The Asia Pacific meal kit delivery services market size was exhibited at USD 5.65 billion in 2023 and is projected to hit around USD 19.87 billion by 2033, growing at a CAGR of 13.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.41 Billion |

| Market Size by 2033 | USD 19.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Offering, Service, Platform, Meal Type, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China; Japan; India; Australia; New Zealand |

| Key Companies Profiled | Blue Apron, LLC; HelloFresh; Freshly Inc.; Sun Basket; Relish Labs LLC (Home Chef) |

The increasing demand for home-cooked meals in Asia Pacific is projected to drive market growth. There is high adoption of these services among Generation Y and Z. The market is expected to witness incredible growth in the region with China, Japan, and South Korea being the key markets.

The Asia Pacific’s meal kit delivery services market accounted for a share of 24.5% of the global meal kit delivery services market revenue in 2023. The number of meal kit delivery service organizations is rising in the region owing to their growing popularity. Startups, such as Curefoods and Chope, are looking to cater to the increasing demand by entering key markets within the region. These companies offer meals specially designed to suit the local tastes and are made by regional chefs.

Major economies, such as Japan, China, India, Indonesia, Malaysia, Singapore, Thailand, and Vietnam, have turned into manufacturing hubs. Therefore, the increasing rate of employment has led to a busy lifestyle, leaving little time for daily chores and cooking. This, in turn, drives the demand for meal kits.

The cook & eat segment held a market share of 60.8% in 2023. The growing popularity of home-cooked meals among the population and awareness of the health benefits associated with it are projected to drive the segment’s growth. Furthermore, for people suffering from depression, anxiety, brain injuries, chronic illness, or anyone wanting to maintain brain health as they age, cooking is a great exercise. Thus, the popularity of cook & eat meal kit delivery service can be seen among the common mass.

The heat & eat segment is projected to grow at a CAGR of 13.4% over the forecast period. This service offers prepared food meals to the customers. Heat & eat meal kit delivery service is gaining popularity among the working population due to their hectic lifestyles and busy schedules with no or less time for cooking. These meals are prepared by professionals and packed well for mess-free meals.

The single-delivery service segment accounted for a revenue share of 54.3% in 2023. The increasing working population in the Asia Pacific is creating more opportunities for single-service meal kit delivery in the commercial sector. Millennials and Gen Z are the main consumer groups for meal kit delivery services. This demographic is mainly comprised of students and professionals leading busy lives, with a focus on maintaining a healthier lifestyle.

The multiple-delivery service segment is expected to grow at a CAGR of 13.6% over the forecast period. These multiple-serving meal kits are gaining traction among busy households and older generations. Furthermore, the rising number of female working population in Asia Pacific and the increasing number of nuclear families is anticipated to drive the segment’s growth.

The non-vegetarian meal kit delivery services segment accounted for a revenue share of 64.5% in 2023. The demand for a high-protein diet and high adoption of non-vegetarian meal boxes in China, Japan, and Singapore is anticipated to drive the segment’s growth over the forecast period.

Asia is the most populous continent in the world with more than half (estimated 60%) of the world’s population. This gives the region an upper hand when it comes to influencing food trends around the world. Countries, such as Taiwan, Hong Kong, Australia, Japan, China, Singapore, Sri Lanka, South Korea, and India, are driving the market for vegetarian and vegan meal kits. Although India has always been a hub for vegetarians, the rising prevalence of lactose intolerance in the country is propelling the demand for vegan or dairy-free meal kits.

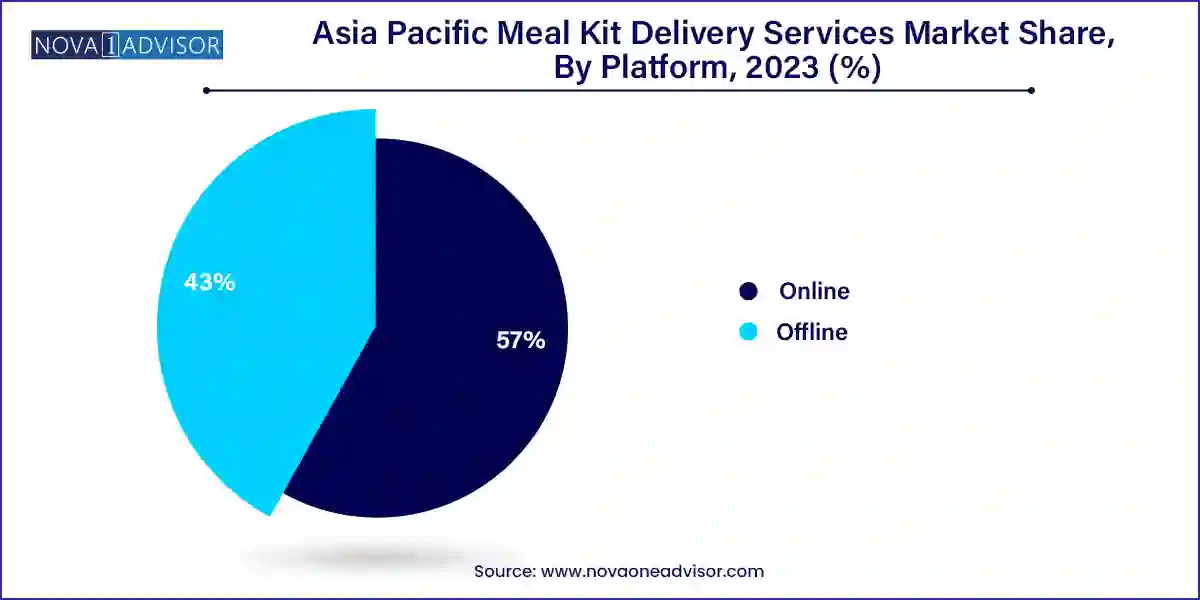

The online platform segment accounted for a revenue share of 57.0% in 2023. Most companies prefer to sell their products primarily through a strong network of distributors to reach a larger customer base. However, the Internet penetration in the Asia Pacific is still at a growing stage, thereby indicating a large potential for companies to enter the regional market through online platforms.

The offline segment is expected to grow at a CAGR of 13.5% over the forecast period. Many consumers like to purchase meal kits with other grocery products, which is driving the demand through offline platforms. Some of the meal kits available at these stores include Taylor Farms, Ortega, and Home Chef.

China Meal Kit Delivery Services Market Trends

The meal kit delivery services market in China accounted for a revenue share of 35.7% in 2023. The hectic lifestyles of people leave little time for grocery shopping and cooking from scratch, driving the market in China. The Coronavirus pandemic has increased the interest in home-cooked food and surged the demand for meal kits in the nation. Some of the large food chains have started delivering raw food ingredients with recipes to the consumers. For instance, Pizza Hut started delivering raw steaks along with a complete recipe for home cooks.

Japan Meal Kit Delivery Services Market Trends

The meal kit delivery services market in Japan is expected to grow at a CAGR of 12.4% over the forecast period. With the increasing demand for meal kit delivery services in the country, major players are adopting various marketing strategies like new product lines, acquisitions, and expansion of distribution channels to gain maximum customer penetration.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific meal kit delivery services market

Offering

Service

Platform

Meal Type

Country

Chapter 1. Meal Kit Delivery Services Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Meal Kit Delivery Services Market: Executive Summary

2.1. Market Outlook

2.2. Offering Outlook

2.3. Service Outlook

2.4. Platform Outlook

2.5. Meal Type Outlook

2.6. Competitive Insights

Chapter 3. Meal Kit Delivery Services Market: Variables, Trends & Scope

3.1. Market Introduction

3.2. Penetration & Growth Prospect Mapping

3.3. Impact of COVID-19 on the Meal Kit Delivery Services Market

3.4. Industry Value Chain Analysis

3.4.1. Sales/Retail Channel Analysis

3.4.2. Profit Margin Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. Business Environment Analysis

3.6.1. Industry Analysis – Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.7. Roadmap of Meal Kit Delivery Services Market

3.8. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

4.1. Demographic Analysis

4.2. Consumer Trends and Preferences

4.3. Factors Affecting Buying Decision

4.4. Consumer Product Adoption

4.5. Observations & Recommendations

Chapter 5. Meal Kit Delivery Services Market: Offering Estimates & Trend Analysis

5.1. Offering Movement Analysis & Market Share, 2024 & 2033

5.2. Heat & Eat

5.2.1. Heat & eat meal kit delivery service market estimates and forecast,2021 - 2033 (USD Million)

5.3. Cook & Eat

5.3.1. Cook & eat meal kit delivery service market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 6. Meal Kit Delivery Services Market: Service Estimates & Trend Analysis

6.1. Service Movement Analysis & Market Share, 2024 & 2033

6.2. Single

6.2.1. Single meal kit delivery services market estimates and forecast, 2021 - 2033 (USD Million)

6.3. Multiple

6.3.1. Multiple meal kit delivery services market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 7. Meal Kit Delivery Services Market: Platform Estimates & Trend Analysis

7.1. Platform Movement Analysis & Market Share, 2024 & 2033

7.2. Online

7.2.1. Market estimates and forecast, through online platform, 2021 - 2033 (USD Million)

7.3. Offline

7.3.1. Market estimates and forecast, through offline platform, 2021 - 2033 (USD Million)

Chapter 8. Meal Kit Delivery Services Market: Meal Type Estimates & Trend Analysis

8.1. Meal Type Movement Analysis & Market Share, 2024 & 2033

8.2. Vegan

8.2.1. Vegan meal kit delivery services market estimates and forecast, 2021 - 2033 (USD Million)

8.3. Vegetarian

8.3.1. Vegetarian meal kit delivery services market estimates and forecast, 2021 - 2033 (USD Million)

8.4. Non-Vegetarian

8.4.1. Non-vegetarian meal kit delivery services market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 9. Meal kit delivery services Market: Regional Estimates & Trend Analysis

9.1. Regional Movement Analysis & Market Share, 2024 & 2033

9.2. North America

9.2.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.2.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.2.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.2.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.2.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.2.6. U.S.

9.2.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.2.6.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.2.6.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.2.6.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.2.6.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.2.7. Canada

9.2.7.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.2.7.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.2.7.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.2.7.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.2.7.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.2.8. Mexico

9.2.8.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.2.8.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.2.8.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.2.8.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.2.8.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3. Europe

9.3.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3.6. Germany

9.3.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.6.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.6.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.6.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.6.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3.7. UK

9.3.7.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.7.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.7.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.7.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.7.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3.8. France

9.3.8.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.8.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.8.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.8.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.8.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3.9. Italy

9.3.9.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.9.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.9.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.9.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.9.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.3.10. Spain

9.3.10.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.3.10.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.3.10.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.3.10.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.3.10.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.4. Asia Pacific

9.4.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.4.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.4.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.4.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.4.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.4.6. China

9.4.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.4.6.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.4.6.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.4.6.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.4.6.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.4.7. Japan

9.4.7.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.4.7.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.4.7.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.4.7.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.4.7.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.4.8. India

9.4.8.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.4.8.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.4.8.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.4.8.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.4.8.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.4.9. Australia and New Zealand

9.4.9.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.4.9.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.4.9.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.4.9.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.4.9.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.5. Central & South America

9.5.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.5.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.5.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.5.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.5.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.5.6. Brazil

9.5.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.5.6.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.5.6.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.5.6.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.5.6.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

9.6. Middle East & Africa

9.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

9.6.2. Market estimates and forecast, by offering, 2021 - 2033 (USD Million)

9.6.3. Market estimates and forecast, by service, 2021 - 2033 (USD Million)

9.6.4. Market estimates and forecast, by platform, 2021 - 2033 (USD Million)

9.6.5. Market estimates and forecast, by meal type, 2021 - 2033 (USD Million)

Chapter 10. Competitive Analysis

10.1. Key global players, recent developments & their impact on the industry

10.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

10.3. Vendor Landscape

10.3.1. Key company market share analysis, 2022

Chapter 11. Company Profiles

11.1. Blue Apron, LLC

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.1.4. Strategic Initiatives

11.2. Freshly Inc.

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. Product Benchmarking

11.2.4. Strategic Initiatives

11.3. HelloFresh

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. Product Benchmarking

11.3.4. Strategic Initiatives

11.4. Sun Basket

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. Product Benchmarking

11.4.4. Strategic Initiatives

11.5. Relish Labs LLC (Home Chef)

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. Product Benchmarking

11.5.4. Strategic Initiatives

11.6. Gobble

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. Product Benchmarking

11.6.4. Strategic Initiatives

11.7. Marley Spoon Inc.

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. Product Benchmarking

11.7.4. Strategic Initiatives

11.8. Purple Carrot

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. Product Benchmarking

11.8.4. Strategic Initiatives

11.9. Fresh n' Lean

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. Product Benchmarking

11.9.4. Strategic Initiatives

11.10. Hungryroot

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. Product Benchmarking

11.10.4. Strategic Initiatives