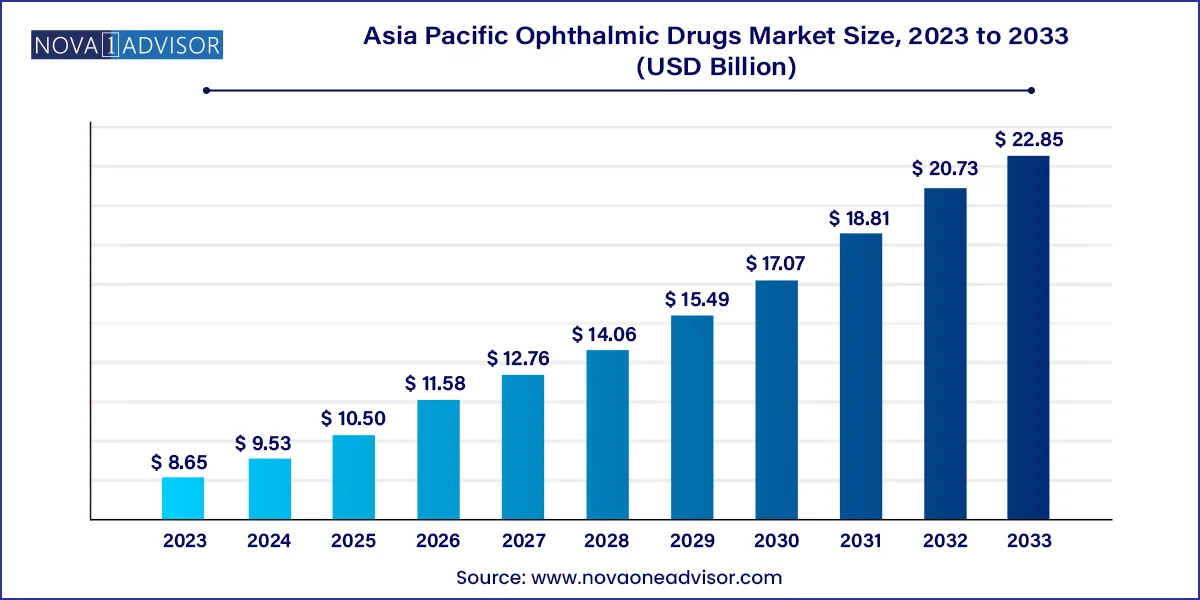

The Asia Pacific ophthalmic drugs market size was exhibited at USD 8.65 billion in 2023 and is projected to hit around USD 22.85 billion by 2033, growing at a CAGR of 10.2% during the forecast period 2024 to 2033.

The Asia Pacific ophthalmic drugs market is experiencing an era of rapid evolution, driven by increasing awareness about eye health, a growing geriatric population, a surge in lifestyle-related ocular disorders, and advances in pharmaceutical technologies. The region is emerging as a dynamic landscape for ophthalmic therapeutics, backed by a combination of public health initiatives, heightened healthcare expenditure, and rising incidences of chronic eye conditions such as glaucoma, macular degeneration, and diabetic retinopathy.

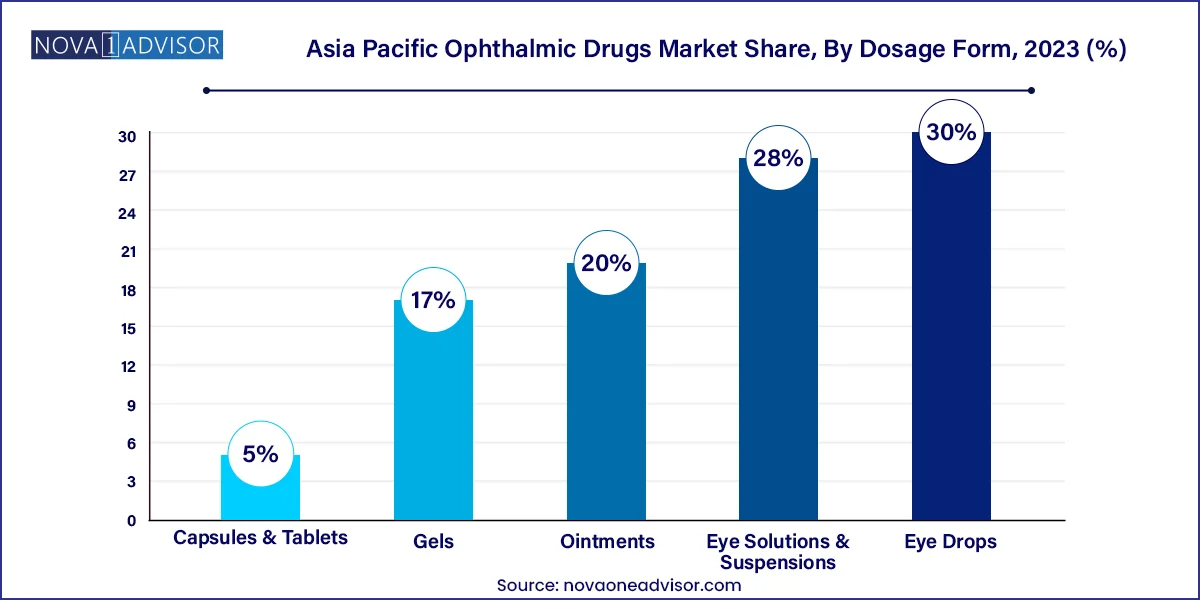

Ophthalmic drugs are specifically formulated for treating a wide array of eye conditions, and they are available in various dosage forms like eye drops, ointments, gels, tablets, and suspensions. With increasing demand from both urban and semi-urban areas, countries like India, China, and Japan are spearheading the market momentum due to their extensive patient pools, improving diagnostic capabilities, and a flourishing generic drug manufacturing ecosystem. Notably, the widespread integration of digital healthcare solutions and teleophthalmology is further amplifying the accessibility and prescription of ophthalmic medications in remote areas.

Moreover, government campaigns promoting routine eye checkups, along with collaborations between pharmaceutical companies and healthcare institutions, are fostering faster clinical adoption and innovation in ophthalmic drug development. In light of these dynamics, the Asia Pacific ophthalmic drugs market is poised for consistent growth over the forecast period, with a favorable landscape for both established players and new market entrants.

Growing adoption of combination therapies: A shift toward fixed-dose combinations for treating multiple ocular conditions with a single drug is on the rise to improve patient compliance.

Rise of biosimilars in ophthalmology: Biosimilars, especially for Anti-VEGF agents, are gaining traction as cost-effective alternatives for treating age-related macular degeneration and diabetic retinopathy.

Increased penetration of teleophthalmology: Countries like India and Indonesia are leveraging telemedicine platforms for remote eye consultations and prescription drug delivery.

Innovation in ocular drug delivery: Companies are investing in technologies such as microneedles, ocular inserts, and sustained-release implants to improve drug bioavailability and patient outcomes.

Rise in ophthalmic gene and cell therapy trials: With regulatory support and scientific breakthroughs, trials in cell-based therapies for inherited retinal diseases are on the upswing.

Expansion of OTC eye care: A rise in screen-induced dry eye and allergies has led to growing consumer preference for OTC eye drops and lubricants.

Collaborative R&D and licensing agreements: Cross-border research collaborations between Asian and Western firms are fueling ophthalmic innovation.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.53 Billion |

| Market Size by 2033 | USD 22.85 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Drug Class, Disease, Dosage Form, Route of Administration, Product Type, Product, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India; Australia; South Korea; Thailand; Indonesia |

| Key Companies Profiled | AbbVie Inc.; Merck & Co., Inc.; Alcon; Pfizer Inc.; Novartis AG; Bayer AG; Lupin; Sun Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.; Santen Pharmaceutical Co., Ltd.; Zhaoke Ophthalmology; Arctic Vision Hong Kong Biotech Ltd. |

One of the most compelling growth drivers for the Asia Pacific ophthalmic drugs market is the alarming rise in diabetes and its associated complications, especially diabetic retinopathy. Countries such as China and India rank among the top globally for diabetic populations, with lifestyle changes and urbanization exacerbating the incidence. Diabetic retinopathy is one of the most common microvascular complications of diabetes and is a leading cause of blindness among working-age adults.

To address this pressing issue, governments have implemented national screening programs and public health policies to detect diabetic eye diseases early. The healthcare infrastructure is being strengthened to facilitate timely diagnosis and the administration of intravitreal Anti-VEGF agents such as ranibizumab and aflibercept. The increasing need for lifelong therapy and regular follow-ups creates a consistent demand for ophthalmic drugs, making this a significant market catalyst.

Despite the overall progress in ophthalmic drug availability, one of the major restraints facing the Asia Pacific market is the limited accessibility of advanced eye care services in rural and underserved regions. While urban centers benefit from sophisticated diagnostic and therapeutic capabilities, a vast segment of the rural population lacks access to ophthalmologists, surgical facilities, and even basic eye care medications.

This gap is further widened by economic disparities, transportation barriers, and a shortage of trained personnel. As a result, diseases like glaucoma and cataracts often go undiagnosed or are treated inadequately. Although initiatives like mobile eye clinics and teleophthalmology are being explored, their penetration remains suboptimal. Bridging this rural-urban healthcare divide will require concerted policy-level efforts and private sector participation.

The Asia Pacific region presents an emerging opportunity in personalized ophthalmology. As genomic research and biomarker discovery advance, there is growing potential for tailored therapies targeting specific ocular conditions at the molecular level. This is particularly relevant in the treatment of rare retinal disorders, uveitis, and hereditary macular degeneration.

Pharmaceutical companies are investing in companion diagnostics and biomarker-based therapeutics to improve treatment efficacy and reduce adverse effects. In Japan, for instance, regulatory frameworks have been updated to expedite the approval of gene and cell therapy-based ophthalmic products. As precision medicine gains momentum, companies that align with this trend stand to unlock new patient populations and expand their product portfolios in niche but high-value therapeutic categories.

Anti-VEGF agents dominated the drug class segment owing to their widespread use in managing retinal disorders such as diabetic retinopathy and macular degeneration. These agents, including ranibizumab, aflibercept, and bevacizumab, are widely administered through intravitreal injections and have demonstrated clinical efficacy in preserving and improving vision. Japan and South Korea have witnessed high adoption rates due to their aging populations and superior healthcare coverage, enabling increased access to costly biologics. Moreover, ongoing research and the introduction of biosimilars are likely to further boost the affordability and availability of these drugs across developing countries.

Gene & cell therapy is the fastest-growing drug class, as it represents a transformative approach in treating previously untreatable inherited retinal diseases. The increasing number of clinical trials and faster regulatory approvals in countries like Japan indicate an active pipeline. Luxturna, the first approved gene therapy for inherited retinal dystrophy, has paved the way for local biotech companies to explore similar candidates.

Glaucoma emerged as the dominant disease segment in the Asia Pacific ophthalmic drugs market. Its chronic nature and progressive vision loss necessitate long-term medication and monitoring. Eye drops such as prostaglandin analogs and beta-blockers form the mainstay treatment, available in various dosage forms including gels and suspensions. Countries like China and India are seeing a spike in glaucoma diagnoses owing to improved awareness and screening programs. The burden of this disease among the elderly is substantial, driving sustained demand for anti-glaucoma medications.

Retinal disorders are the fastest-growing disease segment, attributed to rising diabetes prevalence and increased screening for age-related macular degeneration. Anti-VEGF eye drops and injections are standard treatments, and this area has been the focus of extensive R&D. A growing number of retina specialists, coupled with technological advancements in optical coherence tomography (OCT), is improving diagnostic accuracy and treatment precision. Multinational companies are increasingly launching newer biologics and conducting post-market studies to capture a larger market share in this segment.

Topical route dominated the administration route segment, as it is the most commonly used method for delivering ophthalmic drugs. The topical route is convenient, causes minimal systemic side effects, and is preferred for conditions such as conjunctivitis, dry eye, and glaucoma. This route also supports a wide variety of formulations including eye drops, gels, and ointments, making it highly versatile and popular across Asia Pacific.

Intravitreal injection is the fastest-growing local ocular route, primarily driven by the administration of Anti-VEGF therapies for retinal diseases. It allows for direct delivery of the drug to the affected retina, providing high efficacy and reducing systemic absorption. As the incidence of macular degeneration and diabetic retinopathy increases, the use of this targeted delivery route is expected to surge, supported by expanding ophthalmic surgery and diagnostic centers.

Prescription drugs dominate the product type segment, owing to their usage in chronic and severe eye diseases that require medical supervision. Conditions like glaucoma, retinal disorders, and uveitis typically involve prescription medications, and these drugs are covered under insurance schemes in countries like Japan and South Korea. The regulatory emphasis on prescription drugs for newly approved biologics and gene therapies further reinforces their dominance.

OTC drugs are growing rapidly, especially in segments such as dry eye and allergies. With increasing consumer awareness and self-care culture, more people are opting for OTC eye drops, lubricants, and antihistamines. Pharmacies and e-commerce channels across Asia Pacific are enhancing the accessibility of these medications, and manufacturers are focusing on branding and consumer education.

Branded drugs dominate the product segment, mainly due to the presence of patented biologics and innovative delivery systems. Pharmaceutical giants continue to hold strong brand equity with ophthalmologists and hospitals, especially in the Anti-VEGF and anti-inflammatory drug categories. Countries with advanced regulatory standards like Japan lean heavily toward branded options due to quality assurance.

Generic drugs are witnessing the fastest growth, supported by government policies encouraging cost-effective treatments and local production. India, in particular, is a significant player in the ophthalmic generics space, exporting to multiple Asia Pacific countries. The expiration of patents on key ophthalmic drugs is expected to further open up the market to generics.

Eye drops dominate the dosage form segment, due to their widespread application in treating allergies, dry eye, glaucoma, and infections. Their ease of use, non-invasive nature, and patient compliance make them the preferred form of medication in both prescription and OTC categories. Countries like Australia and India have seen a sharp increase in the consumption of lubricating eye drops due to rising screen time and dry eye syndrome. This segment benefits from a continuous influx of new formulations including preservative-free and multi-dose containers.

Gels are gaining traction as the fastest-growing dosage form as they offer longer retention time and enhanced drug absorption, especially useful in treating conditions like dry eye and uveitis. Gels are increasingly being recommended for nighttime use to enhance symptom relief and minimize dosing frequency. Pharmaceutical companies are focusing on developing non-blurring, bioadhesive gel formulations to ensure better therapeutic outcomes. The trend is catching on in countries like South Korea and Thailand, where patient-centric drug development is gaining priority.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific ophthalmic drugs market

Drug Class

Disease

Dosage Form

Route of Administration

Product Type

Product

Country