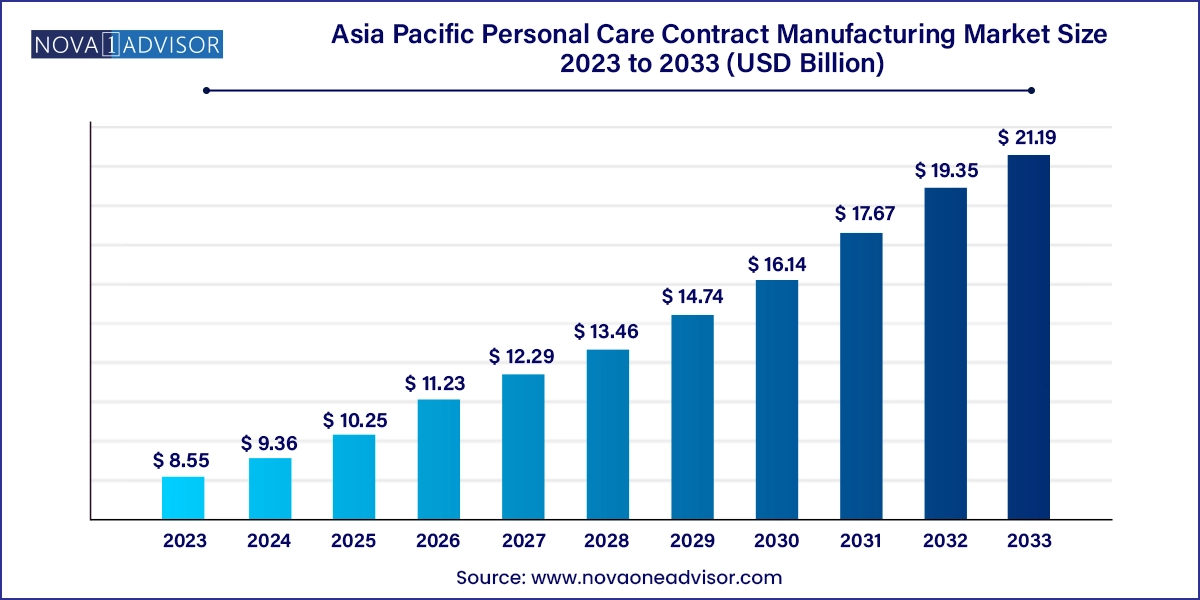

The Asia Pacific personal care contract manufacturing market size was exhibited at USD 8.55 billion in 2023 and is projected to hit around USD 21.19 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2024 to 2033.

The Asia Pacific personal care contract manufacturing market is undergoing a significant transformation, driven by dynamic shifts in consumer preferences, rapid globalization of beauty brands, and evolving regulatory frameworks. Contract manufacturers are increasingly becoming strategic partners to both emerging and established cosmetic and personal care brands, offering them cost-effective, scalable, and agile manufacturing solutions across skin care, hair care, make-up, fragrances, and wellness products.

This market plays a critical role in bridging the gap between innovation and commercialization. Startups, DTC brands, and even multinational corporations are outsourcing not just production, but also formulation development, clinical testing, packaging design, and fulfillment logistics to regional contract manufacturing organizations (CMOs). With countries like China, India, South Korea, and Japan leading the charge in innovation, the Asia Pacific region is becoming a global hub for contract manufacturing in personal care.

The rise of “Clean Beauty,” K-beauty, Ayurveda-based skincare, and functional cosmetic products is reshaping product development trends. Simultaneously, the increasing demand for fast-moving consumer goods (FMCG), localized formulations, and premium packaging solutions has boosted the reliance on CMOs that can provide end-to-end services, ensuring faster time to market, regulatory compliance, and consistent quality.

Rising Popularity of Clean and Green Beauty Products: Brands are demanding formulations free from parabens, sulfates, and artificial fragrances, and CMOs are adapting by offering sustainable ingredient sourcing.

Integration of Digital and AI in Formulation: Contract manufacturers are leveraging AI for predictive ingredient synergy and developing hyper-personalized skincare products.

Flexible Manufacturing for DTC Brands: Small-batch, quick-turnaround production is growing in demand due to the rise in digital-first beauty brands.

Premiumization of Packaging Services: CMOs are increasingly investing in custom molds, 3D printing, and sustainable packaging innovations.

Boom in Men’s Grooming and Gender-Neutral Products: More CMOs are launching dedicated R&D lines to cater to new demographic preferences.

Increased Focus on Regulatory Support: With different rules across countries, contract manufacturers are expanding regulatory affairs teams to help clients navigate APAC markets.

Sustainable and Refillable Product Lines: CMOs are collaborating with brands to launch products in recyclable, compostable, and refillable containers, aligning with global ESG goals.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.36 Billion |

| Market Size by 2033 | USD 21.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Product, Product Forms, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India; Australia; South Korea |

| Key Companies Profiled | VVF Ltd.; Sarvotham Care Ltd.; Beautech; Cosmax; Albion Cosmetics, Ltd.; Fine Today Shiseido Co., Ltd.; Zoic Cosmetics; Athena Cosmetics Manufacturer Co., Ltd.; Ausmetics Daily Chemicals (Guangzhou) Co., Ltd. |

A core driver of the Asia Pacific personal care contract manufacturing market is the significant cost efficiency and speed-to-market benefits it offers to brand owners. Outsourcing production to specialized CMOs allows companies to avoid capital-intensive infrastructure investments, reduce overheads, and scale production based on real-time market demand.

In fast-evolving segments like skincare and cosmetics, where trends can shift within weeks, CMOs enable rapid prototyping, batch testing, and accelerated compliance approvals—critical for keeping pace with consumer expectations. Additionally, labor and raw material costs in parts of Asia remain lower than in Western markets, giving brands both a pricing edge and manufacturing flexibility.

CMOs often possess dedicated R&D teams, GMP-certified facilities, dermatological testing labs, and regulatory knowledge, making them indispensable partners for beauty brands looking to launch innovative products with global reach. Their economies of scale and industry relationships (e.g., with packaging suppliers and ingredient vendors) make them value-adding contributors rather than mere manufacturers.

Despite its advantages, a major restraint in this market is the risk of intellectual property theft, duplication, or leakage, particularly for brands developing proprietary formulations. Some emerging markets in the Asia Pacific region lack strong enforcement of IP laws or have ambiguous legal frameworks, creating hesitancy among brands to fully disclose their formulations.

Moreover, outsourcing key stages of the product lifecycle can compromise brand control and authenticity, particularly for indie or artisanal brands that emphasize handmade or founder-developed formulations. Ensuring consistent quality control, ingredient traceability, and ethical sourcing across contract partners also presents a challenge, especially when expanding across multiple APAC countries.

To overcome this, brands must engage in robust NDA protocols, IP audits, and quality assurance systems, and many opt for long-term exclusive agreements or use modular outsourcing (e.g., in-house R&D, outsourced manufacturing only) to mitigate risk.

One of the most promising opportunities lies in the growth of indie, niche, and hyper-local beauty brands targeting culturally specific skin and hair concerns. Consumers across Asia Pacific are showing increasing preference for products tailored to local climatic conditions, skin tones, hair textures, and cultural rituals.

For instance, Ayurvedic skincare in India, fermented essences in Korea, and rice-water serums in Japan are examples of how traditional ingredients and local beauty philosophies are driving formulation trends. CMOs that can co-create customized solutions, source local botanicals, and offer heritage-inspired product lines are well-positioned to capture this demand.

Moreover, as e-commerce platforms and social commerce democratize brand access to consumers, even small-scale entrepreneurs are launching direct-to-consumer lines, relying heavily on contract manufacturers for small-batch runs, fast development cycles, and scalable production options.

Skin care is the leading product category, driven by booming demand for moisturizers, serums, sunscreens, exfoliators, and anti-aging creams. This segment benefits from both premiumization and mass-market expansion, with consumers across all income groups investing in daily skincare rituals, especially in urban Asia. With rising pollution, UV exposure, and wellness awareness, brands are rapidly expanding their skincare lines, creating robust demand for contract manufacturers that can handle a wide range of actives, textures, and packaging formats.

Make-up and Color Cosmetics are witnessing the fastest growth, particularly in India and Southeast Asia. Social media, influencer marketing, and e-commerce have democratized access to cosmetics, and local brands are launching inclusive shade ranges and vegan formulations. CMOs are expanding their capabilities in powder pressing, pigment dispersion, and texture optimization to serve this vibrant category. Additionally, the rise of gender-neutral and hybrid cosmetics (e.g., skincare-infused makeup) is adding new product complexity and opportunity.

Liquids dominate the product form category, including lotions, toners, facial mists, liquid soaps, and conditioners. Liquid forms are widely preferred for their ease of application, faster absorption, and suitability for sensitive skin types, especially in warmer and humid climates prevalent across Asia. CMOs with liquid-filling lines are in high demand, particularly those offering viscosity flexibility and dual-phase packaging capabilities.

Oils and Serums are the fastest-growing segment, as consumers are increasingly drawn to concentrated, active-rich formulations. The success of facial oils, dry body oils, and vitamin C serums in China, India, and Japan has led to a spike in demand for CMOs specializing in anhydrous formulations and dropper packaging. Cold-pressing, solvent-free extraction, and carrier-oil blending are specialized capabilities that give CMOs a competitive edge in this category.

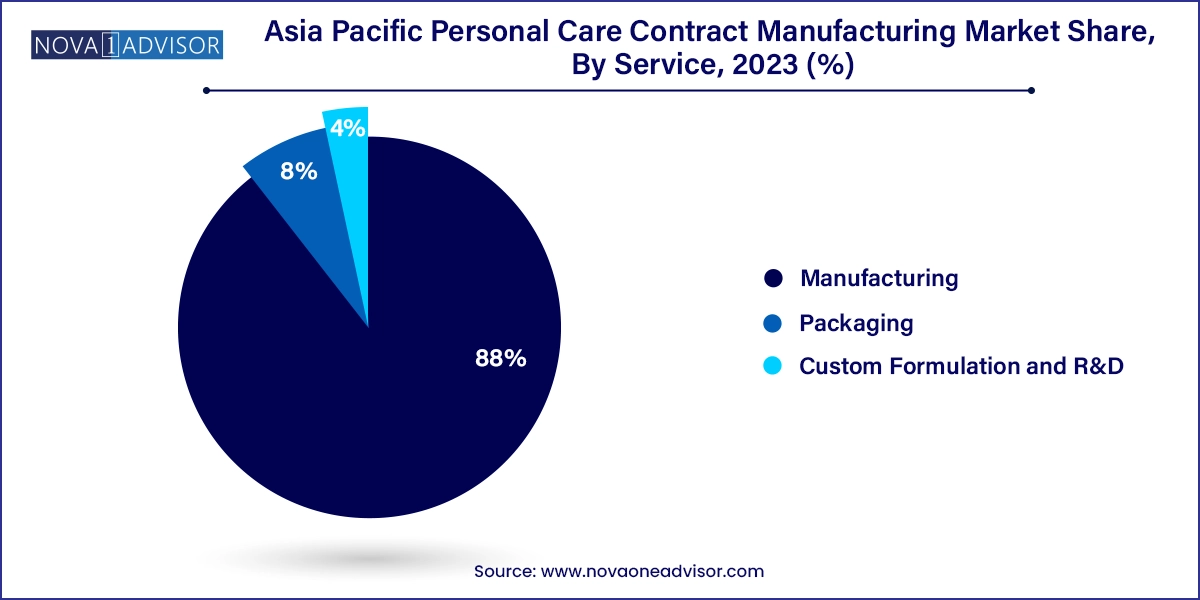

Manufacturing services dominate the Asia Pacific personal care contract manufacturing market, accounting for the highest revenue share. CMOs across China, India, and South Korea are equipped with advanced machinery for emulsification, mixing, filling, and sterilization, enabling them to handle large-scale mass production as well as small-batch runs for niche brands. This service includes private labeling, white-label production, and turnkey manufacturing where brands simply provide a brief and receive market-ready products.

Custom Formulation and R&D is the fastest-growing segment, propelled by rising demand for natural, clean-label, and functional skincare solutions. Contract manufacturers are expanding their in-house labs to offer clients full-service product development—from ingredient synergy studies to stability testing and dermatologist-backed clinical trials. South Korean CMOs, in particular, are known for launching cutting-edge R&D services, including AI-driven skin analysis and bio-fermentation processes, appealing to brands seeking innovation differentiation.

China

China is the largest market for personal care contract manufacturing in Asia Pacific, owing to its high-volume beauty industry, low-cost manufacturing infrastructure, and fast-growing domestic demand. Chinese CMOs are investing in green chemistry, AI-driven R&D, and GMP-certified plants, becoming global exporters of skincare and makeup products. The “Made in China” 2025 policy also incentivizes local innovation and high-tech production, making China a strategic hub for beauty brands globally.

India

India is an emerging hotspot, particularly for Ayurveda, natural cosmetics, and clean-label personal care. The market benefits from abundant botanical resources, low labor costs, and a vast domestic market. CMOs in India are seeing growing demand from both D2C startups and multinational brands entering tier-2 and tier-3 cities. The rise of Ayurveda 2.0—merging tradition with science—is leading to new R&D collaborations and white-label expansions.

South Korea

South Korea is at the forefront of cosmetic R&D and beauty innovation, renowned globally for K-beauty trends. Korean CMOs lead in fermentation technology, packaging aesthetics, and dermocosmetic efficacy, often launching new textures (e.g., jelly masks, sleeping packs) and hero ingredients (e.g., snail mucin, cica). Many CMOs partner with Western brands looking to "K-beautify" their offerings and enter Asian markets.

Japan

Japan is known for its minimalist skincare, hygiene products, and anti-aging solutions, and its CMOs are highly regarded for precision, consistency, and safety standards. Japanese CMOs focus on high-end skin and hair care segments, often partnering with luxury labels from Europe and the U.S. The country is also advancing in biotech-based cosmetic R&D, offering differentiated value in probiotic skincare and skin barrier science.

Australia

Australia is becoming known for clean, natural, and vegan-certified skincare, with its CMOs specializing in organic formulations, reef-safe sunscreens, and indigenous botanicals. Australian brands are gaining global traction for their sustainability ethos, and local CMOs are responding with eco-friendly production lines and cruelty-free certification expertise.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific personal care contract manufacturing market

Service

Product

Product form

Country