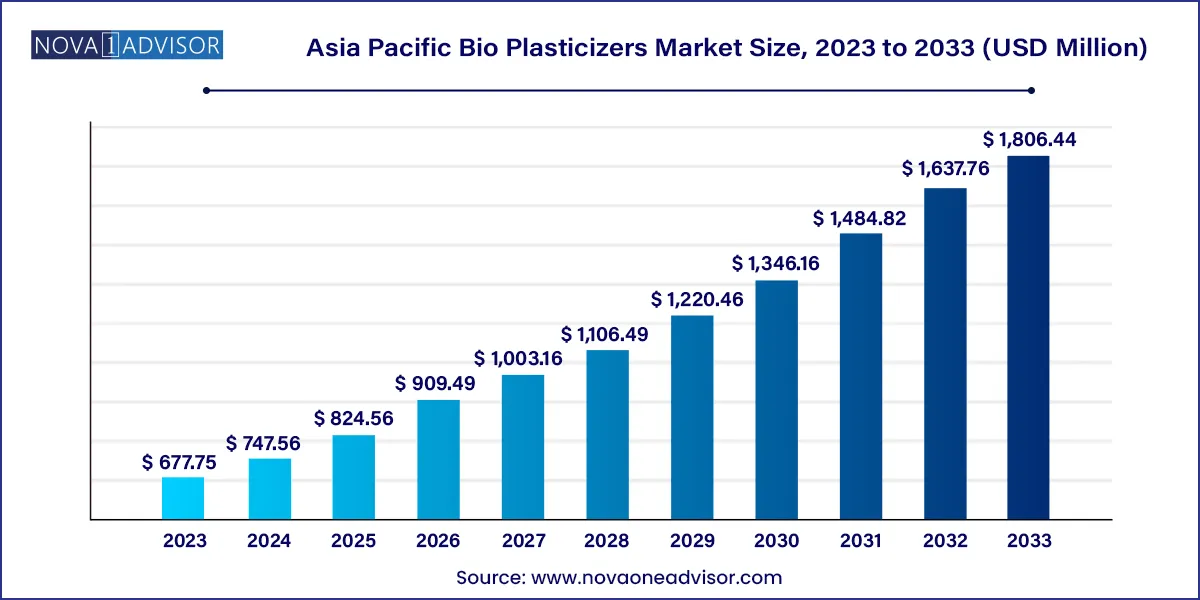

The Asia Pacific bio plasticizers market size was exhibited at USD 677.75 million in 2023 and is projected to hit around USD 1,806.44 million by 2033, growing at a CAGR of 10.3% during the forecast period 2024 to 2033.

The Asia Pacific Bio Plasticizers Market is experiencing a robust transformation driven by the region’s accelerating push toward sustainable materials, industrial innovation, and regulatory reforms targeting conventional phthalate-based plasticizers. Bio plasticizers are environmentally friendly compounds derived from renewable resources such as vegetable oils (e.g., soybean, castor), citric acid, and succinic acid, and are used to enhance the flexibility, durability, and longevity of polymer materials, particularly polyvinyl chloride (PVC) and other plastics.

Asia Pacific is one of the most dynamic markets for plastic and polymer-based applications ranging from packaging and automotive components to construction materials and consumer electronics. With rising environmental awareness, increased adoption of green building standards, and mounting pressure from global buyers on sustainability compliance, manufacturers across China, India, Japan, and Southeast Asia are shifting toward bio-based alternatives to traditional plasticizers.

The rapid growth of e-commerce, food packaging, automotive production, and textile innovation further amplifies demand for performance-enhancing additives that are safe, biodegradable, and non-toxic. Unlike conventional plasticizers such as DEHP and DBP known for their environmental persistence and potential health risks bio plasticizers offer a non-toxic and often biodegradable profile, appealing to brands and regulators alike.

This trend aligns strongly with Asia Pacific's position as a global manufacturing hub and a region increasingly concerned with ESG standards, green procurement policies, and circular economy initiatives.

Phthalate-Free Material Legislation: Several countries, particularly China, Japan, and South Korea, are tightening restrictions on conventional plasticizers in sensitive applications such as toys, food packaging, and medical devices.

Rapid Industrial Adoption of ESBO and Citrates: Epoxidized soybean oil and citrates are gaining popularity for their balance of performance, cost, and renewability in packaging and construction.

Growth in Automotive Lightweighting Initiatives: Automakers in the region are using bio plasticizers to produce lighter, more flexible interiors, trims, and wiring insulation.

Surging Investment in Bioplastics R&D: Academic institutions and chemical giants in India and China are heavily investing in bio-based polymer formulations, including plant-based plasticizer additives.

Boom in Green Construction Materials: Bio plasticizers are being used in green PVC flooring, waterproofing membranes, sealants, and wall coverings as part of smart infrastructure projects.

Strategic Collaborations Between Agri-Bio and Chemical Industries: Partnerships between agriculture-based processors and chemical firms are emerging to secure raw material supply chains for bio plasticizer manufacturing.

Consumer Push for Non-Toxic Goods: A shift in consumer preference for safe, phthalate-free products is fueling market demand in personal care, children’s toys, and packaging.

| Report Coverage | Details |

| Market Size in 2024 | USD 747.56 Million |

| Market Size by 2033 | USD 1,806.44 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China; India; Japan; South Korea; Indonesia; Thailand |

| Key Companies Profiled | DIC Corporation; Zhejiangjiaao Enprotech Stock Co., Ltd.; Aekyung Chemical; JiangXi East Huge Dragon Chemical co.,ltd; Hebei Jingu Plasticizer Co. Ltd.; UPC Technology Corp.; Toling Corporation (m) sdn bhd; KLJ GROUP; Hanwha Chemical; Cargill Inc.; Avient Corporation. |

A powerful driver of the Asia Pacific bio plasticizers market is the regulatory push to eliminate hazardous phthalates and the rise of sustainability mandates across consumer and industrial sectors. With studies linking traditional phthalates to environmental and health concerns ranging from hormone disruption to plastic leaching the region is undergoing a strategic policy shift favoring eco-safe additives.

Countries like China have implemented national standards limiting phthalates in food-contact and children’s products, while Japan has adopted Green Procurement Laws promoting eco-friendly material sourcing. Similarly, India’s BIS (Bureau of Indian Standards) has endorsed non-phthalate alternatives in PVC applications.

In response, industries are embracing bio-based plasticizers derived from soybean oil, citric acid, and succinic acid as safer substitutes that meet both performance and regulatory requirements. These alternatives not only reduce dependence on fossil fuels but also align with corporate sustainability goals and export standards demanded by Europe and North America, enhancing the market's momentum.

Despite their advantages, bio plasticizers face a critical barrier in the form of higher production costs and a constrained raw material supply chain. Compared to their synthetic counterparts, bio-based alternatives often involve expensive processing, seasonal feedstock availability, and fluctuating crop yields, particularly for inputs like soybean oil, castor oil, and succinic acid.

The cost difference between bio plasticizers and traditional phthalates can be substantial, discouraging adoption in price-sensitive applications like low-end construction materials, commodity packaging, or mass-market consumer goods. In addition, supply chain instability caused by agricultural volatility, climate events, or geopolitical issues can disrupt the flow of feedstock, impacting manufacturing consistency.

Although regional governments are investing in agri-based value chains and subsidies, the current dependency on imported bio-feedstocks or limited regional processors still hampers widespread scalability. This constraint is especially evident in fast-growing economies like Indonesia and Thailand, where demand outpaces local raw material availability.

A significant opportunity for the Asia Pacific bio plasticizers market lies in the explosive growth of e-commerce and demand for flexible, eco-friendly packaging materials. As online shopping and direct-to-consumer (D2C) brands proliferate across China, India, and Southeast Asia, there is rising demand for customizable, recyclable, and safe packaging films and laminates that use bio plasticizers to enhance flexibility and barrier properties.

Flex-pack converters are increasingly switching to non-phthalate solutions to meet export requirements and brand mandates that prioritize sustainability. Bio-based citrates and epoxidized soybean oil are proving highly effective in PVC and biopolymer-based films used for food wraps, personal care pouches, and electronic packaging.

Additionally, the emergence of biodegradable and compostable plastics—such as PLA and PHA—further boosts the use of compatible bio plasticizers that preserve mechanical strength while enabling end-of-life recyclability. This convergence of e-commerce growth and circular packaging innovation offers a lucrative expansion path for bio plasticizer manufacturers.

Packaging materials emerged as the dominant application, given the region's leadership in food processing, consumer electronics, and industrial goods. Bio plasticizers improve the pliability and barrier properties of films, laminates, and containers used in everything from snacks and bottled beverages to electronics blister packs. Regulatory pressure to phase out phthalates in food-contact materials has accelerated the adoption of bio-based plasticizers in PVC cling films and PET packaging, especially among exporters to Europe and the U.S.

Automotive & transport is the fastest-growing application, propelled by the shift toward lightweight, sustainable interiors and insulation components. Bio plasticizers are increasingly being used in door trims, under-the-hood insulation, seat covers, and wiring harnesses, replacing DEHP and DINP. Japanese and Korean automakers are leading in green material R&D, while Indian EV startups are adopting bio-plasticizer-enhanced components to align with sustainable mobility goals. The automotive industry’s movement toward zero-waste factories and LCA-based sourcing is further bolstering demand.

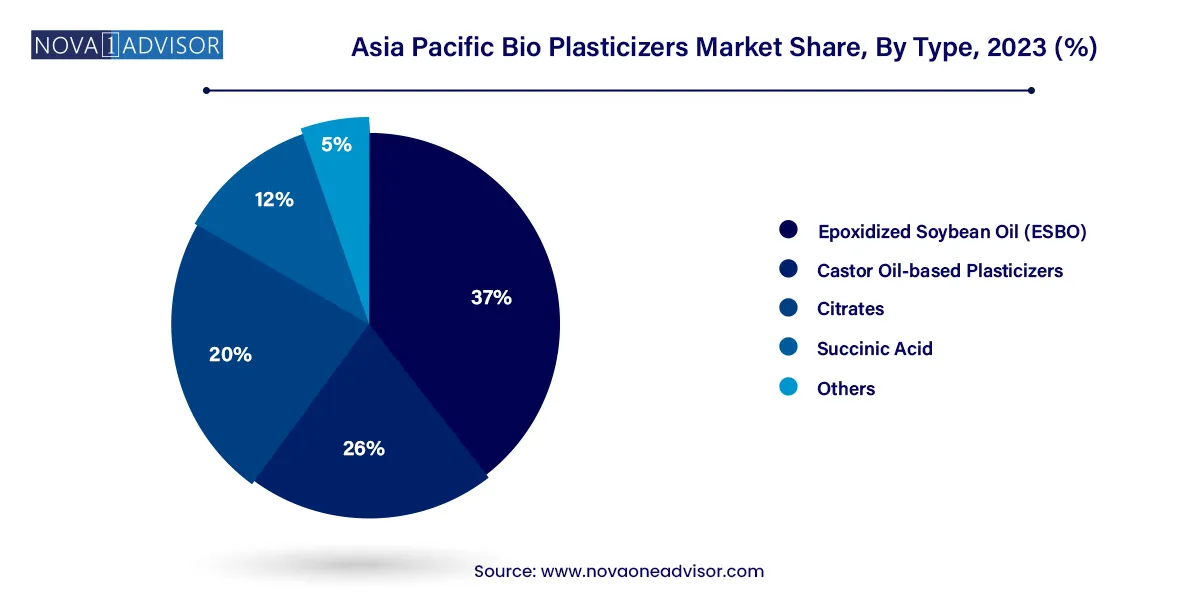

Epoxidized Soybean Oil (ESBO) dominated the type segment, primarily due to its cost-efficiency, wide applicability in PVC-based products, and status as a safe, FDA-approved additive. ESBO is commonly used in the production of films, sheets, tubes, and toys, where it imparts superior flexibility and thermal stability. Its agricultural origin also aligns well with sustainability narratives and regional circular economy goals. Countries like China and India are investing in soybean oil processing to ensure domestic supply for ESBO production.

Citrates are the fastest-growing bio plasticizer type, fueled by their high compatibility with food-grade materials, non-toxic profile, and rising demand in flexible packaging and consumer goods. Citrates such as triethyl citrate (TEC) and tributyl citrate (TBC) offer excellent cold resistance and are increasingly being used in cosmetics, pharmaceuticals, and biodegradable films. The versatility of citrates across rigid and flexible polymers, especially in regulated sectors, is driving rapid adoption across Southeast Asian markets and Japan.

China dominates the Asia Pacific bio plasticizers market, both as a producer and consumer. The government’s dual carbon policy (carbon peak by 2030, carbon neutrality by 2060) is a major push behind the adoption of sustainable materials. China’s expansive plastic manufacturing base, coupled with strict regulations on phthalates in toys, medical devices, and packaging, positions the country as a volume leader in ESBO and citrate consumption. Local companies are also investing in bio-feedstock processing and proprietary bio-additive formulations.

India is the fastest-growing market, driven by government policies such as “Make in India”, the Plastic Waste Management Rules, and a ban on select single-use plastics. The food and beverage industry is rapidly adopting phthalate-free, recyclable packaging using bio plasticizers, especially for export compliance. India is also witnessing rising investments in castor and soy-based chemical processing, opening opportunities for domestic production of citrates and ESBO. The construction and automotive industries are likewise experimenting with bio plasticizer-enhanced PVC flooring, wall panels, and car interiors.

Both nations are early adopters of green materials, with well-established chemical sectors focusing on R&D-driven innovations. Japanese firms are leading in citrate-based formulations for cosmetics and pharma, while Korean conglomerates are scaling bio-based PVC applications in smart cities and high-speed rail projects. Their stringent eco-labeling laws and end-of-life material mandates create a stable regulatory environment for bio plasticizer growth.

In March 2025, Mitsubishi Chemical Group announced a new bioplasticizer formulation based on renewable succinic acid, targeting applications in green construction and automotive wiring.

KLJ Group India expanded its ESBO production capacity in January 2025, citing rising demand from flexible packaging converters in South Asia and the Middle East.

LG Chem (South Korea) introduced a citrate-based plasticizer line in December 2024, developed for application in medical-grade and food-safe plastics, following successful FDA certification.

In November 2024, China’s Sinochem Group announced a joint venture with a soy processing cooperative to secure bio-feedstock for industrial-scale ESBO production.

Tata Chemicals (India) launched a green plasticizer innovation lab in Mumbai in October 2024, aimed at developing castor oil-based compounds for domestic and export use.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific bio plasticizers market

Type

Application

Country