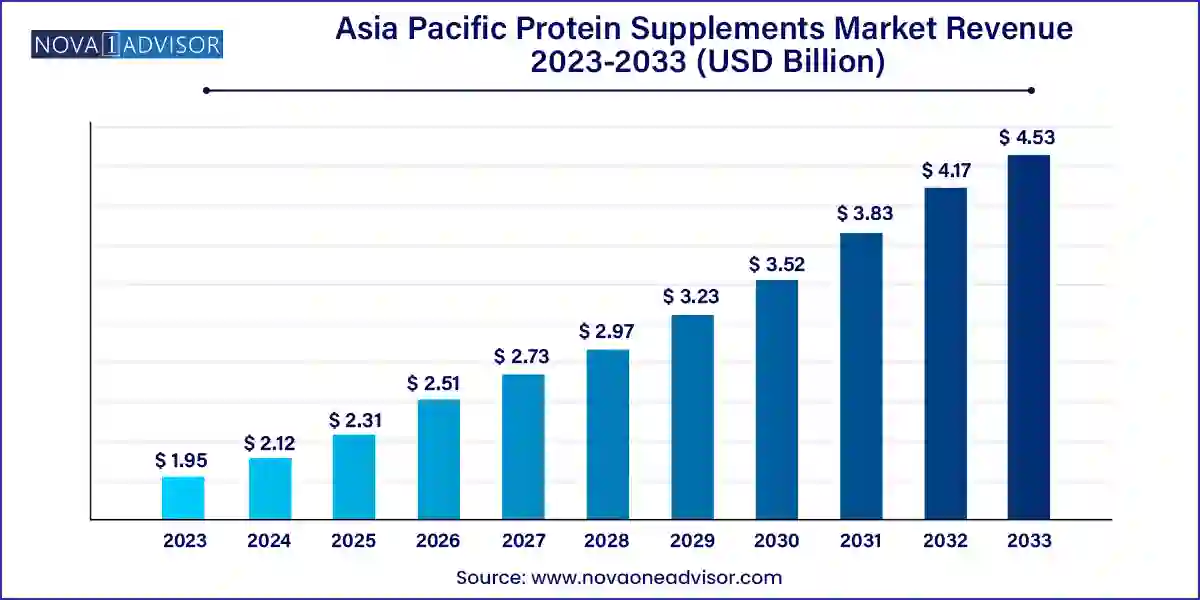

The Asia Pacific protein supplements market size was exhibited at USD 2.12 billion in 2023 and is projected to hit around USD 4.53 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2024 to 2033.

The Asia Pacific protein supplements market is witnessing robust growth, fueled by rising health consciousness, rapid urbanization, and an increasing emphasis on preventive healthcare. Once a niche segment consumed mainly by athletes and bodybuilders, protein supplements have now entered the mainstream across urban and semi-urban regions in Asia Pacific. From gym-goers in Tokyo to health-conscious millennials in Bangalore and elderly wellness consumers in Shanghai, protein-based nutrition is becoming a part of everyday diets.

This growth is further propelled by the convergence of several macro-level trends: rising disposable income, growing participation in fitness activities, the digitalization of health awareness, and evolving dietary preferences. Cultural shifts are also contributing, as traditional protein-deficient diets in many Asian countries are being supplemented by modern formats of protein intake such as powders, bars, and Ready-to-Drink (RTD) products.

The rise in plant-based alternatives has also opened the market to vegan and lactose-intolerant consumers, especially in India and Australia, while Japan and China are at the forefront of innovations in functional protein-enriched foods. As global brands localize their offerings and regional players gain ground with indigenous ingredients and traditional wellness narratives, the Asia Pacific region is shaping up to be one of the most dynamic arenas for protein supplement innovation and growth.

Rise of Plant-Based Protein Supplements: Driven by veganism, lactose intolerance, and sustainability, plant proteins are capturing a significant market share across urban Asia.

Functional Protein Integration: Protein supplements are being infused with probiotics, collagen, vitamins, and adaptogens, targeting holistic health beyond muscle building.

E-Commerce and DTC Growth: Digital platforms and influencer-led brands are reaching consumers directly, especially in China, India, and Australia.

Customized Nutrition: Personalized protein mixes based on DNA, age, and lifestyle are gaining attention among tech-savvy health enthusiasts.

Increased Female Participation: Women are emerging as a key demographic for protein supplements, seeking benefits related to strength, metabolism, and skincare.

Traditional Ingredients Modernized: Asian heritage ingredients like mung beans, rice, and hemp are being reformulated into modern protein powders and bars.

Regulatory Standardization and Label Transparency: Government efforts across Asia are increasing scrutiny around protein quality, purity, and health claims.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.12 Billion |

| Market Size by 2033 | USD 4.53 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Source, Product, Application, Distribution Channels, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India; Australia |

| Key Companies Profiled | Glanbia Nutritionals; Abbott; Quest Nutrition LLC; Dymatize Enterprises LLC; BRF Global; Rousselot; Gelita AG; Hoogwegt |

One of the primary drivers behind the growing demand for protein supplements in the Asia Pacific region is the rise in health consciousness and the adoption of fitness-oriented lifestyles. Consumers are increasingly aware of the importance of protein for muscle development, metabolic function, immune support, and overall well-being. This shift is particularly strong among the urban population who are exposed to global fitness trends through social media, gyms, and wellness influencers.

In countries like China and India, fitness centers, yoga studios, and CrossFit clubs are expanding rapidly, attracting younger demographics. Meanwhile, Australia and Japan are seeing a strong senior citizen focus on maintaining muscle mass through protein supplementation as part of healthy aging. As consumers seek convenient and efficient ways to meet their nutritional requirements, protein supplements are becoming a go-to solution across demographics.

Despite the favorable demand outlook, a key restraint in the Asia Pacific protein supplements market is price sensitivity and limited accessibility in rural or economically weaker regions. High-quality protein supplements, especially those containing imported whey or organic plant proteins, often come at a premium price point that is inaccessible to middle- and lower-income groups in several Asian countries.

Additionally, infrastructure limitations in terms of cold storage for RTD products or inconsistent distribution in tier-2 and tier-3 cities can hamper market penetration. In India and Southeast Asia, local counterfeit products and mislabeling also reduce consumer trust in the category. While urban consumers are growing more sophisticated, the broader market requires pricing strategies and education efforts to overcome these barriers.

A lucrative opportunity lies in the integration of protein supplements into the broader functional food segment and the targeting of the aging population. As health evolves from reactive to preventive, consumers are embracing foods fortified with protein as part of their everyday diet rather than consuming supplements as isolated products.

This trend is particularly promising in countries like Japan and Australia, where populations are aging rapidly and require muscle support to combat sarcopenia (age-related muscle loss). Functional products such as protein-enriched yogurt, baked goods, breakfast cereals, and soups are gaining popularity, offering subtle and consistent ways for elderly consumers to incorporate protein into their daily meals. Additionally, brands offering clean-label, low-carb, or collagen-fortified proteins have a competitive edge in this emerging health-conscious demographic.

Animal-based protein supplements currently dominate the Asia Pacific market, particularly those derived from whey and casein. Whey protein, a byproduct of dairy, remains the gold standard due to its complete amino acid profile and rapid absorption rate, making it ideal for post-workout recovery. Whey isolate and hydrolysate variants are especially popular among athletes and gym enthusiasts in countries like India, China, and Australia. Casein, with its slower absorption, is often marketed for nighttime recovery, while egg and fish proteins are being adopted for their allergen-free and high-digestibility traits.

However, plant-based proteins are the fastest-growing category, reflecting the rise of veganism, sustainability awareness, and dietary sensitivities like lactose intolerance. Pea protein, soy, and rice protein dominate this segment due to their neutral flavor and high compatibility in various formats. In India and China, there’s growing interest in hemp, mung bean, and pumpkin seed proteins, which align with local agricultural practices and cultural familiarity. Plant-based proteins are increasingly being positioned not only for fitness but also for gut health, beauty, and general wellness, expanding their consumer base significantly.

Protein powders remain the dominant product format in the Asia Pacific market due to their versatility, cost-efficiency, and long shelf life. Powders allow users to customize intake, choose flavors, and mix them with various beverages or foods. Bodybuilders, athletes, and fitness professionals in countries like Australia, India, and China favor powders for their high protein concentration and easy integration into daily routines. Both branded and private-label powders are available across retail, gyms, and online platforms, offering a wide range of price and quality points.

On the other hand, Ready-to-Drink (RTD) protein beverages are witnessing the fastest growth, particularly among younger, on-the-go consumers in urban centers. These beverages are perceived as convenient, lifestyle-oriented, and less intimidating for new users compared to powders. In markets like Japan and South Korea, functional protein lattes, smoothies, and sparkling protein waters are gaining momentum. Innovations in packaging, flavors, and shelf-stable technologies are making RTDs a rapidly expanding category, especially through online and convenience store channels.

Sports nutrition is the leading application segment, deeply embedded in fitness ecosystems across Asia Pacific. Consumers in this category are typically bodybuilders, athletes, and fitness enthusiasts looking for muscle growth, recovery, and performance enhancement. Protein intake in this context is often strategic, with consumers paying close attention to macronutrient ratios, ingredient sourcing, and absorption rates. Whey-based supplements dominate this segment, with specialized variants like isolate, hydrolysate, and blends for pre- and post-workout consumption.

Functional foods are the fastest-growing application area, as health-conscious consumers seek daily, integrated nutrition solutions. Protein-fortified snacks, desserts, and even traditional foods are being reformulated to offer added nutritional value. In countries like Japan, protein is being added to rice cakes and soups, while in Australia, protein-infused bread and granola bars are mainstream. This shift allows brands to reach beyond athletes to general wellness seekers, elderly consumers, and even children, making protein intake part of regular, everyday eating.

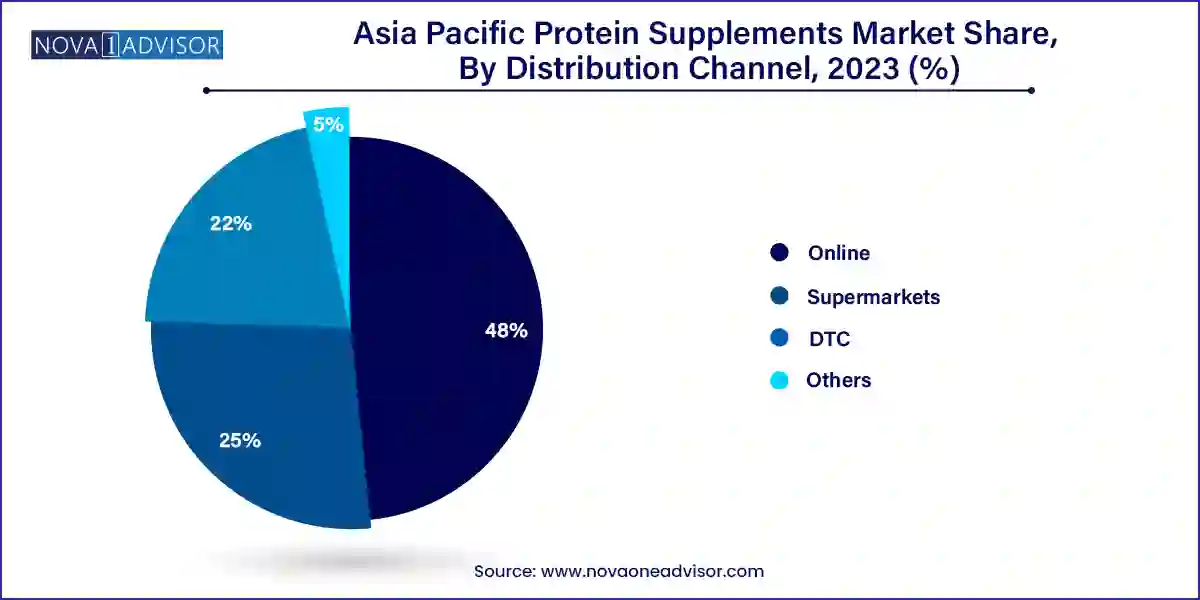

Supermarkets remain the leading distribution channel across the region due to their widespread presence, in-store sampling, and the trust they inspire. Chains like Aeon in Japan, Big Bazaar in India, Woolworths in Australia, and Carrefour in China stock a wide variety of protein supplements across price tiers. Supermarkets cater to both impulse buyers and regular users and offer bundled promotions and seasonal discounts that drive volume sales.

Yet, online and DTC (Direct-to-Consumer) channels are expanding at the fastest pace, powered by the digital commerce boom in Asia. Platforms like Alibaba’s Tmall, Flipkart, Amazon, and brand-specific websites are reshaping how supplements are marketed and sold. Influencer marketing, virtual consultations, reviews, and subscription models make online buying not only convenient but also trusted. Emerging DTC brands often highlight clean-label transparency, sustainability, and niche benefits, attracting a younger, digital-native demographic.

China leads the Asia Pacific protein supplements market in volume and growth potential. With a burgeoning middle class and increasing concerns over public health and aging, the market is experiencing strong consumer pull across fitness, wellness, and eldercare segments. The Chinese government’s endorsement of nutrition in national health policies, coupled with rapid urbanization, has made protein consumption more mainstream. Local brands are innovating with traditional ingredients such as soy and mung bean, while international brands cater to the premium urban niche.

India is one of the fastest-growing markets, driven by a young population, rising fitness awareness, and a booming sports culture. The traditional vegetarian diet in India often lacks sufficient protein, making supplementation a relevant and increasingly necessary solution. Urban youth are adopting gym memberships, yoga, and functional fitness in record numbers, fueling protein supplement usage. Local startups like Oziva, MyProtein India, and MuscleBlaze are redefining the space with clean-label, affordable, and culturally aligned offerings.

Japan is a mature but innovation-driven market, focusing heavily on protein for healthy aging, immunity, and recovery. The country’s aging population uses protein supplementation to prevent sarcopenia, while functional RTD beverages and snacks are popular among younger working professionals. Japanese brands excel at product innovation, offering high-protein yogurts, tofu-based snacks, and convenient bento box integrations. The market is characterized by premium pricing, scientific credibility, and aesthetically refined packaging.

Australia is a well-established and health-driven market, where protein supplements are commonly used not only by athletes but also by wellness-focused consumers. The country has a strong outdoor and fitness culture, and protein supplements are sold across pharmacies, grocery chains, and boutique health stores. Regulatory compliance and clean-label nutrition are major drivers, with plant-based proteins and collagen supplements seeing rapid uptake. Australia's educated consumer base prefers transparent sourcing, organic labels, and high digestibility.

Herbalife Nutrition (March 2024): Announced the expansion of its plant-based protein line in China and India to cater to vegan and lactose-intolerant populations.

MyProtein (February 2024): Launched a new DTC personalization tool in Australia that allows users to create custom protein blends based on activity and health goals.

MuscleBlaze (India, January 2024): Introduced a protein bar line fortified with ashwagandha and multivitamins, merging traditional wellness with modern sports nutrition.

Asahi Group (Japan, December 2023): Rolled out a range of RTD protein coffees and teas targeting working professionals and elderly consumers in convenience stores.

Amazon China (November 2023): Reported a 40% YoY growth in protein supplement sales during its annual 11.11 Shopping Festival, highlighting e-commerce demand.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific protein supplements market

Source

Product

Application

Distribution Channel

Country