The Asia Pacific ice cream market size was exhibited at USD 42.85 billion in 2023 and is projected to hit around USD 64.10 billion by 2033, growing at a CAGR of 4.11% during the forecast period 2024 to 2033.

The Asia Pacific ice cream market is undergoing a transformative evolution marked by shifting consumer preferences, innovative product launches, and regional diversification. Once regarded as a seasonal indulgence, ice cream has now become a year-round product in many Asia Pacific countries, driven by changing lifestyles, rising disposable incomes, and increased westernization of diets. From street vendors in Bangkok to luxury dessert parlors in Tokyo, ice cream consumption has expanded across socio-economic groups and geographies.

Asia Pacific’s sheer demographic diversity presents a complex and promising landscape for ice cream manufacturers. The region houses countries with varying climates, dietary habits, religious restrictions, and levels of urbanization, creating opportunities for customization and market segmentation. Global players like Unilever, Nestlé, and General Mills compete alongside dynamic regional brands such as Lotte (South Korea), Meiji (Japan), and Kwality Wall’s (India) to capture the imagination of a population that is increasingly open to experimentation.

Health-conscious consumers in cities like Singapore and Melbourne are embracing vegan and low-sugar alternatives, while traditional dairy-rich options remain popular in countries like South Korea and Taiwan. Product innovations such as probiotic ice creams, exotic tropical fruit flavors, and artisanal gelatos are redefining how consumers experience frozen desserts. Moreover, digital transformation in retail and logistics, especially in markets like Indonesia and Thailand, has streamlined the cold chain supply, enabling ice cream companies to reach rural and semi-urban locations efficiently.

Rise of Vegan and Plant-Based Ice Creams: Driven by lactose intolerance awareness, animal welfare concerns, and health trends, vegan options are gaining traction across urban Asia Pacific markets.

Flavor Innovation and Localization: Companies are introducing culturally relevant flavors such as matcha (Japan), durian (Thailand), red bean (China), and taro (Taiwan) to appeal to local palates.

Premiumization of Ice Cream Offerings: Gourmet, small-batch, and craft ice creams are rising in popularity, especially in high-income cities like Seoul and Sydney.

Growth of E-commerce and Delivery Platforms: Online delivery of ice cream is increasing via platforms like GrabFood, Swiggy, Uber Eats, and direct brand channels.

Sustainability in Packaging: Brands are adopting biodegradable and recyclable materials, especially in markets like Australia and New Zealand.

Fusion and Hybrid Formats: Innovations such as ice cream mochi, ice cream cakes, and frozen yogurt-infused varieties are capturing diverse consumer segments.

Functional Ice Creams: Ice creams fortified with probiotics, vitamins, and immunity-boosting ingredients are increasingly introduced to meet wellness trends.

Impulse Buying in Urban Centers: Expansion of vending machines, pop-up kiosks, and convenience stores is driving impulse consumption in busy city areas.

| Report Coverage | Details |

| Market Size in 2024 | USD 44.61 Billion |

| Market Size by 2033 | USD 64.10 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Source, Flavor, Packaging, Distribution Channel, country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Hong Kong; Taiwan; South Korea; Thailand; Singapore; Indonesia; Australia; New Zealand; Japan |

| Key Companies Profiled | Nestle SA; General Mills Inc.; Appolo Ice Cream Co Ltd; Unilever PLC; Yili Group; CAMPINA ICE CREAM INDUSTRY Tbk.; Diamond Food Indonesia; Dairy Bell Ice Cream; PT. United Family Food; Froneri International Limited |

One of the strongest drivers behind the growth of the Asia Pacific ice cream market is the ongoing shift in consumer lifestyles and snacking behaviors. As urbanization intensifies, work schedules become more hectic, and dining habits evolve, ice cream is increasingly perceived as a go-to indulgence for quick relief and emotional comfort. Consumers are replacing traditional desserts with on-the-go frozen snacks, especially in high-temperature climates or after meals.

Additionally, the surge in nuclear families, single-person households, and millennials with strong digital connectivity is fueling demand for innovative, easy-to-consume, and shareable ice cream formats. Whether it’s bars, cones, or cups—convenience is king. Coupled with aggressive marketing by major brands and influencers, ice cream has evolved from a children’s treat to an anytime dessert for all age groups.

Despite the promising outlook, cold chain logistics remain a persistent challenge in many Asia Pacific countries. Several emerging economies in the region still struggle with inadequate refrigeration infrastructure, inconsistent power supply, and limited temperature-controlled transportation—especially in tier 2 and rural locations.

This infrastructure gap increases product wastage, limits the penetration of premium and sensitive product categories, and raises operational costs for manufacturers and distributors. For example, while countries like Australia and Japan boast highly developed cold chain networks, markets like Indonesia and rural Thailand still require significant investments in distribution systems to ensure product integrity. This challenge could hinder market expansion, particularly for niche and high-value offerings.

The rise in dietary restrictions and lifestyle-based food preferences has opened a significant opportunity for vegan and lactose-free ice cream variants. The Asia Pacific region, despite its traditionally dairy-centric cultures, is witnessing a shift toward plant-based diets, driven by factors such as lactose intolerance, veganism, and growing awareness around animal cruelty and sustainability.

Brands like Ben & Jerry’s, So Delicious, and regional players like Kokos in Indonesia and Over The Moo in Australia are expanding their dairy-free portfolios. Coconut milk, almond milk, and soy-based ice creams are gaining popularity, especially among Gen Z and millennial consumers. Additionally, local ingredient incorporation—such as using rice milk or oat milk—offers brands a chance to innovate while maintaining cultural relevance. With an expanding customer base seeking “guilt-free indulgence,” this segment is poised for explosive growth across APAC nations.

Based on source, the dairy & water-segment led the market with the largest revenue share of 94.5% in 2023. These products remain the staple in traditional ice cream consumption patterns, deeply rooted in the cultural and culinary habits of Asia Pacific countries. Creamy textures and sweetened dairy flavors continue to be favored by families and younger consumers alike. Brands such as Meiji, Lotte, and Walls capitalize on this trend with widely distributed dairy-based options in cones, tubs, and bars.

The vegan segment is projected to grow at the fastest CAGR of 9.0% from 2024 to 2033. Markets such as Australia, Singapore, and parts of Japan are experiencing an influx of plant-based innovations using almond, soy, rice, and oat milk bases. Vegan brands are also being favored for their clean labels—free of artificial additives and preservatives—making them attractive to both vegans and flexitarians.

Based on flavor, the vanilla segment led the market with the largest revenue share of 31.6% in 2023. It serves as a base for many other flavor combinations and is often preferred in multi-scoop and layered desserts. Brands tend to prioritize vanilla in both mass-market and premium ranges, often pairing it with ingredients like caramel swirls or chocolate chips to enhance variety without deviating from core consumer preferences.

The fruit segment is projected to grow at the fastest CAGR of 5.5% from 2024 to 2033. Tropical flavors like mango, lychee, passion fruit, and durian are being embraced in Southeast Asia, while berry-infused varieties are trending in Oceania. These flavors not only offer a refreshing alternative to cream-heavy profiles but also align with the demand for vitamin-enriched, low-fat options. Seasonal promotions and locally sourced fruits further boost this segment’s growth trajectory.

Cups and bars are currently dominating the packaging segment, thanks to their convenience, portion control, and suitability for impulse purchases. These formats are widely found in convenience stores, malls, and public venues—allowing consumers to enjoy their favorite frozen treats on the go. Their affordability and portability make them especially popular among students and working professionals.

On the other hand, tubs are rapidly growing in popularity, particularly in households and online retail settings. The trend of “ice cream at home” has gained momentum post-pandemic, with families opting for larger packs during grocery runs or online orders. Tubs also allow brands to experiment with indulgent flavors, swirls, and mix-ins, making them perfect for family desserts or weekend treats.

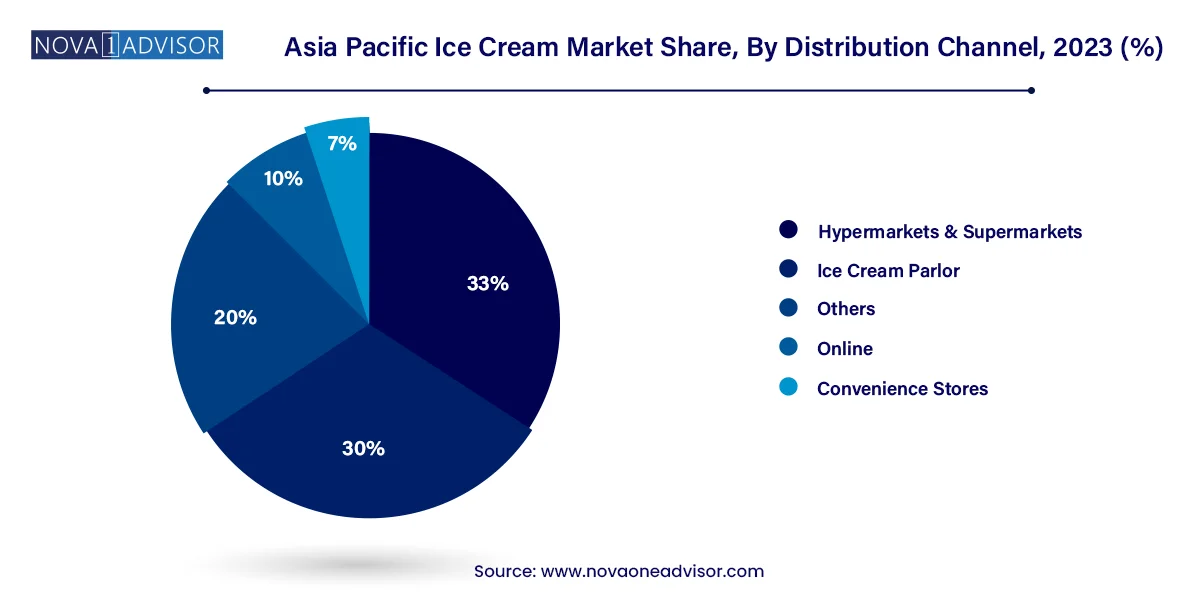

Based on distribution channel, the hypermarkets & supermarkets segment led the market with the largest revenue share of 33.0% in 2023. Chains like Woolworths (Australia), FairPrice (Singapore), and AEON (Japan) are primary retail touchpoints for both domestic and international brands. The availability of organized retail and consistent product display has kept this segment dominant.

The online channels segment is projected to grow at the fastest CAGR of 6.1% from 2024 to 2033. E-commerce platforms and food delivery apps such as RedMart, Shopee, Uber Eats, and HappyFresh are partnering with ice cream brands for instant delivery and subscription models. The ability to shop by dietary preference, flavor, and packaging type online has simplified decision-making and expanded brand reach.

Japan's ice cream market is among the most mature and innovative in Asia Pacific. With its preference for unique textures and regional ingredients, Japanese consumers embrace flavors like matcha, black sesame, and sakura. Convenience stores such as 7-Eleven and Lawson are pivotal in product distribution. The country also leads in packaging innovation and aesthetic appeal, often using seasonal packaging to attract buyers.

South Korea showcases high per capita ice cream consumption, with domestic brands like Lotte Confectionery holding significant market share. Premium ice cream cafes and artisanal parlors have also gained popularity in cities like Seoul. Consumer loyalty is strong, and new product launches typically go viral through social media, accelerating demand almost instantly.

Australia's market is diversified, with strong penetration of both local dairy brands and international players. Vegan and organic variants are highly favored, particularly in urban centers. Ice cream is a year-round favorite, often sold in supermarkets and online platforms. Sustainability in packaging and clean-label ingredients are major selling points.

Indonesia represents an emerging market with vast potential due to its large population and hot climate. While traditional push carts dominate rural regions, urban centers are witnessing a surge in modern retail and online delivery. Local brands like Campina and Aice are expanding aggressively, and affordable price points drive mass appeal.

Thailand’s affinity for tropical flavors, coupled with its tourist-driven economy, makes it a vibrant market for ice cream innovation. Coconut and durian ice creams are highly popular, and international brands often introduce localized versions. Supermarkets and convenience stores dominate retail distribution.

February 2024 – Lotte Confectionery launched its new “Zero Ice Cream” line in South Korea, targeting diabetic and low-carb consumers with sugar-free formulations.

November 2023 – Ben & Jerry’s introduced a new vegan line in Australia, incorporating almond milk bases and sustainable packaging.

September 2023 – Meiji announced plans to expand its ice cream plant in Japan to meet growing demand for premium frozen desserts.

July 2023 – Unilever partnered with GrabFood across Southeast Asia to offer 15-minute delivery service for brands like Wall’s and Magnum.

May 2023 – New Zealand's Tip Top brand introduced “Pure Delight,” a low-calorie, high-protein ice cream targeting fitness-focused consumers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific ice cream market

Source

Flavor

Packaging

Distribution Channel

Country