The Asia Pacific in vitro fertilization market size was exhibited at USD 8.25 billion in 2023 and is projected to hit around USD 16.85 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2024 to 2033.

The Asia Pacific In Vitro Fertilization (IVF) market is emerging as one of the most dynamic and rapidly expanding segments in the global assisted reproductive technology (ART) landscape. Driven by a convergence of social, medical, and economic factors, IVF has transitioned from an elite medical service to a mainstream solution for infertility challenges across a broad socioeconomic spectrum in the region. Countries such as China, India, Japan, South Korea, and Australia are at the forefront, offering a wide range of fertility services through both public health institutions and private fertility clinics.

Several demographic and cultural factors are shaping the IVF landscape in Asia Pacific. Rising infertility rates due to lifestyle factors, pollution, delayed marriages, and increasing maternal age are major contributors. Urbanization and changing societal norms have also created a cultural shift, normalizing fertility treatments that were previously considered taboo in many Asian societies. Furthermore, an increasing number of same-sex couples and single individuals are turning to IVF for family building, especially in countries like Australia where legislation has supported inclusivity in reproductive health access.

Government policies across Asia Pacific are gradually becoming more favorable toward IVF. China, for instance, has expanded its family planning policy from the two-child to the three-child regime, indirectly boosting fertility awareness and treatment uptake. Meanwhile, India’s ART Act 2021 has brought long-awaited regulation to IVF clinics, ensuring better standards and consumer protection. Coupled with technological innovation such as AI-driven embryo selection, time-lapse imaging systems, and improved cryopreservation techniques the Asia Pacific IVF market is on a robust growth trajectory that is expected to continue throughout the decade.

Increasing prevalence of lifestyle-related infertility: Stress, obesity, diabetes, and smoking are contributing to rising infertility rates in both men and women.

Growing awareness and destigmatization of fertility treatments: IVF is becoming widely accepted across different cultural backgrounds due to education and media exposure.

Rising adoption of egg and embryo freezing: Fertility preservation among career-oriented women and cancer patients is gaining momentum, especially in metro cities.

Technological advancements in lab automation and AI-powered embryo selection: Time-lapse imaging, automated incubators, and AI-based embryo scoring systems are being widely adopted.

Expanding IVF tourism within Asia: Affordable IVF procedures and advanced clinic infrastructure are drawing international patients to countries like India, Thailand, and Malaysia.

Emergence of mega fertility chains and networks: Brands like Bloom IVF, Apollo Fertility, and Jinxin Fertility are expanding their reach through M&A and franchising.

Governmental involvement in IVF funding and regulation: Countries like Japan and China are offering partial subsidies and regulatory frameworks for ART services.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.86 Billion |

| Market Size by 2033 | USD 16.85 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Procedure, Providers, Instruments, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Japan; China; India; South Korea; Australia |

| Key Companies Profiled | Birla Fertility & IVF; Kitazato Corporation; Amrita Hospital; Morpheus IVF (MLSPL); Babies & Us Fertility IVF & ICSI Center; Southend Fertility Clinic |

Culture media dominated the instrument segment, accounting for the largest revenue contribution due to its indispensable role in fertilization, embryo development, and cryopreservation. IVF clinics across Asia rely heavily on high-performance culture media to mimic the natural reproductive environment. Products such as cryopreservation media and embryo culture media are in consistent demand, especially with the rise in elective egg freezing and embryo banking services. Leading manufacturers such as Vitrolife, CooperSurgical, and Origio supply tailored media solutions optimized for local climatic and regulatory conditions.

Equipment is the fastest-growing segment, driven by the increasing adoption of technologically advanced lab devices that ensure better embryo viability and standardization. Equipment such as micromanipulators, time-lapse incubators, sperm analyzers, and anti-vibration tables are rapidly becoming standard in modern IVF labs across India, China, and South Korea. Many fertility chains are also investing in full-spectrum automation of IVF workflows, from gamete handling to embryo transfer. As clinics compete to enhance live birth rates and efficiency, the demand for advanced equipment continues to escalate across urban Asia.

Fresh non-donor cycles remain the most commonly performed IVF procedure, particularly in conservative societies where patients prefer to conceive using their own gametes. This trend is especially prevalent in India, China, and Japan, where traditional family structures and cultural norms place emphasis on genetic continuity. Fresh cycles often provide slightly better implantation outcomes and are preferred for first-line ART attempts in younger couples.

Frozen donor cycles are emerging as the fastest-growing segment, fueled by the normalization of donor-assisted reproduction and improved success rates of vitrification techniques. Egg donation, embryo sharing, and sperm donation are increasingly accepted across socio-demographic segments in Thailand, Australia, and Singapore. The use of frozen donor eggs allows better scheduling flexibility and is often used in fertility tourism, where patients travel to Asia for cost-effective and high-quality ART services. Growing gamete bank networks and advancements in genetic screening will continue to drive this segment forward.

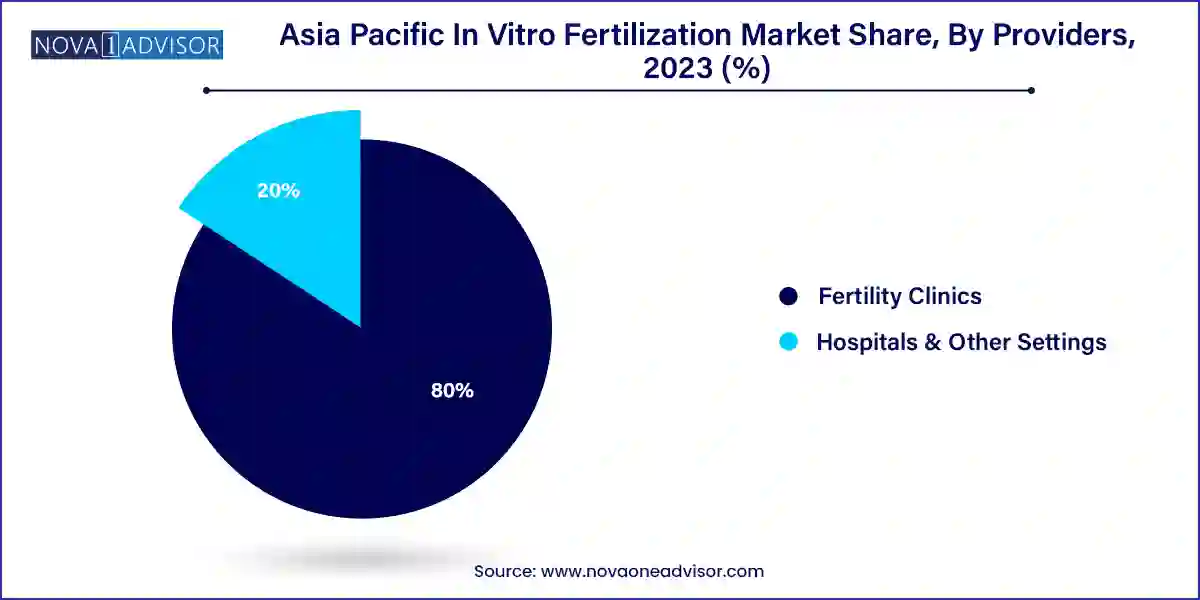

Fertility clinics dominate the provider segment, as they represent the majority of ART service delivery in the region. Many standalone IVF centers, as well as multi-clinic networks, operate across India, China, and Australia, offering specialized services, advanced labs, and higher success rates. Notable players include Apollo Fertility, Bloom IVF, and Jinxin Fertility, which are expanding their reach through acquisitions, franchising, and digital platforms. These clinics are investing in full-suite embryology equipment, electronic medical records, and patient engagement tools to deliver end-to-end fertility services.

Hospitals and other settings are growing rapidly, especially in countries like China and Japan, where public hospitals are integrating fertility services into general reproductive health departments. Government-subsidized programs are driving IVF adoption in these settings, particularly for lower-income couples and medically indicated cases. Additionally, maternity hospitals and gynecology departments in South Korea and India are adding IVF labs to their facilities to expand their service offerings and meet local demand.

China – Dominant Market

China is the largest IVF market in Asia Pacific, supported by a massive population base, rising infertility rates, and recent shifts in family planning policies. Following the abolition of the one-child policy, the Chinese government now actively encourages childbirth, with IVF playing a pivotal role in enabling older couples to conceive. China has over 500 licensed IVF clinics, most of which are located in major cities like Beijing, Shanghai, and Guangzhou. Jinxin Fertility, one of the largest fertility networks in China, has seen double-digit growth annually and is investing in AI, embryo vitrification, and cross-border egg donation to serve an expanding patient base.

India – Fastest Growing Market

India is the fastest-growing market for IVF in Asia Pacific, driven by a large pool of infertile couples, rising disposable incomes, and a booming private healthcare sector. It is estimated that over 25 million couples in India face fertility issues, with IVF cycles projected to increase exponentially in the next decade. Major players like Apollo Fertility, Indira IVF, and Bloom IVF are expanding aggressively, especially in Tier-II and Tier-III cities. The Assisted Reproductive Technology (Regulation) Act 2021 has brought much-needed regulatory oversight to the sector, boosting patient confidence and clinical standards.

March 2024 – Vitrolife announced the expansion of its EmbryoScope+ time-lapse incubator line across IVF centers in Japan, South Korea, and Australia, integrating AI analytics to enhance embryo viability assessment.

February 2024 – Ferring Pharmaceuticals launched a digital fertility education campaign in India and Thailand, aimed at increasing awareness of ART options and driving early consultation for couples experiencing fertility challenges.

January 2024 – Medicover Fertility expanded its IVF clinic network across Delhi NCR and Bengaluru, with plans to integrate virtual consultation platforms and genetic screening labs.

December 2023 – CooperSurgical partnered with leading IVF clinics in China to introduce its electronic witness system, improving lab traceability and patient safety.

November 2023 – Apollo Fertility inaugurated three new IVF centers in South India, equipped with advanced micromanipulators, embryo vitrification tools, and AI-integrated tracking systems.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific in vitro fertilization market

Instrument

Procedure

Providers

Country