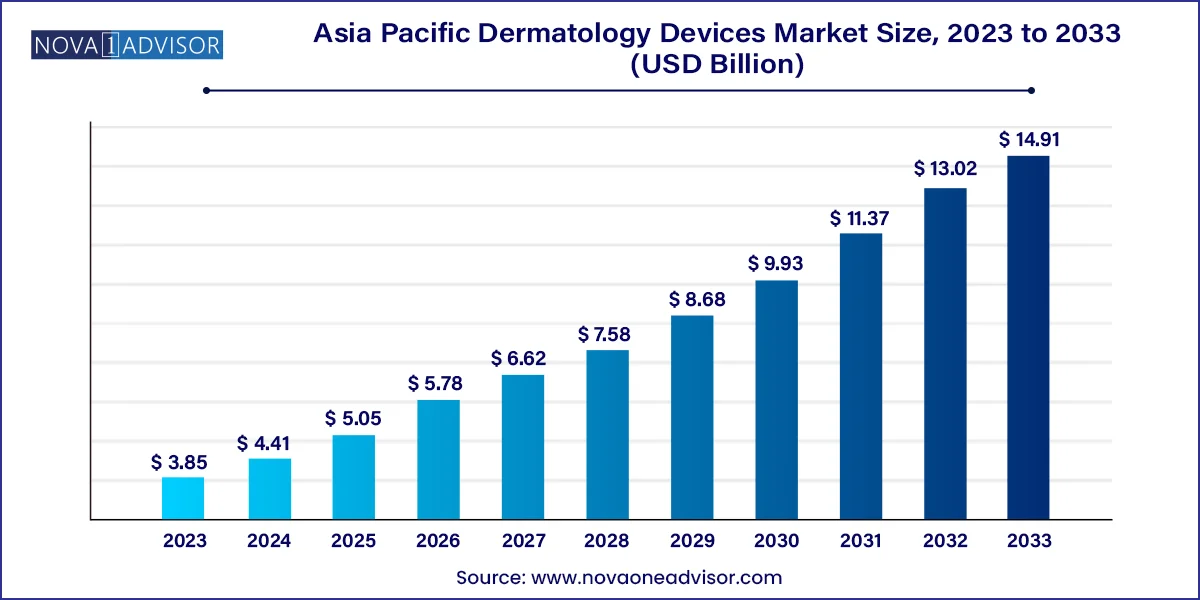

The Asia Pacific dermatology devices market size was exhibited at USD 3.85 billion in 2023 and is projected to hit around USD 14.91 billion by 2033, growing at a CAGR of 14.5% during the forecast period 2024 to 2033.

The Asia Pacific dermatology devices market is undergoing a transformative phase marked by rising demand for aesthetic procedures, increased prevalence of skin conditions, and expanding medical tourism. Countries such as Japan, South Korea, and India are leading hubs for dermatology innovation, fueled by a strong cosmetic culture, growing middle-class population, and improving access to dermatological care. Across urban regions in Asia Pacific, both medical and cosmetic dermatology are experiencing robust growth, aided by technological advancements in imaging, diagnostics, and energy-based treatment devices.

This dynamic market is shaped by two core pillars: medical dermatology and aesthetic dermatology. Medical dermatology in the region is responding to rising incidences of skin disorders, such as eczema, psoriasis, acne, and skin cancers—largely driven by pollution, urbanization, and changing climatic conditions. On the other hand, aesthetic dermatology is booming with the increasing popularity of procedures like laser resurfacing, non-surgical skin tightening, scar reduction, and pigmentation treatments.

The affordability of treatments, skilled practitioners, and regulatory advances in countries like India, China, and Thailand have positioned Asia Pacific as a favorable destination for both domestic patients and international medical tourists. Moreover, ongoing digital transformation in healthcare, including the integration of AI in diagnostics and remote consultation models, is further augmenting the dermatology ecosystem. From a commercial standpoint, the region holds enormous potential for global and regional manufacturers of dermatology devices as investments in healthcare infrastructure and patient awareness continue to rise.

Growing demand for minimally invasive aesthetic procedures like laser skin resurfacing, acne scar revision, and pigment correction.

Rise in AI-driven diagnostic devices for accurate skin condition assessments and early cancer detection.

Booming medical tourism industry in countries like India, Thailand, and South Korea, contributing to dermatology device adoption.

Emergence of portable and home-use dermatology devices, especially in urban China and Japan.

Government initiatives to improve skin cancer screening and dermatological access in rural areas of India and Indonesia.

Increased collaboration between tech firms and dermatology clinics to integrate AR/VR in patient engagement and treatment visualization.

Favorable demographic shifts, including aging populations in Japan and South Korea, fueling demand for anti-aging and skin rejuvenation treatments.

Growing preference for combination therapies, such as lasers combined with cryotherapy or microneedling.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.41 Billion |

| Market Size by 2033 | USD 14.91 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Philippines |

| Key Companies Profiled | Alma Lasers; Candela Corp.; Cutera Inc.; Maruho Co., Ltd.; FotoFinder Systems GmbH; Leica Microsystems; Lumenis; Allergan Plc; Merz Pharma; Sinclair Pharma |

One of the most prominent drivers in the Asia Pacific dermatology devices market is the surge in demand for aesthetic dermatology treatments, particularly among millennials and Gen Z populations. Countries such as South Korea and Japan are globally renowned for their advanced aesthetic standards and cosmetic dermatology procedures. Social media, influencer culture, and the normalization of beauty enhancements have significantly increased public interest in laser skin treatments, microdermabrasion, and light-based therapies for skin brightening and anti-aging.

According to estimates, South Korea performs more cosmetic procedures per capita than any other country globally, and India and China are seeing exponential growth in skin-lightening and rejuvenation procedures. This has prompted clinics and aesthetic centers across major Asian cities to invest heavily in high-end dermatology devices particularly lasers and cryotherapy units. The integration of non-invasive technologies, coupled with declining stigma and rising affordability, is transforming dermatological care from a medical necessity to a lifestyle-driven service.

Despite market potential, a major restraint remains the high cost of dermatology devices, especially for advanced treatments. Lasers, cryotherapy machines, and digital imaging devices often come with significant capital expenditure and recurring maintenance costs. For many clinics in Tier 2 and Tier 3 cities in developing nations such as India, the Philippines, or Indonesia, acquiring and operating these devices remains financially challenging.

Furthermore, the import-heavy nature of dermatology equipment inflates costs due to duties and logistics, particularly in price-sensitive countries. While urban centers boast of well-equipped clinics, smaller towns and rural areas continue to rely on basic diagnostic tools and manual procedures. In addition, the lack of trained professionals to handle sophisticated machines further impedes adoption, especially outside metro areas. This cost barrier leads to market fragmentation and slows down the penetration of cutting-edge devices in broader regions.

An emerging opportunity in the Asia Pacific dermatology devices market lies in the integration of artificial intelligence (AI) with diagnostic tools. With high smartphone penetration, increased awareness, and a rising burden of skin disorders, AI-powered dermatology platforms are gaining momentum in the region. These tools offer rapid, accurate, and cost-effective skin condition detection, even in resource-limited settings.

Several startups across India, China, and Singapore are developing AI-enabled dermatoscopes and smartphone apps that allow clinicians and users to scan, detect, and analyze skin lesions remotely. AI-based tools are particularly valuable in primary care settings where specialist access is limited. Moreover, collaborations between hospitals, research centers, and health tech firms are accelerating the validation of these devices for regulatory approval. As the region continues to embrace digital health transformation, AI in dermatology diagnostics offers a scalable and high-impact growth frontier.

Treatment devices dominated the Asia Pacific dermatology devices market, owing to the growing consumer inclination toward aesthetic procedures and the availability of various technologically advanced therapeutic tools. Among treatment devices, laser systems lead the charge, especially in South Korea, Japan, and urban China, where clinics offer high volumes of procedures such as laser skin tightening, pigmentation correction, and tattoo removal. Cryotherapy devices and microdermabrasion tools are also seeing high usage in acne and wart treatments, while electrosurgical equipment continues to be integral in dermatological surgeries and mole removals.

Diagnostic devices, particularly dermatoscopes and biopsy devices, are the fastest-growing segment, as early detection of skin cancer and chronic skin diseases becomes a priority in high-incidence areas like Australia and coastal Southeast Asia. The introduction of digital dermatoscopes with AI and cloud connectivity is enhancing diagnostic accuracy and patient monitoring. Additionally, the rising demand for mole mapping, lesion analysis, and non-invasive skin imaging across hospitals and specialty clinics is boosting the uptake of imaging devices. Governments in countries like India and Malaysia are encouraging early skin cancer screening through public programs, leading to broader diagnostic tool deployment.

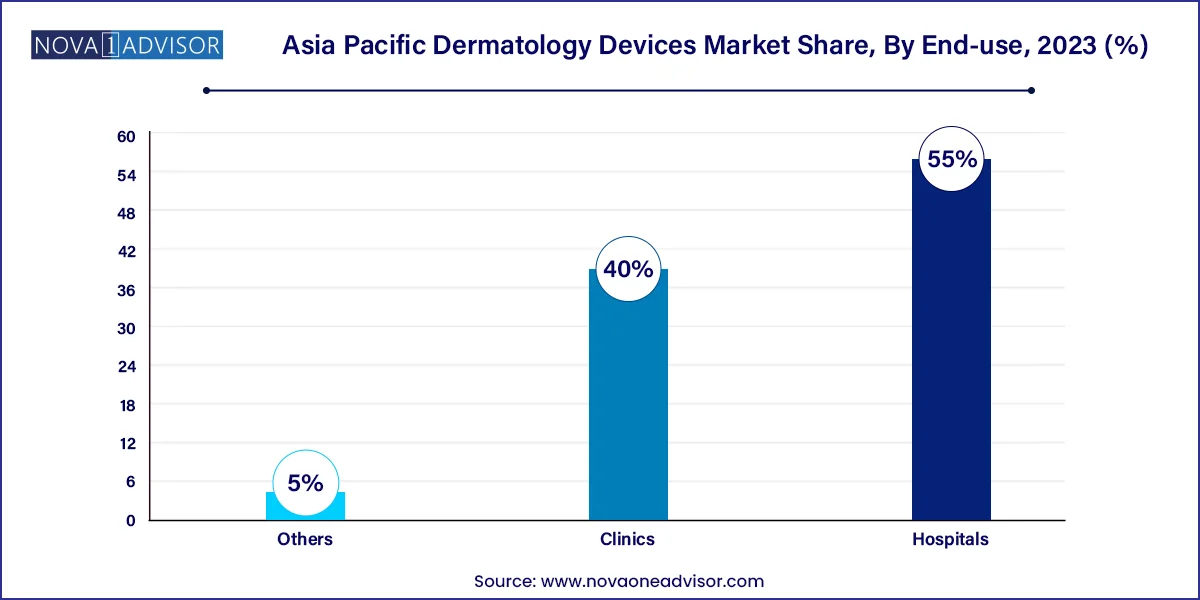

Hospitals dominated the end-use segment due to their comprehensive service offerings, access to advanced diagnostic equipment, and the ability to manage complex dermatological cases. In countries like Japan and Australia, hospitals maintain dedicated dermatology departments capable of performing both clinical and aesthetic services, from biopsies and cryosurgeries to laser therapy. Additionally, hospitals benefit from favorable reimbursement frameworks for medical dermatology and attract referrals for severe skin disorders, driving demand for both diagnostic and treatment devices.

Clinics are the fastest-growing end-use segment, fueled by the aesthetic dermatology boom and the increasing number of specialized skin clinics in urban areas. In cities like Seoul, Bangkok, and New Delhi, dermatology clinics offer customized, high-frequency skin care treatments using compact, multi-functional devices. These facilities cater to a younger demographic seeking cosmetic enhancements and skin rejuvenation procedures. Clinics are more agile in adopting the latest technologies and often lead the charge in introducing new devices such as portable lasers, IPL systems, and home-care compatible equipment.

Japan’s dermatology devices market is characterized by a strong demand for both anti-aging treatments and skin cancer diagnostics. With one of the world’s oldest populations, non-invasive skin tightening and pigmentation correction procedures are in high demand. Japanese clinics also maintain high standards for dermatological safety and device precision, supporting robust sales of laser and biopsy tools.

China is one of the fastest-growing markets in the region, driven by urban affluence, increased aesthetic consciousness, and large-scale public health initiatives. Chinese cities are home to high-end dermatology centers offering state-of-the-art laser and light therapies. Moreover, local manufacturers are emerging in the low-to-mid-tier device segment, improving affordability and availability across the country.

India offers a diverse dermatology market, with significant demand for both medical and aesthetic services. Rising cases of fungal infections, eczema, and acne, combined with a cultural shift toward personal grooming, are fueling the uptake of dermatology devices. Clinics in metropolitan areas are adopting advanced lasers and microdermabrasion units, while hospitals are investing in diagnostic tools to manage skin cancer and chronic infections.

Globally recognized for its cosmetic dermatology industry, South Korea leads the region in laser-based aesthetic device adoption. High consumer expectations, advanced clinical infrastructure, and a thriving beauty tourism industry have made it a hub for innovation and exports in dermatology devices.

Australia’s high incidence of skin cancer due to UV exposure has made it a key market for diagnostic dermatology devices. Public health campaigns emphasize early detection and regular skin checks, driving demand for dermatoscopes, imaging systems, and biopsy tools. Private clinics are also witnessing rising demand for aesthetic treatments.

Medical tourism in Thailand, particularly in Bangkok, is a major driver of dermatology device usage. International patients seek treatments ranging from acne correction to laser resurfacing. Thai clinics offer cost-effective services using modern equipment, making it a competitive market for global manufacturers.

Singapore combines high-tech infrastructure with skilled medical professionals, making it a leading dermatology hub in Southeast Asia. Dermatology clinics here adopt premium devices early and cater to both local and international patients seeking top-tier care.

Both countries are emerging markets, with growing awareness of dermatological health and increasing access to clinics. Urban centers are seeing higher adoption of light therapy and diagnostic tools, but rural areas still lack comprehensive dermatological infrastructure. Government support and public-private partnerships are beginning to address this gap.

Malaysia’s healthcare tourism and growing middle-class population are driving demand for dermatology treatments. Both public and private hospitals offer advanced dermatological care, and clinics are expanding their use of aesthetic equipment, particularly lasers and cryotherapy systems.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific dermatology devices market

Product

End-use

Country