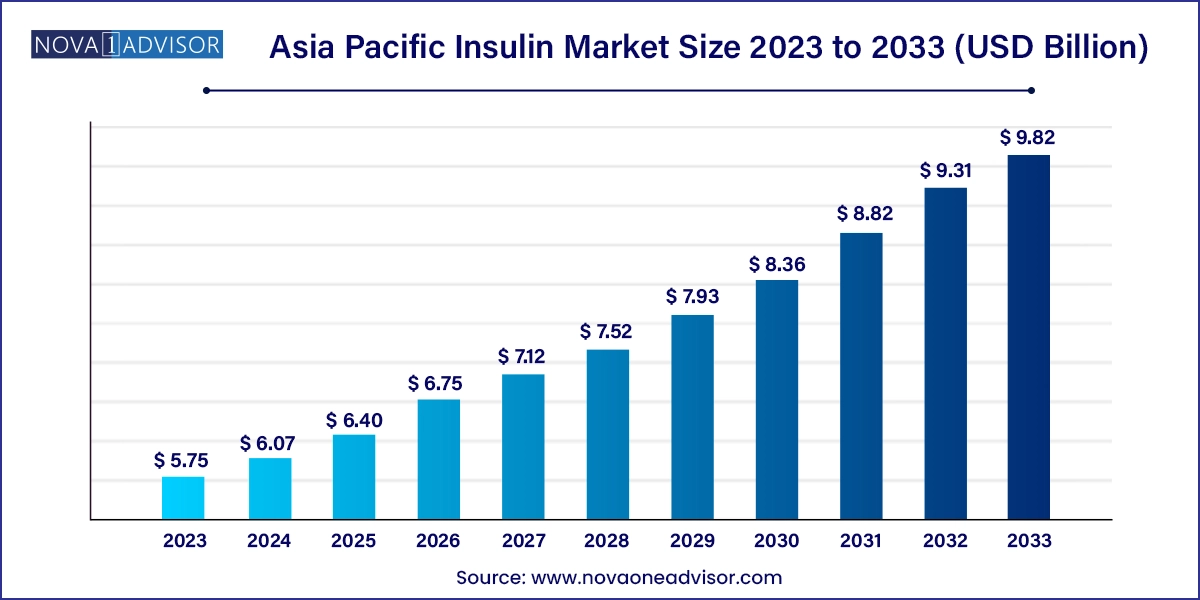

The Asia Pacific insulin market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 9.82 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

The Asia Pacific insulin market is witnessing sustained expansion due to a rapidly growing diabetic population, improved healthcare infrastructure, rising health awareness, and innovations in insulin delivery technologies. Diabetes mellitus, a chronic and life-threatening disease affecting the pancreas' ability to produce or use insulin, has become one of the most significant public health concerns across Asia Pacific. This region, home to over 60% of the global population, bears the brunt of the diabetes epidemic, with countries like China and India leading global diabetes prevalence statistics.

Insulin is essential for managing both Type 1 and Type 2 diabetes, particularly as patients progress to advanced stages or become insulin-dependent. Increasing disease burden, urban lifestyle changes, sedentary behavior, and dietary shifts are fueling insulin demand. Additionally, initiatives by governments and private sectors are improving patient access to insulin therapies through price subsidies, public-private partnerships, and disease awareness campaigns.

Biosimilar insulin, insulin analogs, and new delivery formats such as insulin pens and smart insulin injectors are creating new market dynamics. While affordability remains a challenge in lower-income segments of the region, local manufacturers and biosimilar entry are disrupting monopolistic pricing models. Regulatory harmonization efforts across ASEAN, India, and China are also improving market entry for novel insulin therapies.

With the dual pressures of high disease burden and growing patient empowerment, the Asia Pacific insulin market is positioned for robust growth throughout the next decade. Stakeholders must navigate a complex landscape of price sensitivity, therapeutic preferences, evolving reimbursement models, and varying degrees of healthcare access across countries.

Growing Demand for Insulin Analogs: Modern analogs offering better pharmacokinetics are gaining preference over human insulin in urban and insured populations.

Biosimilar Insulin Disruption: Entry of biosimilar insulin products is creating competitive pricing, especially in India, Malaysia, and the Philippines.

Rise of Pen Devices and Smart Injectors: Pen-based insulin delivery systems are becoming the norm due to ease of use, dose accuracy, and patient comfort.

Digital Health Integration: Mobile apps, glucose monitoring tools, and connected insulin delivery systems are enhancing patient adherence and physician monitoring.

Local Manufacturing Initiatives: Governments in India, China, and Thailand are promoting domestic insulin production to reduce dependence on imports.

Shift Toward Long-acting and Combination Products: Physicians are increasingly prescribing long-acting basal insulins and fixed-ratio combination products to simplify regimens.

Increased Insurance Coverage: Government-subsidized health insurance schemes are expanding access to insulin for low-income populations.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.07 Billion |

| Market Size by 2033 | USD 9.82 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, Application, Distribution, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China; Japan; India; South Korea; Australia; Singapore; Malaysia; Philippines; Thailand; Rest of Asia Pacific |

| Key Companies Profiled | Novo Nordisk A/S; Eli Lilly and Company; Sanofi; Biocon; Boehringer Ingelheim International GmbH; The United Laboratories International Holdings Ltd.; Tonghua Dongbao Pharmaceutical Co. Ltd. |

Escalating Diabetes Prevalence in Asia Pacific

The primary driver of the Asia Pacific insulin market is the alarming rise in diabetes cases, particularly Type 2 diabetes. According to the International Diabetes Federation (IDF), over 230 million adults in the region live with diabetes, a number expected to rise significantly by 2040. China and India alone account for over 40% of the global diabetic population. Urbanization, rising obesity, unhealthy dietary habits, and low physical activity levels are major contributing factors.

The disease progression in many patients eventually requires insulin therapy, especially when oral hypoglycemics fail. The increase in diagnosis rates, regular screenings, and awareness programs often supported by NGOs and public health agencies—are bringing more patients under treatment. Moreover, with earlier initiation of insulin in progressive diabetes cases being advocated by medical societies, demand is surging not only in hospitals but also at the primary care level.

Affordability and Access Disparities Across the Region

Despite growing demand, a significant restraint is the uneven affordability and access to insulin across Asia Pacific. While high-income countries like Japan, Australia, and Singapore provide insurance or state-sponsored access to modern insulin therapies, lower-income countries such as the Philippines, Indonesia, and rural parts of India still face limited access due to cost constraints and weak distribution channels.

Moreover, the reliance on imports for high-end insulin analogs results in high retail prices, creating barriers for uninsured patients. Out-of-pocket healthcare models prevalent in many APAC countries add to this burden. While biosimilars are easing price points in some markets, their penetration remains limited by regulatory and clinical adoption challenges. Unless addressed through scalable public health models and pricing strategies, insulin access will remain inconsistent, impacting long-term disease management.

Biosimilar Insulin and Local Production Expansion

An exciting opportunity in the Asia Pacific insulin market lies in the expansion of biosimilar insulin and regional manufacturing hubs. With patents for several blockbuster insulin molecules expiring, the regulatory and commercial space is opening for biosimilar insulin products. These lower-cost alternatives offer comparable efficacy and safety, making them ideal for cost-sensitive markets like India, Thailand, and Vietnam.

Government initiatives such as India’s “Pharma Vision 2020” and China’s “Made in China 2025” are supporting biosimilar development. Companies like Biocon (India), Gan & Lee (China), and Dong-A ST (South Korea) are already playing critical roles in reshaping insulin availability through local production. Furthermore, regional harmonization of regulatory approvals will fast-track biosimilar adoption and make insulin therapies more accessible across Asia Pacific.

Long-acting insulin led the product category, widely prescribed for maintaining basal glucose control over 24 hours. Products like insulin glargine and insulin detemir are favored for their once-daily dosing convenience, improved glycemic stability, and lower hypoglycemia risks. These insulins are essential in basal-bolus regimens and are particularly preferred in Type II patients transitioning from oral drugs. Market leaders like Sanofi and Novo Nordisk have extensive portfolios of long-acting insulins, driving high adoption in hospitals and clinics.

Combination insulins, which include premixed formulations and fixed-ratio combinations (e.g., basal insulin plus GLP-1), are emerging as the fastest-growing product type. These simplify treatment regimens, particularly for patients with poor compliance. In countries like India and the Philippines, where frequent injections are a barrier, combination insulins are improving adherence and outcomes. Additionally, regulatory approvals for biosimilar combinations are accelerating access and uptake.

Insulin analogs held the dominant share of the Asia Pacific insulin market due to their enhanced pharmacokinetic properties, reduced risk of hypoglycemia, and suitability for intensive treatment regimens. These modern insulins such as glargine, detemir, aspart, and lispro mimic physiological insulin release patterns more closely than traditional human insulin. As healthcare systems in urban centers modernize and insurance coverage widens, analogs are increasingly prescribed for both Type 1 and Type 2 diabetes management.

However, human insulin continues to play a vital role in rural and public healthcare settings where cost is a significant factor. With the aid of WHO’s Essential Medicines List and support from NGOs, human insulin remains accessible in developing countries. Yet, with biosimilar analogs gaining regulatory traction, the analog segment is also expanding in semi-urban and tier-2 markets, particularly in India and China.

Type II diabetes was the dominant application segment, accounting for the majority of insulin demand across Asia Pacific. Unlike Type 1 diabetes, which typically requires immediate insulin initiation, Type II cases often begin with lifestyle changes and oral medications. However, due to disease progression, insulin becomes necessary for many patients, particularly those with uncontrolled glucose levels. Given the rising prevalence of Type II diabetes across all age groups in Asia, this segment continues to drive significant insulin demand.

Conversely, Type 1 diabetes remains less prevalent but represents a high-value segment due to the lifelong need for insulin therapy. Pediatric and adolescent populations in countries like Australia, South Korea, and Japan are benefiting from public health programs and insurance reimbursement that enable access to modern insulin delivery options, including pens and pumps. These systems increasingly use rapid-acting insulin analogs to manage post-prandial spikes, contributing to segment growth.

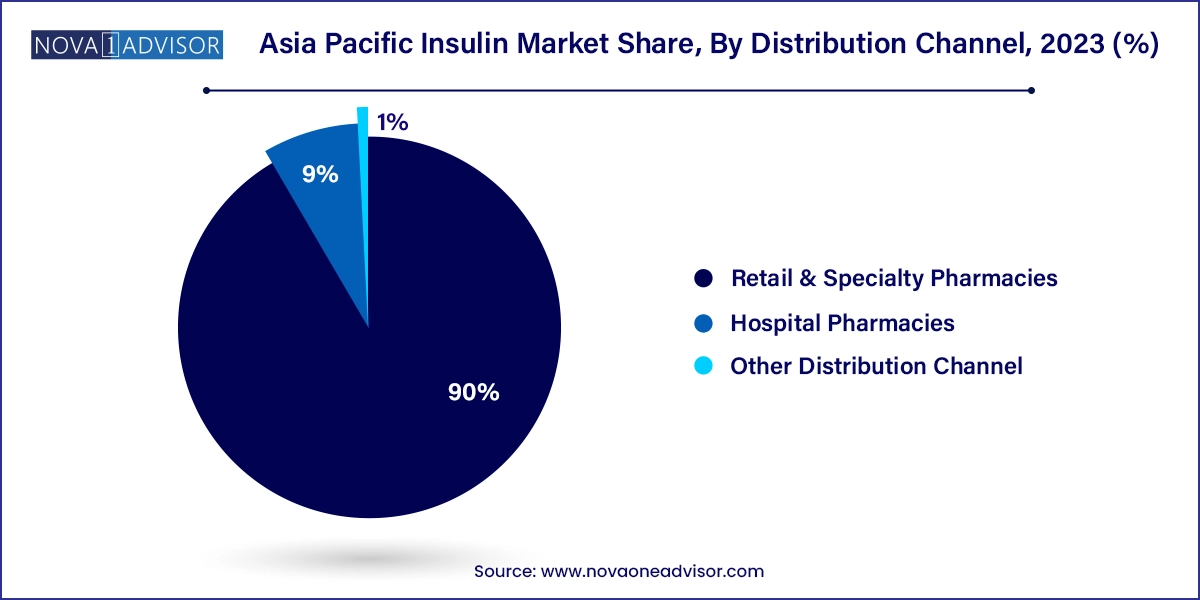

Retail and specialty pharmacies are the dominant distribution channel, accounting for a substantial share of insulin dispensation across Asia Pacific. With increasing prescriptions for outpatient diabetes management and the rising popularity of insulin pens and cartridges, pharmacies serve as key access points. Countries like Japan, Australia, and Singapore have well-regulated pharmacy networks, while countries like India and Vietnam rely heavily on chemist shops for insulin dispensation.

Meanwhile, hospital pharmacies are growing fast due to rising admissions for diabetes-related complications and postoperative glycemic management. Large hospitals with endocrinology departments stock a wide range of insulin types, including emergency-use rapid-acting insulins. As healthcare infrastructure improves and public health programs promote hospital-based diabetes care, this distribution channel is expected to gain further traction.

China

China dominates the insulin market in the region, driven by over 120 million diabetes patients and government-supported insurance coverage under the Basic Medical Insurance scheme. Local manufacturers such as Gan & Lee and United Laboratories are expanding biosimilar insulin production. Additionally, the government’s volume-based procurement (VBP) policies are lowering insulin prices significantly.

India

India is a high-volume, price-sensitive market where companies like Biocon, Wockhardt, and Sanofi are active. Government schemes like Jan Aushadhi and Ayushman Bharat are improving access to low-cost insulin. Tier 2 and 3 cities are emerging as growth hubs due to improving pharmacy penetration and rising diabetes diagnosis rates.

Japan

Japan has a mature insulin market with a strong emphasis on analog insulin and advanced delivery systems like insulin pumps. Aging population and early diagnosis programs drive insulin use. The government’s universal insurance model ensures consistent access to insulin, particularly among the elderly.

Australia

Australia has high per capita insulin usage, thanks to a well-developed healthcare system and National Diabetes Services Scheme (NDSS). Insulin analogs and combination therapies are widely used, and there’s growing adoption of insulin pens and CGM-integrated injectors.

South Korea

South Korea combines advanced diagnostics with smart insulin delivery technologies. Pharmaceutical companies like Dong-A ST are actively involved in biosimilar production. The government supports insulin access through the National Health Insurance Service (NHIS).

Thailand, Malaysia, Singapore, Philippines

These Southeast Asian countries are expanding access to insulin through subsidies, diabetes registries, and international aid programs. Singapore leads in tech-enabled diabetes management, while Malaysia and Thailand are promoting biosimilar adoption.

Gan & Lee Pharmaceuticals

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific insulin market

Type

Application

Product

Distribution

Country