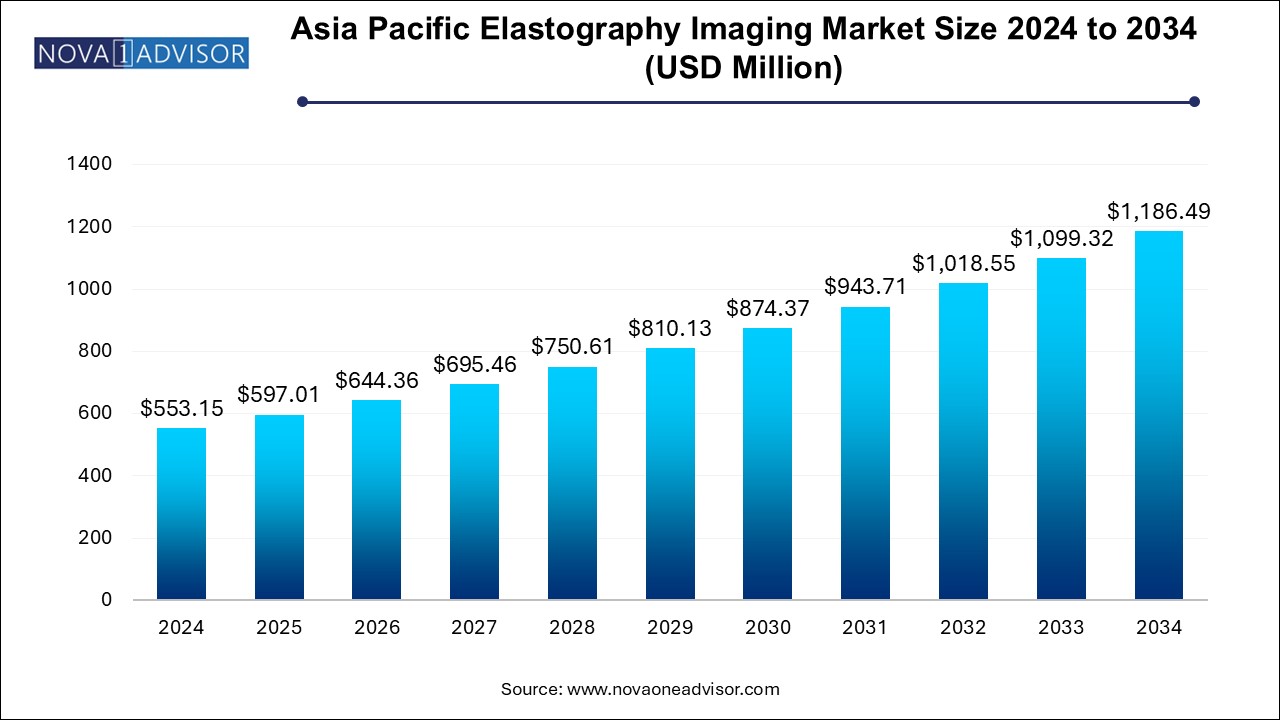

The Asia Pacific elastography imaging market size was exhibited at USD 553.15 million in 2024 and is projected to hit around USD 1186.49 million by 2034, growing at a CAGR of 7.93% during the forecast period 2025 to 2034.

The Asia Pacific Elastography Imaging Market is witnessing rapid growth, driven by rising healthcare expenditure, growing awareness of early disease detection, and increased adoption of non-invasive diagnostic technologies. Elastography imaging is an advanced technique used to assess tissue stiffness, an important biomarker in diagnosing conditions like liver fibrosis, tumors, and certain cardiovascular diseases. The Asia Pacific region, home to over half the world’s population and marked by a growing burden of chronic diseases, presents an expansive landscape for elastography technology adoption.

This imaging modality is increasingly preferred for its non-invasive nature, speed, and ability to provide quantitative data. Elastography, especially in ultrasound and magnetic resonance imaging (MRI), has been integrated into routine diagnostics for hepatology, oncology, musculoskeletal disorders, and even breast cancer detection. Governments across the region, particularly in countries like China, India, and South Korea, are investing heavily in public healthcare infrastructure, facilitating wider access to imaging services.

The market is further supported by the rising penetration of private diagnostic centers, medical tourism in countries like Thailand and India, and the introduction of portable and affordable elastography devices by key players. Furthermore, clinical trials and academic research initiatives are promoting the clinical efficacy of elastography in newer applications such as nephrology and cardiology. As Asia Pacific continues to shift toward value-based and precision medicine, elastography imaging is poised to become a cornerstone of diagnostic radiology in the region.

Growing Preference for Non-Invasive Liver Disease Diagnosis

With liver diseases such as hepatitis B, hepatitis C, and NAFLD rising in the region, elastography is becoming an essential tool for liver fibrosis staging.

Adoption of Portable Ultrasound Elastography Systems

Manufacturers are launching compact, handheld elastography systems suited for remote clinics and point-of-care diagnostics.

Integration with Artificial Intelligence (AI)

AI-enabled elastography platforms are emerging to improve diagnostic accuracy and automate image interpretation.

Expansion into Oncology and Breast Cancer Diagnostics

Elastography is being increasingly used for tumor detection and characterization, especially in dense breast tissue.

Medical Tourism Boosting Imaging Demand

Countries like Thailand and India, known for affordable and high-quality healthcare, are seeing rising demand for diagnostic imaging among international patients.

Government Screening Programs

Initiatives such as free hepatitis screening in China and Japan are boosting the use of elastography in public health settings.

| Report Coverage | Details |

| Market Size in 2025 | USD 597.01 Million |

| Market Size by 2034 | USD 1186.49 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.93% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Modality, Application, End use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Canon Medical Systems Corporation; Esaote SpA; FUJIFILM Corporation; GE Healthcare; Hitachi, Ltd.; Koninklijke Philips N.V.; Mindray Bio-Medical Electronics Co., Ltd.; Samsung Medison Co., Ltd.; Siemens; Toshiba America Medical Systems, Inc. |

A significant driver propelling the Asia Pacific elastography imaging market is the surge in chronic liver diseases across the region. Liver disorders, including hepatitis B and C, alcoholic liver disease, and non-alcoholic fatty liver disease (NAFLD), are prevalent in both urban and rural populations. According to the World Health Organization, more than 100 million people in China alone are affected by hepatitis B, while India has a rising prevalence of NAFLD due to increasing obesity and diabetes rates.

Elastography imaging, particularly ultrasound-based shear wave elastography, offers a non-invasive alternative to liver biopsies for assessing fibrosis and cirrhosis. This makes it an essential tool in hepatology, especially in primary care and outpatient settings where fast and safe diagnostics are crucial. With governments emphasizing early detection and long-term disease management, the integration of elastography into standard liver disease evaluation is becoming increasingly common across Asia Pacific.

Despite growing demand, one of the key restraints in the market is the high cost of advanced elastography imaging systems, particularly MRI-based elastography. While ultrasound elastography is relatively cost-effective, MRI elastography systems come with higher installation, maintenance, and training costs. This limits adoption in low- and middle-income countries within the region, where healthcare budgets are constrained and price sensitivity is high.

Moreover, elastography imaging requires radiologists and technicians to be trained in interpreting tissue stiffness maps, which can pose a challenge in rural or underdeveloped healthcare settings. While urban hospitals and diagnostic chains in Asia Pacific’s developed markets can absorb these costs, smaller facilities often defer adoption, which creates disparities in access and availability.

One of the most promising opportunities for the Asia Pacific elastography imaging market lies in its expanding role in oncology diagnostics. Elastography has demonstrated strong potential in detecting and characterizing tumors based on tissue stiffness—particularly useful in breast cancer, thyroid nodules, prostate cancer, and pancreatic masses. With cancer rates rising rapidly across the region, early and non-invasive detection is a major public health priority.

Breast cancer, for example, has become the most diagnosed cancer among women in countries like Japan, South Korea, and India. Elastography imaging provides additional diagnostic information that complements mammography and traditional ultrasound, especially in women with dense breast tissue. The ability to reduce unnecessary biopsies and improve diagnostic confidence is pushing radiology departments and cancer screening centers to adopt elastography. As healthcare systems across the region embrace precision medicine and patient-centered care, elastography's utility in oncology is expected to unlock new avenues of growth.

Ultrasound elastography is the dominant modality in the Asia Pacific market, owing to its affordability, portability, and widespread availability. Compared to MRI, ultrasound elastography requires lower infrastructure investment and is more adaptable in outpatient and rural settings. It is widely used for liver fibrosis assessment, breast cancer screening, and thyroid nodule evaluation. The growing popularity of handheld ultrasound devices further enhances its appeal. Countries such as India, Thailand, and the Philippines are increasingly deploying portable ultrasound elastography tools in public health clinics, promoting broader adoption at the grassroots level.

Conversely, MRI elastography is emerging as the fastest-growing segment, particularly in advanced hospital settings across China, Japan, and South Korea. This modality provides higher accuracy in detecting subtle stiffness variations and is particularly valuable in assessing liver disease progression and evaluating complex tumors. Although expensive, MRI elastography is gaining traction in tertiary care centers and academic hospitals. With innovations reducing scan times and improving image quality, MRI elastography is expected to experience greater uptake among specialized institutions and private hospitals catering to affluent patient segments.

Hepatology leads the application segments in elastography imaging across Asia Pacific, driven by the region’s high prevalence of liver disease. The non-invasive assessment of liver stiffness has become a routine procedure in both public and private healthcare setups. Screening programs targeting hepatitis B and C, along with growing awareness about liver health among diabetic and obese populations, have firmly established hepatology as the largest segment. In China and India, dedicated liver clinics are incorporating elastography into routine checkups, further reinforcing its position.

On the other hand, the oncology-focused breast application segment is witnessing the fastest growth, as elastography’s role in breast cancer screening gains wider acceptance. In countries like South Korea and Japan, where breast density among women is typically high, elastography helps distinguish between benign and malignant lesions. Diagnostic centers are integrating elastography with 3D ultrasound systems for improved lesion visualization and biopsy guidance. With cancer awareness campaigns and increased access to screening tools, the use of elastography in breast health is set to expand significantly.

Hospitals currently dominate the elastography imaging market by end use, as they are typically the first adopters of advanced diagnostic technologies. In urban centers across Asia Pacific, public and private hospitals are investing in elastography-capable ultrasound and MRI systems to offer comprehensive diagnostic services. Hospitals also play a central role in managing chronic liver and cancer patients, making them ideal environments for elastography integration. Government-run tertiary care hospitals in India, China, and Vietnam are increasingly equipping hepatology and oncology departments with elastography units as part of national health missions.

Imaging centers, however, are becoming the fastest-growing end users, particularly in metropolitan areas and medical tourism hubs. Independent diagnostic labs in countries like Thailand and Malaysia are incorporating elastography as a value-added service to attract international patients. These centers benefit from faster decision-making cycles, higher throughput, and partnerships with insurance providers, making them agile adopters of new imaging technologies. As patient preferences shift toward accessible and high-quality outpatient diagnostics, imaging centers will continue to gain market share.

China dominates the Asia Pacific elastography imaging market, backed by its massive population, high burden of chronic liver diseases, and aggressive investments in healthcare modernization. The Chinese government has rolled out national-level hepatitis screening programs, and local manufacturers are entering the elastography space with affordable, AI-enabled ultrasound solutions. Additionally, China’s large network of tertiary hospitals and rapid urbanization are contributing to increased adoption of both ultrasound and MRI elastography across multiple specialties, from hepatology to oncology.

In contrast, India is the fastest-growing country in the market, driven by its burgeoning middle class, rising incidence of liver and kidney disorders, and expanding private healthcare infrastructure. Diagnostic chains like Apollo Diagnostics and Metropolis Healthcare are investing in elastography systems to differentiate their service offerings. Furthermore, mobile diagnostic vans and telemedicine platforms are deploying portable elastography tools in rural India, bridging access gaps. Government initiatives like Ayushman Bharat and liver health awareness campaigns are also spurring market demand across public and semi-urban healthcare facilities.

March 2024 – Canon Medical Systems launched a new elastography ultrasound system tailored for Asian liver clinics, featuring AI-driven quantification and remote collaboration features.

January 2024 – Samsung Medison introduced an upgraded version of its HERA W10 ultrasound platform with enhanced elastography modules for breast and liver imaging at the 2024 Seoul Medical Expo.

November 2023 – Hitachi, Ltd. collaborated with Kyoto University to conduct clinical trials on liver fibrosis staging using MRI elastography in a multi-center study across Japan.

October 2023 – Mindray Medical International expanded its elastography product portfolio by introducing a portable solution targeted at rural healthcare centers in India and Southeast Asia.

September 2023 – Siemens Healthineers announced the integration of elastography software with its ultrasound portfolio, aiming to enhance diagnostic utility across APAC hospitals.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Asia Pacific elastography imaging market

By Modality

By Application

By End Use

By Country