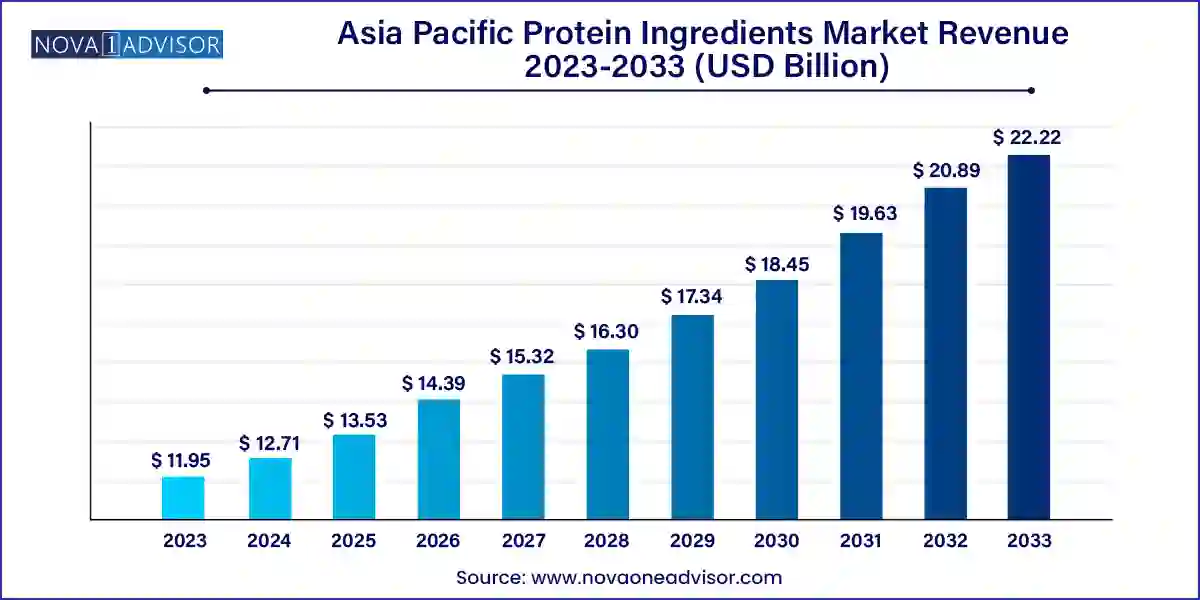

The Asia Pacific protein ingredients market size was exhibited at USD 11.95 billion in 2023 and is projected to hit around USD 22.22 billion by 2033, growing at a CAGR of 6.4% during the forecast period 2024 to 2033.

The Asia Pacific protein ingredients market is experiencing a transformative evolution, catalyzed by a fusion of nutrition science, technological innovation, and cultural dietary shifts. As the global population grows increasingly aware of the role of proteins in health, immunity, and fitness, Asia Pacific has emerged as a dynamic region where protein demand is rising across diverse consumer segments—from traditional food consumers to new-age fitness enthusiasts and even clinical patients.

This market encapsulates a wide range of ingredients derived from plant, animal/dairy, microbial, and insect-based protein sources. These are utilized in a broad spectrum of applications including food & beverages, sports and clinical nutrition, infant formulations, and animal feed. The region’s cultural diversity and varying levels of development add complexity and opportunities to the protein ingredients market. While countries like China and India demonstrate surging demand due to population size and nutritional transitions, Japan and Australia are innovation hubs for high-protein functional foods and nutraceuticals.

Growing veganism and vegetarianism, combined with the rising prevalence of lactose intolerance and allergies to conventional dairy proteins, have fueled the adoption of plant-based proteins across the region. Simultaneously, increased interest in sustainable protein sources such as microbe-based and insect proteins is beginning to gain momentum, especially among environmentally conscious younger consumers.

Rapid urbanization, the rise of the middle class, and an increased emphasis on health and wellness in the aftermath of the COVID-19 pandemic have further underscored the importance of functional proteins in daily diets. The Asia Pacific protein ingredients market, therefore, represents not just a high-volume opportunity, but a technologically rich and innovation-driven ecosystem forecasted to grow significantly through 2034.

Surging Demand for Plant-Based Proteins: Consumers across Asia are moving toward clean-label, vegan-friendly food and beverage products, spurring innovations in pea, soy, oat, and rice protein categories.

Emergence of Microbe-Based and Insect Proteins: Algae, fungi, and insect-based proteins are making their way into functional foods and animal feed due to their sustainability and high nutritional value.

Widespread Use of Protein in Infant and Clinical Nutrition: Specialized protein formulations are gaining traction in infant formula and medical nutrition for improved recovery, immunity, and muscle maintenance.

Technological Advancements in Protein Extraction and Processing: New methods such as high-moisture extrusion, enzymatic hydrolysis, and fermentation are enhancing the functionality of proteins for food and pharma use.

Growth of Sports and Performance Nutrition: Rising gym memberships and social media-driven fitness trends in India, China, and Australia are boosting demand for whey protein, casein, and soy protein isolates.

Functional Proteins in Cosmetics: The inclusion of collagen peptides and hydrolyzed proteins in skincare and haircare products is gaining popularity in South Korea and Japan.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.71 Billion |

| Market Size by 2033 | USD 22.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China; India; Japan; Australia; Indonesia |

| Key Companies Profiled | Cargill, Inc.; Glanbia PLC; Kerry Group plc; Tate & Lyle; Ingredion; DSM; Roquette Frères; Proeon; Wilmar International Ltd; ETChem; Australian Plant Proteins Pty. Ltd.; Entobel; Shandong Jianyuan Group |

A prominent driver of the Asia Pacific protein ingredients market is the growing diversification of consumer diets in alignment with health, wellness, and environmental values. Increasing urbanization and rising disposable incomes have empowered consumers across emerging markets like India, Indonesia, and China to seek functional foods enriched with quality proteins. Simultaneously, awareness of diet-related disorders such as obesity, diabetes, and cardiovascular diseases is pushing consumers toward nutrient-rich food alternatives.

In Australia and Japan, where aging populations dominate, consumers are actively pursuing products with added protein to combat muscle deterioration and promote longevity. For younger demographics, particularly in urban India and China, the influence of Western fitness culture has created demand for high-protein snacks, RTD shakes, and performance powders. This diversification is propelling demand across all protein categories—plant, animal, microbe, and insect.

Despite the rising demand, digestibility and allergenicity issues remain critical challenges restraining the market. Commonly used protein sources such as soy and dairy (whey, casein) are associated with allergic reactions in certain population groups. For example, soy allergies are prevalent in Japan, while lactose intolerance is widespread across East Asia. Such issues can limit the market potential of traditional protein ingredients in these areas.

Moreover, some plant-based proteins, particularly legumes and grains, contain anti-nutritional factors like phytates and lectins, which can reduce nutrient absorption and cause digestive discomfort. While technologies like hydrolysis and fermentation are helping mitigate these concerns, consumer skepticism around less familiar or genetically modified proteins still poses barriers to adoption.

A vast opportunity lies in the mainstreaming of protein-enriched everyday foods and beverages. Traditionally, protein powders and supplements were confined to athletes and bodybuilders. However, this perception is rapidly changing as general consumers look for convenient ways to boost protein intake throughout the day.

This shift is fueling demand for fortified beverages, breakfast cereals, dairy alternatives, protein bars, bakery items, and even ready meals with added functional protein. The convergence of taste, convenience, and health is driving manufacturers to innovate. Local food giants in India, China, and Southeast Asia are actively launching protein-rich versions of staple products—such as high-protein noodles, soy milk, and biscuits. This trend holds immense long-term potential for brands that can marry functionality with familiarity.

Plant proteins have emerged as the dominant product segment, driven by their accessibility, scalability, and consumer preference for vegan and allergen-free options. Soy, pea, and rice proteins are extensively used across food, beverage, and dietary supplement applications. For example, textured soy protein is widely used in meat analogs across China and India, while pea protein is gaining ground in dairy alternatives and snacks in Australia. The extensive range of subcategories such as isolates, concentrates, hydrolysates, and textured forms offers tailored functionality across diverse food matrices.

On the other hand, microbe-based proteins represent the fastest-growing product segment. Algae, yeast, fungi, and bacterial proteins offer high digestibility, sustainable production, and complete amino acid profiles. These are being explored in next-gen food products including cultured meats and high-end supplements. In Japan, startups are leveraging microbial fermentation to produce protein-rich beverages and food additives, while in Singapore, cell-based protein labs are exploring algae-based protein powders and meat analogs. Though still nascent, the scalability and environmental benefits of this segment are likely to fuel rapid growth in the forecast period.

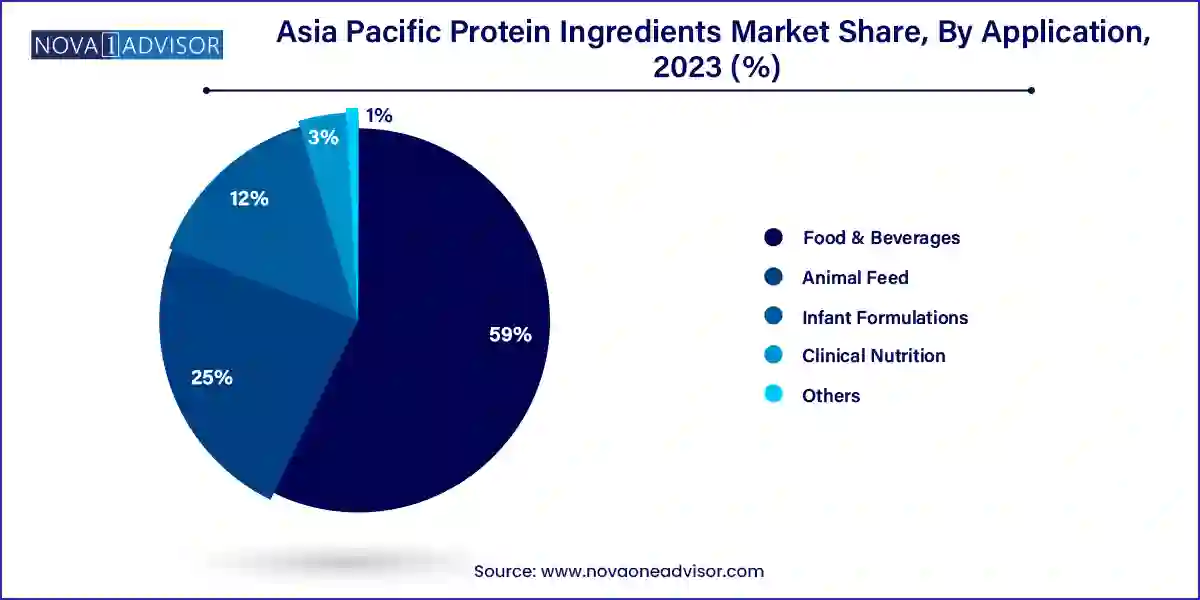

The food & beverage segment accounted for a dominant revenue share of 59.0% in the Asia Pacific protein ingredients market in 2023. Within this, sports nutrition and meat alternatives are the leading sub-segments. Beverages like plant-based milks, protein waters, and fortified teas are gaining popularity in urban markets across India and China. In Japan, consumers are adopting functional bakery and snack products featuring plant and dairy proteins. Protein-fortified traditional products—such as soy-flavored tofu snacks in Korea or high-protein noodles in Vietnam—are also boosting the segment's footprint.

Meanwhile, clinical nutrition is emerging as a rapidly growing segment, supported by the rising aging population and medical awareness in Japan and Australia. Protein isolates and hydrolysates are used in therapeutic foods and drinks aimed at post-operative recovery, elderly nutrition, and chronic disease management. Innovations such as ready-to-drink medical shakes with rice or whey protein are being introduced in hospitals and pharmacies. This segment’s growth is further supported by government-led nutrition intervention programs and private healthcare investments.

China stands at the forefront of the Asia Pacific protein ingredients market, with rapid advancements in both demand and innovation. The country's growing middle class, increased consumer spending on health and wellness, and rising demand for clean-label and high-protein foods have created a conducive environment for protein market expansion.

Major domestic players like Yantai Shuangta Food and international giants such as ADM and Cargill are actively investing in China’s protein landscape. Plant-based meat and dairy alternatives are booming, particularly in tier-1 and tier-2 cities. Functional beverages, especially soy and pea-based protein drinks, are occupying more shelf space in retail stores. Additionally, China's National Health Commission has initiated campaigns promoting protein intake for all age groups, further boosting the market. In parallel, research into fermentation-derived and insect proteins is underway, positioning China as both a consumption and innovation hub in the global protein economy.

In March 2024, Roquette opened a new R&D center in Shanghai to enhance innovation in plant protein ingredients tailored for Asian food applications.

June 2024 saw Triton Algae Innovations, a U.S.-based company, enter a strategic partnership with a Singapore-based distributor to launch microalgae-based protein drinks in China and Indonesia.

ADM announced in January 2024 its collaboration with China's Qishan Foods to co-develop textured soy protein solutions for traditional Chinese cuisine adaptations.

In February 2024, Indian startup Prolgae revealed plans to scale production of spirulina-based protein isolates with export focus on Southeast Asia and Australia.

Australian Dairy Nutritionals Group launched a line of whey protein isolate-based RTD beverages targeting clinical and fitness nutrition sectors in April 2024.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific protein ingredients market

Product

Application

Country