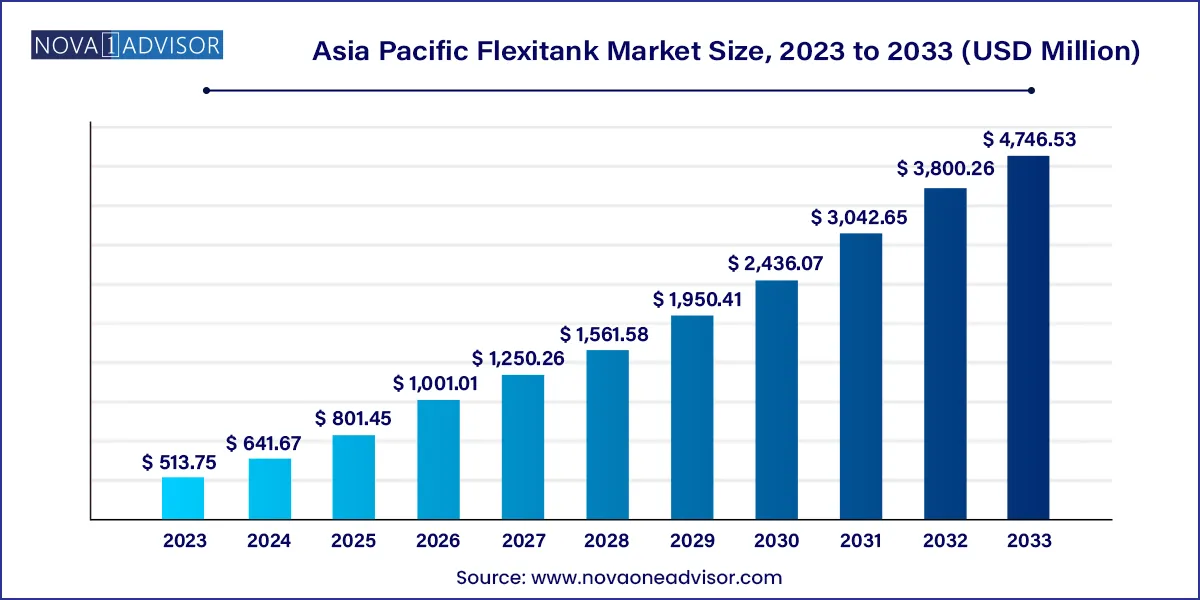

The Asia Pacific flexitank market size was exhibited at USD 513.75 million in 2023 and is projected to hit around USD 4,746.53 million by 2033, growing at a CAGR of 29.9% during the forecast period 2024 to 2033.

The Asia Pacific Flexitank Market is rapidly evolving as a dynamic and high-growth segment within the global bulk liquid logistics and packaging industry. A flexitank is a collapsible, single-use or reusable bladder, typically made from multiple layers of polyethylene and polypropylene, and used to transport non-hazardous liquids in standard shipping containers. As a cost-effective and logistically efficient alternative to traditional methods such as drums, ISO tanks, and IBCs (intermediate bulk containers), flexitanks are becoming increasingly popular in the Asia Pacific region.

The region’s significant growth in bulk exports of edible oils, wine and beverages, chemicals, industrial fluids, and pharmaceutical intermediates is driving the expansion of flexitank use. Flexitanks offer numerous benefits over conventional methods, including higher payload capacity (up to 24,000 liters), lower transportation costs, reduced cleaning and repositioning costs, and minimal contamination risks. Their ability to convert standard 20-foot containers into safe and hygienic bulk liquid carriers is revolutionizing how small and medium-sized enterprises (SMEs) engage in cross-border trade.

Asia Pacific stands at the forefront of global trade flows, with China, India, Malaysia, and Singapore acting as major manufacturing and export hubs. In this context, the demand for safe, scalable, and low-cost liquid logistics solutions is soaring. Moreover, government support for international trade, rising e-commerce, and the post-pandemic resurgence of supply chains are contributing to the market’s robust outlook.

Rising Adoption of Single-Use Flexitanks: Shippers are increasingly choosing disposable flexitanks to avoid cleaning costs and eliminate the risk of cross-contamination, particularly for food-grade applications.

Technological Innovation in Flexitank Design: Companies are introducing multilayered, anti-leak, and temperature-controlled flexitanks with better load resistance and compatibility with a wide range of cargo types.

Integration of Smart Monitoring Systems: IoT-enabled flexitanks with sensors for tracking temperature, pressure, and GPS location are gaining traction, especially in high-value or perishable shipments.

Expansion of Agrochemical and Edible Oil Exports: Countries like Malaysia and India are ramping up exports of palm oil and liquid fertilizers, creating a surge in demand for flexitanks as the preferred bulk packaging solution.

Surge in E-commerce Cross-border Trade: The need for flexible, scalable, and low-cost bulk liquid transport for cosmetic oils, syrups, and food ingredients is increasing with the rise of Asia’s online trade landscape.

Environmental Awareness Driving Recyclable Materials Use: Players are developing eco-friendly flexitanks made with recyclable polymer materials to reduce the carbon footprint of logistics operations.

| Report Coverage | Details |

| Market Size in 2024 | USD 641.67 Million |

| Market Size by 2033 | USD 4,746.53 Million |

| Growth Rate From 2024 to 2033 | CAGR of 24.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Qingdao BLT Packing Industrial Co., Ltd. (BLT).; Bulk Liquid Solutions Pvt. Ltd.; Rishi FIBC Solutions Pvt Ltd.; Infinity Bulk Logistics Sdn Bhd; ORCAFLEXI SDN BHD; FLUIDTAINER FLEXITANK Sdn Bhd; My Flexitank Industries Sdn. Bhd.; Global Barrels Industries Pte Ltd; Singapore Tank Supply Limited.; AZUMA SHIPPING CO., LTD. |

A significant market driver is the superior cost-effectiveness of flexitanks compared to traditional bulk packaging solutions, such as drums, IBCs, and ISO tanks. In international shipping, optimizing cargo volume and minimizing per-unit transport costs are critical to maintaining profitability especially for exporters of low- to mid-margin liquid goods.

Flexitanks allow shippers to carry 15–40% more liquid per container than drums or IBCs. For example, a standard 20-foot container equipped with a flexitank can transport around 24,000 liters of liquid, compared to only about 16,000 liters when using drums. This efficiency translates into significant freight savings, reduced loading and unloading time, and lower packaging material costs.

Additionally, since flexitanks are typically single-use, they eliminate the need for cleaning, return freight, and inspection cutting logistical complexity and turnaround time. These advantages are especially beneficial for SMEs, agro-exporters, and manufacturers of food-grade liquids and chemicals, many of whom operate under tight logistics budgets and value flexibility over large fixed investments.

Despite the many benefits, a notable limitation of the flexitank market lies in its restricted use for hazardous and highly reactive chemicals. Current flexitank designs—mostly made of polyethylene-based materials—are not compatible with strong oxidizers, highly volatile solvents, or corrosive acids and bases, due to risks of leakage, degradation, or chemical interaction.

This makes ISO tanks or specialized stainless-steel containers the only safe and compliant option for a significant portion of the chemical and industrial liquid transport sector. Regulatory authorities in various Asia Pacific countries enforce strict guidelines under ADR, IMDG, and local environmental laws that prohibit or limit flexitank usage for such cargoes.

Additionally, improper handling, incorrect installation, or overfilling of flexitanks can cause container bulging, leakage, or ruptures, especially during long-haul transits. These risks have led to stringent training requirements and certifications, which may act as entry barriers for smaller logistics firms or new exporters.

A compelling opportunity for the Asia Pacific flexitank market lies in the escalating export of agricultural commodities, edible oils, fruit juices, and processed food ingredients. Countries such as India (vegetable oils), Malaysia (palm oil), Thailand (coconut water and sauces), and Australia (wine and fruit concentrates) are scaling up international food and beverage trade.

Flexitanks are increasingly favored in these sectors due to their hygiene standards, zero cross-contamination risk, and ease of disposal. For example, Indian exporters have adopted single-trip flexitanks to ship refined sunflower and rice bran oils to the Middle East and Africa. Similarly, Chinese companies are using multilayer flexitanks to export soy milk, liquid glucose, and sorbitol to European markets.

As food safety regulations become more stringent and traceability gains importance, flexitanks—especially those with smart monitoring systems and food-grade liners offer a compliant and scalable solution. This makes them ideal for emerging food-tech exporters, cold chain logistics providers, and organic product brands aiming to maintain quality while minimizing packaging and shipping costs.

Food stuffs are the leading application segment, encompassing edible oils, juices, sauces, sugar syrups, and dairy ingredients. The Asia Pacific region exports millions of metric tons of bulk food liquids annually, and flexitanks are a preferred packaging method due to their low cost per liter transported, minimal spoilage risk, and temperature-insulated options. For instance, India and Malaysia alone account for a significant share of flexitank use in palm and soybean oil exports.

Wine & spirits and pharmaceutical goods are the fastest-growing applications. Australia’s premium wine exporters are increasingly using temperature-controlled flexitanks to preserve taste and avoid oxidation during long-haul shipments to North America and Asia. Similarly, companies involved in the export of medicinal syrups, nutraceutical suspensions, and intermediate pharmaceutical liquids are adopting flexitanks for their sterility and regulatory compliance benefits. The ability to track temperature and tamper status via embedded sensors is further enhancing appeal in these high-value sectors.

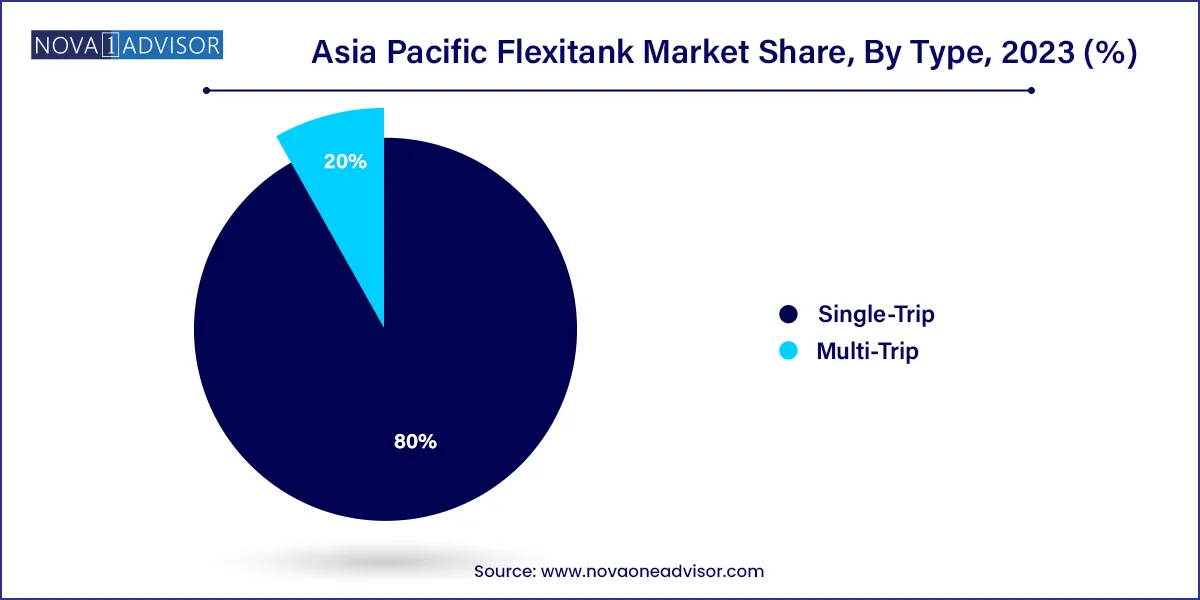

Single-trip flexitanks dominate the market, particularly due to their widespread use in food-grade, pharmaceutical, and agricultural exports. These tanks are typically disposed of after one use, which significantly reduces the chances of contamination, eliminates cleaning costs, and ensures compliance with Good Manufacturing Practices (GMP) and international hygiene protocols. Their ease of installation and compatibility with various container types makes them a top choice for high-volume, non-hazardous shipments in the region.

On the other hand, multi-trip flexitanks are the fastest-growing segment, driven by rising demand in cost-sensitive, domestic liquid transportation across countries like China and India. Multi-trip options allow shippers to reuse flexitanks several times, offering improved ROI for logistics companies handling non-sensitive industrial liquids such as lubricants, base oils, or surfactants. However, stricter tracking and cleaning protocols are required, making them more suitable for seasoned operators.

China is the largest market for flexitanks in Asia Pacific, driven by its massive manufacturing base, export-oriented economy, and innovation in bulk logistics. Chinese exporters extensively use flexitanks for transporting industrial liquids, base oils, food-grade additives, and glycerin to North America, Europe, and the Middle East. Additionally, domestic companies are producing flexitanks for global export, establishing China as both a consumer and supplier in the market.

With investments in green logistics, IoT-enabled containers, and liquid food exports, the Chinese market is witnessing rapid technological integration. Several Chinese ports have installed dedicated flexitank handling terminals, further enhancing throughput and reducing spillage risks.

India is the fastest-growing flexitank market, fueled by exponential growth in edible oil exports, agrochemicals, and sugar derivatives. As Indian exporters aim to reach new markets across Africa and Southeast Asia, flexitanks provide a scalable solution for liquid cargo with minimal capital outlay. Government initiatives such as Make in India and PLI schemes for food processing are indirectly supporting flexitank adoption.

Ports such as Kandla, Mundra, and Nhava Sheva have streamlined customs clearance and inspection protocols for flexitank shipments, reducing logistics bottlenecks. Indian manufacturers like Rishi FIBC and SIA Flexitanks are expanding production capacity to meet both domestic and global demand.

Australia is a significant player in the wine and fruit concentrate export segments. Temperature-controlled and oxygen-barrier flexitanks are gaining ground among high-end producers in South Australia and New South Wales.

Singapore serves as a regional logistics hub with high transshipment activity. Companies leverage Singapore’s advanced infrastructure and free trade agreements to move liquid bulk cargo efficiently throughout Southeast Asia.

Malaysia, with its palm oil dominance, continues to use flexitanks for shipping edible oils and oleochemicals. Ports like Port Klang have integrated specialized loading facilities for flexitank operations.

Japan has a smaller market size but focuses on high-value pharmaceutical, flavor, and industrial exports. Japanese logistics firms emphasize reliability and regulatory compliance, fostering demand for advanced, traceable flexitank systems

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific flexitank market

Type

Application

Asia Pacific Flexitank Market Country