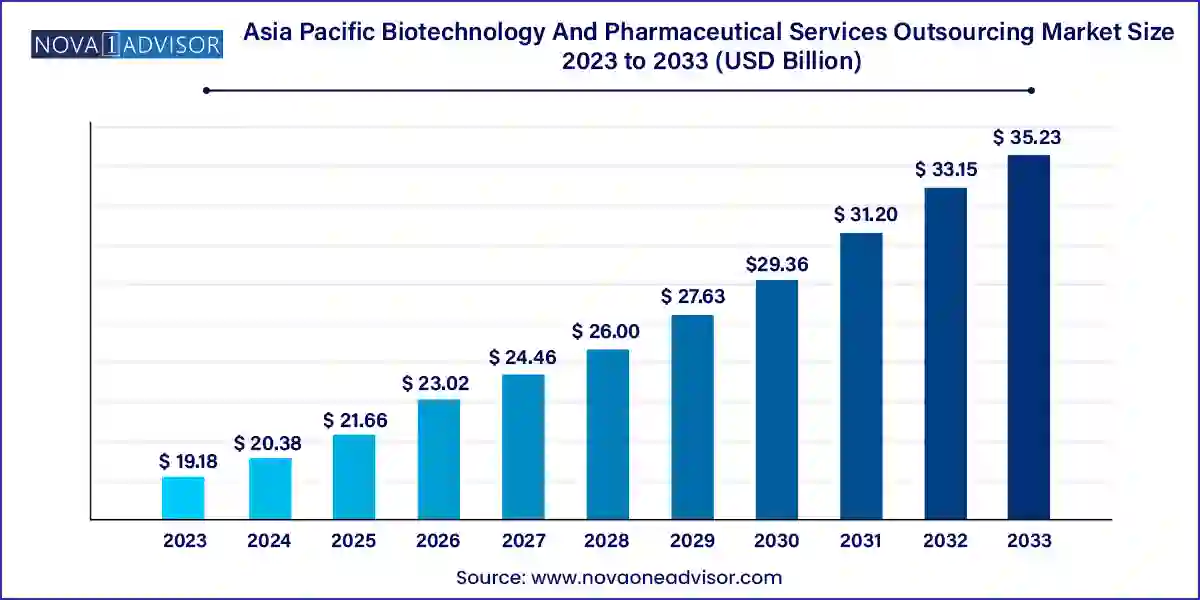

The Asia Pacific biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 19.18 billion in 2023 and is projected to hit around USD 35.23 billion by 2033, growing at a CAGR of 6.27% during the forecast period 2024 to 2033.

The Asia Pacific biotechnology and pharmaceutical services outsourcing market has undergone a remarkable transformation in recent years. With the convergence of innovation, cost competitiveness, regulatory evolution, and rising demand for biopharmaceuticals, the region has emerged as a vital hub for outsourced pharmaceutical and biotechnology services. The outsourcing market in Asia Pacific encompasses a wide spectrum of contract-based services including regulatory affairs, clinical trial management, consulting, product design and development, auditing, and post-marketing surveillance. These services are provided to both pharmaceutical and biotechnology companies to optimize costs, access specialized expertise, and expedite drug development timelines.

The growing complexity of drug development processes, coupled with a surge in biologics and personalized therapies, is pushing pharmaceutical and biotech companies to outsource non-core activities to Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and specialized service providers. Countries such as China, India, Japan, and South Korea have become strategic locations for outsourcing due to their mature infrastructure, expanding talent pool, and proactive government policies. Moreover, rising investment from multinational firms, regulatory harmonization, and an influx of clinical trials have significantly boosted the market dynamics across the region.

As the need for speed, agility, and compliance continues to escalate in the post-pandemic healthcare ecosystem, Asia Pacific remains uniquely positioned to serve global outsourcing demands. Key market players such as WuXi AppTec, ICON, IQVIA, Parexel, Pharmaron, Syneos Health, and Charles River Laboratories are increasingly expanding their footprint across the region, while regional service providers are also maturing in capabilities and scale.

Surge in oncology and rare disease clinical trials across Asia Pacific: Rising disease burden and patient recruitment ease are driving outsourcing of trials in oncology, CNS, and genetic diseases.

Increased penetration of decentralized and virtual clinical trials: Remote monitoring, digital health platforms, and AI-based patient recruitment are revolutionizing trial management.

Growth of regulatory consulting and submissions services: Companies are relying on local expertise to navigate country-specific regulatory frameworks across APAC markets.

Strategic collaborations and partnerships with regional CROs: Global pharmaceutical companies are forming long-term outsourcing partnerships with Asia-based CROs for cost and speed advantages.

Expansion of full-service CDMOs across China and India: End-to-end services including formulation, process development, and commercial manufacturing are in high demand.

Emphasis on quality management systems and GxP compliance consulting: The complexity of global compliance requirements is driving demand for specialized auditing and QMS services.

Training and knowledge transfer programs across Asia: Upskilling the local workforce through customized training is increasingly part of service packages offered by outsourcing providers.

| Report Coverage | Details |

| Market Size in 2024 | USD 20.38 Billion |

| Market Size by 2033 | USD 35.23 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.27% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | End-use, Service, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | China; India; Japan; Australia; South Korea; Thailand |

| Key Companies Profiled | Dr. Reddy’s Laboratories; MSN Laboratories; Syngene International Ltd.; Aragen Life Sciences Ltd.; Bellen; Arlak Biotech Pvt. Ltd.; Gracure Pharmaceuticals Ltd.; Nvron Life Science |

A primary driver of the Asia Pacific biotechnology and pharmaceutical services outsourcing market is the rising cost pressure faced by global pharmaceutical companies. The traditional drug development model is both time-intensive and capital-heavy, with the average cost of bringing a new drug to market often exceeding $2 billion. Given this landscape, outsourcing to Asia Pacific provides an economically viable alternative without compromising on quality, speed, or innovation.

Companies can leverage a skilled workforce at a fraction of Western labor costs, benefit from operational efficiencies, and expedite time-to-market through streamlined regulatory pathways in countries such as India and China. Additionally, the region offers access to large patient pools for clinical trials, high patient retention rates, and fewer regulatory bottlenecks in early-phase studies. Outsourcing services such as clinical development, regulatory affairs, and quality assurance allow innovators to focus on core R&D, while experienced local CROs and CDMOs manage the execution with precision and compliance.

Despite the growth momentum, regulatory fragmentation across Asia Pacific continues to hinder seamless outsourcing. Each country maintains its own regulatory framework, timelines, and documentation standards for drug approvals, clinical trials, and GxP compliance. For example, while Japan’s PMDA operates under a stringent review system with high expectations for data quality, China’s NMPA has its own unique approval processes that differ significantly from India’s CDSCO.

This lack of harmonization forces service providers and clients to customize strategies for each market, leading to increased operational complexity and potential delays. Moreover, concerns around data integrity, especially in clinical trials and manufacturing, continue to be flagged by Western regulators such as the FDA and EMA. Companies operating in or outsourcing to the region must invest heavily in training, auditing, and documentation systems to ensure global compliance an area where smaller providers may struggle due to limited resources and experience.

A transformative opportunity for the Asia Pacific outsourcing market lies in the region's growing adoption of biologics and personalized medicine. The demand for targeted therapies, gene therapies, mRNA vaccines, and biosimilars is exploding, and so is the need for specialized services to support their development, testing, and regulatory approval. With rising investment in genomics, bioinformatics, and cell and gene therapy platforms, outsourcing providers in the region are stepping up to offer expertise in assay development, companion diagnostics, and biomarker-driven clinical trials.

For example, China's BGI Genomics and India’s Syngene are building capabilities in personalized diagnostics, while AGC Biologics and WuXi Biologics are expanding facilities for large-scale biologics manufacturing. These service providers are offering consulting, regulatory, and clinical development services tailored to biologics and complex therapies. As Western biotech firms look to enter emerging APAC markets, they increasingly rely on regional partners who understand local patient populations, pricing sensitivities, and healthcare infrastructure. This synergy offers a long-term growth channel for outsourcing players willing to invest in next-gen capabilities.

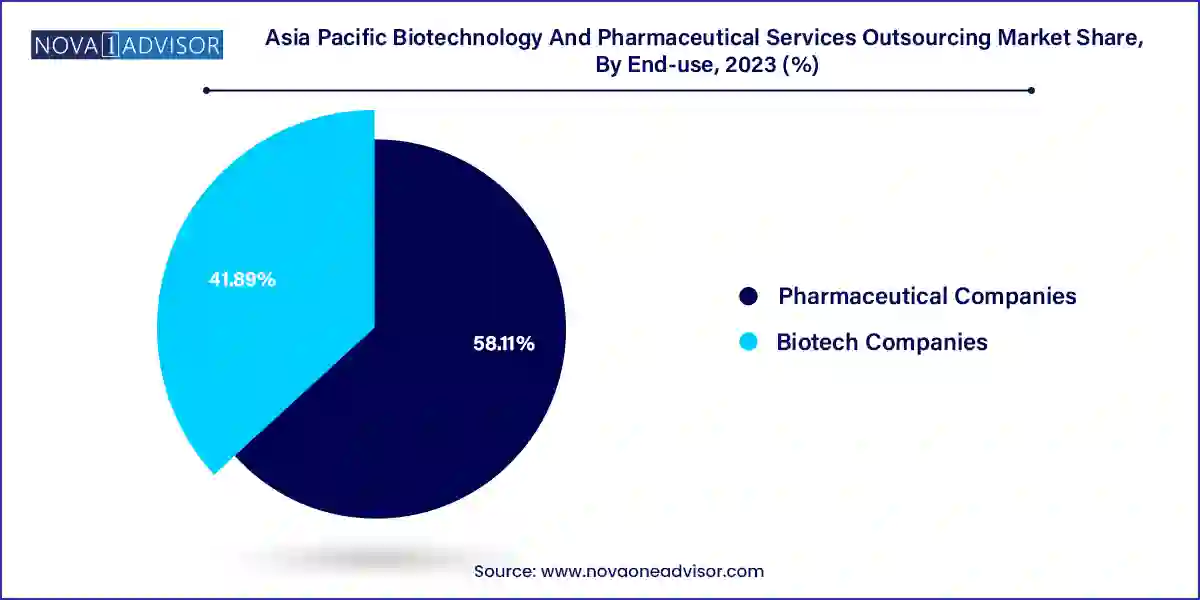

Pharmaceutical companies are the dominant end-users in the Asia Pacific outsourcing market, accounting for a major share of the overall revenue. These companies often have large and complex pipelines that demand multi-phase clinical support, regulatory assistance, and quality consulting. Given the intense competition in small-molecule drug markets and the need for rapid market entry, big pharma firms are increasingly leveraging Asian CROs and CDMOs for trial management, regulatory filing, and manufacturing. The cost arbitrage and high operational efficiency offered by service providers in China, India, and Southeast Asia have made outsourcing an essential part of pharmaceutical companies' strategic roadmap.

Biotech companies represent the fastest-growing end-user segment, driven by the boom in biologics, cell and gene therapies, and targeted oncology products. Most biotech firms, especially early-stage or virtual biotechs, lack in-house capabilities for development, scale-up, or regulatory filings. As a result, they are heavily reliant on outsourcing for everything from discovery support and formulation development to regulatory submissions and market access. The presence of venture capital funding, government incubation programs, and specialized service partners in countries like Japan and Australia is fueling rapid growth in this segment.

Regulatory affairs services dominate the market, as navigating Asia’s complex and diverse regulatory landscape is a critical challenge for both global and local companies. Regulatory services include writing and publishing, clinical trial applications, product registration, regulatory operations, and submissions. CROs and consultants in the region are increasingly offering localized regulatory intelligence to accelerate approvals and reduce compliance risks. Countries like South Korea and Thailand have become regional centers for regulatory operations outsourcing due to their skilled regulatory professionals and cost-effective talent pools.

Consulting services are the fastest-growing segment, covering areas such as clinical development strategy, quality systems, strategic planning, and business development. Pharmaceutical and biotech companies are looking for expert guidance on trial design, market access, and post-marketing surveillance in Asia Pacific. Quality management consulting is also in high demand as global audits by the FDA and EMA increase. Many consulting firms are offering hybrid models that combine strategic advisory with executional support, helping clients achieve faster commercialization.

China – Dominant Market

China leads the Asia Pacific biotechnology and pharmaceutical services outsourcing market, thanks to a robust biopharma manufacturing base, a supportive policy environment, and substantial government investment in life sciences. Companies such as WuXi AppTec, Pharmaron, and Tigermed have built end-to-end capabilities encompassing discovery, preclinical research, regulatory filing, and GMP production. China's regulatory reforms under the National Medical Products Administration (NMPA) have also reduced clinical trial approval timelines, making the country more attractive for multinational trials. Moreover, the rise of homegrown biopharma firms is creating a steady pipeline of outsourcing demand within China itself.

India – Fastest Growing Market

India is the fastest-growing country in the region, supported by its strong foundation in generics, clinical research, and IT-enabled services. Indian CROs and CDMOs such as Syngene, GVK Bio, and Dr. Reddy’s Laboratories are expanding their services to cover end-to-end drug development and regulatory affairs. The government’s Make in India initiative and new R&D incentives have encouraged domestic and foreign investment in pharma outsourcing. Additionally, India’s vast patient pool, cost competitiveness, and English-speaking scientific workforce give it a strategic edge in clinical trial management and pharmacovigilance outsourcing.

March 2024 – Pharmaron announced strategic partnerships with several biotech firms across Australia and South Korea to expand its biopharmaceutical development services, especially for biosimilar and gene therapy candidates.

February 2024 – ICON plc launched a new digital platform to support decentralized trials in Japan, allowing remote patient monitoring and regulatory integration with the PMDA.

January 2024 – Parexel opened a new Asia Pacific headquarters in Shanghai and expanded its regulatory affairs consulting team to support growing demand from Chinese biotech firms seeking FDA/EMA approval.

December 2023 – WuXi AppTec completed a major expansion of its biologics facility in Suzhou, China, adding new capacity for cell and gene therapy analytical development and manufacturing services.

November 2023 – IQVIA announced the launch of a regional pharmacovigilance and quality systems training academy in India to build capacity for GxP compliance and audit readiness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific biotechnology and pharmaceutical services outsourcing market

End-use

Service

Country