The Asia Pacific preclinical CRO market size was exhibited at USD 913.25 million in 2023 and is projected to hit around USD 2,569.83 million by 2033, growing at a CAGR of 10.9% during the forecast period 2024 to 2033.

The Asia Pacific Preclinical Contract Research Organization (CRO) market is witnessing substantial growth as the region increasingly becomes a global hub for pharmaceutical innovation, biomedical research, and drug development. Preclinical CROs serve a pivotal role in the drug development pipeline, offering outsourced services that span toxicology studies, pharmacokinetics, pharmacodynamics, and bioanalytical assessments before a candidate drug enters human trials. By facilitating early-stage testing and evaluation of investigational compounds, CROs accelerate the transition from discovery to clinical development while ensuring compliance with regulatory standards.

The rapid expansion of pharmaceutical R&D activities across emerging economies such as China, India, and South Korea has significantly fueled demand for preclinical outsourcing services. In recent years, multinational pharmaceutical companies have increasingly opted to shift their preclinical research operations to the Asia Pacific due to favorable cost structures, expanding talent pools, and improved infrastructure. Domestic CROs are also scaling up their capabilities, offering services that rival global standards. Furthermore, governments across the region are investing heavily in biopharmaceutical innovation ecosystems, fostering academia-industry collaborations and funding translational research initiatives.

For example, India’s Biotechnology Industry Research Assistance Council (BIRAC) and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) are facilitating faster research, early access to investigational drugs, and harmonized preclinical regulatory protocols. Meanwhile, countries like China are making massive strides with homegrown CRO giants like WuXi AppTec spearheading integrated services from discovery to IND submission. As the regulatory environment matures and international harmonization increases, the Asia Pacific region is poised to dominate global preclinical research outsourcing in the next decade.

Integration of AI and digital technologies: CROs are deploying AI-driven data analytics, in silico models, and digital biomarkers to enhance predictive toxicology and compound screening efficiency.

Increased demand for patient-derived models: The use of PDOs and PDX models is growing due to their enhanced translational accuracy in oncology drug development.

Expansion of GLP-certified facilities: Regulatory stringency and the need for global compliance are prompting CROs to invest in Good Laboratory Practice-certified infrastructure.

Rising number of strategic partnerships: Pharma companies are entering long-term alliances with CROs to access end-to-end preclinical services and reduce time-to-market.

Emergence of hybrid CRO models: New entrants are offering integrated discovery-to-IND services, combining preclinical testing, regulatory consulting, and digital platform support.

Growing focus on biosimilars and novel biologics: As the market for biosimilars and antibody-drug conjugates expands, CROs are adapting their offerings to support complex biologics testing.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,012.79 Million |

| Market Size by 2033 | USD 2,569.83 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Model Type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Asia Pacific |

| Key Companies Profiled | WuXi AppTec; Pharmaron; Radyus Research and Dt&CRO; Novotech; Syngene International Limited; Veeda Clinical Research Limited; Stelis Biopharma Ltd.; Aragen Life Sciences Ltd. |

A central driver for the Asia Pacific preclinical CRO market is the cost advantage that regional service providers offer compared to their Western counterparts. Conducting toxicology or pharmacokinetics studies in North America or Europe often involves significantly higher operational expenditures due to higher labor costs, regulatory compliance complexities, and limited scalability. Conversely, CROs based in Asia Pacific especially in India, China, and South Korea are able to offer competitive pricing while maintaining high-quality standards through adherence to OECD GLP, FDA, and EMA guidelines.

This affordability factor becomes especially relevant for small to mid-sized biopharmaceutical companies seeking to optimize R&D spending and accelerate timelines. These companies are increasingly turning to Asia-based CROs for studies such as in vitro ADME screening, dose range finding, and acute toxicity testing. Furthermore, scalability plays a critical role: with the rising number of investigational new drug (IND) filings, the capacity to accommodate large volumes of studies without compromising turnaround time becomes a strategic differentiator. The region’s deep pool of scientific talent, combined with an expanding footprint of GLP facilities, provides a scalable and economically viable solution for global drug developers

While the Asia Pacific region is rapidly progressing in terms of regulatory alignment, the lack of standardized regulations and ethical frameworks across different countries remains a significant barrier. Each nation maintains its own set of preclinical study requirements, animal welfare protocols, and institutional review processes, creating a fragmented landscape for multinational pharmaceutical clients. For example, animal testing regulations in China differ substantially from those in Australia or India, leading to inconsistency in study outcomes and increased compliance costs for clients managing multi-site studies.

Additionally, the limited availability of harmonized animal models, variable data integrity protocols, and occasional delays in approvals from ethics committees can affect project timelines. CROs operating in countries with underdeveloped ethical review systems may also face reputational risks, particularly from Western clients concerned with global compliance. Although organizations like the Asia-Pacific Association of Laboratory Animal Science are working toward standardization, the region still faces challenges in unifying regulatory protocols. This fragmentation may prompt certain sponsors to restrict outsourcing to only a few vetted countries within the region.

One of the most exciting opportunities in the Asia Pacific preclinical CRO market is the rapid expansion of personalized medicine and oncology research. Precision therapies require specialized preclinical testing environments that can evaluate drug efficacy and toxicity using patient-specific biological models. The region is seeing a surge in demand for patient-derived xenograft (PDX) and organoid-based models, particularly in countries like Japan and China, which are investing heavily in oncology R&D. These models provide higher translational relevance and are critical for evaluating immunotherapies, targeted therapies, and companion diagnostics.

Several CROs in Asia Pacific are now developing capabilities in personalized preclinical trials, incorporating genomic profiling, biomarker discovery, and AI-driven phenotype assessments. For instance, Chinese CROs are collaborating with hospital networks to access tumor biopsy libraries, while Japanese institutions are offering high-throughput organoid screening platforms. As pharma and biotech firms move toward individualized treatment paradigms, preclinical CROs that can support such studies with validated, scalable models stand to gain significant competitive advantage. Furthermore, these trends open up new service segments like preclinical companion diagnostic validation and ex vivo tumor pharmacology testing.

Toxicology testing services dominated the Asia Pacific preclinical CRO market, accounting for the largest revenue share. Toxicology studies are indispensable to early-stage drug development and are often mandated before moving to clinical trials. CROs in countries like China and India offer a wide array of toxicological assessments including acute, sub-chronic, chronic, reproductive, and genotoxicity testing at competitive costs and under GLP compliance. These services are essential not just for pharmaceuticals but also for medical devices and chemicals, expanding their applicability. With a growing number of drug candidates entering the preclinical phase, the demand for reliable toxicological studies is only set to rise.

On the other hand, Bioanalysis and DMPK studies are emerging as the fastest-growing segment, driven by advancements in LC-MS/MS technology and increasing demand for pharmacokinetics/pharmacodynamics (PK/PD) integration. These services are crucial for evaluating drug metabolism, absorption, and elimination profiles, which directly influence dosing and safety margins. In particular, Japan and South Korea have established reputations for precise, high-throughput bioanalytical services that meet stringent global regulatory standards. As biopharmaceutical companies continue to develop complex biologics and small-molecule therapies, the need for tailored, sensitive, and rapid DMPK studies will continue to grow, making this segment a hotbed of innovation and expansion.

Patient Derived Xenograft (PDX) models currently dominate this market, owing to their superior ability to recapitulate human tumor biology in animal systems. These models maintain the histological and genetic characteristics of the patient’s original tumor, making them valuable tools for oncology drug testing, biomarker validation, and resistance profiling. CROs in China and Japan are leveraging their hospital networks and tissue banks to establish vast libraries of PDX models that cater to specific cancer subtypes. These models are increasingly being used to support IND filings and efficacy studies for targeted cancer therapies.

In contrast, Patient-derived organoid (PDO) models are witnessing the fastest growth, particularly in South Korea and Australia. Organoids provide a three-dimensional, in vitro environment that mimics organ-specific physiology more accurately than conventional cell lines. Their applications extend beyond oncology to include liver, lung, and gastrointestinal diseases. The use of PDOs in preclinical screening is gaining traction due to their potential to reduce animal usage and enhance predictive accuracy. Several CROs in Asia Pacific are investing in biobanking, CRISPR-based editing, and high-throughput screening platforms to scale organoid production and validation, setting the stage for exponential growth in this segment.

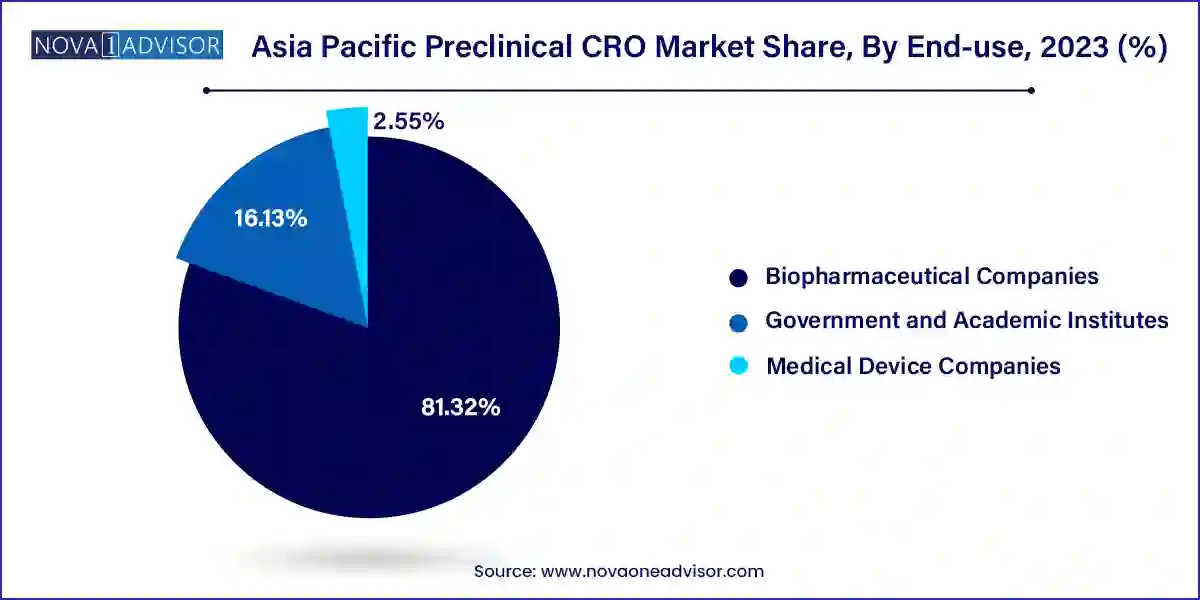

Biopharmaceutical companies constitute the largest end-user segment, given their extensive need for early-phase research, safety evaluation, and IND-enabling studies. Multinational pharmaceutical firms frequently partner with Asia-based CROs for rapid and cost-efficient turnaround of preclinical studies. Additionally, emerging biotech startups across Singapore, China, and India are increasingly outsourcing preclinical work to focus on core competencies such as drug discovery and IP development. This trend is further reinforced by venture capital inflows into biotech R&D across the region, necessitating outsourcing to control costs and accelerate timelines.

Medical device companies are, however, the fastest-growing end-user group, largely due to evolving regulations around biocompatibility and toxicological testing. Devices with drug-eluting components, such as stents and catheters, require preclinical evaluation similar to pharmaceutical compounds. As the Asia Pacific medical devices industry flourishes particularly in India, Australia, and Taiwan so does the demand for preclinical CROs that can conduct ISO 10993-compliant studies. CROs are thus expanding their capabilities to serve this niche, offering integrated device and material safety testing services, making this an increasingly lucrative vertical.

China remains the powerhouse of preclinical CRO activity in Asia Pacific. With the presence of global players like WuXi AppTec and strong government backing through initiatives like “Made in China 2025,” the country offers comprehensive infrastructure for toxicology, DMPK, and disease modeling studies. WuXi AppTec’s preclinical research campuses in Suzhou and Shanghai are among the largest globally and provide end-to-end solutions to international clients.

India is fast emerging as a key player due to its cost advantages, English-speaking scientific workforce, and large animal model facilities. Government support through the Department of Biotechnology and faster regulatory clearances are boosting the country’s appeal for global clients. Syngene International, for instance, is expanding its preclinical footprint to serve U.S. and EU sponsors.

Japan is renowned for precision, regulatory compliance, and high-end research. The country’s CROs specialize in bioanalysis, imaging, and neuropharmacology. Companies like Shin Nippon Biomedical Laboratories (SNBL) are pioneering preclinical work in neurological and cardiovascular domains.

South Korea is investing in translational research hubs, including government-funded Bio Clusters in Osong and Daegu. The country’s emphasis on cell and gene therapies is prompting CROs to adapt their preclinical services for novel biologics.

Australia’s robust animal ethics framework and proximity to Western markets make it an ideal site for toxicological and safety pharmacology studies. Companies like Agilex Biolabs are growing their influence in bioanalysis and immunogenicity services.

April 2024 – WuXi AppTec announced the expansion of its Suzhou preclinical campus with a new 160,000 sq. ft. facility to meet the rising demand for toxicology and pharmacology studies from international sponsors.

February 2024 – Syngene International launched a new integrated preclinical discovery platform in Bengaluru, aiming to support small biotech firms with IND-enabling studies at competitive prices.

January 2024 – Agilex Biolabs, an Australian CRO, completed the acquisition of TetraQ, a Brisbane-based preclinical service provider, to expand its offerings in DMPK and bioanalytical testing.

March 2024 – SNBL Japan partnered with a U.S.-based AI firm to develop automated behavior analysis tools for neuropharmacology studies in animal models, integrating machine vision and deep learning technologies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific preclinical CRO market

Service

Model Type

End-use

Country