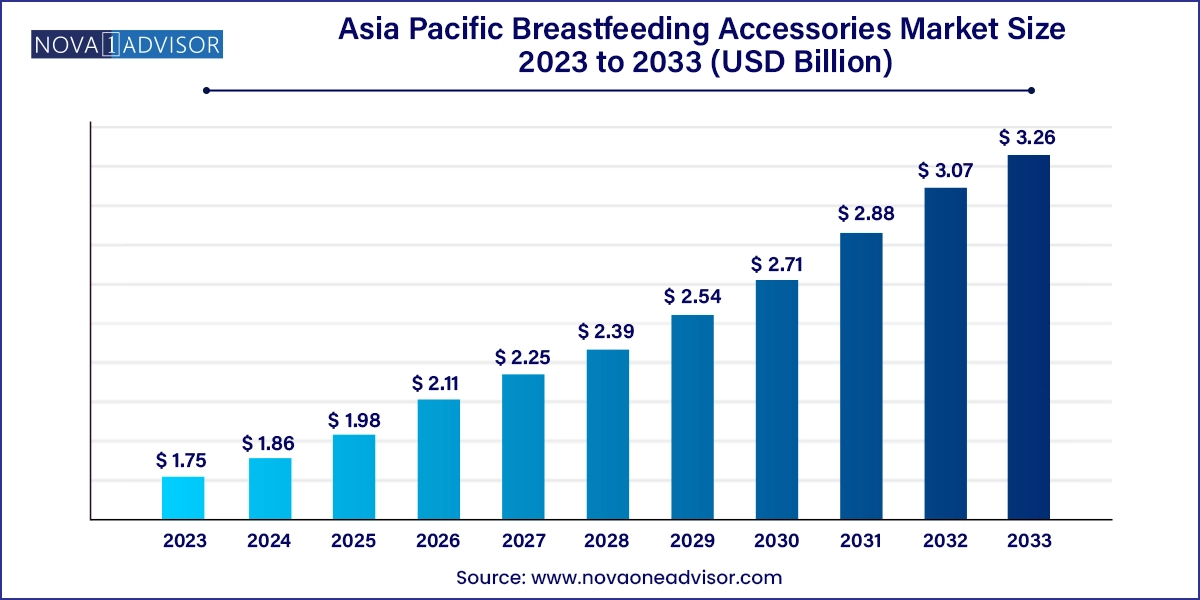

The Asia Pacific breastfeeding accessories market size was exhibited at USD 1.75 billion in 2023 and is projected to hit around USD 3.26 billion by 2033, growing at a CAGR of 6.43% during the forecast period 2024 to 2033.

The Asia Pacific breastfeeding accessories market is experiencing strong growth as awareness surrounding maternal and infant health continues to increase across both developing and developed countries in the region. Rising birth rates in countries such as India, Indonesia, and the Philippines, combined with greater acceptance and promotion of breastfeeding by healthcare systems, have contributed to the expansion of this market. Moreover, urbanization and a growing number of working mothers have created demand for practical, comfortable, and technologically enhanced breastfeeding aids.

Breastfeeding accessories include a wide array of products designed to support and ease the breastfeeding process, including nipple care products, breast pads, breastmilk storage solutions, maternity wear, nursing pillows, and postpartum recovery items. These products play a significant role in encouraging continued breastfeeding and improving maternal comfort and convenience.

Government-led breastfeeding awareness campaigns, particularly in emerging economies, have highlighted the health benefits of exclusive breastfeeding for the first six months, as recommended by the WHO. In response, product innovation in the form of cooling pads, heating pads, nursing bras, and lactation massagers has grown significantly. Additionally, the increasing role of digital commerce platforms has made a broader variety of accessories accessible across both rural and urban markets, transforming purchasing behavior.

With rising disposable incomes and the growing prioritization of infant nutrition, the Asia Pacific market presents a fertile environment for domestic and international brands offering innovative, ergonomic, and affordable breastfeeding solutions.

Increasing preference for eco-friendly and reusable breastfeeding accessories, such as washable breast pads and bamboo nursing covers.

Rise in digital health support tools, including smart breast pumps and mobile apps integrated with baby weighing scales and lactation tracking.

Shift toward multifunctional accessories, like nursing bras with built-in pumping features or pillows offering lumbar and neck support.

Growing demand for postnatal recovery products, especially in urban markets with higher cesarean delivery rates.

Retail expansion through e-commerce and mother-care platforms, making premium and international brands accessible in Tier 2 and Tier 3 cities.

Surge in workplace-friendly accessories, such as portable coolers and discreet nursing tops, catering to the growing population of working mothers.

Healthcare institutional partnerships with accessory brands, especially in countries like India, Australia, and China, for maternity ward kit distribution.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.86 Billion |

| Market Size by 2033 | USD 3.26 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.43% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China, Japan, India, South Korea, Australia, and Thailand |

| Key Companies Profiled | Medela AG; Ameda Inc.; Koninklijke Philips N.V.; Pigeon Corporation; Spectra Baby; Lavie Mom; Motif Medical; Mayborn Group Limited |

A significant driver shaping the Asia Pacific breastfeeding accessories market is the increasing number of women in the workforce, especially in urban centers across countries like China, India, and South Korea. As women seek to balance professional responsibilities with motherhood, there is growing reliance on accessories that offer mobility, comfort, and efficiency.

Products such as breast pump carry bags, portable milk storage containers, and nursing tank tops are increasingly used by working mothers who need to express and store milk during office hours. Employers across regions like Singapore and Australia have also begun adopting more breastfeeding-friendly policies, such as dedicated lactation rooms and flexible break times. These policies not only support maternal wellness but also stimulate the demand for workplace-suitable breastfeeding accessories.

Moreover, as women delay childbirth into their 30s and 40s where complications such as sore nipples and milk latching difficulties are more prevalent there’s heightened demand for supportive products such as nipple care ointments, massagers, and heating pads to ease breastfeeding challenges.

Despite progressive trends, the lack of awareness and cultural stigma associated with breastfeeding in public and maternal product use in conservative segments remains a key restraint in the Asia Pacific region. In many rural or traditional communities in South and Southeast Asia, mothers may face societal pressure or embarrassment when using accessories like breast pumps or nursing wear, particularly outside the home.

Furthermore, limited education about breastfeeding best practices and misconceptions surrounding breastmilk storage or accessory hygiene can inhibit usage. While urban centers benefit from maternal education and medical guidance, rural healthcare infrastructure often falls short in promoting modern maternal care solutions. This gap in access, combined with high costs of branded accessories, reduces market penetration among lower-income and remote populations, ultimately restricting full-scale growth.

A powerful opportunity for market players lies in the growth of e-commerce platforms and direct-to-consumer (DTC) models, which are transforming the accessibility of breastfeeding accessories across the region. Digital platforms such as Lazada, Flipkart, Amazon, Shopee, and specialized mother-care websites have democratized access to international brands and innovative products even in smaller cities and towns.

In a region as geographically and culturally diverse as Asia Pacific, DTC channels allow brands to personalize content, educate consumers, and build loyalty through targeted campaigns and subscription models. Companies can now leverage influencer marketing, social media parenting communities, and digital lactation consultancy services to educate and convert customers at scale.

Moreover, pandemic-driven changes in shopping behavior have led to a significant rise in online sales of personal care and wellness products, including breastfeeding accessories. The ability to discreetly purchase intimate or niche products online adds another layer of convenience for mothers reluctant to discuss such topics openly in traditional retail settings.

Breastmilk storage and feeding accessories dominated the Asia Pacific breastfeeding accessories market, as they offer practical utility for both stay-at-home and working mothers. Items such as milk storage containers, coolers, and portable bottle sets are indispensable for safely collecting and storing breastmilk over extended periods. Particularly in countries like Japan and South Korea, where mothers often return to work within months of delivery, the demand for reliable and hygienic storage solutions is very high. Coolers that preserve breastmilk temperature for several hours are especially popular among commuting mothers. Moreover, growth in hospital-grade storage kits supplied through maternity wards has also boosted segment demand.

Postpartum recovery accessories are among the fastest-growing product categories, including nursing pillows, disposable maternity gowns, and perineal cooling pads. Nursing pillows that help with feeding alignment and posture are now being widely used not just for breastfeeding but also during pregnancy and sleep. Brands offering ergonomically designed multi-functional pillows have gained traction in urban markets of Australia, India, and China. Similarly, disposable gowns and perineal products have seen greater uptake due to the rise in cesarean births, which require enhanced postpartum care. Retail and online bundles or "new mother starter kits" often feature multiple recovery aids, driving bundled product growth.

China leads the Asia Pacific breastfeeding accessories market, thanks to its vast population, rising healthcare standards, and one-child to two-child policy transition. Major urban areas like Shanghai and Beijing have witnessed a surge in demand for nursing bras, breast pads, and baby weighing scales. Local manufacturers like Realbubee have gained popularity for affordable and smart breastfeeding gadgets, while international brands continue to compete in premium segments. The government’s maternal health initiatives, including hospital-based breastfeeding promotion programs, have further supported growth.

India is rapidly emerging as a high-potential market, driven by increasing maternal health awareness, growth in institutional births, and the rising middle-class population. Urban Indian women are increasingly turning to lactation accessories such as pumps, nipple creams, and feeding pillows for convenience and support. Domestic brands like R for Rabbit and Mee Mee are making these products more affordable and accessible. However, adoption in rural areas remains limited, highlighting the potential for NGO-led awareness campaigns and community health programs to expand market reach.

Japan’s aging demographic and work-centric culture create unique challenges for breastfeeding continuity, driving strong demand for efficient and discreet accessories. Breast pads, compact milk storage containers, and smart weighing scales are popular, particularly among tech-savvy urban mothers. Japanese consumers value design aesthetics, hygiene, and precision, leading to a preference for high-quality accessories. Companies like Pigeon have established deep brand trust in this market.

South Korea has a mature breastfeeding accessories market, fueled by a tech-forward population and a strong wellness culture. The government promotes maternal care through subsidies and hospital support, further encouraging breastfeeding. Korean brands like Spectra have achieved international success with hospital-grade pumps and ergonomic feeding accessories. The country also sees high demand for stylish nursing wear, maternity tank tops, and skincare-focused nipple care products.

Australia’s emphasis on women’s health and postpartum recovery has spurred consistent demand for breastfeeding accessories, especially nursing bras, perineal cooling pads, and natural fiber-based breast pads. Health funds often reimburse lactation-related expenses, increasing accessibility. Moreover, maternity support groups and hospital lactation programs serve as powerful touchpoints for product education and distribution.

Thailand's market is smaller in comparison but is growing due to improvements in public health education and urbanization. The tourism-heavy economy is increasingly supported by private maternity clinics that promote modern maternal wellness. Breastfeeding accessories like wipes, disposable breast pads, and postpartum recovery gowns are gaining visibility through retail pharmacies and maternity e-commerce sites.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific breastfeeding accessories market

Product

Country