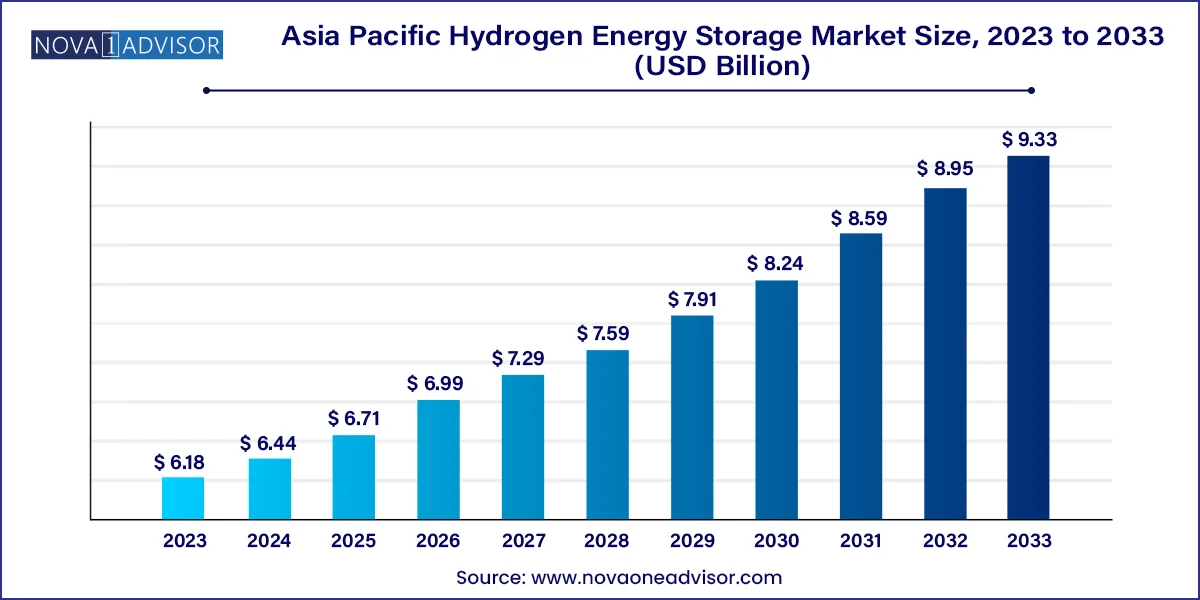

The Asia Pacific hydrogen energy storage market size was valued at USD 6.18 billion in 2023 and is anticipated to reach around USD 9.33 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

The Asia Pacific Hydrogen Energy Storage Market is gaining strategic importance as countries in the region pursue aggressive decarbonization goals, accelerate renewable energy integration, and strengthen their energy security. As a clean, versatile, and storable energy carrier, hydrogen has emerged as a key enabler for future energy systems — offering a compelling solution for long-duration storage, seasonal balancing, and decoupling renewable energy supply from real-time demand.

Hydrogen energy storage involves converting electricity (typically from renewables like wind or solar) into hydrogen via electrolysis, storing it in various physical forms — gas, liquid, or solid — and later converting it back into electricity through fuel cells or combustion. This capability allows hydrogen to bridge the intermittency gaps inherent in renewable energy systems, provide backup power, and serve as a feedstock in industrial applications such as steelmaking, ammonia production, and refineries.

Asia Pacific stands at the forefront of the global hydrogen transition. With strong government commitments, cross-border hydrogen trade initiatives, and major investments in infrastructure, the region is witnessing rapid growth in hydrogen-related pilot projects and commercial ventures. Countries like Japan and South Korea have already developed national hydrogen roadmaps, while China and Australia are investing in mega-scale green hydrogen projects.

Driven by climate pledges under the Paris Agreement and regional sustainability targets, the hydrogen energy storage ecosystem in Asia Pacific is evolving rapidly. The synergy between renewable energy growth, fuel diversification, and technological innovation makes this market one of the most promising areas for investment and industrial transformation over the next decade.

Expansion of green hydrogen production from solar and wind power: Countries are scaling up electrolysis capacity to produce hydrogen from renewables.

Growth in hydrogen storage infrastructure: Investment in underground salt caverns, high-pressure tanks, and cryogenic systems is rising to support large-scale hydrogen storage.

Cross-sector hydrogen integration: Hydrogen is increasingly being used in transport, industry, and power generation applications across the region.

Strategic government roadmaps and subsidies: National plans in Japan, South Korea, and India are driving pilot projects and market adoption.

Advancements in material-based hydrogen storage: Research in metal hydrides, carbon-based materials, and chemical hydrogen carriers is gaining momentum.

Hydrogen trade corridors emerging: Export-focused projects in Australia are preparing to supply hydrogen to Japan, South Korea, and beyond.

Rise in ammonia and methanol as hydrogen carriers: Chemical storage of hydrogen is being explored to facilitate easier transport and reconversion.

| Report Attribute | Details |

| Market Size in 2024 | USD 6.44 Billion |

| Market Size by 2033 | USD 9.33 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, physical state, application, country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Taiyo Nippon Sanso Corporation; Iwatani Corporation; Adani Green Energy Ltd.; GAIL; Sunshine Hydro.; Japan Suiso Energy, Ltd; Toshiba Fuel Cell Power Systems Corporation.; LG Energy Solutions.; Doosan Fuel Cell Co., Ltd.; SPIC Hydrogen Energy Tech. |

A central driver propelling the Asia Pacific hydrogen energy storage market is the need to integrate large volumes of renewable energy into national power grids while meeting ambitious carbon neutrality targets. The intermittency of solar and wind power poses challenges for grid stability and energy reliability, particularly as penetration levels increase. Hydrogen offers a flexible, scalable, and long-duration storage solution that can convert surplus renewable electricity into storable energy, thus flattening fluctuations and extending the utility of variable renewables.

Japan, for instance, has committed to becoming carbon neutral by 2050 and is increasingly investing in green hydrogen production to stabilize its energy mix and reduce dependency on imported fossil fuels. In India, the government’s National Green Hydrogen Mission, launched in 2023, aims to establish the country as a global hub for green hydrogen production and storage. Australia is building large-scale solar farms in Western and Northern territories, linked to electrolysers and hydrogen storage systems that will cater to both domestic and export markets.

As more nations aim to meet zero-emission energy targets, hydrogen energy storage is becoming not just an ancillary technology but a cornerstone of integrated energy systems.

Despite its potential, hydrogen energy storage in the Asia Pacific region faces considerable barriers — the foremost being the high cost of storage infrastructure and inefficiencies in energy conversion cycles. Storing hydrogen as a gas requires high-pressure tanks (up to 700 bar), which are expensive and energy-intensive to operate. Liquid hydrogen storage, while more compact, demands extremely low temperatures (below -253°C) and specialized cryogenic systems. Solid-state and material-based storage solutions, though promising, are still in early development stages and lack large-scale commercial viability.

Furthermore, the round-trip efficiency of hydrogen storage — from electricity to hydrogen and back to electricity — is currently lower than alternatives like lithium-ion batteries. This makes hydrogen less economically attractive for short-term grid balancing and requires substantial financial support and policy incentives to compete.

In developing economies within the Asia Pacific region, such as Vietnam, Indonesia, and the Philippines, the lack of hydrogen-ready infrastructure and skilled labor adds to deployment delays. These challenges highlight the need for public-private R&D collaboration, standardized regulatory frameworks, and sustained policy incentives to overcome technological and cost-related barriers.

One of the most significant opportunities in the Asia Pacific hydrogen storage market lies in the development of international hydrogen supply chains. Australia, with its vast renewable energy resources and low population density, is uniquely positioned to become a global exporter of green hydrogen. Large-scale projects such as the Asian Renewable Energy Hub and Western Green Energy Hub are in development, aiming to use solar and wind power to produce hydrogen via electrolysis and store it for export in various forms.

Japan and South Korea, on the other hand, have limited domestic renewable potential and are investing in hydrogen imports as part of their decarbonization plans. Both countries are establishing hydrogen import terminals and forging trade partnerships with Australia, the Middle East, and Southeast Asia. These developments create a market pull for large-scale hydrogen storage systems — including compressed gas tanks, liquefied hydrogen vessels, and chemical carriers like ammonia and methylcyclohexane.

The opportunity to become a hydrogen-exporting nation has led to a surge in investment in hydrogen infrastructure across the Asia Pacific, with storage systems playing a vital role in transport logistics, port terminal operations, and long-haul energy trade. As these transnational supply chains mature, storage systems will become key revenue drivers across the hydrogen value chain.

The industrial segment accounted for the largest market share of 40.66% in 2023. due to the extensive use of hydrogen in steel manufacturing, ammonia synthesis, and oil refining. Countries like China and India — among the world’s largest industrial producers — are investing in hydrogen to decarbonize hard-to-abate sectors. In these settings, hydrogen energy storage supports both energy supply reliability and feedstock availability, particularly when linked with renewable energy sources for green hydrogen generation.

Industrial clusters in countries like Japan and South Korea are adopting hydrogen energy hubs where production, storage, and usage are co-located. These projects often involve hundreds of megawatts of electrolyzer capacity and large-scale storage systems — both gaseous and liquid — to supply round-the-clock energy for production processes. Industrial demand, backed by emission reduction targets and carbon pricing policies, ensures this segment remains the revenue cornerstone of the market.

In contrast, the residential application of hydrogen energy storage is the fastest-growing segment, especially in Japan. Projects like the ENE-FARM program have installed tens of thousands of residential fuel cell systems powered by hydrogen, allowing homeowners to generate electricity and heat. As energy independence and decarbonization become household priorities, small-scale hydrogen storage systems are gaining favor. These systems allow surplus renewable energy to be stored and reused as hydrogen, offering homeowners resilience during blackouts and a lower carbon footprint. As costs fall and public subsidies increase, residential hydrogen storage adoption is expected to grow rapidly across Asia Pacific.

The compression segment held the largest market share of 45.83% in 2023. due to its technological maturity, cost-effectiveness, and extensive deployment in mobility and industrial applications. Compressed hydrogen gas at pressures of 350 to 700 bar is widely used in fuel cell electric vehicles (FCEVs), hydrogen refueling stations, and backup power systems. The infrastructure for high-pressure storage has already been deployed across regions like Japan and South Korea, where fuel cell cars and buses are part of the government’s clean mobility agenda.

In industrial zones and renewable hydrogen hubs, compressed storage offers a reliable medium for short- to mid-duration storage, enabling efficient delivery to downstream applications. As more hydrogen-powered transportation fleets and backup energy systems are adopted, the demand for compressed hydrogen storage systems will continue to lead the market in the near term.

However, material-based hydrogen storage is emerging as the fastest-growing segment. These systems utilize advanced materials like metal hydrides, activated carbon, and chemical absorbers to store hydrogen at lower pressures and temperatures, potentially improving safety and volumetric efficiency. Though currently limited to R&D and niche applications, material-based storage is gaining traction in research institutions and pilot projects across countries like Japan, Australia, and China. As technology advances and costs decrease, this segment is expected to revolutionize hydrogen storage, especially in space-constrained environments.

The solid state accounted for the largest market share of 48.78% in 2023 largely due to the prevalence of compressed gas storage in transportation, power generation, and hydrogen refueling infrastructure. This method allows for relatively easy handling, rapid fueling, and flexible integration with existing pipelines and storage vessels. Gaseous storage is particularly prominent in distributed energy systems and short-haul transport sectors across Japan, China, and South Korea.

Liquid state storage held a substantial portion of the market in 2023 While more technically demanding, it allows for significantly greater energy density and is better suited for large-scale storage, long-distance transport, and export-oriented applications. For example, Kawasaki Heavy Industries and ENEOS in Japan are investing heavily in liquefied hydrogen production and shipping infrastructure, aiming to import hydrogen from Australia via liquefied hydrogen carriers. This trend is mirrored in South Korea, where companies like Hyundai are exploring liquid hydrogen-powered vehicles and storage systems. As large-scale hydrogen trade accelerates, the need for cryogenic liquid hydrogen storage is expected to expand substantially.

Japan is a pioneer in hydrogen energy storage, driven by national energy security concerns and a commitment to carbon neutrality by 2050. The government has allocated significant funding toward hydrogen fuel cell infrastructure, residential storage systems, and liquefied hydrogen supply chains. Japan’s collaboration with Australia for green hydrogen imports via liquefied hydrogen carriers sets a global precedent in hydrogen trade. In 2024, Japan unveiled its updated Basic Hydrogen Strategy with a goal to scale up domestic hydrogen consumption to 20 million tons by 2050, with storage technologies playing a central role.

China is investing heavily in hydrogen storage to complement its vast renewable energy deployments. Pilot cities and industrial parks have launched hydrogen storage initiatives, particularly in Inner Mongolia, Hebei, and Xinjiang. In 2023, China’s National Development and Reform Commission (NDRC) announced new guidelines promoting hydrogen storage R&D, particularly material-based and underground storage methods. Chinese companies like Sinopec are developing integrated hydrogen hubs with electrolysis, storage, and fueling capabilities.

Australia is positioning itself as a global green hydrogen exporter, with numerous projects under development in Queensland, Western Australia, and the Northern Territory. These projects include massive electrolyzer installations and hydrogen storage facilities designed to export hydrogen to Asia via liquefied carriers or ammonia. In February 2025, the Western Green Energy Hub received environmental clearance, marking a major milestone in Australia’s hydrogen export journey.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific Hydrogen Energy Storage market.

By Technology

By Physical State

By Application

By Country