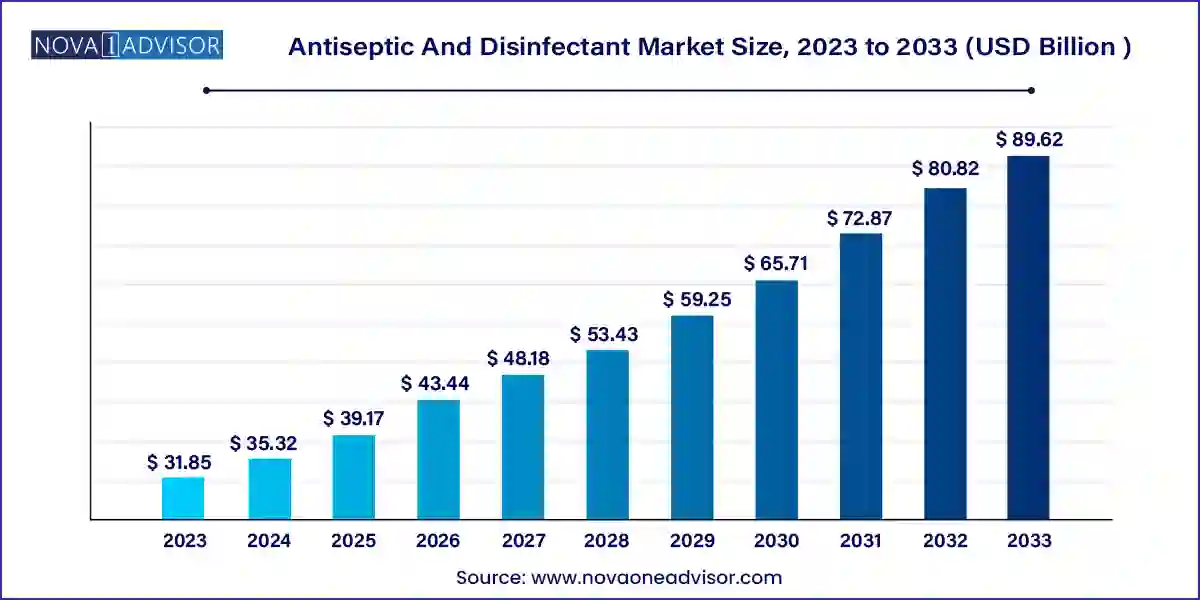

The global antiseptic and disinfectant market size was valued at USD 31.85 billion in 2023 and is anticipated to reach around USD 89.62 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033.

The antiseptic and disinfectant market represents a vital pillar in the global healthcare and hygiene ecosystem, with its applications spanning hospitals, commercial facilities, consumer households, and industrial environments. As agents used to kill or inhibit the growth of microorganisms on living tissues (antiseptics) and inanimate objects (disinfectants), these products are foundational to infection control and public health protocols.

The market has witnessed dynamic growth in the wake of the COVID-19 pandemic, which catapulted awareness about surface hygiene, hand sanitization, and preventive health measures to unprecedented levels. While the post-pandemic period has seen some stabilization, increased demand for institutional-grade disinfectants, antimicrobial hand sanitizers, and sterilization solutions remains intact across multiple sectors.

Healthcare-associated infections (HAIs), rising surgical procedures, increased awareness of zoonotic diseases, and global outbreaks of diseases such as avian flu and mpox continue to reinforce the relevance of antiseptic and disinfectant products. Stringent healthcare regulations, enhanced sanitation standards in food production, and the evolution of multi-drug-resistant bacteria further escalate the need for broad-spectrum disinfecting solutions.

Innovation in formulation (alcohol-free, biodegradable, or skin-sensitive antiseptics), convenience (wipes, sprays, foggers), and safety (non-toxic and non-corrosive products) is reshaping consumer and institutional preferences. The rising overlap between health, environment, and sustainability is also giving rise to eco-friendly disinfectants that address both infection control and green chemistry.

Eco-Friendly and Biodegradable Disinfectant Solutions: Consumer and institutional shift toward plant-based, non-toxic, and sustainable formulations is gaining momentum.

Rise of Disinfection-as-a-Service (DaaS): Facilities management and industrial cleaning services are increasingly bundling disinfection protocols with AI-based scheduling and tracking.

Increased Demand for Alcohol-Free Antiseptics: Alcohol-free solutions are being adopted in pediatrics, dermatology, and for sensitive environments such as ICUs.

Broad-Spectrum Antimicrobial Innovation: New disinfectants are being developed that target resistant pathogens like MRSA, CRE, and Clostridium difficile.

Automation in Disinfection: UV-C robots, electrostatic sprayers, and fogging devices are redefining industrial and hospital disinfection workflows.

Home Hygiene Elevation: Post-pandemic hygiene habits persist, with households continuing to use antiseptic wipes, sprays, and hand sanitizers daily.

Stringent Regulatory Landscape: Agencies like the U.S. EPA, FDA, and EU ECHA are mandating data-backed efficacy and environmental impact disclosures.

| Report Attribute | Details |

| Market Size in 2024 | USD 35.32 Billion |

| Market Size by 2033 | USD 89.62 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, product, sales channel, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | 3M; Reckitt Benckiser; Steris Plc; Kimberly-Clark Corporation; Bio-Cide International, Inc.; Cardinal Health; BD; Johnson & Johnson |

A key driver propelling the antiseptic and disinfectant market is the persistent and widespread challenge of healthcare-associated infections (HAIs). According to the CDC, approximately 1 in 31 hospital patients has at least one HAI on any given day in the United States alone. These infections not only increase patient morbidity and mortality but also significantly elevate treatment costs and hospital stays.

Hospitals, clinics, and long-term care facilities are under increasing regulatory pressure to adopt stringent hygiene protocols. The demand for surgical site antiseptics, hard surface disinfectants, and hand sanitizers is deeply embedded in daily clinical workflows. Moreover, the rise of antimicrobial-resistant bacteria (e.g., MRSA, CRE) necessitates the use of more powerful, targeted, and fast-acting disinfectants.

Companies like Ecolab and 3M are addressing this demand by developing high-efficacy surface disinfectants and hand hygiene solutions tailored for operating rooms, ICU settings, and isolation wards. The implementation of hospital infection prevention strategies worldwide directly correlates with the sustained growth in this market.

One of the significant restraints in the antiseptic and disinfectant market lies in the potential environmental and human health hazards posed by chemical-based products. Common active ingredients like quaternary ammonium compounds (quats), chlorine compounds, and aldehydes can be corrosive, cause skin irritation, or release volatile organic compounds (VOCs).

Regulatory agencies in North America and Europe are placing tighter controls on permissible concentrations, labelling requirements, and wastewater impact, which restricts product formulations and marketing claims. Growing consumer awareness about "chemical overload" and antimicrobial resistance further dampens enthusiasm for harsh disinfectants, particularly in home and food-related environments.

This has led to a complex market scenario where companies must balance antimicrobial efficacy with safety, sustainability, and regulatory compliance—often at the cost of higher R&D investments and longer go-to-market cycles.

A rapidly growing opportunity lies in the expansion of antiseptic and disinfectant usage beyond healthcare into public, industrial, and residential infrastructure, particularly in developing economies. As urbanization accelerates, public transport systems, educational institutions, gyms, airports, and malls are being upgraded with hygiene-first policies.

The hospitality and food industries are adopting hygiene certifications and upgrading protocols in response to traveler safety concerns. Similarly, schools and childcare centers are institutionalizing disinfection routines as part of wellness policies. In countries like India, Brazil, and Indonesia, national sanitation missions are driving demand for bulk and automated disinfectant solutions in public washrooms, transport hubs, and community centers.

Emerging market governments are also subsidizing infection control programs in rural healthcare facilities. This broad-based infrastructural hygiene expansion creates long-term, recurring demand for both B2B and FMCG disinfectant formats.

Quaternary Ammonium Compounds (QACs) dominate the antiseptic and disinfectant market, primarily due to their broad-spectrum efficacy, relatively low toxicity, and cost-effectiveness. QACs are used in surface disinfectants, instrument sterilants, and even some skin antiseptics in hospital and non-healthcare settings. Their ability to target both gram-positive and gram-negative bacteria, fungi, and enveloped viruses makes them a go-to ingredient across sectors.

However, Alcohols & Aldehyde Products are the fastest-growing segment, especially ethanol-based and isopropyl alcohol-based hand sanitizers and pre-surgical scrubs. Their fast-acting nature and superior virucidal capabilities—especially against enveloped viruses like SARS-CoV-2—have fueled demand in hospitals, airports, and homes alike. Growth is also supported by alcohol’s adaptability into wipes, sprays, and foam formulations that offer convenient application.

Surface Disinfectants hold the largest share, used extensively in hospitals, food processing plants, schools, offices, and homes. Their widespread utility in sanitizing high-touch areas such as door handles, countertops, railings, and medical equipment ensures consistent demand. Companies such as Clorox and Reckitt Benckiser have seen surging sales of surface disinfectant wipes and sprays since the pandemic era.

Medical Device Disinfectants are the fastest-growing product category, driven by increased surgical procedures, sterilization protocol upgrades, and regulatory compliance. High-level disinfectants (HLDs) and low-temperature sterilants are essential in endoscope and surgical instrument reprocessing. With the rise of minimally invasive and robotic surgeries, precision cleaning is more crucial than ever, spurring demand for aldehyde-free and enzyme-compatible formulations.

B2B channels dominate the market, accounting for a major portion of bulk disinfectant sales to hospitals, hotels, manufacturing facilities, and public institutions. This includes long-term supply contracts and customized formulation services offered by companies like Ecolab and Steris. Automated ordering, cloud-based tracking, and tailored on-site services are enhancing efficiency and loyalty in B2B sales.

FMCG channels are the fastest-growing segment, especially with the expansion of retail disinfectant brands into e-commerce platforms and modern trade stores. The surge in home hygiene awareness has led companies to scale up consumer-facing product lines including multi-surface sprays, disinfectant liquids, and personal hygiene antiseptics. Global players like Johnson & Johnson, Procter & Gamble, and GOJO Industries continue to diversify their retail offerings.

Hospitals dominate the antiseptic and disinfectant market, driven by infection prevention requirements in surgical suites, ICUs, maternity wards, and outpatient departments. From hard surface disinfectants to antiseptic hand scrubs and instrument sterilants, hospitals remain the largest volume consumers across all geographies. Public health funding and compliance mandates sustain ongoing demand.

Clinics and ambulatory centers represent the fastest-growing segment, fueled by decentralized care delivery, expanding primary health infrastructure, and outpatient surgical services. As patient flow increases outside major hospitals, these facilities are prioritizing infection control and investing in high-quality, ready-to-use disinfectant products for staff and patient safety.

North America remains the largest market, driven by mature healthcare infrastructure, regulatory mandates, and strong institutional hygiene culture. The presence of major players like Ecolab, 3M, GOJO, and Clorox ensures product availability and innovation. Stringent FDA and EPA regulations promote continuous R&D in formulation efficacy and safety.

The U.S. healthcare sector’s robust infection prevention protocols, particularly in operating rooms and intensive care units, support high-volume usage. Additionally, awareness campaigns during and post-COVID have elevated public hygiene behavior, boosting retail segment growth.

Asia-Pacific is the fastest-growing region, with high potential in healthcare expansion, urban sanitation, and personal hygiene adoption. Countries like China and India are investing in public health facilities, while Southeast Asia sees rising demand from hospitality and tourism sectors. The growth of the middle class and increased spending on personal care are also fueling retail disinfectant sales.

Domestic manufacturers in India, Japan, and South Korea are partnering with multinational corporations to localize production, while e-commerce platforms are rapidly penetrating tier-2 and tier-3 cities with antiseptic product portfolios. The “Swachh Bharat” mission in India and similar hygiene campaigns in ASEAN countries are reshaping market dynamics in favor of long-term growth.

By Type

By Product

By Sales Channel

By End-use

By Region