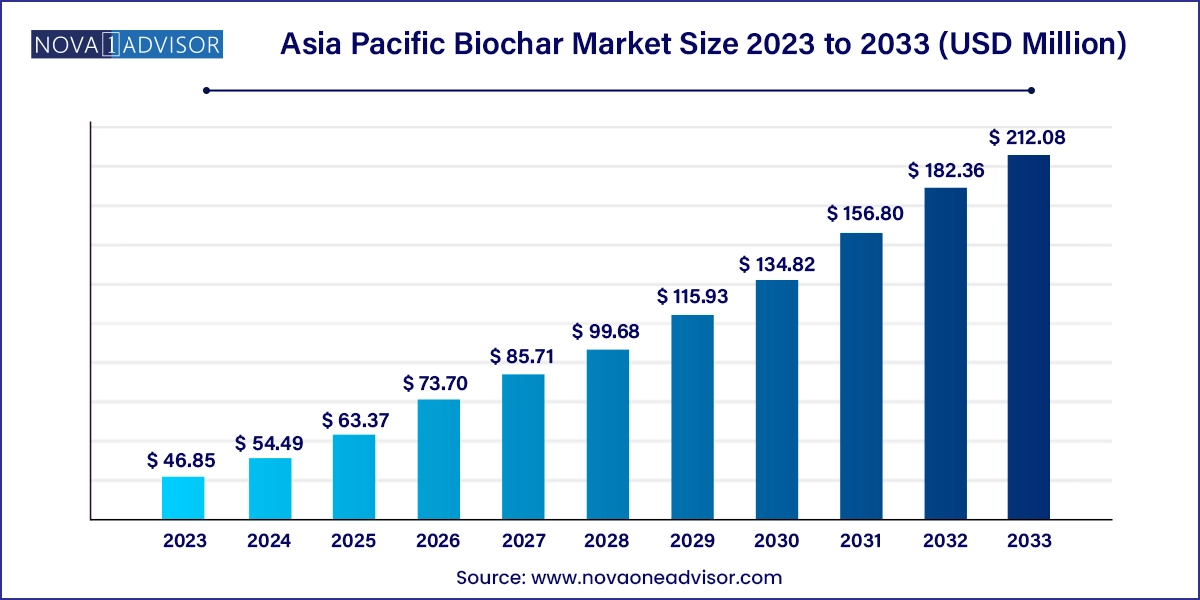

The Asia Pacific biochar market size was exhibited at USD 46.85 million in 2023 and is projected to hit around USD 212.08 million by 2033, growing at a CAGR of 16.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 54.49 Million |

| Market Size by 2033 | USD 212.08 Million |

| Growth Rate From 2024 to 2033 | CAGR of 16.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Australia, China, India, Japan, Malaysia and RoAPAC |

| Key Companies Profiled | Pacific Biochar; Airex Energy; Arsta Eco; Carbon Gold; Biochar Products, Inc.; Carbofex; Biochar Supreme, LLC; Bio Energy Earth Systems; Farm2energy |

Increasing demand for organic products like organic pulses in the market is driving the market growth. Biochar helps improve soil health and crop yields without using synthetic fertilizers. As soil degradation severely threatens agricultural productivity; biochar improves soil health by enhancing water retention, promoting beneficial microbial activity, and reducing nutrient leaching. Ongoing research and development on biochar production methods and optimizing its applications for different soil types propel the market forward. Biochar production utilizes organic waste materials such as crop residues and manure and helps in waste management.

Biochar is used to remove pollutants like heavy metals, organic toxins, and pharmaceuticals from wastewater, industrial effluents, and even drinking water sources. In March 2023, PepsiCo India extended its biochar initiative to help farmers in Punjab, through its pilot crop program the company found a potential solution to address the issue of stubble burning of crops. Through this initiative, the company will help farmers to better manage their harvest residue using a process called pyrolysis which will give biochar fertilizer.

The regulatory bodies in the region are taking initiative to promote the use of biochar. In December 2023, the Indian government announced a task force to explore the use of biochar in steel industry to reduce carbon emissions. In addition, the India Biochar and Bioresources Network (IBBN) initiated a project in Byrkuru, Kolar, to promote the use of bioresources & biochar in India.

Based on technology, the pyrolysis segment dominated the market with the largest revenue share of 30.60% in 2023 and is expected to retain its dominance over the forecast period. The rise in demand for renewable energy and increased environmental awareness is driving segment growth. Pyrolysis uses thermal decomposition of organic waste and offers biochar with higher content of carbon.

The ‘others’ segment is expected to grow at the fastest growing CAGR over the forecast year. New technologies emerging in the production of biochar such as hydrothermal carbonization offer greater control over properties of final biochar product. Hydrothermal carbonization can handle wet biomass feedstocks efficiently which allows efficient use of food waste, sewage sludge, and other high moisture organic materials for biochar production.

The agriculture segment dominated the market with the largest revenue share in 2023. The market is driven by biochar's ability to improve soil health, reduce the need for fertilizers, and sequester carbon, which helps combat climate change. Additionally, converting agricultural waste into biochar offers a sustainable waste management solution. Technological advancements and growing awareness among farmers contribute to its popularity in sustainable farming practices.

The ‘others’ segment is expected to grow at the fastest growing CAGR over the forecast period. Biochar has applications beyond agriculture, and it is used in water treatment plants for removal of heavy metals due to its ability to absorb contaminants. Biochar is used in waste management of organic waste and helps lower carbon emissions, and therefore the others segment is expected to grow rapidly in the coming years.

Australia Biochar Market Trends

Australia biochar market held the largest revenue share in the region in 2023. Growing demand for biochar is rising due to its agricultural benefits, climate change mitigation potential, waste conversion capabilities, and support from government policies. Increasing awareness about environmental sustainability, financial incentives like carbon credits, and ongoing research and innovation further fuel its popularity across various sectors. In August 2020, researchers from the University of Western Australia’s Institute of Agriculture found that mixed application of zinc and biochar could help mitigate stress in wheat caused by heavy metal cadmium. The study showed that adding mixed zinc and biochar to cadmium contaminated soil improved both soil yield and zinc grain concentration.

Malaysia Biochar Market Trends

Malaysia is anticipated to grow at the fastest CAGR during the forecast period. The growth of biochar is driven by its properties in improving agriculture, managing palm oil industry waste, aligning with environmental policies, combating climate change, handling forestry residues, and supporting urban sustainability efforts. In October 2022, Patriot Hydrogen announced expansion in Southeast Asia. The company announced a project in Malaysia for production of renewable energy, biochar and H2 across the country. The project will focus on biochar production through gasification methods to address the shortage of biochar in the country.

closed Pre-Series A funding round securing total investment of USD 5 million.Capital Code, Singapore-based climate-focused and agri-food investment firm, led the funding round. ACM will use the funding to roll out new projects in Philippines, India and other countries to develop other climate change technologies from syngas produced during the pyrolysis process.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific biochar market

Technology

Asia Pacific Biochar Application

Asia Pacific Biochar Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Asia Pacific Biochar Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Distribution Channel Analysis

3.2.2. Raw Material Trends

3.2.3. Technological Overview

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Asia Pacific Biochar Market: Technology Estimates & Trend Analysis

4.1. Technology Movement Analysis & Market Share, 2024 & 2033

4.2. Biochar Market Estimates & Forecast, By Technology, 2021 to 2033 (Kilo Tons) (USD Million)

4.3. Pyrolysis

4.3.1. Pyrolysis Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

4.4. Gasification

4.4.1. Gasification Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

4.5. Other Technology

4.5.1. Other Technology Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

Chapter 5. Asia Pacific Biochar Market: Application Estimates & Trend Analysis

5.1. Application Movement Analysis & Market Share, 2024 & 2033

5.2. Asia Pacific Biochar Market Estimates & Forecast, By Application, 2021 to 2033 (Kilo Tons) (USD Million)

5.3. Agriculture

5.3.1. Agriculture Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

5.3.1.1. Farming

5.3.1.1.1. Farming Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

5.3.1.2. Livestock

5.3.1.2.1. Livestock Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

5.3.1.3. Others

5.3.1.3.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

5.4. Other Applications

5.4.1. Other Applications Market Revenue Estimates and Forecasts, 2021 - 2033 (Kilo Tons) (USD Million)

Chapter 6. Asia Pacific Biochar Market: Country Estimates & Trend Analysis

6.1. Country Movement Analysis & Market Share, 2024 & 2033

6.2. Asia Pacific

6.2.1. Asia Pacific Chemical Market Estimates & Forecast, 2021 - 2033 (Kilo Tons) (USD Million)

6.2.2. China

6.2.2.1. Key country dynamics

6.2.2.2. China biochar market estimates & forecast, 2021 - 2033 (Kilo Tons) (USD Million)

6.2.3. Japan

6.2.3.1. Key country dynamics

6.2.3.2. Japan biochar market estimates & forecast, 2021 - 2033 (Kilo Tons) (USD Million)

6.2.4. India

6.2.4.1. Key country dynamics

6.2.4.2. India biochar market estimates & forecast, 2021 - 2033 (Kilo Tons) (USD Million)

6.2.5. Malaysia

6.2.5.1. Key country dynamics

6.2.5.2. Malaysia biochar market estimates & forecast, 2021 - 2033 (Kilo Tons) (USD Million)

6.2.6. Australia

6.2.6.1. Key country dynamics

6.2.6.2. Australia biochar market estimates & forecast, 2021 - 2033 (Kilo Tons) (USD Million)

Chapter 7. Asia Pacific Biochar Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map/Position Analysis, 2024

7.4. Strategy Mapping

7.4.1. Expansion

7.4.2. Mergers & Acquisition

7.4.3. Partnerships & Collaborations

7.4.4. New Product Launches

7.4.5. Research And Development

7.5. Company Profiles

7.5.1. Biochar Products, Inc.

7.5.1.1. Participant’s overview

7.5.1.2. Financial performance

7.5.1.3. Product benchmarking

7.5.1.4. Recent developments

7.5.2. Biochar Supreme, LLC

7.5.2.1. Participant’s overview

7.5.2.2. Financial performance

7.5.2.3. Product benchmarking

7.5.2.4. Recent developments

7.5.3. ArSta Eco

7.5.3.1. Participant’s overview

7.5.3.2. Financial performance

7.5.3.3. Product benchmarking

7.5.3.4. Recent developments

7.5.4. Carbon Gold Ltd

7.5.4.1. Participant’s overview

7.5.4.2. Financial performance

7.5.4.3. Product benchmarking

7.5.4.4. Recent developments

7.5.5. Airex Energy Inc.

7.5.5.1. Participant’s overview

7.5.5.2. Financial performance

7.5.5.3. Product benchmarking

7.5.5.4. Recent developments

7.5.6. Pacific Biochar Benefit Corporation

7.5.6.1. Participant’s overview

7.5.6.2. Financial performance

7.5.6.3. Product benchmarking

7.5.6.4. Recent developments

7.5.7. Biochar Ireland

7.5.7.1. Participant’s overview

7.5.7.2. Financial performance

7.5.7.3. Product benchmarking

7.5.7.4. Recent developments

7.5.8. Swiss Biochar GmbH

7.5.8.1. Participant’s overview

7.5.8.2. Financial performance

7.5.8.3. Product benchmarking

7.5.8.4. Recent developments

7.5.9. Sonnenerde GmbH

7.5.9.1. Participant’s overview

7.5.9.2. Financial performance

7.5.9.3. Product benchmarking

7.5.9.4. Recent developments

7.5.10. De Pyro power

7.5.10.1. Participant’s overview

7.5.10.2. Financial performance

7.5.10.3. Product benchmarking

7.5.10.4. Recent developments

7.5.11. Stiesdal

7.5.11.1. Participant’s overview

7.5.11.2. Financial performance

7.5.11.3. Product benchmarking

7.5.11.4. Recent developments

7.5.12. Novocarbo

7.5.12.1. Participant’s overview

7.5.12.2. Financial performance

7.5.12.3. Product benchmarking

7.5.12.4. Recent developments