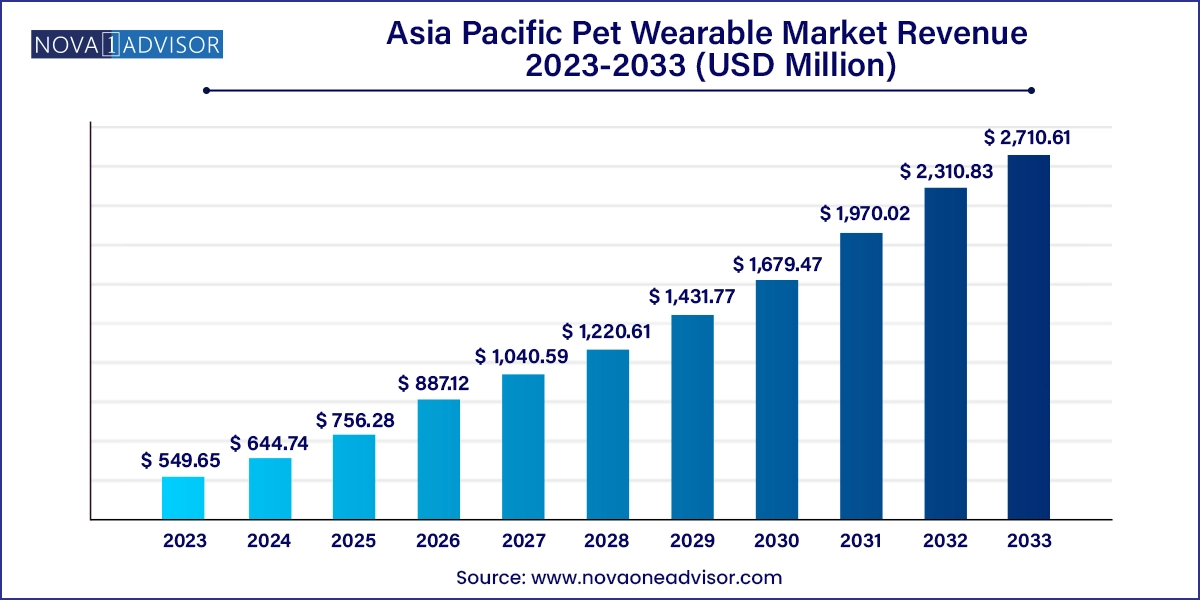

The Asia Pacific pet wearable market size was exhibited at USD 549.65 million in 2023 and is projected to hit around USD 2,710.61 million by 2033, growing at a CAGR of 17.3% during the forecast period 2024 to 2033.

The Asia Pacific pet wearable market is witnessing rapid growth, driven by rising pet ownership, increased expenditure on pet health and lifestyle, and the regional embrace of smart, IoT-enabled consumer technologies. Pet wearables—ranging from GPS tracking collars and health-monitoring harnesses to Bluetooth-enabled behavioral devices—are redefining the relationship between humans and their companion animals in the region.

Countries like China, Japan, South Korea, Australia, and India are leading the transformation, fueled by the convergence of three major forces: growing urban pet populations, digitization of the pet care ecosystem, and rising awareness of pet wellness. As pet parents become more conscious about the safety, health, and overall well-being of their animals, wearable technology is emerging as a vital solution for real-time monitoring, fitness tracking, and medical diagnostics.

Additionally, the rising influence of Gen Z and millennial pet owners—who seek connected, app-based solutions and view pets as part of the family—has created a highly receptive environment for smart pet technologies. From pet-friendly smart homes in urban Japan to rapidly expanding e-commerce pet platforms in India and China, the region is witnessing unprecedented demand for intelligent and multifunctional pet wearables.

Rapid Urbanization and Smaller Living Spaces Fueling Pet Technology Adoption: As cities grow denser, pet owners are turning to wearables for monitoring safety, behavior, and activity in confined environments.

Integration of Wearables with Mobile Ecosystems: Most wearables are now paired with companion apps offering dashboards for health insights, GPS tracking, and personalized alerts.

Rise of Medical-Grade Wearables for Veterinary Integration: Devices that track vitals such as temperature, heart rate, and respiration are being adopted for early diagnosis and post-operative care.

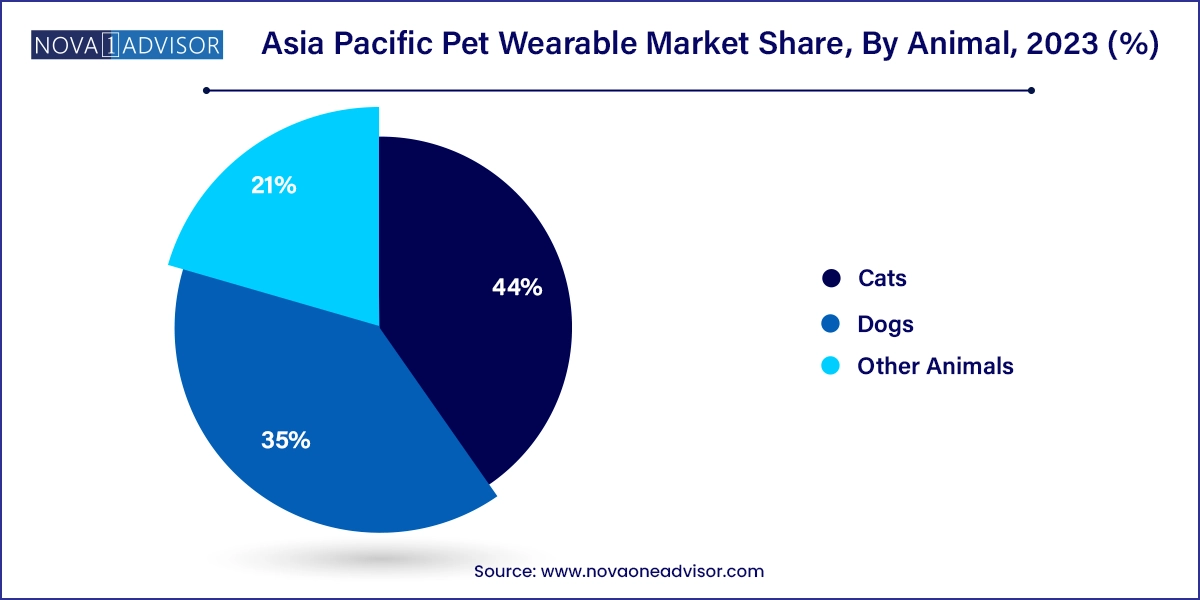

Wearables Tailored for Cats and Exotic Pets: Companies are developing lighter, smaller devices suited for felines and less traditional pet species like rabbits and reptiles.

Expansion of AI and Predictive Health Algorithms: Smart collars and harnesses now use machine learning to predict behavior changes or emerging health conditions.

Shift Toward Eco-Friendly and Lightweight Materials: Consumers are increasingly demanding sustainable, breathable, and biodegradable designs.

Regional Tech Players Entering the Market: Chinese and Korean electronics firms are entering the pet wearable space with advanced connectivity and modular systems.

E-commerce Platforms Driving Distribution: Digital pet supply chains—such as Tmall Pet (Alibaba), Amazon Japan, and Flipkart in India—are rapidly pushing wearable accessibility.

| Report Coverage | Details |

| Market Size in 2024 | USD 644.74 Million |

| Market Size by 2033 | USD 2,710.61 Million |

| Growth Rate From 2024 to 2033 | CAGR of 17.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Product, Animal, Component, Application, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China; India; Japan; Australia; South Korea |

| Key Companies Profiled | Mobiusworks Private Ltd.; PETBLE; PetPace; Mars, Inc.; FitBark; DeLaval; SUGA International Holdings Ltd.; Datamars; PETREK; Tractive; Allflex |

One of the strongest drivers for the pet wearable market in Asia Pacific is the growing humanization of pets and the rising awareness of their health and safety needs. Across APAC countries, particularly in urban areas, pets are increasingly seen as integral family members rather than simply domestic animals. This shift in perspective has spurred a surge in spending on advanced pet care products and services.

In countries like Japan and South Korea, where aging populations and smaller family units are common, pets are often considered emotional companions, encouraging the use of tech-enabled solutions for companionship, safety, and health. In China, where the pet care market surpassed $30 billion in 2024, wearable adoption is linked closely to rising incomes and an increasing number of pet-related lifestyle influencers on social platforms like Douyin (TikTok China).

As health consciousness among pet parents grows, wearables offer not only peace of mind but also tools for proactive veterinary care. Whether tracking chronic illnesses, monitoring food intake, or optimizing daily walks, these smart devices empower owners to maintain their pets’ wellness in an informed, tech-integrated manner.

Despite strong potential, one of the main restraints in the APAC pet wearable market is the combination of cost sensitivity and lack of product awareness in emerging economies like India, Indonesia, and parts of Southeast Asia. High-end smart collars and diagnostic vests often cost between $50–$200, which remains a luxury expenditure for many middle-income households.

Additionally, while awareness of pet wellness is growing, many owners are still unfamiliar with the functional advantages that wearables can provide. In countries where traditional pet ownership practices dominate, technological solutions are not yet seen as essential. Furthermore, inconsistent access to GPS signals, limited battery infrastructure, and low smartphone penetration in rural areas hinder adoption of advanced wearables.

Bridging the knowledge gap through education, subsidies, and locally optimized product variants will be essential for manufacturers aiming to tap the massive underpenetrated markets across APAC.

The Asia Pacific pet wearable market holds strong future opportunities through integration with broader smart infrastructure—particularly in urban centers aiming to become smart cities. Cities like Singapore, Tokyo, and Seoul are investing in connected technologies for everything from transportation to animal control, creating an opportunity for pet wearables to plug into municipal systems for pet registration, GPS fencing, and emergency tracking.

Additionally, partnerships between wearable providers and veterinary networks are on the rise. Companies like Petkit in China and Whistle Labs (through its local distribution) are developing APIs and data-sharing systems that enable veterinarians to receive real-time health metrics directly from a pet’s wearable device. In countries like Australia and Japan, this integration is also being linked with pet insurance providers, creating bundled packages that reward proactive health tracking with reduced premiums.

This confluence of IoT, telemedicine, and pet services represents a major growth vector that can significantly expand the utility and adoption of pet wearables in Asia.

Smart collars dominate the APAC market, offering a compact and efficient form factor with integrated GPS, sensors, and communication chips. These are especially popular in China and Japan, where daily pet walks and access to pet-friendly parks make activity tracking essential. The smart collar market benefits from aesthetic customization options, brand recognition, and seamless app integration, making it the preferred entry point for first-time wearable buyers.

Smart harnesses and vests are the fastest-growing products, particularly in segments requiring more detailed data collection, such as service dogs, therapy animals, and senior pets. These products offer more sensor coverage and surface area for additional features like heart rate detection, stress monitoring, and thermal imaging. Markets like Australia and South Korea are adopting smart harnesses for performance dogs and those involved in agility training or pet-assisted therapy programs.

Dogs remain the leading animal category for pet wearables, due to their outdoor habits, sociable behavior, and established infrastructure for training and mobility. Dog-specific wearables are the most developed, with GPS trackers, activity monitors, and behavior training modules widely available. Countries like Japan and Australia have well-developed pet retail chains that prioritize canine wearable SKUs.

Cats are the fastest-growing category, with brands now focusing on lighter, more ergonomic devices that suit feline behavior. In China and South Korea, there’s been a notable increase in the number of indoor-outdoor cats wearing miniaturized GPS collars and activity bands. Petkit’s “Mini Smart Cat Collar” and similar products by domestic startups are designed to monitor movement range, rest cycles, and eating behavior, offering cat owners a new layer of insight into typically elusive feline habits.

GPS chips are the most widely used components, essential to the tracking capabilities of collars and harnesses. These are especially crucial in regions with sprawling urban layouts like Shanghai, Seoul, and Tokyo, where pets can easily get lost in high-traffic environments. GPS integration also allows for smartphone app-based boundary alerts and historical movement tracking.

Bluetooth and cellular chips are the fastest-growing connectivity components, particularly as wearables evolve into real-time communication devices. Cellular-enabled wearables allow continuous tracking without dependence on local Wi-Fi, which is beneficial in remote or highly mobile environments like dog parks or during travel. Bluetooth chips, on the other hand, support short-range indoor tracking and sync functions with home automation systems or local control hubs.

Identification and tracking is the most dominant application, with GPS and RFID-enabled devices helping reduce pet loss incidents and theft. Municipal partnerships in Tokyo and Seoul already use wearable tags for identity registration, vaccination status, and location tracking. Smart wearables double as digital ID cards and can integrate with smart pet doors or feeders to provide access control.

Medical diagnosis and treatment is the fastest-growing application, especially in South Korea, Japan, and Australia, where veterinary services are advanced and increasingly integrated with technology. Smart collars that track sleep, pulse, activity, and abnormal behavior can preempt illness and alert veterinarians via shared cloud dashboards. Devices like PetPace’s health monitoring collar are now available in APAC markets, reflecting growing demand for wellness-centric wearables.

GPS technology leads the APAC pet wearable market, especially in high-density urban regions where pet loss is a major concern. GPS-enabled devices are widely used in Japan, South Korea, and urban China for real-time tracking, geo-fencing, and automated alerts. Pet parents appreciate the ability to trace outdoor movements or detect unsanctioned travel beyond property boundaries. GPS wearables have become a key tool in reducing pet theft and supporting municipal registration systems.

Sensor technology is the fastest-growing segment, with applications extending from behavioral monitoring to health diagnostics. Smart collars and harnesses now include temperature sensors, motion detectors, and stress-level indicators. These are gaining ground in South Korea and Australia, where there’s a cultural emphasis on detailed wellness tracking and preventive healthcare. Wearables equipped with biometric sensors are being used in post-surgery recovery, chronic illness management, and even emotional behavior interpretation for anxious pets.

China represents the largest and fastest-growing pet wearable market in Asia. The country is home to several domestic brands like Petkit, which has gained significant traction through platforms like JD.com and Tmall. With pet ownership in cities like Shanghai and Beijing surging, GPS and health tracking collars are increasingly part of the modern urban lifestyle. The growth of the "pet economy" in China—spanning smart feeders, wearables, and pet insurance—is fueling innovation and domestic production.

India is an emerging but promising market. While overall adoption is still nascent, awareness is growing among urban pet owners in cities like Bengaluru, Delhi, and Mumbai. Domestic startups are beginning to enter the pet tech space, and GPS collars for dogs are seeing interest among pet-friendly residential complexes. Price sensitivity remains a barrier, but the expanding middle class and pet parent community are opening the market for affordable wearables.

Japan is among the most advanced pet tech markets in APAC. High disposable incomes, an aging population seeking pet companionship, and a cultural emphasis on precision make Japan ideal for smart wearables. Companies like Sony and local pet care retailers are launching customized solutions for elderly dog care, post-surgery recovery, and advanced fitness tracking.

South Korea has high rates of pet ownership in urban areas and a strong appetite for smart devices. The tech-savvy consumer base supports pet wearable startups, and national regulations around pet registration create synergy with identification-focused devices. Many households integrate pet wearables with smart home ecosystems, making South Korea one of the most connected markets in APAC.

Australia has a well-developed pet care industry, and the demand for activity tracking, safety alerts, and smart training systems is high. Wearables that support outdoor adventures and remote monitoring in rural areas are particularly in demand. E-commerce penetration is strong, and partnerships between wearable makers and veterinary networks are emerging across the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific pet wearable market

Technology

Product

Animal

Component

Application

Country