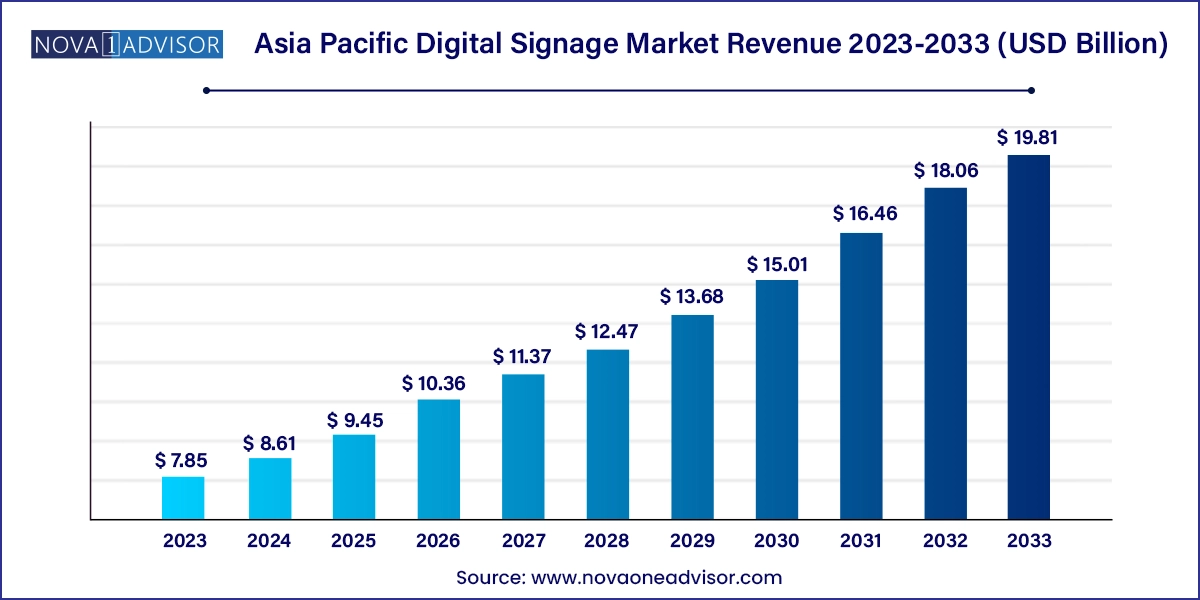

The Asia Pacific digital signage market size was exhibited at USD 7.85 billion in 2023 and is projected to hit around USD 19.81 billion by 2033, growing at a CAGR of 9.7% during the forecast period 2024 to 2033.

The Asia Pacific (APAC) digital signage market is undergoing a profound transformation, fueled by rapid urbanization, retail modernization, evolving consumer behaviors, and government investments in smart infrastructure. Digital signage, which encompasses dynamic digital displays used to convey multimedia content for information, marketing, and communication, has become a critical tool for businesses across retail, hospitality, transportation, healthcare, and education sectors.

In recent years, the region has seen an explosion of large-scale display networks in airports, railway stations, shopping malls, educational institutions, and even outdoor public spaces. This shift reflects a broader trend towards immersive and data-driven customer engagement. With vibrant economies such as China, India, and Japan at the forefront, the APAC region offers a fertile landscape for digital signage providers, solution integrators, and software developers.

Digital signage is no longer confined to static display; it now encompasses interactive kiosks, smart video walls, touchscreens, and AI-powered content systems. Integration with cloud platforms, analytics, and IoT further enhances the relevance of these displays in real-time communication and experience personalization. In a digitally accelerating Asia, the convergence of technology, marketing, and infrastructure is firmly embedding digital signage as a central pillar of commercial, civic, and cultural expression.

Adoption of Smart Signage with AI and Data Analytics: AI-powered content scheduling, facial recognition, and user engagement tracking are becoming key differentiators.

Rise of 4K and 8K Displays in High-End Retail and Airports: Demand for ultra-HD signage is increasing in luxury stores and transportation hubs across Japan, Singapore, and South Korea.

Interactive Kiosks and Touch-Based Engagement: Retail and public spaces are deploying kiosks with touch, voice, and gesture inputs for customer service and information delivery.

Integration of Cloud-Based Digital Signage Software: Content is increasingly managed and deployed remotely via centralized platforms, ensuring agility and real-time updates.

Green Signage with Low Power Consumption: Manufacturers are designing energy-efficient LED/OLED screens with sustainability in mind to meet government and corporate ESG goals.

DOOH (Digital-Out-Of-Home) Advertising Networks Expansion: Digital billboards and advertising panels are multiplying in cities like Mumbai, Bangkok, Beijing, and Jakarta.

Smart City and Public Information Systems: Governments are embedding digital signage into urban infrastructure for real-time traffic, weather, and civic alerts.

Multi-Screen and Curved Displays for Immersive Environments: High-end entertainment and exhibitions are incorporating curved, edge-blending, and panoramic digital displays.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.61 Billion |

| Market Size by 2033 | USD 19.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Location, Type, Component, Application, Size, Content Type, Technology, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India |

| Key Companies Profiled | LG Electronics; Sony Group Corp.; Samsung Electronics Co., Ltd.; Sharp NEC Display Solutions, Ltd.; Leyard Optoelectronic Co., Ltd.; Barco; Panasonic Holdings Corp.; Shanghai Goodview Electronics Technology Co., Ltd.; AUO Corp.; BrightSign LLC |

The most prominent driver of the APAC digital signage market is the acceleration of urbanization and the digitization of retail environments, particularly in China, India, Southeast Asia, and parts of Oceania. As shopping malls, hypermarkets, and specialty stores expand across tier-1 and tier-2 cities, brands are investing heavily in digital signage to elevate the in-store experience and differentiate from online platforms.

Retailers use dynamic displays for personalized marketing, flash sales, queue management, and interactive product catalogues. These systems provide real-time adaptability, enabling campaigns to be modified on-the-fly based on footfall, time of day, or inventory levels. For instance, major mall operators in Shanghai and Delhi are deploying AI-integrated signage that adjusts content based on gender, age, or mood of passers-by.

Beyond commercial utility, governments in India, Indonesia, and Thailand are investing in digital information systems at railway stations and bus terminals to provide schedule updates, civic alerts, and emergency communication. These developments are indicative of a structural shift in the communication architecture of the region, making digital signage an indispensable tool for modern urban life.

Despite growing demand, one of the notable restraints hindering faster adoption in certain parts of the Asia Pacific market is the high upfront investment required for large-scale digital signage deployment. High-definition LED walls, OLED displays, interactive kiosks, and cloud-connected systems involve considerable costs in hardware procurement, installation, cabling, software integration, and ongoing content management.

In countries such as Indonesia, the Philippines, and Vietnam, cost constraints can be particularly pronounced for small businesses and public sector institutions. Maintenance is another issue—especially in outdoor applications where displays are exposed to dust, humidity, and extreme weather conditions.

While long-term operational benefits and ROI are increasingly evident, budget-conscious buyers often delay or limit investment in favor of traditional static signage or hybrid approaches. Vendors need to offer leasing models, modular systems, and low-cost alternatives to unlock deeper market penetration across APAC's diverse economies.

A major opportunity on the horizon is the integration of digital signage into smart city platforms being developed across APAC. From Singapore’s Smart Nation initiative to India’s Smart Cities Mission and Japan’s Society 5.0 vision, governments are incorporating digital communication infrastructure into urban planning.

Digital signage plays a vital role in disseminating transport schedules, air quality data, emergency messages, and civic engagement content. Interactive kiosks at metro stations, LED road displays for traffic updates, and e-directory systems in municipal buildings are examples of civic-focused digital signage already deployed in smart cities.

As these cities become data-rich environments, there is potential to link signage to IoT networks, enabling dynamic content changes based on environmental sensors or real-time analytics. This fusion of infrastructure and communication can be transformative—positioning digital signage not just as an advertising tool, but as a core smart city enabler across APAC.

Indoor digital signage dominates the Asia Pacific market, particularly in shopping malls, airports, hospitals, schools, and offices. The controlled environment enables the use of high-resolution displays, interactive screens, and wall-mounted video solutions. Retail environments in Tokyo, Seoul, and Singapore lead indoor signage applications, with dynamic product showcases, wayfinding tools, and branded content being common uses. Hospitality players in India and Thailand are also embedding indoor displays for concierge services, room availability, and entertainment.

Outdoor signage is the fastest-growing segment, driven by DOOH advertising and smart transportation projects. Cities like Beijing, Mumbai, and Jakarta are expanding outdoor signage for both commercial and government use. Outdoor displays require high brightness, rugged enclosures, and weatherproofing—factors that are now being addressed through LED and e-paper technologies. Growth is also fueled by increasing foot traffic, outdoor festivals, and sports venues that demand robust and visible messaging solutions.

Kiosks are the most dominant type of digital signage, especially self-service and interactive kiosks. These are prevalent in malls, airports, restaurants, and government offices across APAC. In India and China, self-check-in kiosks are used in hospitals and railways, while Japan’s retail chains offer digital customer support kiosks. Self-order kiosks in QSRs (Quick Service Restaurants), such as McDonald’s and KFC, are now commonplace in urban centers.

Video walls are the fastest-growing type, offering impactful, large-scale displays that are increasingly used in corporate lobbies, exhibitions, and transportation hubs. These are often composed of ultra-narrow bezel LCDs or seamless LED panels that provide an immersive viewing experience. The high resolution, flexibility in configuration, and premium aesthetic make video walls ideal for branding, live events, and data-rich dashboards in control rooms.

Hardware is the leading component segment, comprising screens, media players, mounting structures, and networking components. Companies like LG, Samsung, and Panasonic dominate this space with high-resolution LCD/LED/OLED panels customized for vertical applications. Hardware sales remain high due to infrastructure projects, retail upgrades, and the recurring need for panel replacements.

Software is the fastest-growing component, particularly cloud-based content management systems (CMS), analytics tools, and API-driven integration platforms. Businesses are increasingly investing in software to personalize content, schedule campaigns, and collect data. Software innovations are also enabling interactive features like touch gestures, QR code integrations, and AI-assisted content decisions. Vendors are offering SaaS models to make solutions scalable for SMEs and large enterprises alike.

Retail is the largest application of digital signage in APAC, reflecting the digital transformation of storefronts, malls, and showrooms. Retailers use displays for promotions, product info, queue management, and dynamic pricing. China's mega-malls and India’s organized retail boom have led to widespread adoption. Flagship stores in Tokyo and Seoul utilize digital walls and touch displays for high-end customer engagement.

Transportation is the fastest-growing application, driven by infrastructure development across APAC. Airports, railways, metros, and bus terminals are deploying digital signage for real-time schedules, advertising, and crowd control. Governments in China and India are leading smart mobility projects with embedded signage, such as Beijing's AI-powered metro kiosks or Delhi’s integrated bus stop displays.

The 32 to 52 inches screens dominate the market, balancing visibility with compactness. These are ideal for retail shelves, lobbies, hospitals, and public service environments. They are also the standard for standalone digital posters and kiosks. Their widespread use in smart classrooms, banks, and offices reinforces this segment's dominance.

More than 52 inches is the fastest-growing screen size category, reflecting demand for larger-than-life visuals in entertainment venues, public areas, and event halls. These screens often power video walls, museum exhibits, and sports scoreboards. LED and OLED panels in this range are growing rapidly due to decreasing costs and enhanced durability.

Non-broadcast content dominates, used for localized advertising, brand content, public messaging, and interactive media. Retailers and public sector agencies prefer controlled, branded content that can be customized by time, location, and event.

Broadcast content (news, sports, weather) is a significant growth area, especially in public transportation, banking, and hotel lobbies. APAC countries are integrating live feeds from local channels or IPTV platforms, supported by smart signage software that pulls real-time data into display cycles.

LED remains the most dominant technology, favored for brightness, durability, and versatility in indoor and outdoor applications. Chinese manufacturers like Leyard and AOTO Electronics have scaled production, making LED solutions cost-effective for large-scale deployments.

OLED is the fastest-growing segment, offering superior color, contrast, and form factor flexibility. High-end malls, museums, and automotive showrooms are adopting OLED for ultra-thin transparent screens and curved displays. Though expensive, OLED's premium appeal is finding traction in Japan and South Korea.

China is the largest market for digital signage in APAC, with rapid deployment in retail, transportation, and civic communication. DOOH networks in major cities are expanding, while companies like Leyard and Unilumin are exporting technology globally. Government initiatives in smart city infrastructure further strengthen demand.

India is the fastest-growing market, driven by infrastructure upgrades, retail modernization, and smart city rollouts. Government railway stations, education institutions, and tier-2 city malls are key adopters. Startups and system integrators are emerging to offer cost-effective signage-as-a-service models.

Japan continues to be a technology leader with high adoption in public transit, hospitality, and retail. Tokyo’s train networks, airports, and smart hotels are pioneers in dynamic signage. Japanese brands like Sharp and Panasonic continue to drive innovation in large-format displays and embedded touch solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific digital signage market

Location

Type

Component

Application

Size

Content Type

Technology

Country