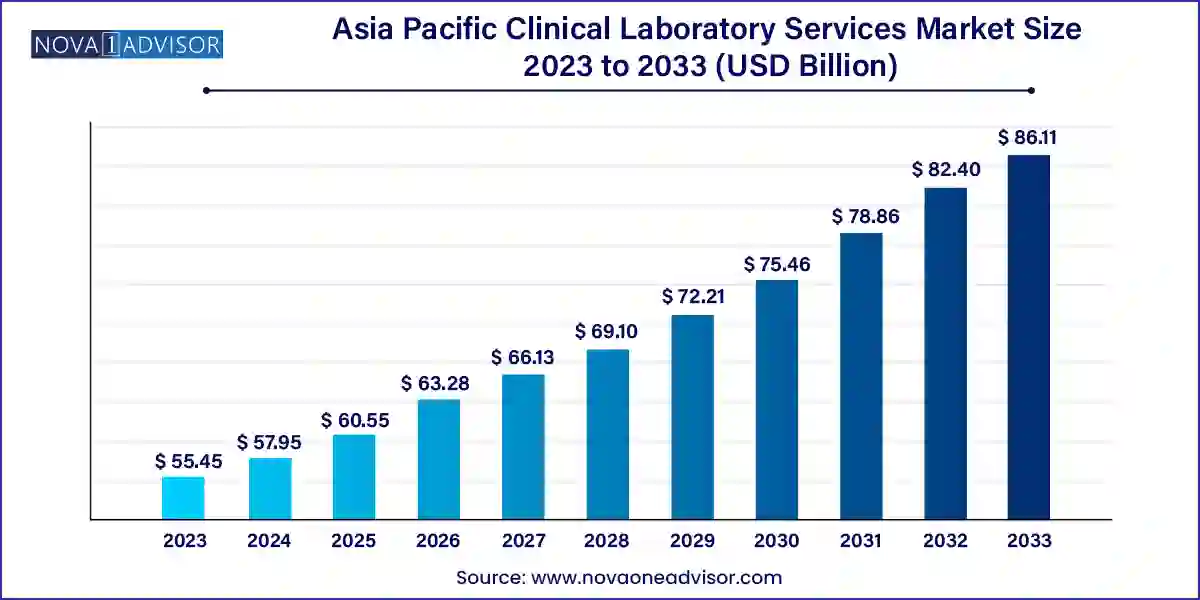

The Asia Pacific clinical laboratory services market size was exhibited at USD 55.45 billion in 2023 and is projected to hit around USD 86.11 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

The Asia Pacific clinical laboratory services market is undergoing a transformation fueled by rising healthcare awareness, digital integration, increasing burden of chronic diseases, and the expansion of diagnostic capabilities across public and private sectors. Clinical laboratory services are foundational to healthcare systems, as they support diagnosis, disease monitoring, therapy evaluation, and preventive health screening. As the region navigates demographic shifts, urbanization, and epidemiological transitions, clinical labs are evolving to meet the demand for accurate, scalable, and fast diagnostic services.

In countries like China, India, Japan, and Australia, laboratory services are not only expanding in volume but also in complexity. Traditional clinical chemistry and hematology labs are now complemented by specialized testing such as genomics, molecular diagnostics, pharmacogenomics, and advanced toxicology. Governments across Asia Pacific are investing in diagnostic infrastructure to support universal health coverage, early disease detection, and pandemic preparedness, leading to exponential growth in both central labs and point-of-care testing platforms.

Private sector laboratories ranging from diagnostic giants like Roche Diagnostics, Quest Diagnostics, and Sonic Healthcare, to regional leaders such as SRL Diagnostics, Dr Lal PathLabs, and Metropolis Healthcare—are expanding their footprints via partnerships, acquisitions, and technology integration. These players are adopting automated systems, AI-enabled analytics, and cloud-based laboratory information systems (LIS) to enhance speed, quality, and accessibility. As a result, the Asia Pacific clinical laboratory services market is not only expanding in size but also elevating its value proposition in the regional healthcare ecosystem.

Rising demand for esoteric and specialized diagnostic testing, including genetic, molecular, and biomarker-based analysis.

Digital transformation of laboratory services with the integration of AI, machine learning, and LIS platforms to ensure faster and more accurate results.

Expansion of standalone laboratories and private diagnostic chains in Tier 2 and Tier 3 cities across India, China, and Southeast Asia.

Boom in preventive healthcare and wellness testing, driving the demand for regular health check-ups and at-home lab sample collection.

Increasing reliance on outsourcing of bioanalytical services and clinical trial sample testing by pharmaceutical and biotech companies.

Growing partnerships between hospitals and private labs to expand diagnostic reach and reduce turnaround time.

Accelerated focus on infectious disease surveillance post-COVID, leading to stronger molecular testing capabilities.

Entry of multinational diagnostics companies into emerging Asian markets through strategic collaborations and acquisitions.

| Report Coverage | Details |

| Market Size in 2024 | USD 57.95 Billion |

| Market Size by 2033 | USD 86.11 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Test Type, Service Provider, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Japan, China, India, Australia, RoAP |

| Key Companies Profiled | Abbott Laboratories; ARUP Laboratories, Inc.; OPKO Health, Inc.; Bioscientia Healthcare GmbH; Charles River Laboratories International, Inc.; NeoGenomics Laboratories, Inc.; Healthscope Limited; Laboratory Corporation of America Holdings |

A principal driver of the clinical laboratory services market in Asia Pacific is the escalating prevalence of chronic and infectious diseases. The region is experiencing a dual disease burden—non-communicable diseases (NCDs) such as diabetes, cardiovascular diseases, cancer, and chronic respiratory disorders are on the rise, while infectious diseases like tuberculosis, hepatitis, dengue, and COVID-19 continue to demand public health attention.

According to the World Health Organization, NCDs account for more than 60% of deaths in the Asia Pacific region. Diagnosing and monitoring these conditions requires laboratory support, including clinical chemistry, hematology, molecular diagnostics, and advanced imaging correlation. In addition, emerging infections and zoonotic diseases have underscored the need for scalable laboratory networks that can handle high testing volumes and diverse assay types. Governments and private players are responding by expanding diagnostic capacity, establishing reference labs, and decentralizing testing to rural areas—thus propelling the market forward.

Despite the strong growth trajectory, the Asia Pacific clinical laboratory services market faces structural challenges related to fragmented infrastructure, variable quality standards, and regulatory disparities. While urban centers in Japan, Australia, and metropolitan India have access to cutting-edge diagnostic labs, many rural and semi-urban areas lack access to standardized, accredited facilities. Sample transport, storage, and result reporting can be delayed or compromised due to inadequate logistics or lack of integrated systems.

Furthermore, there is a significant absence of uniform laboratory accreditation bodies or quality frameworks across the region. This has led to inconsistency in test methodologies, pricing, and interpretation. Patients and physicians often face difficulty comparing or trusting lab results from different providers. While efforts like National Accreditation Board for Testing and Calibration Laboratories (NABL) in India and CAP accreditation in larger markets exist, wider implementation and regulatory enforcement remain limited. Unless harmonization and quality benchmarks are established, the full potential of diagnostics in driving healthcare outcomes may remain underutilized.

A major opportunity in the Asia Pacific clinical laboratory services market lies in the integration of personalized and genomic diagnostics into mainstream healthcare. Advances in molecular biology and bioinformatics have enabled laboratories to move beyond symptomatic diagnosis to predictive, preventive, and precision diagnostics. Tests such as next-generation sequencing (NGS), pharmacogenomics, liquid biopsy, companion diagnostics, and whole-genome analysis are gaining traction across the region.

In February 2024, Roche Diagnostics announced its expansion of molecular diagnostic capabilities across Asia Pacific, with a focus on oncology and infectious disease genomics. Simultaneously, local players like MedGenome and Mapmygenome in India and Fujifilm Holdings in Japan are entering the personalized medicine space through partnerships with academic institutions and hospitals. With the growing adoption of electronic health records (EHR), cloud-based databases, and AI interpretation tools, clinical labs can now integrate genomic data with clinical insights, paving the way for tailored therapies and risk-based interventions. As regulatory frameworks for data privacy and genetic testing mature, this segment is set to offer high-margin growth opportunities.

Clinical chemistry dominates the test type segment, reflecting its foundational role in routine diagnostics. Tests such as lipid profiles, liver and kidney function panels, glucose levels, and electrolytes are routinely performed in both inpatient and outpatient settings. These tests support diagnosis and monitoring of metabolic, renal, hepatic, and systemic diseases. In rapidly urbanizing countries like India and China, increasing health consciousness and employer-sponsored health packages have led to a surge in preventive testing that includes clinical chemistry panels.

Human & tumor genetics is the fastest-growing segment, driven by technological advancements in genomic sequencing and rising demand for precision oncology, prenatal screening, and hereditary disease risk profiling. Laboratories offering BRCA mutation analysis, NGS panels, and single-cell genomics are seeing an influx of clients, especially from oncology centers, IVF clinics, and corporate wellness programs. The affordability of genetic tests is improving, and awareness is spreading through government and private education campaigns, particularly in Japan, South Korea, and Australia.

Hospital-based laboratories hold the largest share, as they are integrated into patient care workflows and handle large volumes of routine, emergency, and surgical diagnostics. Tertiary and quaternary hospitals in Japan, Singapore, and India often have in-house labs equipped with immunochemistry, microbiology, and molecular platforms. These facilities enjoy clinical trust and easy sample flow from inpatient departments, but often outsource complex or esoteric tests to specialty labs.

Standalone laboratories are the fastest-growing providers, fueled by urban diagnostics chains like SRL Diagnostics, Dr Lal PathLabs, Metropolis Healthcare, and Pathkind. These chains offer competitive pricing, home sample collection, and digital result access, appealing to younger, tech-savvy populations. The scalability of standalone labs, their franchising models, and their focus on Tier 2/3 cities have helped them penetrate underserved areas and build customer loyalty through preventive health packages and subscription plans.

Bioanalytical and lab chemistry services dominate this segment, accounting for the majority of routine and specialized diagnostics. These services cover biochemical assays, blood tests, urine analysis, and disease biomarkers that are essential in every medical specialty from endocrinology and cardiology to nephrology and internal medicine. The volume and frequency of these tests, especially for chronic disease monitoring, ensure sustained demand from both hospitals and independent practices.

Cell and gene therapy-related services are the fastest-growing, propelled by the emergence of CAR-T therapies, stem cell applications, and regenerative medicine research. While still niche, countries like Japan and Australia are investing heavily in advanced therapies, and regulatory bodies are providing fast-track approvals for innovative treatments. Clinical laboratories are being upgraded to support high-complexity testing such as vector quantification, cell viability assessment, and patient eligibility screening for gene therapies. Over the next decade, this application segment is expected to expand significantly as more cell-based therapies move from trial to market.

India is one of the fastest-growing markets in Asia Pacific for clinical laboratory services. Factors driving this growth include a high disease burden, growing middle class, increased insurance penetration, and rising awareness about early detection and preventive care. Diagnostic chains like Dr Lal PathLabs, Metropolis Healthcare, and Thyrocare are expanding into Tier 2 and Tier 3 cities through hub-and-spoke models, offering affordable and high-quality testing. The government’s Ayushman Bharat initiative and digital health mission are promoting tele-diagnostics, e-pathology, and integration of diagnostics into primary healthcare. Additionally, the post-COVID boom in RT-PCR testing has helped laboratories upgrade their molecular capabilities, positioning them for growth in genomics and personalized testing.

Japan represents a technologically advanced and mature diagnostics market, characterized by high test volumes, automation, and an aging population with complex healthcare needs. Hospital-based labs dominate, but private labs like BML Inc. and Fujifilm Holdings are investing in AI-driven pathology, precision diagnostics, and genomic services. The country’s leadership in geriatric care, cancer screening, and advanced therapeutic research provides fertile ground for high-value lab services. Furthermore, government incentives for cancer genomics, companion diagnostics, and regenerative medicine are encouraging public-private partnerships and lab modernization initiatives.

February 2024 – Roche Diagnostics announced the expansion of its molecular diagnostics portfolio in Asia Pacific, focusing on cancer genomics and infectious disease panels, in collaboration with regional hospitals and academic labs.

January 2024 – Metropolis Healthcare launched a network of specialized esoteric labs in India to meet growing demand for advanced molecular and immunohistochemistry tests, targeting oncology and rare disease diagnostics.

December 2023 – Sonic Healthcare opened a new centralized laboratory in Singapore featuring full LIS integration and AI-powered slide imaging for histopathology diagnostics, aimed at regional expansion.

November 2023 – Quest Diagnostics entered into a partnership with a leading hospital chain in Australia to co-develop a precision medicine program, including pharmacogenomics and cancer biomarkers.

October 2023 – Pathkind Diagnostics deployed an AI-powered result interpretation system in its Indian operations to accelerate turnaround time and reduce human error in clinical reporting.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific clinical laboratory services market

Test Type

Service Provider

Application

Country