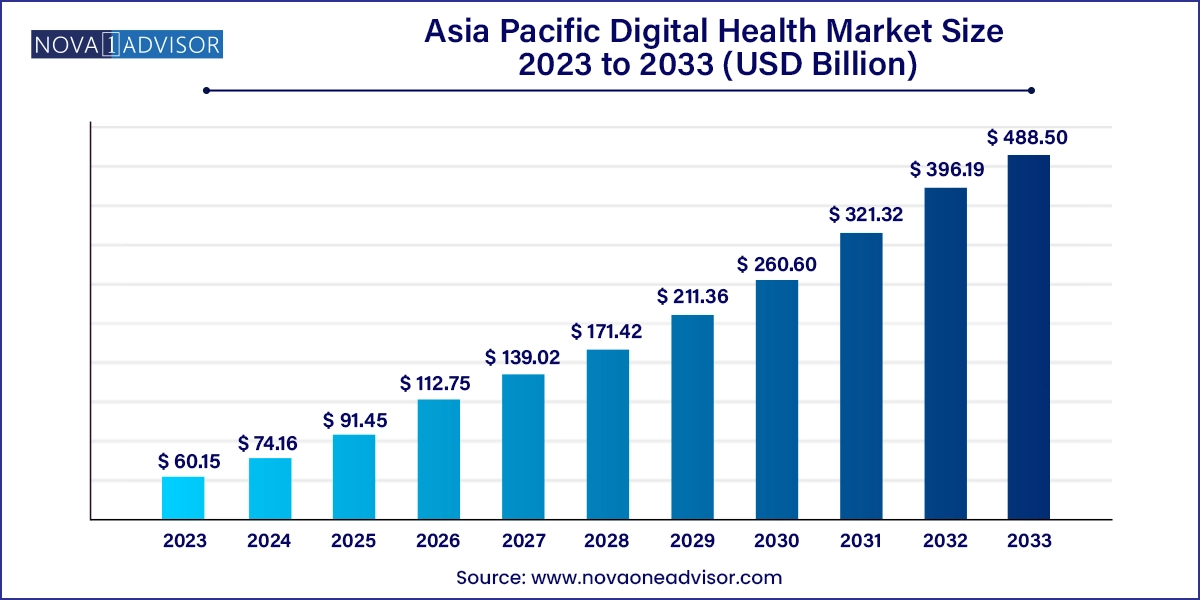

The Asia Pacific digital health market size was exhibited at USD 60.15 billion in 2023 and is projected to hit around USD 488.50 billion by 2033, growing at a CAGR of 23.3% during the forecast period 2024 to 2033.

The Asia Pacific (APAC) digital health market represents one of the most vibrant and rapidly expanding sectors in the global healthcare technology ecosystem. Fueled by demographic pressures, government digitization drives, mobile-first populations, and a flourishing startup culture, the region is witnessing a fundamental transformation in how healthcare is delivered, consumed, and financed. Digital health in APAC encompasses a broad spectrum of technologies ranging from telehealth, wearable medical devices, mobile health (mHealth) apps, digital diagnostics, healthcare analytics, to electronic health record (EHR) systems.

The region’s diversity from high-tech hubs like Singapore and South Korea, to populous emerging economies like India and Indonesia has created a fragmented yet opportunity-rich environment for digital health providers. Governments across APAC are responding to challenges like aging populations, rural health access gaps, rising chronic diseases, and pandemic preparedness by promoting e-health frameworks and digital infrastructure. For instance, China’s Healthy China 2030 plan, India’s Ayushman Bharat Digital Mission, and Japan’s Society 5.0 all prioritize healthcare innovation through technology.

The COVID-19 pandemic was a pivotal accelerant, drastically increasing adoption of teleconsultations, AI diagnostics, home-based health monitoring, and remote mental health solutions. Digital health became not just a convenience, but a public health necessity. Today, healthtech startups, multinational medtech companies, insurance firms, and telecom providers are racing to build digital ecosystems that can support personalized, preventive, and connected care models. With over 60% of the world’s population, the Asia Pacific region stands as a center of gravity for digital health innovation, investment, and adoption.

National Digital Health Missions: Countries like India, Australia, and China are implementing centralized platforms for health records, teleconsultation, and e-prescriptions.

Rise of Chronic Disease Management Platforms: mHealth apps and wearable devices for managing diabetes, hypertension, and respiratory conditions are seeing explosive growth.

Remote Monitoring and Aging Population Solutions: Japan and South Korea are leading in home-care tech solutions and robotic monitoring for their aging populations.

Mental Health and Wellness Apps: Mobile-based mental health solutions are on the rise, especially among youth and urban professionals across Southeast Asia.

Integration of AI in Diagnostics and Imaging: AI-powered platforms are supporting radiology, dermatology, and ophthalmology with decision-support tools in both hospital and rural settings.

Healthcare Startups and Unicorn Growth: Healthtech startups like Halodoc (Indonesia), Practo (India), and Ping An Good Doctor (China) are disrupting care delivery models.

Insurance and Fintech Collaboration: Digital health is increasingly tied to wellness-based insurance models, incentivizing healthy behavior via data-sharing and app integration.

| Report Coverage | Details |

| Market Size in 2024 | USD 74.16 Billion |

| Market Size by 2033 | USD 488.50 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 23.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Component, Application, End-use, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Asia Pacific |

| Key Companies Profiled | Veradigm LLC; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc.; Samsung Electronics Co. Ltd.; HiMS; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs & Systems, Inc.; IBM Corp.; CISCO Systems, Inc. |

A central driver of the APAC digital health boom is the region’s deep smartphone penetration, affordable internet access, and growing digital literacy. With over 1.5 billion smartphone users and rapidly declining data costs, mobile phones have become the de facto health access point for vast populations across Asia Pacific.

mHealth apps ranging from chronic disease tracking, symptom checkers, appointment scheduling, and fitness guidance are allowing users to access healthcare services on-demand, irrespective of location. In rural India and Indonesia, where physical health infrastructure may be scarce, mobile phones serve as lifelines for teleconsultation and medication reminders. In urban centers, lifestyle-conscious consumers are using fitness and nutrition apps, wearable trackers, and AI-powered chatbots for health engagement. The convergence of e-wallets, UPI payments, and digital pharmacies has made mHealth not only accessible but also monetizable, opening new revenue models for developers and providers.

A significant restraint in the Asia Pacific digital health market is the lack of standardized regulations, data privacy laws, and interoperability protocols across countries. While some countries like Australia and Singapore have advanced digital health regulations and centralized systems, others face fragmented policy landscapes that hinder cross-border collaboration and system integration.

This regulatory patchwork creates challenges for multinational companies and startups alike. For example, data residency requirements in China limit the ability of foreign firms to process patient data in offshore clouds. Similarly, the absence of unified data standards in India or the Philippines complicates EHR deployment across public and private providers. Moreover, patient trust in data security remains fragile in many markets. Without robust legal protections and infrastructure for secure health data exchange, the scalability and cross-functionality of digital health solutions are limited, particularly in multi-provider, multi-platform environments.

A major opportunity in the Asia Pacific digital health market lies in the application of artificial intelligence (AI), big data analytics, and machine learning (ML) to personalize care and improve decision-making. As digital platforms gather vast volumes of patient data from apps, wearables, and remote monitors, the opportunity to derive clinical insights, predict health risks, and personalize interventions is immense.

AI is already being used in teleradiology, pathology screening, disease outbreak prediction, and even mental health triaging. In China, AI algorithms are supporting overburdened diagnostic systems in rural hospitals. In India, startups are developing AI-based platforms to predict diabetic retinopathy and heart disease using smartphone cameras. The combination of natural language processing (NLP), predictive modeling, and patient engagement tools will shape the next generation of proactive, patient-centric healthcare. The region’s genomic diversity, high mobile adoption, and emerging middle class make it an ideal environment for AI-driven digital health scaling.

mHealth is the dominating technology segment across Asia Pacific, owing to widespread smartphone adoption and increasing reliance on mobile-based health engagement. Countries like India, Indonesia, and the Philippines are experiencing massive growth in fitness apps, symptom checkers, menstrual health trackers, and AI-powered teleconsultation platforms. Urban populations in Singapore and South Korea are using mHealth apps for medication adherence, chronic disease logging, and nutrition guidance. In parallel, public health campaigns in Thailand and Vietnam are leveraging mHealth for maternal care education and vaccination tracking.

Tele-healthcare is the fastest-growing segment, particularly in the subcategories of video consultation and LTC (long-term care) monitoring. Japan and South Korea are leading in telehealth innovation to serve their aging populations, deploying robot-assisted consultation, home vitals tracking, and tele-psychiatry. During the pandemic, governments like Australia’s and India’s issued emergency telehealth mandates, permanently changing care-seeking behavior. Additionally, remote medication management platforms are scaling in China and Malaysia, supported by e-pharmacy growth and logistics integration.

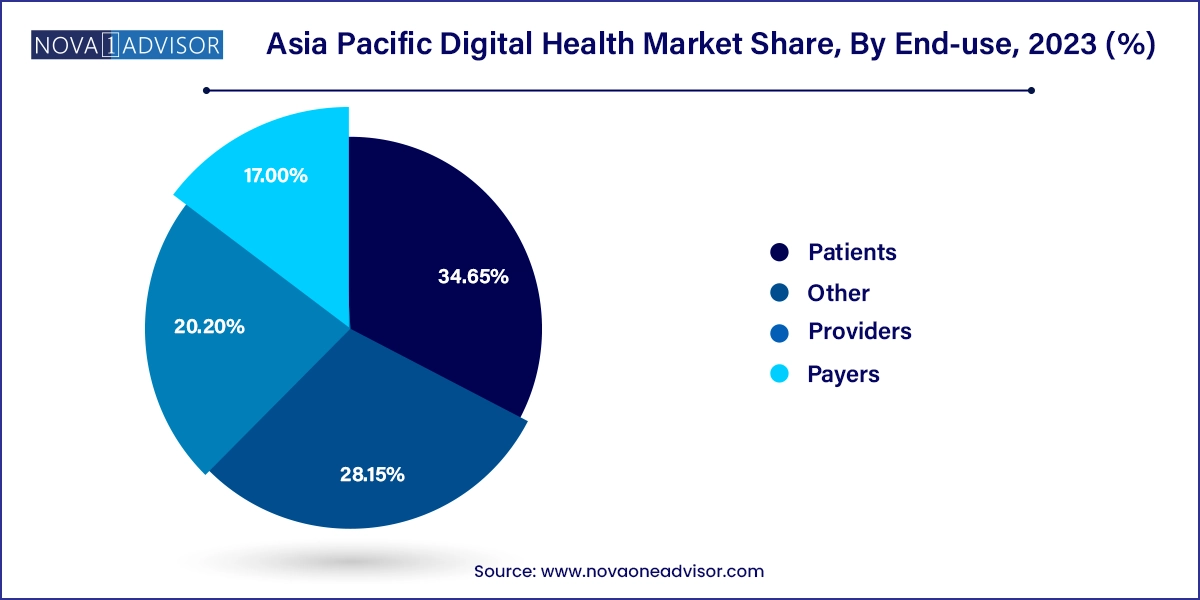

Patients are the leading end-user group, particularly in direct-to-consumer markets like India, China, and Australia. Consumers are increasingly using on-demand consultations, home diagnostics, fitness apps, and personal health trackers to take charge of their health. The digital health revolution is turning patients into active health managers, enabled by real-time data and remote care tools.

Providers are the fastest-growing end-user group, especially as hospitals adopt EHR systems, integrate telehealth platforms, and deploy AI for workflow optimization. Healthcare professionals across APAC are leveraging digital tools for clinical decision-making, remote follow-ups, care coordination, and multilingual patient communication. The COVID-era transition to digital-first outpatient care has permanently altered provider workflows, making digital health indispensable in both primary and specialty care.

Software is the dominant component, encompassing mobile applications, EHR platforms, AI decision-support tools, and healthcare integration systems. With governments digitizing healthcare operations and private hospitals adopting health informatics tools, the need for scalable, cloud-based software is surging. Healthtech companies across APAC are building local-language, culturally tailored interfaces for broader usability.

However, services are the fastest-growing component, especially with the rise in subscription-based virtual consultations, remote monitoring packages, and digital diagnostics. Startups in India and Indonesia are offering personalized care bundles, combining software, real-time doctor access, and lab partnerships. These services are increasingly integrated into insurance and employer wellness plans, expanding their reach across middle-income groups and the urban employed class.

Diabetes management dominates the application segment, reflecting the high regional prevalence of Type 2 diabetes in China, India, and Southeast Asia. Apps offering blood glucose monitoring, diet tracking, foot care reminders, and virtual coaching are widely used. Public-private programs are targeting early detection and education using mHealth tools in rural areas. Countries like Malaysia and Singapore are integrating digital diabetes tools into national non-communicable disease (NCD) control strategies.

Mental health is the fastest-growing application area, driven by increasing awareness and post-pandemic trauma. Digital platforms like Wysa and Intellect are expanding across Asia, offering anxiety relief, guided meditation, CBT modules, and therapist consultations via mobile. In Japan and South Korea, youth-focused mental health apps are seeing high adoption, while in India, corporate wellness programs are including mental health apps as employee benefits. The anonymity, affordability, and accessibility of digital mental health tools are accelerating this category across age and income brackets.

China is the largest digital health market in Asia Pacific, bolstered by massive government investment, domestic innovation, and the presence of giants like Ping An Good Doctor, JD Health, and WeDoctor. Digital hospitals, AI imaging, and e-prescription platforms are integrated with insurance systems, and mobile-based care is widely used even in Tier 2 and 3 cities.

India is the fastest-growing market, fueled by the Ayushman Bharat Digital Mission (ABDM) and an exploding healthtech startup ecosystem. Platforms like Practo, PharmEasy, and Tata 1mg are democratizing access to virtual care, diagnostics, and e-pharmacy. The growth of UPI-enabled health payments, regional language apps, and AI triage tools in rural areas reflect a unique model of frugal, scalable digital health.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific digital health market

Technology

Component

Application

End-use

Country